|

市場調查報告書

商品編碼

1628786

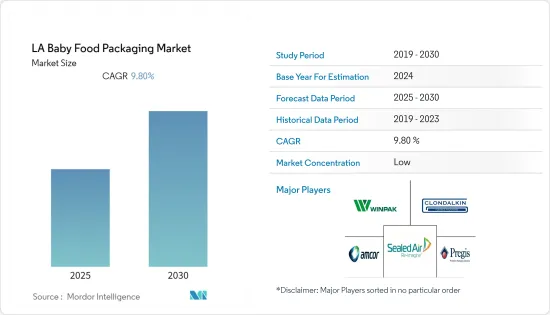

拉丁美洲嬰兒食品包裝:市場佔有率分析、產業趨勢與成長預測(2025-2030)LA Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

拉丁美洲嬰兒食品包裝市場預計在預測期內複合年成長率為 9.8%

主要亮點

- 玻璃瓶仍然是已烹調嬰兒食品最常見的包裝類型,並將繼續在 2020 年該類別的銷售中佔據主導地位。 2020 年最受歡迎的包裝尺寸仍然是 120 克和 170 克玻璃瓶。消費者仍然傾向於購買較小的包裝尺寸,並且更有可能為孩子定期更換庫存,而不是長時間儲存較大的包裝。

- 嬰兒乾食品擴大以軟性鋁/塑膠立式袋出售,從而降低了單價。

- 在拉丁美洲,隨著消費者擴大選擇其他嬰兒食品,乾燥嬰兒食品預計將繼續下降。儘管由於 COVID-19 大流行的影響預計在拉丁美洲消退,預計 2022 年將出現暫時復甦,但隨著其他類別的佔有率預計將擴大,該類別的銷量將繼續下降。

拉丁美洲嬰兒食品包裝市場趨勢

塑膠預計將佔據最大的市場佔有率

- 塑膠是一種比其他替代材料更有效的食品包裝材料,因為它的製造節能且比替代材料更輕。

- 例如,只需 2 磅塑膠即可提供 10 加侖液體或牛奶,而需要 3 磅鋁、8 磅鋼和超過 40 磅玻璃才能提供相同量的液體。

- 在嬰兒配方奶粉領域,工作父母的忙碌生活導致了各種品牌的單劑量塑膠袋的推出。因此,即用營養產品的重要性日益增加,進一步推動了市場成長。

- 隨著嬰兒營養市場的擴大,對牛奶等營養產品的需求明顯增加,直接帶動了嬰兒食品包裝市場。它也很耐用,可以由父母隨身攜帶,沒有任何麻煩。此外,塑膠的氣密性很高,因此不太可能被淘汰。

巴西佔最大市場佔有率

- 在拉丁美洲地區,巴西是該解決方案的主要市場,其次是墨西哥和阿根廷。消費者意識的提高和可支配收入的增加是推動嬰兒食品包裝解決方案需求的因素。

- 拉丁美洲是預計在預測期內在全球嬰兒食品包裝市場中獲得重要佔有率的成長地區之一。巴西人以在各種平台上搜尋產品評論而聞名,此外,他們也是社交網路的重度使用者。

- 根據巴西地區統計研究所的數據,到 2023 年,巴西的包裝製造業銷售額預計將達到約 69 億美元。此外,該市場存在有利於優質化的趨勢。儘管對價格敏感,但它具有環保意識。

- 此外,新的收購和協議可能會增加市場成長的價值。 Armor Protective Packaging 最近宣布歡迎 Orvic Brasil 加入 ARMOR 全球「大家庭」。 ARMOR 和 Orvic 建立了策略夥伴關係關係。

拉丁美洲嬰兒食品包裝產業概況

由於國內外公司眾多,嬰兒食品包裝市場高度分散。市場碎片化,企業在價格、產品設計、產品創新等因素上競爭。市場上的一些主要企業包括 Amcor Ltd、Pregis LLC、Sealed Air Corporation、Huhtamaki OYJ、Clondalkin Group Holdings BV、Winpak 等。

- 2021 年 10 月 - Guarapac Spa 宣佈在巴西的擴張計劃,這是該集團透過垂直整合持續努力實現全球永續成長的一部分。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 奶粉食品包裝和嬰兒配方奶粉的需求不斷成長

- 都市區職業婦女人口的增加

- 市場限制因素

- 政府對一次性塑膠包裝的嚴格規定

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按材質

- 塑膠

- 紙板

- 金屬

- 玻璃

- 按包裝類型

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 小袋

- 其他包裝類型

- 依產品

- 液態乳

- 乾燥嬰兒食品

- 奶粉

- 準備好的嬰兒食品

- 按國家/地區

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第6章 競爭狀況

- 公司簡介

- Amcor Ltd.

