|

市場調查報告書

商品編碼

1628835

嬰兒食品包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

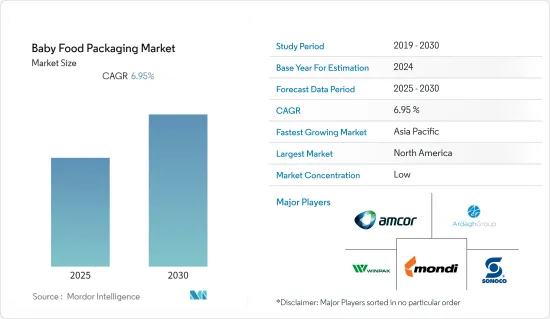

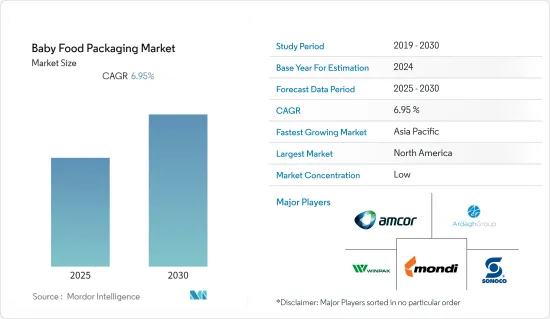

嬰兒食品包裝市場預計在預測期內複合年成長率為 6.95%

主要亮點

- 世界各地的新興國家正在經歷快速的都市化、可支配收入的增加和現代生活方式的採用。這些因素正在增加嬰兒食品的支出。

- 此外,嬰兒食品製造商正在不斷創新,以滿足消費者的不同需求,從而推動了對包裝解決方案的需求。這促使主要企業開發出創新、環保且可回收的常規包裝替代品。

- 由於生活方式和工作父母數量的增加,對更大包裝尺寸和更方便包裝的需求預計在預測期內嬰兒食品包裝市場將顯著成長。已烹調嬰兒食品類別的需求預計將增加,薄壁塑膠容器、軟質塑膠包裝和尺寸大於 100 克的鋁/塑膠袋預計將取代玻璃瓶,因為它們具有便攜性、易於使用和一次性福利將完成。

- 儘管COVID-19對整個包裝產業的影響較小,但由於供應鏈中斷和部分生產設施關閉等因素,嬰兒食品的生產和分銷能力暫時減少。鑑於需求增加、世界各地廣泛接種疫苗以及旅行限制的取消,包裝行業預計將很快復甦。

- 此外,在過去的十年中,瓶裝和玻璃包裝的嬰兒食品佔據了大部分銷售量。然而,在過去的十年裡,消費者對環保袋及其安全、再生性、衛生、輕量和便攜等特性的偏好日益增加,導致軟包裝的採用增加。預計類似的趨勢將推動預測期內受調查市場的成長。

嬰兒食品包裝市場趨勢

塑膠預計將佔據最大的市場佔有率

- 塑膠是一種比其他替代材料更有效的食品包裝材料,因為它的製造更節能,而且比替代材料更輕。例如,只需 2 磅塑膠即可輸送 10 加侖飲料,而輸送相同量的飲料則需要 3 磅鋁、8 磅鋼和超過 40 磅玻璃。

- 金屬和塑膠包裝主要用於嬰兒奶粉。 Ball Company 是提供食品罐等金屬包裝的主要企業之一。然而,在預測期內,使用大型折疊式紙盒在軟質塑膠二次包裝中進行單劑量遞送作為奶粉的初級包裝預計將會增加。

- 在奶粉領域,由於工作父母的忙碌生活,各品牌正在推出單劑量塑膠袋。這增加了即用營養產品的重要性,進一步促進了市場成長。

- 消費者對環保袋包裝的日益偏好也增加了軟包裝的採用。增加塑膠包裝解決方案需求的另一個因素是嬰兒食品製造商正在引入創新技術來滿足不同消費者的需求。

- 為了滿足對環保嬰兒食品的需求,包裝製造商擴大選擇對包裝食品沒有影響的塑膠。例如,2020 年 3 月,雀巢宣布推出全球首款專為未來回收而設計的單一材料嬰兒食品袋。本產品可透過由 TerraCycle 提供支援的格柏國家回收計畫 100% 回收。

