|

市場調查報告書

商品編碼

1628838

亞太地區嬰兒食品包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)APAC Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

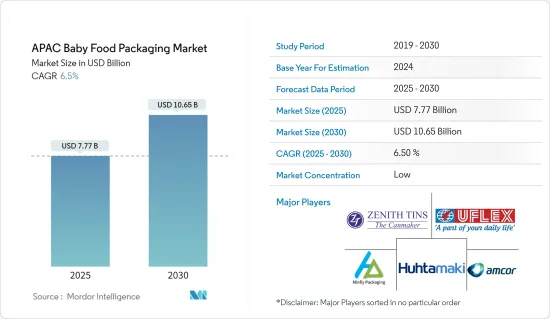

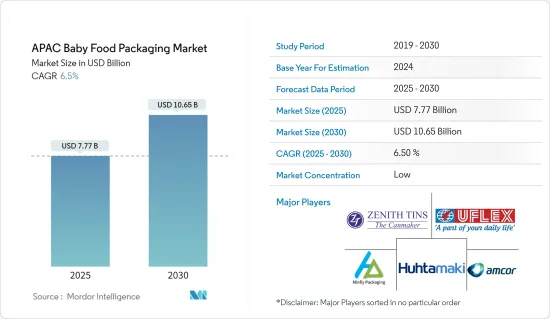

亞太地區嬰兒食品包裝市場規模預估至2025年為77.7億美元,預估至2030年將達106.5億美元,預測期間(2025-2030年)複合年成長率為6.5%。

主要亮點

- 由於幾個關鍵因素,亞太地區的嬰兒食品包裝市場正在蓬勃發展。中國、印度和日本等國家的出生率不斷上升,城市人口迅速成長,導致對嬰兒食品的需求增加。隨著越來越多的家庭採用雙收入生活方式,人們擴大轉向方便、即食和安全的嬰兒食品。這一演變凸顯了對衛生和兒童安全包裝解決方案的需求,這些解決方案優先考慮便利性、安全性和功能性。

- 軟包裝正在成為全部區域的首選材料。輕質袋子和軟性塑膠因其易於儲存和消費而受到青睞。另一方面,玻璃容器由於其非反應性和高安全性,在高階市場領域保持自己的地位,特別是在日本和韓國等已開發國家。隨著環境問題的日益嚴重,向永續包裝的轉變已變得顯而易見,公司轉向使用生物分解性和可回收材料來減少其生態足跡。

- 市場趨勢突顯了優質有機嬰兒食品的顯著趨勢。如今,健康意識日益增強的父母正在推動對有機嬰兒食品的需求,這也延伸到了確保這些有機食品的安全和品質的專用包裝。此外,包裝創新引入了支持份量控制和旅途中母乳餵養的功能,例如易於傾倒的噴嘴、難以打開的密封件和可重新密封的袋子,從而提高了家長的便利性。

- 亞太地區的市場動態呈現鮮明的區域特徵。中國因其龐大的人口和不斷成長的可支配收入而成為最大的市場。相較之下,由於都市化和飲食習慣的改變,印度正在經歷快速成長。日本和韓國等成熟市場對優質有機產品有著強烈的偏好,對高品質包裝的需求不斷增加。同時,印尼和菲律賓等東南亞國家正在開拓市場,見證了可支配收入的增加和消費者偏好的變化。這種複雜的區域動態正在塑造亞太地區嬰兒食品包裝市場的未來。

- 由於政府對一次性塑膠的嚴格監管,亞太地區嬰兒食品包裝市場的成長受到限制。隨著環境問題的日益嚴重,印度、中國和日本等國家正在收緊政策來遏制塑膠廢棄物。這項運動正在推動產業轉向永續包裝替代品,包括生物分解性、可回收和可堆肥材料。雖然這種綠色轉變為地球帶來了好處,但它也為製造商帶來了挑戰。

- 這些挑戰包括製造成本上升、新技術的採用以及供應鏈的必要調整。這些障礙可能會推高嬰兒食品的價格,並疏遠對價格敏感的消費者,尤其是在新興市場。但在這些挑戰中蘊藏著永續包裝解決方案創新的機會,這與消費者對環保產品日益成長的願望產生了共鳴。

