|

市場調查報告書

商品編碼

1629792

歐洲流程自動化:市場佔有率分析、產業趨勢與成長預測(2025-2030)Europe Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

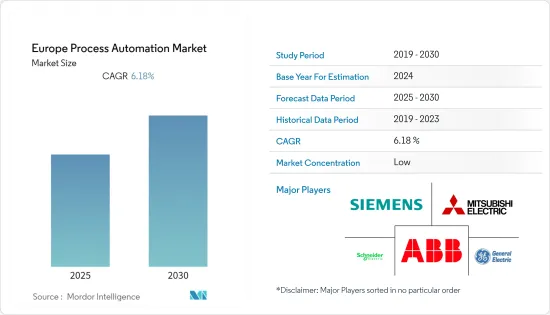

歐洲製程自動化市場預計在預測期內複合年成長率為 6.18%

主要亮點

- 物聯網需求趨勢預計在不久的將來將從消費需求轉向工業領域,主要由各種工業4.0應用推動。英國等國家正處於工業革命的邊緣,資料在生產中大規模使用,並與整個供應鏈中的各種製造系統整合。

- 歐洲國家一直處於實施工業自動化解決方案的最前沿,並得到了政府的持續支持。例如,英國政府宣布了一項“產業戰略”,計劃到 2020 年每年投資 20 億英鎊用於新技術的研發。智慧製造和物聯網 (IIot) 將建立在過去幾年自動化已經完成的工作的基礎上。專注於自動化解決方案帶來的可能性將為多個產業提供挑戰創新極限的機會,這對於英國脫歐後的經濟至關重要。自動化解決方案有望徹底改變流程工業。

- 此外,化學品和石化、造紙和紙漿、水和污水處理、能源和公共產業、石油和天然氣、製藥以及食品和飲料等加工行業預計將推動成長。

- 工業系統設計師、整合商和機器製造商正在利用互聯運算的進步來幫助製造設施更有效率地運作。製造業對即時智慧、更好地控制營運、調度以及巨量資料分析市場滲透率不斷提高的需求預計將在不久的將來創造對先進製程自動化的需求。巨量資料分析被用來改善複雜的流程和管理供應鏈。

- 此外,巨量資料分析允許公司利用工廠自動化從反應性實踐轉向預測性實踐。這項變更旨在提高流程效率和產品效能。

歐洲流程自動化市場趨勢

醫藥產業可望佔據較大市場佔有率

- 自動化正在融入活性藥物成分 (API) 等主要方面和包括包裝和分銷在內的其他次要方面。數位轉型為該地區的製藥公司提供了新的業務效率、品質、流程自動化和員工生產力。

- 此外,Lonza 選擇羅克韋爾自動化來幫助實現 Lonza 的戰略願景,即在 9 個生產藥物膠囊的前 Capsugel 工廠實施數位化工廠。該公司選擇羅克韋爾自動化的 PharmaSuite MES 軟體來實現製造業務的數位化。該解決方案將有助於避免在大量即時訂單按需生產期間出現混亂。

- 此外,Lonza 可以使用 PharmaSuite MES 軟體和 FactoryTalk InnovationSuite 軟體來追蹤產品直至單個膠囊盒,從而更深入地了解性能和生產。透過分離 SAP 和 PharmaSuite MES,我們能夠實施工作流程並收集必要的資訊,以避免因 World Enterprise Resource Planning ERP 關閉和所需維護而造成中斷。

- 此外,後 COVID-19 員工和組織可能會採用新的、更有效率的工作方式。隨著勞動力從體力技能轉向更具技術性的技能,營運職能也需要新的能力。隨著自動化程度的提高,製藥公司的營運可能對能夠編程、操作和解釋這些新技術資料的人員的需求不斷增加。這可能需要大量的技能提升和能力建構工作,以及持續的策略規劃。

- 過去三個月,歐洲多家製藥公司動員員工遠距辦公。在這種情況下,自動化可以幫助基本流程不受阻礙地繼續進行。藥物發現的自動化透過最大限度地減少人為錯誤、提高通量和提高再現性來提高整個過程的可靠性。

英國佔最大市場佔有率

- 食品和飲料行業在提供大規模生產系統的同時保持國內最高的衛生標準。此外,競爭力要求營運效率,包括原料消耗和生產成本。實現這些目標是在這個行業中生存的關鍵因素。需求和勞動力的季節性也推動該行業採用自動化,幫助市場成長。