亞太地區實現顯著成長

- 由於城市人口擴大使用包裝嬰兒食品,預計亞太地區在預測期內將出現高速成長。此外,隨著新興國家人們可支配收入的增加和忙碌的生活方式,亞太市場將大幅成長。

- 此外,預計中國將在亞太嬰兒食品包裝市場中佔據最高佔有率,其次是日本和印度。消費者對嬰兒食品包裝產品營養益處的認知不斷提高預計將推動市場成長。

- 此外,由於日本品牌的卓越品質和安全保障,日本製造的嬰兒配方奶粉在其他國家也越來越受歡迎,擴大了出口和包裝範圍。此前,歐洲是日本嬰兒食品的主要出口目的地之一。但最近,它開始瞄準其他新興地區。例如,近年來,日本嬰兒配方奶粉在東南亞地區,尤其是新興國家迅速普及。

- 此外,亞太地區女性就業人數顯著增加,這使得女性以傳統方式照顧嬰兒的時間減少。這為嬰兒食品市場創造了機會並推動了所研究的市場。

嬰兒食品包裝產業概況

嬰兒食品包裝市場競爭非常激烈,國內外都有許多參與企業。市場是細分的,每個參與企業都在價格、產品設計和產品創新等因素上競爭。市場上的一些主要企業包括 Ardagh Group、Amcor Ltd、Mondi Group 和 Sonoco。

- 2021 年 9 月 - Silgan Holdings Inc. 宣布已收購 Gateway Plastics。該業務向消費品製造商生產和銷售分配瓶蓋和整合分配包裝解決方案,主要面向食品和飲料市場,包括整合容器和瓶蓋以及 100% 可回收的分配飲料盒。

- 2021 年 8 月 - 亨氏推出易於回收的嬰兒食品袋。所有產品均由聚丙烯製成,並經過包裝回收標籤 (OPRL) 評級。這符合該公司盡可能消除塑膠的使命,以及在 2025 年使其包裝 100% 可回收、可重複使用或可堆肥的目標。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進和市場約束因素

- 市場促進因素

- 快速的都市化和忙碌的生活方式

- 市場限制因素

- 人們對環保產品的興趣日益濃厚

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對嬰兒食品包裝市場的影響

第5章市場區隔

- 按材質

- 塑膠

- 紙板

- 金屬

- 玻璃

- 按包裝類型

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 小袋

- 依產品

- 奶粉

- 乾燥嬰兒食品

- 奶粉

- 準備好的嬰兒食品

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Ardagh Group

- Amcor PLC

- Mondi Group

- RPC Group

- Winpak Ltd

- Sonoco Products Company

- Silgan Holdings Inc.

- Tetra Laval

- DS Smith PLC

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 55430

The Baby Food Packaging Market is expected to register a CAGR of 6.95% during the forecast period.

Key Highlights

- The developing countries across the world are witnessing rapid urbanization leading to increased disposable income and adoption of modern lifestyle. These factors have led to an increase in the expenditure on baby food products.

- Another factor boosting the need for packaging solutions is the innovations by baby food manufacturers to meet the consumers' various needs. This has led the companies to create green, innovative, and recyclable products to replace normal packaging.

- Owing to the lifestyles and growth in the number of working parents, the demand for larger pack sizes and more convenient packaging is expected to grow significantly in the baby food packaging market over the forecast period. The demand is likely to be high in the prepared baby food category, where thin wall plastic containers, flexible plastic packs, and aluminum/plastic pouches in sizes above 100 g are expected to replace glass jars due to the benefit they offer regarding portability, ease of use, and disposability.

- Although the impact of COVID-19 was less on the packaging industry overall, the factors such as supply chain disruption and partial closure of production facilities temporarily disrupted the production and distribution capacity of baby food products. The packaging industry is expected to recover rather quickly considering the growing demand, widespread vaccination in various parts of the world, and removal of travel restrictions.

