|

市場調查報告書

商品編碼

1629759

歐洲嬰兒食品包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

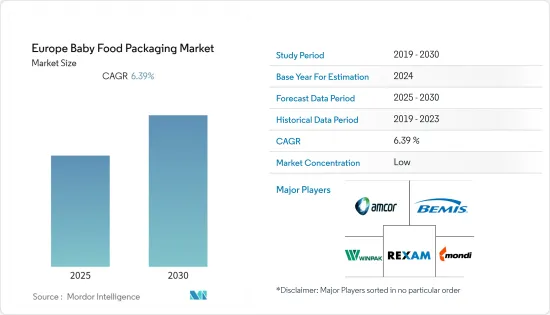

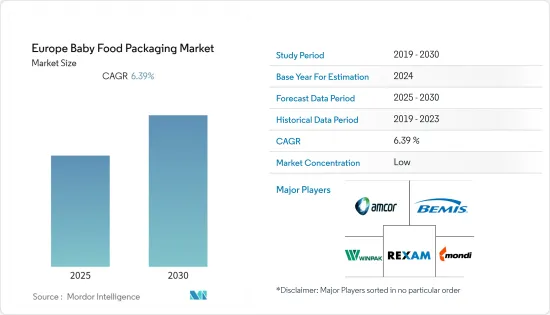

歐洲嬰兒食品包裝市場預計在預測期內複合年成長率為 6.39%

主要亮點

- 歐洲是世界上最發達的大陸之一,都市化迅速,特別是在東歐和南歐,導致可支配收入增加和現代生活方式的採用。這些因素正在增加嬰兒食品和嬰兒食品包裝解決方案的支出。

- 嬰兒食品包裝市場理想地由玻璃瓶、塑膠瓶和玻璃容器組成,但多年來,人們對永續包裝的日益關注導致包裝產品紙質袋和紙盒的增加,我們鼓勵供應商採用它。

- 推動包裝解決方案需求的另一個因素是嬰兒食品製造商為滿足消費者不同需求而進行的技術創新。隨著人們對食品營養和安全的警覺性日益提高,以及嬰兒即食食品的多樣化,歐洲市場正在見證全部區域的多項產品創新。

- 此外,由於安全、可重複使用、衛生、輕巧和易於攜帶等因素,立式袋和薄壁容器的需求量也很大。這正在推動市場。

歐洲嬰兒食品包裝市場趨勢

紙袋大幅成長

- 小袋和袋子主要用於嬰兒食品行業,用於多種嬰兒食品,如奶粉、液體、即溶奶、嬰兒米粉、嬰兒乾糧等。這些是最環保的選擇之一。它們由多層鋁、塑膠和類似的食品級材料製成。

- 包含紙袋的軟包裝的製造需要更少的材料和能源。 Glenroy 表示,與玻璃瓶相比,袋子可以節省 62% 的石化燃料、75% 的溫室氣體和 80% 的水。

- 該袋還採用獨特的封閉技術,可控制分配和均勻的產品分佈,從而實現 99% 的產品排放並有助於防止食物浪費。軟包裝正在鼓勵企業採取更環保的策略,從而減少產品和包裝浪費。

- 此外,紙袋或殺菌袋,也稱為自立袋,廣泛應用於嬰兒食品包裝市場。這些袋子堅固耐用,可在從一個地區運輸到另一個地區時保護內容物免受物理和環境風險。除了這些用途之外,其受歡迎的主要原因之一是它比同類產品便宜得多。

英國佔最大市場佔有率

- 在歐洲地區,英國預計將在嬰兒食品包裝市場中佔最高佔有率,其次是俄羅斯和德國。消費者對嬰兒食品包裝產品營養價值的認知不斷提高預計將推動市場成長。

- 根據 RetailXCoronavirus Consumer Tracker 的數據,對 COVID-19 的擔憂增加導致客戶行為發生了重大變化。

- 歐洲嬰兒食品包裝市場受到嚴格監管,以確保嬰兒食品消費最安全。嚴格且不斷變化的監管也導致市場扭曲。創新的包裝和特殊成分的加入為產品帶來了其他好處,也推動了市場的發展。