- 食品產業的自動化透過消除錯誤和浪費、提高效率和生產力以及擴大利潤率來增強競爭。節省的成本可以用於研發或其他業務改進。

- 此外,政府為重振遭受疫情打擊的英國經濟而推出的投資凸顯了基礎設施和電子產業以及中小型企業的成長,成為主要受益者。基礎設施和電子產業是工業控制系統硬體產品和軟體解決方案的大量用戶,預計將產生直接的正面影響。

- 此外,流程發現、流程最佳化、流程智慧和流程協作等技術和術語正在成為機器人流程自動化 (RPA) 的重要組成部分。未來,業務流程管理 (BPM) 和 RPA 之間的關係將持續發展。

- 此外,可以使用虛擬機器在工廠車間的不同位置輕鬆存取單一實體伺服器上的不同工業自動化系統,例如 SCADA、PLC 和 MES。該國已採用它來降低伺服器的總成本,並提高流程和離散製造業中工業自動化系統和軟體實施的靈活性。

歐洲流程自動化產業概況

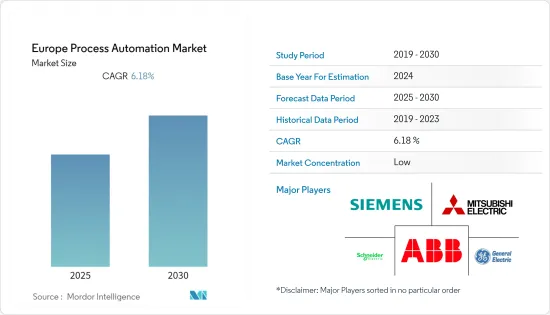

歐洲過程自動化市場適度分散,幾乎沒有新參與企業和一些主導參與者。公司不斷創新並結成策略夥伴關係以維持市場佔有率。近期市場發展趨勢如下:

- 2020 年 8 月 -Schneider Electric完成一項交易,將其低壓和工業自動化產品業務與 Larsen & Toubro 的電氣和自動化業務合併。

- 2020年5月-無線工業自動化與物聯網解決方案供應商OleumTech宣布推出新型智慧壓力感測器(HGPT智慧表壓力感測器)。這些傳送器是該公司快速發展的 H 系列硬佈線製程儀器產品線的補充,是石化、化學、電力、上游石油和天然氣以及污水處理等製程產業的理想選擇。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章 研究方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 市場促進因素(日益關注能源效率和降低成本|安全自動化系統的需求|工業物聯網的出現)

- 市場挑戰(成本和實施挑戰)

- 行業標準和法規

- 英國、德國和法國主要工業自動化地點的分析 - 根據過去三年的投資者活動和擴張活動確定。

第 5 章:評估 COVID-19 對歐洲流程自動化產業的影響

- 根據疫情中短期影響所確定的關鍵主題分析-V型復甦、中期復甦、低迷復甦

- 英國製程自動化市場—基於最終用戶效能的基本變數分析

- 德國製程自動化市場—基於最終用戶效能的基本變數分析

- 法國製程自動化市場—基於最終用戶效能的基本變數分析

- 供應相關挑戰的影響以及市場監管在市場振興中的作用

第6章 市場細分

- 按通訊協定

- 有線

- 無線的

- 依系統類型

- 按系統硬體

- 監控和資料採集系統(SCADA)

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 製造執行系統(MES)

- 閥門和致動器

- 馬達

- 人機介面 (HMI)

- 製程安全系統

- 感測器和發射器

- 依軟體類型

- APC(獨立和客製化解決方案)

- 先進的監理控制

- 多變量模型

- 推理與連續式

- 基於資料分析和彙報的軟體

- 其他軟體和服務

- 按系統硬體

- 按最終用戶產業

- 石油和天然氣

- 化工/石化

- 電力/公共產業

- 用水和污水

- 飲食

- 紙/紙漿

- 製藥

- 其他最終用戶產業

- 按國家/地區

- 英國

- 德國

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Siemens AG

- Schneider Electric

- General Electric Co.

- Mitsubishi Electric

- Rockwell Automation

- Emerson Electric Co.

- Honeywell International Inc.