- Moreover, in the last decade, baby food products packaged in jars or glass accounted for the majority of sales. However, the growing consumer preference for eco-friendly pouches and features such as safety, reusability, hygiene, lightweight, and easy to carry has increased the adoption of flexible packaging in the last ten years. Similar trends are expected to drive the growth of the market studied during the forecast period.

Baby Food Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- Plastics are a more efficient material for food packaging than other alternatives because plastics are energy efficient to manufacture and lighter than alternative materials. For instance, just two pounds of plastic can deliver 10 gallons of a beverage, whereas three pounds of aluminum, eight pounds of steel, or over 40 pounds of glass are needed to deliver the same amount of beverage.

- In infant formula, metal and plastic packaging are majorly adopted. Ball Corporation is one of the major companies offering metal packaging, such as food cans. However, the usage of larger folding cartons as primary packaging for powdered milk formula, which offers individual servings in secondary packs of flexible plastic, is expected to increase over the forecast period.

- In the powder milk formula segment, the busy life of working parents has led to the launch of single-serve plastic sachets by various brands. Thus, this increases the importance of ready nutrition products and further boosts the market growth.

- The growing consumer preference toward eco-friendly pouch packaging has also increased the adoption of flexible packaging. Another factor augmenting the demand for plastic packaging solutions is the innovation by baby food manufacturers to meet varying consumer needs as eco-conscious parents are predominantly choosing baby food packaged in plastic barrier bags and pouches because these materials are recyclable and landfill-friendly.

- To meet the demand for eco-friendly baby food products, packaging companies are opting for plastics that do not affect the packaged food. For instance, in March 2020, Nestle announced the launch of a first-of-its-kind, single-material pouch for its baby food products designed for the future of recycling. The product will be 100% recyclable through Gerber's national recycling program with TerraCycle.

Asia Pacific to Witness a Significant Growth

- The Asia Pacific region is expected to witness high growth during the forecast period, owing to the increased use of packaged baby food products by the urban population. Additionally, with the rising disposable income of people in the emerging economies and their busy lifestyles, there is a significant growth in the market in the Asia-Pacific region.

- Moreover, China is expected to have the highest share in the baby food packaging market in the Asia Pacific region, followed by Japan and India. The increasing awareness of consumers regarding the nutritional benefits of packaged baby food products is expected to drive the growth of the market.

- Furthermore, due to superior quality and the perceived safety and security that comes with Japanese brands, the baby food formulas manufactured in Japan are also gaining popularity in other countries, which is expanding the scope of export and packaging. Earlier, Europe was one of the major export destinations for Japan's baby food products. However, recently, the country started targeting other emerging regions. For instance, in the last few years, the Japanese baby food formulas quickly gained popularity in the Southeast Asian region, especially among the emerging countries.

- Additionally, a significant increase in the employment of women is being observed in the Asia Pacific region, by virtue of which women get less time to care for their babies through traditional methods. This has created an opportunity for the baby food market, thereby driving the studied market.

Baby Food Packaging Industry Overview

The baby food packaging market is highly competitive, owing to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Ardagh Group, Amcor Ltd, Mondi Group, and Sonoco, among others.

- September 2021 - Silgan Holdings Inc. announced that it had acquired Gateway Plastics. This business manufactures and sells dispensing closures and integrated dispensing packaging solutions, such as a combined container and closure or 100% recyclable dispensing beverage pods, to consumer goods product companies primarily for the food and beverage markets.

- August 2021 - Heinz unveiled an easily recyclable baby food pouch. The products are made entirely from polypropylene and have been assessed by the On-Pack Recycling Label (OPRL). This is in line with the company's mission to remove plastic where possible and its aim to make 100 percent of its packaging recyclable, reusable or compostable by 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rapid Urbanization Coupled with Busy Lifestyle

- 4.4 Market Restraints

- 4.4.1 Rising Concerns over Eco-friendly Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Baby Food Packaging Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Pouches

- 5.3 By Product

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ardagh Group

- 6.1.2 Amcor PLC

- 6.1.3 Mondi Group

- 6.1.4 RPC Group

- 6.1.5 Winpak Ltd

- 6.1.6 Sonoco Products Company

- 6.1.7 Silgan Holdings Inc.

- 6.1.8 Tetra Laval

- 6.1.9 DS Smith PLC

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219