亞太地區嬰兒食品包裝市場趨勢

塑膠細分市場佔據主要市場佔有率

- 由於塑膠具有適應各種包裝形式的多功能性,預計將在亞太地區嬰兒食品包裝行業中佔據主導市場佔有率。人們強烈偏好輕便、方便的軟塑膠包裝,尤其是袋子和自立袋。這些形式特別適合嬰兒食品,如果食物泥、零食和配方奶粉,並且易於運輸、儲存和處置。此外,包裝成各種尺寸和形狀的能力使製造商能夠滿足消費者的不同需求,從單份包裝到家庭裝。

- 塑膠在罐子和瓶子中也閃閃發光,使其成為穀物、飲料和奶粉等嬰兒主食的熱門選擇。這些塑膠容器可防止污染物和空氣進入,從而延長新鮮度。塑膠容器的耐用性和防碎特性使之成為比玻璃更安全的選擇,特別是對於外出的父母或帶著幼兒的父母。此外,塑膠容器是透明的,可以讓消費者看到產品並突出其品質和安全性。

- 即食嬰兒食品通常裝在塑膠托盤或容器中,尤其是在優先考慮便利性的市場中。這些容器可以微波加熱或冷藏,並且易於食用,可保持食品的完整性和新鮮度。許多容器都有隔間來分隔不同類型的食品,符合為嬰幼兒提供多樣化且營養均衡的飲食的趨勢。

- 儘管環境問題日益嚴重,但塑膠包裝因其成本效益和維持嬰兒食品品質的功能而仍然廣泛流行。為了應對永續性的壓力,製造商正在研究可回收和生物分解性塑膠等解決方案,在保持傳統塑膠的安全性和便利性的同時減少對環境的影響。憑藉如此先進的包裝,塑膠將繼續成為亞太嬰兒食品包裝市場的重要組成部分,巧妙地平衡實用性和環保性。

- 2024年7月,我國塑膠製品產量為632萬噸,8月增加至688萬噸,9月達749萬噸。塑膠產量的激增與亞太地區的嬰兒食品包裝市場密切相關,其中中國處於領先地位。塑膠產量的增加表明包裝嬰兒食品等消費品所必需的材料供應不斷增加。隨著塑膠產量的增加,嬰兒食品包裝製造商將有更多機會獲得製造袋子、瓶子、罐子和托盤的材料。

- 塑膠產量的增加支撐了對包裝解決方案不斷成長的需求,尤其是嬰兒食品。嬰兒食品消費量的增加以及消費者對便利性和安全性的日益重視推動了這項需求。考慮到塑膠包裝的成本效益、耐用性、靈活性和防潮等優勢,產量的快速成長預示著嬰兒食品包裝市場的擴大。

- 此外,隨著中國加大對永續塑膠生產和回收的承諾,嬰兒食品包裝也可能轉向環保塑膠。隨著環保意識的增強和對一次性塑膠的監管壓力的加大,這種轉變變得越來越重要。塑膠生產的成長趨勢表明,嬰兒食品包裝公司正在不斷發展和整合可回收和生物分解性塑膠,以實現永續性目標並更符合消費者的偏好。

中國佔最大市場佔有率

- 在中國,嬰兒人口的成長、可支配收入的增加以及兒童營養意識的增強,刺激了嬰兒食品包裝需求的成長。父母被方便、安全的嬰兒食品所吸引,並且更喜歡即食和便攜的選擇,同時又不影響品質。因此,包裝必須具有功能性、防拆封、可重新密封性和易用性。這項變革將推動塑膠包裝的成長,特別是食物泥、零食和嬰兒配方奶粉。

- 此外,優質嬰兒食品(尤其是有機營養嬰兒食品)的趨勢正在推動對複雜包裝的需求。包裝強調品質和安全,因為父母優先考慮健康意識的選擇。這些高級產品的製造商擴大選擇永續或專業的包裝形式,例如玻璃瓶和創新塑膠,以確保產品的完整性,同時環保。

- 隨著都市化進程的推進和雙收入家庭的日益普及,對方便外出消費的嬰兒食品包裝的需求不斷增加。這推動了軟包裝形式的流行,尤其是軟包裝袋。這些輕便、可重新密封的攜帶式袋子符合現代中國父母的生活方式,他們重視時間效率和便攜性,同時又不犧牲孩子的安全和營養。

