|

市場調查報告書

商品編碼

1629794

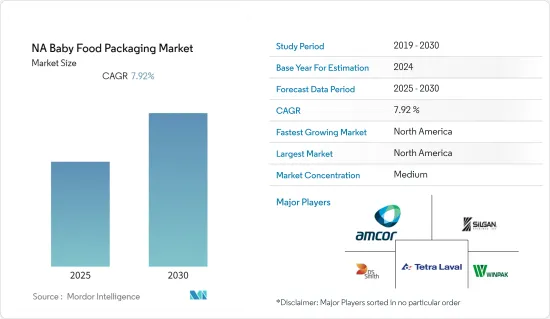

北美嬰兒食品包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)NA Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

北美嬰兒食品包裝市場預計在預測期內複合年成長率為7.92%

主要亮點

- 推動市場成長的主要因素之一是政府對包裝產業的嚴格規則/政策以及環境安全法規。

- 此外,美國和加拿大等國家生活方式的快速變化和對包裝嬰兒食品的高需求也對市場成長做出了重大貢獻。

- 加拿大人口生活方式的改變和消費者可支配收入水準的提高預計將增加對包裝嬰兒食品的需求,這可能會促進北美嬰兒食品包裝市場的成長。

- 一般消費者對安全、可回收、可重複使用、有機、衛生、輕巧且易於攜帶的包裝和廚房容器的認知不斷增強,最近顯示出很高的需求,預計將推動市場成長。

北美嬰兒食品包裝市場趨勢

塑膠預計將佔據最大的市場佔有率

- 塑膠是一種比其他替代材料更有效的食品包裝材料,因為它的製造節能且比替代材料更輕。例如,只需 2 磅塑膠即可輸送 10 加侖飲料,而輸送相同量的飲料則需要 3 磅鋁、8 磅鋼和超過 40 磅玻璃。

- 在嬰兒配方奶粉領域,工作父母的忙碌生活導致了各種品牌的單劑量塑膠袋的推出。因此,即用營養產品的重要性日益增加,進一步推動了市場成長。

- HDPE 是應用最廣泛的塑膠包裝材料。它用於製造多種類型的瓶子和容器。無色瓶子半透明、耐用且具有優異的阻隔性,使其適合包裝保存期限較短的產品,例如牛奶。

- 隨著嬰兒營養市場的擴大,對牛奶等營養產品的需求明顯增加,直接帶動了嬰兒食品包裝市場。

已烹調嬰兒食品顯著成長

- 由於美國和加拿大對即食食品的需求不斷增加以及忙碌的生活方式,預計已烹調嬰兒食品領域將出現最高成長。

- 此外,由於北美地區職業女性數量的增加以及美國人口可支配收入的增加,預計在預測期內對已烹調嬰兒食品的需求將會增加。

- TRS 過著忙碌的工作生活方式,沒有足夠的時間為自己和孩子做飯。因此,他們更喜歡已烹調的嬰兒食品,這推動了市場的成長。

北美嬰兒食品包裝產業概況

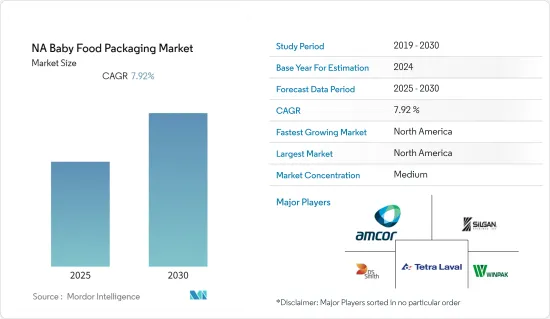

由於國內外公司數量眾多,北美嬰兒食品包裝市場競爭激烈。市場分散,企業在價格、產品設計、產品創新等方面競爭。市場上的一些主要企業包括 Amcor Ltd、Mondi Group 和 Sonoco。

- 2021 年 3 月 - 2021 年 3 月,Ardagh Group, Glass 將與 Bragg Live Food Products 合作,為 Bragg 蘋果醋飲料提供 16 盎司玻璃瓶。這款玻璃瓶 100% 可回收,可重複回收而不會失去其純度。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 包裝奶粉食品和嬰兒配方奶粉的需求不斷成長

- 都市區職業婦女人口的增加

- 市場限制因素

- 政府對一次性塑膠包裝的嚴格規定

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按主要材質分

- 塑膠

- 紙板

- 金屬

- 玻璃

- 其他

- 依產品類型

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 小袋

- 其他

- 透過食物

- 奶粉

- 乾燥嬰兒食品

- 奶粉

- 準備好的嬰兒食品

- 其他

第6章 競爭狀況

- 公司簡介

- Amcor Ltd.

