|

市場調查報告書

商品編碼

1630215

美國油漆和塗料:市場佔有率分析、行業趨勢和成長預測(2025-2030)United States Paints and Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

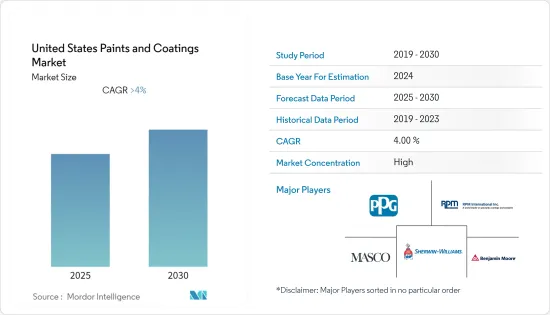

預計美國油漆和塗料市場在預測期內的複合年成長率將超過 4%。

COVID-19 的爆發對美國油漆和塗料業務產生了重大影響。在最初的衝擊之後,由於製造工廠和建築工地等眾多非必要設施的關閉,該行業的需求下降。結果,油漆和被覆劑的產量減少,供應鏈中斷。然而,由於建設產業和終端用戶產業投資增加,市場於 2021 年復甦。

主要亮點

- 該國商業建設活動的增加正在推動對所研究市場的需求。

- 有關使用不含揮發性有機化合物成分和替代化學品的嚴格法規估計會阻礙市場成長。

- 奈米技術在油漆和塗料行業的應用預計將在預測期內為市場成長提供各種機會。

- 在最終用戶領域,建築業在國內市場佔據主導地位。然而,包裝產業在預測期內的複合年成長率將最高。

美國油漆和塗料市場趨勢

丙烯酸樹脂佔據市場主導地位

- 丙烯酸樹脂是油漆和塗料行業中使用最廣泛的聚合物。大多數壓克力型塗料都是水性或溶劑型的,包括乳化(乳膠)、清漆(低固態含量)、瓷漆(高固態含量)和粉末(100%固態)。

- 常見的丙烯酸聚合物有多種類型和組合,包括甲基丙烯酸甲酯和甲基丙烯酸丁酯。對於廉價的塗料,主要使用聚醋酸乙烯酯。

- 所使用的丙烯酸的兩種主要形式是熱塑性和熱固性。熱塑性丙烯酸樹脂是由不同丙烯酸單體聚合而成的合成樹脂。熱固性樹脂透過與其他聚合物反應在高溫下固化。有兩種類型的熱塑性丙烯酸樹脂:溶液丙烯酸樹脂和丙烯酸乳膠塗料。

- 此外,丙烯酸樹脂在塗佈液中表現出透明性、高著色性、耐紫外線性等特性。丙烯酸樹脂常用於水系統,揮發性有機化合物排放低。丙烯酸樹脂具有較高的表面硬度。對於某些應用,例如牆壁、甲板和屋頂,壓克力型塗料提供合成橡膠飾面,當與流體一起使用時,可以提高表面的抗紫外線能力。

- 壓克力型塗料主要用於建築業的高階飾面,例如屋頂、甲板、橋樑和地板。由於環境問題(例如揮發性有機化合物對環境空氣的負面影響),水性壓克力型塗料的需求量很大。美國人口普查資料顯示,美國建築支出近年來大幅成長,與前一年同期比較增10%,達到1.639兆美元。

- 美國塗料市場的主要基底類型是丙烯酸,佔所有水性塗料的 70% 以上。丙烯酸廣泛用於建築塗料。

- 這些正面因素可能會增加預測期內的需求。

建築業需求增加

- 油漆和被覆劑不僅用於為住宅內部增添色彩和裝飾目的,而且還具有多種功能。其功能取決於使用它的環境和房間類型。

- 例如,浴室牆壁有很多濕氣,因此需要擦拭以保持清潔。光澤塗料比平光塗料具有更堅固的分子結構,因此濕氣不太可能滲透它們。這就是為什麼這種類型的油漆用於浴室。

- 在你家的外牆上塗上油漆或塗料不僅能讓它煥然一新,還能保護它免受明媚的夏季、寒冷的冬季、傾盆大雨和日常紫外線的影響,因此它不會褪色、剝落或開裂。為了它。

- 現代塗料技術的進步,特別是丙烯酸配方,提供了各種耐候塗料。

- 該市場受到美國,美國是建築塗料的主要消費者之一。

- 由於強勁的經濟和商業房地產有利的市場基本面,以及聯邦和州對公共工程和機構建築津貼的增加,美國建設產業持續擴張。

- 受多種因素影響,近年來美國住宅建設快速成長。例子包括低利率、強勁的經濟和住宅的增加。低利率意味著更多的人有資格獲得房屋抵押貸款和更多的買家。 2021年美國住宅建築許可數量為174萬份,與前一年同期比較增加18%。

- 由於這些因素,預計在預測期內該國對油漆和被覆劑的需求將會增加。

美國油漆和塗料行業概況

市場集中度較高,前五大企業佔70%以上的市場佔有率。該市場的主要參與者包括宣偉公司、PPG 工業公司、RPM 國際公司、本傑明莫耳公司和 Masco 公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 美國商業建設活動增加

- 其他司機

- 抑制因素

- 關於使用不含 VOC 成分的嚴格規定

- 替代化學物質

- COVID-19 影響造成的不利情況

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依樹脂類型

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他樹脂

- 依技術

- 水性的

- 溶劑型

- 粉末塗料

- 其他技術

- 按最終用戶產業

- 建築學

- 車

- 木頭

- 防護漆

- 一般工業

- 運輸

- 包裝

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Axalta Coatings Systems

- Beckers Group

- Benjamin Moore & Co.