- 中國另一個顯著的趨勢是對永續性的日益重視。儘管塑膠包裝因其成本效益和多功能性而仍然很受歡迎,但人們已經明顯轉向環保替代品。法規的收緊和消費者對塑膠廢棄物的認知不斷提高,正在引導市場轉向生物分解性和永續的塑膠選擇。為此,製造商正在開發新材料和包裝技術,以滿足監管義務和消費者的綠色偏好。因此,中國嬰兒食品包裝市場的格局正在不斷演變,在塑膠的便利性與不斷成長的永續性需求之間取得平衡。

- 中國嬰兒食品零售額持續成長,預計將從 2021 年的 287.4 億美元增至 2025 年的 330.8 億美元。這一成長清楚地表明,在人口結構變化、消費者偏好變化和可支配收入增加的推動下,中國對嬰兒食品的需求不斷成長。

- 隨著零售額的飆升,華人父母顯然正在加大對優質營養嬰兒食品的投資。人們對嬰幼兒營養的認知不斷提高,促使父母轉向食品、強化和專門的嬰兒食品。這些偏好凸顯了對先進包裝解決方案的需求,並凸顯了對便利、安全和衛生的關注,這與對優質嬰兒食品的追求是一致的。

- 隨著零售額的上升,嬰兒食品包裝市場也不斷擴大。對保護產品完整性並適應不斷變化的消費者偏好的包裝的需求不斷成長。雖然塑膠包裝仍然是具有成本效益的選擇,但在環境問題和監管要求的推動下,明顯轉向永續材料。隨著市場價值的擴大,包裝製造商準備進行更重大的創新,並專注於環保和功能性解決方案。

亞太地區嬰兒食品包裝產業概況

嬰兒食品包裝市場被許多國內外公司瓜分。公司主要在價格、產品設計和創新上競爭。市場上的一些主要企業包括 Huhtamaki Oyj、MINFLY PACKAGING、Uflex Ltd.、ZENITH TINS PVT.LTD. 和 Amcor Group。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 嬰兒食品包裝的永續性趨勢

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 包裝嬰兒食品和嬰兒奶粉的需求不斷成長

- 都市區職業婦女人口的增加

- 市場限制因素

- 政府對一次性塑膠包裝的嚴格規定

第6章 市場細分

- 按材質

- 塑膠

- 紙板

- 金屬

- 玻璃

- 按包裝類型

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 小袋

- 其他包裝類型

- 依產品

- 液態乳

- 乾燥嬰兒食品

- 奶粉

- 準備好的嬰兒食品

- 按國家/地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞

第7章 競爭格局

- 公司簡介

- Amcor Group

- Huhtamaki Oyj

- MINFLY PACKAGING

- Berry Global Inc.

- Rexam PLC

- Winpak Ltd.

- Aptar Group

- Uflex Ltd.

- ZENITH TINS PVT. LTD.

- Constantia Flexibles GmbH

- Tetra Laval Holdings

- DS Smith Plc

- Ball Corporation

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 55467

The APAC Baby Food Packaging Market size is estimated at USD 7.77 billion in 2025, and is expected to reach USD 10.65 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

Key Highlights

- The baby food packaging market in Asia Pacific is booming, driven by several pivotal factors. Countries such as China, India, and Japan are witnessing rising birth rates and an urban population surge, leading to heightened demand for baby food products. With more families adopting dual-income lifestyles, there's a pronounced shift towards convenient, ready-to-eat, and safe baby food options. This evolution underscores the demand for packaging solutions prioritizing convenience, safety, and functionality, exceptionally hygienic and child-safe.

- Flexible packaging is becoming the material of choice across the Asia Pacific region. Lightweight pouches and flexible plastics are preferred for their ease of storage and consumption. Meanwhile, glass containers hold their ground in premium market segments, especially in developed nations like Japan and South Korea, thanks to their non-reactive nature and perceived safety. As environmental concerns gain traction, there's a notable shift towards sustainable packaging, with companies leaning into biodegradable and recyclable materials to mitigate their ecological footprint.

- Market trends highlight a pronounced tilt towards premium and organic baby foods. Today's increasingly health-conscious parents are driving the demand for organic baby food, which extends to specialized packaging that guarantees the safety and quality of these organic offerings. Furthermore, packaging innovations enhance convenience for parents, introducing features like easy-pour spouts, tamper-evident seals, and resealable pouches that support portion control and on-the-go feeding.