- Fuji Electric

- Eaton Corporation

- Delta Electronics Limited

- Yokogawa Electric

第8章過程自動化產業關鍵創新者與挑戰分析

第9章投資分析及市場展望

簡介目錄

Product Code: 56741

The Europe Process Automation Market is expected to register a CAGR of 6.18% during the forecast period.

Key Highlights

- The IoT demand trend is expected to shift toward industrial space from consumer demand over the near future, primarily driven by various Industry 4.0 applications. Countries like the United Kingdom are on the verge of the industrial revolution, as data is being used on a large scale for production while integrating it with various manufacturing systems throughout the supply chain.

- European nations have been at the forefront of adopting industrial automation solutions and have been under the government's constant support. For instance, the UK government revealed the Industrial Strategy primarily outlined a plan to invest GBP 2 billion per year by 2020 for new research and development in the technology sector. Smart manufacturing and the Industrial Internet of Things (IIot) will be built upon the work that automation has already forged over these years. Focusing on the possibilities that the automation solutions will enable will present the opportunity for multiple industries to push the boundaries of technological innovation, which is crucial for the UK economy in a post-Brexit phase. Automation solutions are expected to revolutionize the process industries.

- Furthermore, process industries, such as chemical and petrochemical, paper and pulp, water and wastewater treatment, energy and utilities, oil and gas, pharmaceutical, food, and beverages, are expected to fuel growth.

- Industrial system architects, integrators, and machine builders have leveraged connected computing advances to aid manufacturing facilities function more efficiently. The rising need for real-time intelligence, better control of operations, scheduling, and increasing market penetration of big data analytics in the manufacturing industry is expected to generate demand for advanced process automation in the near future. Big data analytics has been used to refine complicated processes and manage supply chains.

- Moreover, big data analytics allows an enterprise to use factory automation to shift from reactionary practices to predictive ones. This change targets to improve the efficiency of the process and performance of the product.

Europe Process Automation Market Trends

Pharmaceutical Industry is Expected to Hold Significant Market Share

- Automation is embedded in primary aspects such as Active Pharma Ingredients (API) and other secondary aspects, including packaging and distribution. Digital transformation provides new operational efficiency, quality, process automation, and employee productivity to pharmaceutical companies in the region.

- Furthermore, Lonza selected Rockwell Automation to implement the Lonza strategic vision of bringing the digital factory to nine former Capsugel facilities that manufacture drug capsules. The company has selected Rockwell Automation's PharmaSuite MES software to digitize the operations in its manufacturing operations. This solution would help avoid disruptions during high volume periods of just-in-time orders for on-demand production.

- Additionally, Lonza would use PharmaSuite MES software and FactoryTalk InnovationSuite software to better trace products down to the individual capsule carton and gain insights into performance and production. Segregation of SAP and PharmaSuite MES helped avoid the disruption of a global enterprise resource planning ERP shutdown or required maintenance by enforcing workflows and collecting necessary information.

- Moreover, the post-COVID-19 workforce and organization would also likely adopt new, more efficient ways of working. New capabilities would also be needed within operations functions as the workforce shifts from manual skills to more technical skills. As the adoption of automation increases, pharmaceutical-operations organizations might have a greater need for talent that can program, operate, and interpret data from these new technologies. This would require significant up-skilling and capability-building efforts alongside ongoing strategic planning.

- Over the past three months, many pharma companies in Europe have mobilized their employees to remote working conditions. In such a scenario, automation helps them continue the essential processes unobstructed. Automation in drug discovery enhances the reliability of the entire process by minimizing manual errors, augments the throughput, and improves the ability to reproduce.

United Kingdom Accounts for the Largest Market Share

- The food and beverage industry maintains some of the highest hygiene standards in the country while delivering high-volume production systems. In addition, competitive forces demand that a business is efficient, both in terms of the raw materials consumed and the cost of manufacturing. Delivering these objectives is a crucial part of remaining in the industry. Seasonality of demand and labor forces have also prompted the industry to adopt increased automation, thus assisting the market's growth.

- Automation in the food industry increases competitiveness by eliminating errors and waste, enhancing efficiency and productivity, and expanding profit margins. Cost savings can be diverted to R&D and other business improvements.

- Moreover, with investment roll-outs by the government to revive the pandemic hit United Kingdom economy, infrastructure, and the electronics industry are marked as the primary beneficiaries alongside the growth of small and medium-sized enterprises. The infrastructure and electronics industry are heavy users of the industrial control systems' hardware products and software solutions and are expected to have a direct positive effect.

