|

市場調查報告書

商品編碼

1637846

拉丁美洲油漆和塗料:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

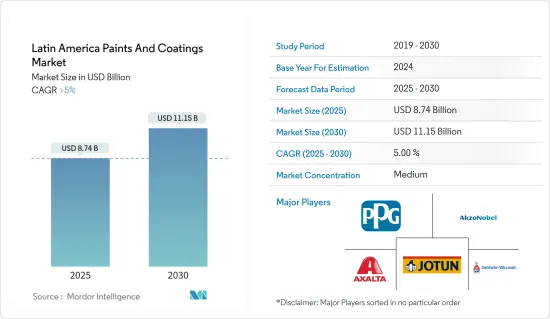

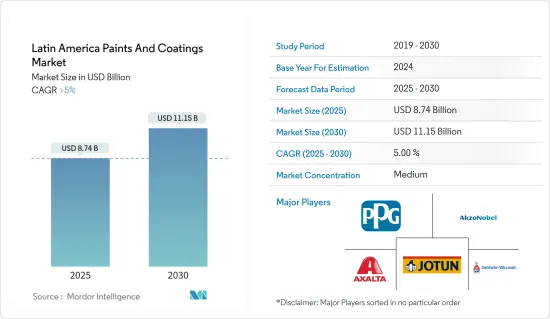

拉丁美洲油漆和塗料市場規模預計在 2025 年將達到 87.4 億美元,預計到 2030 年將達到 111.5 億美元,2025-2030 年複合年成長率為 5% 以上。

2020 年爆發了新冠疫情,導致建築業和工業活動停止,對市場產生了負面影響。不過,目前市場估計已回到疫情前的水平,預計將繼續穩定成長。

主要亮點

- 預計預測期內市場成長將受到建設產業成長和汽車產業需求成長的推動。

- 預計政府關於 VOC排放的嚴格規定將阻礙市場成長。

- 在預測期內,市場可能有機會利用對生物基和環保油漆和塗料日益成長的需求。

拉丁美洲油漆和塗料市場趨勢

建築業預計將主導市場

- 油漆和塗料廣泛用於各種裝飾用途。它用於建築物和家具。油漆和塗料不僅具有美觀的作用,還能提高表面的耐久性,並提供防熱、防水、防潮和防潮的保護。

- 油漆和被覆劑在您家的外部不僅可以給它一個新的外觀,而且還能保護它免受每天夏天的炎熱、冬天的寒冷、雨水和紫外線的侵襲,不會褪色、剝落或開裂。

- 由於預測期內該地區的建築計劃數量增加,預計油漆和塗料的使用量將會增加。

- 2023 年三個季度,建設產業錄得顯著的成長率。根據阿根廷國家統計和人口普查局(INDEC) 的數據,阿根廷建築業GDP 預計將從2023 年第二季的224.1576 億阿根廷比索(8,755 萬美元)成長到2023 年第三季的236.2086 億阿根廷比索。 6748 萬美元)百萬)。

- 阿根廷存在嚴重的結構性住宅短缺。根據城市發展和住宅部統計,25%的阿根廷家庭需要改善住宅。強勁且不斷成長的住宅需求正面臨嚴峻的供不應求短缺。因此,預計市場需求將會增加。

- 智利注重基礎建設。例如,智利外國投資促進機構InvestChile已於2023年推出了一個名為「智利投資機會」的投資組合。該投資組合總合包括 54 個基礎建設計劃,包括高速公路、航空站和其他公共設施的建設。

- 墨西哥政府的支出也推動了建設業的成長。根據墨西哥國家統計和地理研究所 (INEGI) 的數據,2023 年墨西哥建設產業收入與 2022 年相比成長了約 2%。根據《墨西哥新聞日報》報道,由於政府增加對基礎建設計劃的支出,預計2024年建築業將持續成長。

- 作為政府重新運作策略的一部分,哥倫比亞計劃在未來三年內根據區域發展計畫(PDET)加速投資 20 億美元。該計劃將改善受哥倫比亞革命武裝力量遊擊隊武裝衝突嚴重影響的170個城市的經濟狀況。對基礎設施、水利、學校和農村項目進行了投資。資金最初分配從 2021 年到 2030 年。政府已決定將投資節奏加快70%,預計將在預測期內提振市場。