- Sonoco Products Company

- Mondi Group

- Berry Global Inc.

- Rexam PLC

- Winpak Ltd.

- AptarGroup

- Silghan Holding Inc.

- CAN-PACK SA

- Tetra Laval

- DS Smith Plc

- Coldalkin Group Holdings BV

- Pregis LLC

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 54226

The LA Baby Food Packaging Market is expected to register a CAGR of 9.8% during the forecast period.

Key Highlights

- Glass jars remained the most common pack type in prepared baby food, dominating volume sales in the category once more in 2020 by a long way. The most popular pack sizes in 2020 remained 120g and 170g glass jars, as consumers still tend to prefer to purchase smaller pack sizes and to refresh their stocks regularly for their children, rather than keeping larger presentations for a longer time.

- Metal tins remain the main pack type to convey a premium image and for better storage, unlike dried baby food, which is increasingly being sold in flexible aluminum/plastic stand-up pouches, thus reducing unit prices.

- Dried baby food is projected to continue its decline in Latin America as consumers increasingly opt for other baby food products. Despite a brief revival expected in 2022, when the effects of the COVID-19 pandemic are expected to subside in Latin America, the already declining category will continue to register declining volume sales as other categories gain share.

Latin America Baby Food Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- Plastics are a more efficient material for food packaging than other alternatives because plastics are energy efficient to manufacture, and they are also lighter than alternative materials.

- For instance, just two pounds of plastic can deliver 10 gallons of Liquid, i.e., milk, whereas three pounds of aluminum, eight pounds of steel, or over 40 pounds of glass are needed to deliver the same amount of Liquid.

- In the powder milk formula segment, the busy life of working parents has led to the launch of single-serve plastic sachets by various brands. Thus, this increases the importance of ready nutrition products and further boosts the market growth.

- With the expanding infant nutrition market, it is evident that nutritional product demand, such as milk, is increasing, and it is directly driving the baby food packaging market. It is also durable, and parents can carry them without hassle. Moreover, plastics are airtight, so the chances of getting stale are unlikely.

Brazil to Hold the Largest Market Share

- Brazil is the major market for these solutions in the region, followed by Mexico and Argentina in the Latin America region. Increasing consumer awareness and higher disposable income are the factors driving the demand for baby food packaging solutions.

- Latin America is one of the growing regions expected to capture a significant share of the global baby food packaging market during the forecast period. The Brazilian public is famous for searching product reviews on different platforms; furthermore, they are heavy users of social networks.

- As per the Brazilian Institute of Geography and Statistics, it is expected that the revenue of packaging manufacturing in Brazil will amount to approximately USD 6.9 billion by 2023. Further, there is a trend supporting premiumization in this market. Despite being price-sensitive, it follows eco-friendliness.

- Furthermore, newer acquisitions and contracts might add value to the market growth. Recently, Armor Protective Packaging announced that they welcomed the Orvic Brasil to the ARMOR global 'family.' ARMOR and Orvic have joined forces in a strategic partnership.

Latin America Baby Food Packaging Industry Overview

The baby food packaging market is highly fragmented, owing to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Amcor Ltd, Pregis LLC, Sealed Air Corporation, Huhtamaki OYJ, Clondalkin Group Holdings BV, Winpak, among others.

- October 2021 - Gualapack Spa announced its plans for expansion in Brazil as part of the Group's continued efforts for sustainable, global growth through vertical integration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growing Demand of Packaged Baby Food and Infant Formula

- 4.3.2 Increasing Working Women in Urban Areas residing Population

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations over Single-Use Plastic-based Packaging

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Pouches

- 5.2.6 Other Packaging Type

- 5.3 By Product

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd.

- 6.1.2 Sonoco Products Company

- 6.1.3 Mondi Group

- 6.1.4 Berry Global Inc.

- 6.1.5 Rexam PLC

- 6.1.6 Winpak Ltd.

- 6.1.7 AptarGroup

- 6.1.8 Silghan Holding Inc.

- 6.1.9 CAN-PACK S.A.

- 6.1.10 Tetra Laval

- 6.1.11 DS Smith Plc

- 6.1.12 Coldalkin Group Holdings BV

- 6.1.13 Pregis LLC

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219