- Additionally, technologies and terminologies such as process discovery, process optimization, process intelligence, and process orchestration are becoming a more significant part of Robotic Process Automation (RPA). There is an ongoing trend of increasing a closer relationship between business process management (BPM) and RPA in the future.

- Further, different industrial automation systems, such as SCADA, PLCs, and MES on a single physical server, can be easily accessed at a different location on the plant floor using virtual machines. It has been adopted in the country to reduce the overall cost for servers and increase the flexibility in adopting industrial automation systems and software in the process and discrete industries.

Europe Process Automation Industry Overview

The European Process Automation Market is moderately fragmented, with few new entrants and few dominant players. The companies keep on innovating and entering into strategic partnerships to retain their market share. Some of the recent developments in the market are:

- August 2020 - Schneider Electric completes transaction to combine its Low Voltage and Industrial Automation Product business with Larsen & Toubro's Electrical & Automation business.

- May 2020 - OleumTech, wireless industrial automation and IoT solutions provider announced the launch of new intelligent pressure transmitters (HGPT Smart Gauge Pressure Transmitters). These transmitters are an addition to its fast-growing H Series line of hardwired process instrumentation and claimed to deliver remarkable performance, accuracy, and reliability ideal for process industries, such as petrochemical, chemical, power, upstream oil and gas, and wastewater.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHADOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers (Growing emphasis on energy efficiency & cost reduction| Demand for Safety Automation Systems| Emergence of IIoT)

- 4.5 Market Challenges (Cost & Implementation Challenges)

- 4.6 Industry Standards & Regulations

- 4.7 Analysis of the major Industrial Automation hubs in the United Kingdom, Germany, and France - To be identified based on the investor activity & expansion activities undertaken over the last 3 years

5 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE PROCESS AUTOMATION INDUSTRY IN EUROPE

- 5.1 Analysis of the key themes identified based on the near & medium-term effects of the pandemic - V-shaped recovery, Mid-range recovery & Slump recovery

- 5.2 United Kingdom Process Automation Market - Base variable analysis based on end-user performance

- 5.3 Germany Process Automation Market - Base variable analysis based on end-user performance

- 5.4 France Process Automation Market - Base variable analysis based on end-user performance

- 5.5 Impact of Supply-related challenges & the role of market regulations in spurring activity

6 MARKET SEGMENTATION

- 6.1 By Communication Protocol

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By System Type

- 6.2.1 By System Hardware

- 6.2.1.1 Supervisory Control and Data Acquisition System (SCADA)

- 6.2.1.2 Distributed Control System (DCS)

- 6.2.1.3 Programmable Logic Controller (PLC)

- 6.2.1.4 Manufacturing Execution System (MES)

- 6.2.1.5 Valves & Actuators

- 6.2.1.6 Electric Motors

- 6.2.1.7 Human Machine Interface (HMI)

- 6.2.1.8 Process Safety Systems

- 6.2.1.9 Sensors & Transmitters

- 6.2.2 By Software Type

- 6.2.2.1 APC (Standalone & Customized Solutions)

- 6.2.2.1.1 Advanced Regulatory Control

- 6.2.2.1.2 Multivariable Model

- 6.2.2.1.3 Inferential & Sequential

- 6.2.2.2 Data Analytics & Reporting-based Software

- 6.2.2.3 Other Software & Services

- 6.2.1 By System Hardware

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power and Utilities

- 6.3.4 Water & Wastewater

- 6.3.5 Food and Beverage

- 6.3.6 Paper & Pulp

- 6.3.7 Pharmaceutical

- 6.3.8 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Siemens AG

- 7.1.3 Schneider Electric

- 7.1.4 General Electric Co.

- 7.1.5 Mitsubishi Electric

- 7.1.6 Rockwell Automation

- 7.1.7 Emerson Electric Co.

- 7.1.8 Honeywell International Inc.

- 7.1.9 Fuji Electric

- 7.1.10 Eaton Corporation

- 7.1.11 Delta Electronics Limited

- 7.1.12 Yokogawa Electric

8 ANALYSIS OF MAJOR INNOVATORS & CHALLENGERS IN THE PROCESS AUTOMATION INDUSTRY

9 INVESTMENT ANALYSIS & MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219