- Market dynamics across the Asia Pacific showcase distinct regional variations. China is the largest market with its vast population and rising disposable income. In contrast, India is rapidly growing, spurred by urbanization and shifting dietary habits. Mature markets like Japan and South Korea gravitate towards premium and organic options, amplifying the demand for high-quality packaging. Meanwhile, Southeast Asia, with nations like Indonesia and the Philippines witnessing rising disposable incomes and shifting consumer preferences, is carving out its niche in the market. This intricate tapestry of regional dynamics is sculpting the future of the baby food packaging market in Asia Pacific.

- The baby food packaging market in Asia Pacific grapples with growth constraints due to stringent government regulations on single-use plastics. As environmental concerns mount, nations like India, China, and Japan are tightening policies to curb plastic waste. This push drives the industry towards sustainable packaging alternatives, including biodegradable, recyclable, and compostable materials. While these eco-friendly shifts benefit the planet, they pose challenges for manufacturers.

- These challenges encompass heightened production costs, adopting new technologies, and necessary adjustments in the supply chain. Such hurdles can inflate baby food prices, potentially alienating price-sensitive consumers, particularly in emerging markets. Yet, amidst these challenges lie opportunities for innovation in sustainable packaging solutions, resonating with the rising consumer appetite for eco-friendly products.

APAC Baby Food Packaging Market Trends

Plastic Segment to Hold Significant Market Share

- In the Asia Pacific baby food packaging industry, plastic is set to command a substantial market share thanks to its versatility across various packaging formats. The region strongly prefers flexible plastic packaging, especially pouches and stand-up bags, due to their lightweight and convenient nature. These formats are particularly suited for baby food items like purees, snacks, and formula milk, offering easy carrying, storing, and disposing. Moreover, the ability to craft packaging in diverse sizes and shapes allows manufacturers to cater to varied consumer demands, from single-serve portions to family-sized packs.

- Plastic also shines in jars and bottles, frequently chosen for baby food staples like cereals, drinks, and formula. These plastic containers safeguard against contaminants and air, ensuring prolonged freshness. Their durability and shatterproof nature make plastic jars a safer choice than glass, especially for parents on the move or those with younger kids. Furthermore, the transparency of plastic containers lets consumers view the product, a feature that resonates with many markets, emphasizing quality and safety.

- Ready-to-eat baby food meals often come in plastic trays and containers, especially in markets prioritizing convenience. These formats offer microwaveable or refrigerated, easy-to-serve portions, ensuring the food's integrity and freshness. Many containers even feature compartments, separating diverse food types, aligning with the trend of providing infants with varied, nutritionally balanced meals.

- Despite rising environmental concerns, plastic packaging remains prevalent due to its cost-effectiveness and functionality in preserving baby food quality. In response to sustainability pressures, manufacturers are delving into solutions like recyclable and biodegradable plastics, striving to lessen environmental impact while retaining traditional plastics' safety and convenience benefits. With these advancements, plastic is poised to remain a cornerstone in the Asia Pacific baby food packaging market, deftly balancing practicality with environmental considerations.

- In July 2024, China produced 6.32 million metric tons of plastic products, with figures rising to 6.88 million metric tons in August and reaching 7.49 million metric tons in September. This surge in plastic production is closely tied to the baby food packaging market in the Asia Pacific, with China leading the charge. The uptick in plastic output signals a growing supply of essential materials for packaging consumer goods, notably baby food. As plastic output increases, baby food packaging manufacturers gain enhanced access to materials for crafting pouches, bottles, jars, and trays.

- The uptick in plastic production underscores a rising demand for packaging solutions, particularly for baby food. This demand is fueled by heightened baby food consumption and a growing consumer emphasis on convenience and safety. Given the cost-effectiveness and advantages of plastic packaging-like durability, flexibility, and moisture protection-the surge in production bodes well for the expansion of the baby food packaging market.

- Moreover, as China intensifies its commitment to sustainable plastic production and recycling, there's a potential pivot towards eco-friendly plastics in baby food packaging. This shift gains significance amidst heightened environmental awareness and mounting regulatory pressures on single-use plastics. The rising plastic production trend indicates that baby food packaging companies are evolving, integrating recyclable or biodegradable plastics to meet sustainability objectives, thus aligning more closely with consumer preferences.