- Mondi Group

- Bemis Company, Inc.

- Rexam PLC

- RPC Group

- Winpak Ltd.

- AptarGroup

- Sonoco

- Silgan Holdings Inc.

- Tetra Laval

- DS Smith Plc

- CAN-PACK SA

- Prolamina Packaging

第7章 投資分析

第8章 市場未來性

簡介目錄

Product Code: 56751

The NA Baby Food Packaging Market is expected to register a CAGR of 7.92% during the forecast period.

Key Highlights

- One of the major factors driving the growth of the market is stringent government rules/policies for the packaging industry coupled with environmental safety regulations.

- Moreover, owing to the fast lifestyle and the high demand for packaged baby food products in countries such as the United States and Canada has significantly contributed to the growth of the market.

- The changing lifestyle of the Canadian population and rise in the consumers with disposable income levels is anticipated to enhance the demand for packaged baby food which is likely to boost the growth of the North America Baby Food Packaging Market.

- Growing awareness amongst the common populations towards safe, recyclable, reusable, organic, hygienic, lightweight, and easy to carry packets and kitchen containers has witnessed high demand lately, which is expected to boost the growth of the market.

North America Baby Food Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- Plastics are a more efficient material for food packaging than other alternatives because plastics are energy efficient to manufacture, and they are also lighter than the alternative materials. For instance, just two pounds of plastic can deliver 10 gallons of a beverage, whereas three pounds of aluminum, eight pounds of steel, or over 40 pounds of glass are needed to deliver the same amount of beverage.

- In the powder milk formula segment, the busy life of working parents has led to the launch of single-serve plastic sachets by various brands. Thus, this increases the importance of ready nutrition products and further boosts the market growth.

- HDPE is the most widely used type of plastic packaging material. It is used to make many types of bottles and containers. Unpigmented bottles are translucent and sturdy, have good barrier properties, and are well suited for packaging products with a shorter shelf life, such as milk.

- With the expanding infant nutrition market, it is evident that nutritional product demand, such as milk, is increasing, and it is directly driving the baby food packaging market.

Prepared Baby Food to Witness a Significant Growth

- The prepared baby food segment is expected to witness the highest growth, owing to the increase in demand for ready-to-have food and busy lifestyles in the United States and Canada.

- Moreover, the increasing number of working women in the North American region and increasing disposable income of the American population are anticipated to increase the demand for prepared baby food during the forecast period.

- Advancements in TRS with their work-oriented, hectic lifestyle do find enough time to cook for themselves or their children. Thus, they prefer prepared baby food which is boosting the growth of the market.

North America Baby Food Packaging Industry Overview

The North American baby food packaging market is highly competitive due to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Amcor Ltd, Mondi Group, and Sonoco, among others.

- March 2021 - In March 2021, Ardagh Group, Glass partnered with Bragg Live Food Products to provide its 16-oz glass bottle for Bragg's apple cider vinegar beverages. The glass bottles are 100% recyclable and can be recycled multiple times without loss of purity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growing Demand of Packaged Baby Food and Infant Formula

- 4.3.2 Increasing Working Women in Urban Areas residing Population

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations over Single-Use Plastic-based Packaging

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Primary Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Others

- 5.2 Product type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Pouches

- 5.2.6 Others

- 5.3 Food Products

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.3.5 Other

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd.

- 6.1.2 Mondi Group

- 6.1.3 Bemis Company, Inc.

- 6.1.4 Rexam PLC

- 6.1.5 RPC Group

- 6.1.6 Winpak Ltd.

- 6.1.7 AptarGroup

- 6.1.8 Sonoco

- 6.1.9 Silgan Holdings Inc.

- 6.1.10 Tetra Laval

- 6.1.11 DS Smith Plc

- 6.1.12 CAN-PACK S.A.

- 6.1.13 Prolamina Packaging

7 Investment Analysis

8 Futures of the Market

02-2729-4219

+886-2-2729-4219