- 英國市場的成長主要得益於軟包裝產業。全球包裝供應商正在向該地區擴張並收購當地公司,展示了英國市場的潛力。例如,2020年1月,Macfarlane Group收購了防護包裝解決方案提供商Armagrip,收購金額未公開。

- 英國是歐洲地區主要經濟體之一。歐洲國家可支配收入的增加導致嬰兒食品的購買力提高,從而提高了嬰兒期食品的品質。嬰兒食品/配方奶粉市場的成長也受到越來越多移民定居就業的推動。

- 因此,無論是高所得地區或低收入地區,外出工作的婦女人數都在增加。職業媽媽在生完孩子後立即返回工作崗位,這樣她們就可以準備嬰兒食品和牛奶並立即提供給孩子。這是歐洲嬰兒食品包裝市場成長的主要原因,因為包裝產品方便攜帶和運輸。

歐洲嬰兒食品包裝產業概況

由於許多國內外公司的存在,歐洲嬰兒食品包裝市場高度分散。市場在價格、產品設計、產品創新等方面都具有競爭力。市場主要企業包括 Amcor、AptarGroup、Bemis、Mondi Group、Rexam、RPC Group 和 Winpak。

- 2021 年 8 月 - 據報道,亨氏推出了可透過路邊收集回收的單一材料嬰兒食品袋。該公司與 Tesco 的技術團隊和回收慈善機構 RECOUP 合作,使 280 萬個 Heinz for Baby 水果袋“易於回收”,每年減少掩埋的Heinz for Baby 水果袋數量約 20 噸。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 包裝奶粉食品和嬰兒配方奶粉的需求不斷成長

- 都市區職業婦女人口的增加

- 市場限制因素

- 政府對一次性塑膠包裝的嚴格規定

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按材質

- 塑膠

- 紙板

- 金屬

- 玻璃

- 按包裝

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 小袋

- 其他包裝

- 依產品

- 液態乳

- 乾燥嬰兒食品

- 奶粉

- 準備好的嬰兒食品

- 按國家/地區

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 其他歐洲國家

第6章 競爭狀況

- 公司簡介

- Amcor Ltd.

- Sonoco Products Company

- Mondi Group

- Berry Global Inc.

- Rexam PLC

- Winpak Ltd.

- AptarGroup

- Uflex Ltd.

- CAN-PACK SA

- Tetra Laval

- DS Smith Plc

- Bemis Company, Inc.

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 56019

The Europe Baby Food Packaging Market is expected to register a CAGR of 6.39% during the forecast period.

Key Highlights

- Europe is one of the most developed continents across the world; it is witnessing rapid urbanization, especially in Eastern and Southern Europe, leading to increased disposable income and the adoption of a modern lifestyle. These factors have led to an increase in the expenditure on baby food products and, in turn, baby food packaging solutions.

- Baby Food Packaging Market is ideally comprised of glass bottles, plastic bottles, and glass container; however, over the years, the increased concerns over sustainable packaging has encouraged vendors to introduce paper-based pouches and boxes for packaging goods.

- Another factor boosting the need for packaging solutions is the innovations by baby food manufacturers to meet the consumer's various needs. With increased vigilance of food nutrition and safety and a variety of ready-to-eat edible products for babies, the European market is experiencing several product innovations across the region.

- Moreover, owing to some of the factors, like safe, reusable, hygienic, lightweight, and easy to carry, the stand-up pouches and thin wall containers are witnessing high demand. Thus, this is driving the market.