- Diamond Vogel

- Hempel A/S

- Kelly-Moore Paints

- Masco Corporation

- Parker Hannifin Corp

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Sika AG

- Wacker Chemie AG

第7章 市場機會及未來趨勢

- 奈米技術在油漆和塗料行業的應用

The United States Paints and Coatings Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 epidemic has significantly impacted the paint and coatings business in the United States. Following the initial shock, the industry has seen diminished demand due to the closure of numerous non-essential establishments, such as manufacturing factories and building sites. As a result, the output of paints and coatings has decreased, and the supply chain has been disrupted. However, the market bounced back in 2021 due to rising investment in construction and end-user industries.

Key Highlights

- Increasing commercial construction activities in the country are driving the demand for the market studied.

- Strict regulations on the usage of VOC-Free contents and substitution of alternative chemicals are estimated to hamper the market's growth.

- The use of nanotechnology in the paints and coatings industry is expected to offer various opportunities for market growth during the forecast period.

- In the end-user segment, the architectural sector dominated the market in the country. However, the packaging sector will likely have the highest CAGR during the forecast period.

US Paints and Coatings Market Trends

Acrylic Resin Dominating the Market

- Acrylic resins are the most widely used polymers in the paint and coatings industry. Most acrylic paints are water-based or solvent-based and are available as emulsions (latices), lacquers (lower volume solids), enamels (higher volume solids), and powders (100% solids).

- Common acrylic polymers come in various types and combinations, such as methyl and butyl methacrylate. In the case of inexpensive paints, polyvinyl acetate is used primarily.

- The two principal forms of acrylic used are thermoplastic and thermoset. Thermoplastics acrylic resins are synthetic resins achieved by polymerizing different acrylic monomers. Thermosets are cured at elevated temperatures by reacting them with other polymers. Thermoplastic acrylic resins are of two types: solution acrylics and acrylic latex coatings.

- Furthermore, acrylic resins develop properties such as transparency, high colorability, and UV resistance in coating solutions. They are often used in waterborne systems, which results in low VOC emissions. The application of acrylic coatings leads to high surface hardness. In specific applications, such as walls, decks, and roofing, the acrylic coatings provide elastomeric finishes to improve the UV resistance of the surface if employed with some fluids.

- The application of acrylic coatings is primarily found in the construction industry for high-end finishing in roofs, decks, bridges, floors, and other applications. Water-based acrylic coatings are in high demand owing to environmental concerns, such as the negative impact of VOCs affecting the air quality in the environment. According to US census data, construction spending in the United States climbed significantly in recent years and was at USD 1,639 billion, or 10% more than the previous year.

- The primary binder type in the United States paints and coatings market is acrylic, with a total share of more than 70% of all waterborne coatings. Acrylic is widely used in architectural coatings.

- Such positive factors are likely to increase demand over the forecast period.

Increasing Demand from Architectural Industry

- Paints and coatings are not only used in the interiors of houses to add colors or decorative purposes, but also to perform a wide range of functions. Their functions vary depending on the type of environment and room that they are used on.

- For example, because of moisture, the bathroom walls need to have wipe-ability for keeping them clean. Paints with glossier sheens have a tighter molecular structure than flat paints, making it more difficult for moisture to penetrate. So, these types of paints are used in bathroom.

- Paints and coatings are applied on the exterior of the house to not only to give them a new look, but also to protect them from blistering summers, freezing winters, soaking rain, and the daily bombardment of UV radiation without fading, peeling away, and cracking.

- The modern advancements in paint technology, specifically in the acrylic formulations, have offered a wide range of weatherproof coatings.

- Growing infrastructure in the United States, which is one of the major consumers of architectural coatings, is driving the market.

- The construction industry in the United States continued to expand, owing to a strong economy and positive market fundamentals for commercial real estate, along with an increase in federal and state funding for public works and institutional buildings.

- Due to a number of factors, residential construction has rapidly increased in the United States in recent years. Low-interest rates, a booming economy, and rising housing demand are a few of these. More people may now qualify for mortgages because of low-interest rates, which has increased the number of purchasers. In 2021, there were 1.74 million building permits for residential construction in the United States, an increase of 18% from the year before.

- Owing to all these factors, the demand for paints and coatings in the country is expected to increase during the forecast period.

US Paints and Coatings Industry Overview

The market studied is highly consolidated, with the top five players contributing to more than 70% of the market share. Key players in the market include The Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., Benjamin Moore & Co., and Masco Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Commercial Construction Activities in the United States

- 4.1.2 Other Drivers

- 4.2 Restraint

- 4.2.1 Strict Regulations on the Usage of VOC-Free Contents

- 4.2.2 Substitution of Alternative Chemicals

- 4.2.3 Unfavorable Conditions Arising Due to the Impact of COVID-19

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 Other Technologies

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coatings Systems

- 6.4.3 Beckers Group

- 6.4.4 Benjamin Moore & Co.

- 6.4.5 Diamond Vogel

- 6.4.6 Hempel A/S

- 6.4.7 Kelly-Moore Paints

- 6.4.8 Masco Corporation

- 6.4.9 Parker Hannifin Corp

- 6.4.10 PPG Industries, Inc.

- 6.4.11 RPM International Inc.

- 6.4.12 The Sherwin-Williams Company

- 6.4.13 Sika AG

- 6.4.14 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Nanotechnology in the Paints and Coatings Industry