China to Hold the Largest Market Share

- In China, the rising demand for baby food packaging is fueled by a growing population of infants and toddlers, increasing disposable incomes, and heightened awareness of child nutrition. Parents gravitate towards convenient and safe baby food products, favoring ready-to-eat and portable options without compromising quality. Consequently, the packaging must be functional, featuring tamper-evidence, reseal ability, and user-friendliness. This shift propels growth in plastic packaging, particularly for purees, snacks, and baby formula.

- Moreover, the trend toward premium baby food products, especially organic and nutritious ones, amplifies the demand for sophisticated packaging. With parents prioritizing health-conscious choices, a heightened emphasis on packaging underscores quality and safety. Manufacturers of these premium products are increasingly opting for sustainable or specialized packaging formats, like glass jars or innovative plastics, ensuring product integrity while being eco-friendly.

- As urbanization surges and dual-income families become more common, the demand for convenient baby food packaging for on-the-go consumption has intensified. This has spurred the popularity of flexible packaging formats, particularly pouches. These lightweight, resealable, and portable pouches resonate with the modern Chinese parent's lifestyle, emphasizing time efficiency and portability without sacrificing their child's safety and nutrition.

- Another notable trend in China is the heightened emphasis on sustainability. While plastic packaging remains prevalent due to its cost-effectiveness and versatility, there's a discernible shift towards eco-friendly alternatives. Heightened regulations on plastic waste and growing consumer awareness are steering the market towards recyclable, biodegradable, and sustainable plastic options. In response, manufacturers are delving into new materials and packaging technologies to align with regulatory mandates and the consumer's green aspirations. Thus, the landscape of China's baby food packaging market is evolving, striking a balance between the convenience of plastic and the rising clamor for sustainability.

- China's retail sales of baby food are on the rise, climbing from USD 28.74 billion in 2021 to a projected USD 33.08 billion in 2025. This uptick underscores a growing appetite for baby food products in China, spurred by demographic changes, evolving consumer tastes, and rising disposable incomes.

- As retail sales surge, it's evident that Chinese parents are increasingly investing in premium, nutritious baby food. Heightened awareness about infant nutrition is steering parents towards organic, fortified, and specialized baby food. Such preferences underscore the demand for advanced packaging solutions and highlight the emphasis on convenience, safety, and hygiene, aligning with the quest for top-tier baby food.

- With retail sales climbing, the baby food packaging market is also expanding. There's a growing demand for packaging that safeguards product integrity and adapts to shifting consumer preferences. While plastic packaging remains the go-to for cost-effectiveness, a discernible pivot towards sustainable materials is evident, driven by environmental concerns and regulatory mandates. As the market value swells, packaging manufacturers are poised for more significant innovation, focusing on eco-friendly yet functional solutions.

APAC Baby Food Packaging Industry Overview

The baby food packaging market is fragmented due to numerous domestic and international players. Companies compete primarily on price, product design, and innovation. Key players in the market include Huhtamaki Oyj, MINFLY PACKAGING, Uflex Ltd., and ZENITH TINS PVT. LTD., and Amcor Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Sustainability Trends for Baby Food Packaging

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand of Packaged Baby Food and Infant Formula

- 5.1.2 Increasing Working Women in Urban Areas residing Population

- 5.2 Market Restraint

- 5.2.1 Stringent Government Regulations over Single-Use Plastic-based Packaging

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paperboard

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Package Type

- 6.2.1 Bottles

- 6.2.2 Metal Cans

- 6.2.3 Cartons

- 6.2.4 Jars

- 6.2.5 Pouches

- 6.2.6 Other Packaging Type

- 6.3 By Product

- 6.3.1 Liquid Milk Formula

- 6.3.2 Dried Baby Food

- 6.3.3 Powder Milk Formula

- 6.3.4 Prepared Baby Food

- 6.4 By Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 South East Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group

- 7.1.2 Huhtamaki Oyj

- 7.1.3 MINFLY PACKAGING

- 7.1.4 Berry Global Inc.

- 7.1.5 Rexam PLC

- 7.1.6 Winpak Ltd.

- 7.1.7 Aptar Group

- 7.1.8 Uflex Ltd.

- 7.1.9 ZENITH TINS PVT. LTD.

- 7.1.10 Constantia Flexibles GmbH

- 7.1.11 Tetra Laval Holdings

- 7.1.12 DS Smith Plc

- 7.1.13 Ball Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219