Europe Baby Food Packaging Market Trends

Paper Pouches to Show Significant Growth

- Pouches and bags are being predominantly deployed in the baby food industry, serving many baby food products like powdered, liquid, instant formula, baby cereals, dried baby food, etc. They are among the most environmentally friendly options. These are made either with several layers of aluminum, plastic, and similar food-grade materials.

- Flexible packaging incorporating paper pouches uses fewer materials and energy to manufacture. According to Glenroy, when compared to glass bottles, the Pouch saves 62% on fossil fuels, 75% on greenhouse gas emissions, and 80% on water.

- The pouch also has a one-of-a-kind closure technology that helps prevent food waste by allowing for regulated dispensing and even product distribution, resulting in 99% product evacuation. Flexible packaging is facilitating firms to take an eco-friendlier strategy, resulting in less product and packaging waste.

- Furthermore, paper pouches and retort pouches, also known as stand-up bags, are being widely used in the baby food packaging market. These bags are tough and durable, protecting the contents from physical and environmental risks while being transported from one area to another. Apart from these uses, one of the main reasons for their popularity is that they are quite inexpensive in comparison to their counterparts.

United Kingdom to Hold the Largest Market Share

- In the European region, the United Kingdom is expected to have the highest share in the baby food packaging market, followed by Russia and Germany. The increasing awareness of consumers regarding the nutritional benefits of packaged baby food products is expected to drive the growth of the market.

- As per the RetailXCoronavirus Consumer Tracker, there were significant changes in customer behavior due to the growing COVID-19 concerns.

- The European baby food packaging market is highly regulated that making the baby food safest to consume. Stringent and changing regulations have also caused distortions in the market. The innovative packaging and incorporation of special ingredients that have given an additional benefit to the product are also driving factors of the market.

- The market in the United Kingdom is mainly growing due to the flexible packaging sector. The global packaging vendors are expanding in the region, and local companies are being acquired, which is indicative of the market potential in the United Kingdom. For instance, in January 2020, Macfarlane Group acquired protective packaging solutions provider Armagrip for undisclosed sums.

- The United Kingdom is one of the major economies in the European Region. Growing disposable income in European countries has led to rising in the affordability of baby food products, which has resulted in improved quality food from an infant stage. The growth of the baby food/formula market is also being driven by the increasing number of migrants settling for employment.

- Therefore, the number of women working outside the homes both in the high and low-income areas has also risen. Since working mothers return to their jobs shortly after giving birth, prepared baby foods and formulas, which can be instantly provided to the children, this is the main reason of the Europe Baby Food Packaging Market to grow as packaged products makes carrying and transportation convenient.

Europe Baby Food Packaging Industry Overview

The baby food packaging market is highly fragmented in Europe, owing to the presence of many domestic and international players. The market is competitive with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Amcor, AptarGroup, Bemis, Mondi Group, Rexam, RPC Group, Winpak, among others.

- August 2021 - Heinz reported to launch a mono-material baby food pouch that is recyclable via kerbside collection. The company will be collaborating with Tesco's technical team, and recycling charity RECOUP is predicted to make 2.8m of Heinz for Baby fruit pouches 'easily recyclable' and save nearly 20 tonnes of plastic from Heinz for Baby fruit pouches going to landfill every year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growing Demand of Packaged Baby Food and Infant Formula

- 4.3.2 Increasing Working Women in Urban Areas residing Population

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations over Single-Use Plastic-based Packaging

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Pouches

- 5.2.6 Other Packaging Type

- 5.3 By Product

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 France

- 5.4.3 Germany

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd.

- 6.1.2 Sonoco Products Company

- 6.1.3 Mondi Group

- 6.1.4 Berry Global Inc.

- 6.1.5 Rexam PLC

- 6.1.6 Winpak Ltd.

- 6.1.7 AptarGroup

- 6.1.8 Uflex Ltd.

- 6.1.9 CAN-PACK S.A.

- 6.1.10 Tetra Laval

- 6.1.11 DS Smith Plc

- 6.1.12 Bemis Company, Inc.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219