- 預計這些因素將在預測期內推動拉丁美洲的油漆和塗料市場的發展。

巴西可望主導市場

- 巴西是拉丁美洲最大的經濟體。根據巴西地區統計局(IBGE)預測,2023年巴西GDP將超過2.2兆美元。此外,根據拉丁美洲和加勒比海經濟委員會的數據,該國建築業的國內生產毛額約為19,532.1億美元,是該地區最高的。

- 與其他拉丁美洲國家相比,巴西擁有最多的建築物、最大的基礎設施和最高的建築支出。巴西是世界上第十六高層建築的國家,也是拉丁美洲第一高的國家,擁有超過 62 座高度超過 150 公尺的建築。

- 政府新推出的 3,322 億美元加速成長計畫將在預測期內大幅提升巴西在該地區油漆和塗料市場的主導地位。該計畫將於2023年8月啟動,旨在2028年開發學校、醫院、高速公路、鐵路、港口、機場、水道、5G網路、住宅和衛生設施。

- 巴西是拉丁美洲油漆和被覆劑消費量的領導者。約75.2%的油漆和塗料消費量由建築業主導,其次是工業業(19.2%)、汽車售後市場(3.9%)和汽車OEM製造商(1.7%)。

- 巴西是世界十大汽車生產國之一。汽車產業是巴西經濟的主要貢獻者。據巴西工業協會(Anfavea)稱,2023年10月產量、註冊量和出口指標與上月相比穩步上升。 2023年10月,銷量從197,693輛成長至217,738輛。

- 因此,預計巴西將繼續主導拉丁美洲油漆和被覆劑市場。

拉丁美洲油漆和塗料行業概況

拉丁美洲的油漆和塗料市場部分合併。市場的主要企業包括 PPG Industries Inc.、Akzo Nobel NV、Jotun、Axalta Coating Systems 和 The Sherwin-Williams Company。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 拉丁美洲主要國家建築業成長

- 汽車產業需求增加

- 限制因素

- 嚴格控制VOC排放

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 丙烯酸纖維

- 環氧樹脂

- 醇酸

- 聚酯纖維

- 聚氨酯

- 其他樹脂

- 依技術分類

- 水性

- 溶劑型

- 粉末塗料

- UV固化型

- 按最終用戶

- 建築學

- 車

- 木頭

- 工業的

- 運輸

- 包裝

- 按地區

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 墨西哥

- 其他拉丁美洲國家

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE

- Jotun

- Lanco Paints

- Pintuco SA

- PPG Industries Inc.

- Renner Herrmann SA

- The Sherwin William Company

- WEG Coatings

第7章 市場機會與未來趨勢

- 對生物基和環保油漆和塗料的需求不斷增加

The Latin America Paints And Coatings Market size is estimated at USD 8.74 billion in 2025, and is expected to reach USD 11.15 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

In 2020, the COVID-19 pandemic had a detrimental effect on the market due to the halt in construction and industrial activities. However, the market is currently estimated to be at pre-pandemic levels, and it is expected to grow steadily in the future.

Key Highlights

- During the forecast period, the growth of the market is expected to be driven by the growth in the construction industry and the increasing demand from the automotive sector.

- The stringent regulations imposed by the government related to VOC emissions are expected to hinder the growth of the market.

- During the forecast period, the market is likely to have a chance to take advantage of the growing demand for bio-based and environmentally friendly paints and coatings.

Latin America Paints And Coatings Market Trends

The Architectural Segment is Expected to Dominate the Market

- Paints and coatings are widely used for various decorative applications. They are used in building construction and furniture. Besides providing aesthetic appeal, paints and coatings also increase the durability of the surface and protect it from heat, water, humidity, and moisture.

- Paints and coatings are applied on the exterior of the house to not only give it a new look but also protect it from the heat in summer, the cold in winter, rain, and the daily exposure to UV radiation without fading, peeling away, or cracking.

- Over the forecast period, the usage of paints and coatings is expected to increase because there are more building projects in the region.

- The construction industry registered a significant growth rate in three quarters of 2023. As per the National Institute of Statistics and Census of Argentina (INDEC), GDP from Construction in Argentina increased to ARS 23,620.86 million (USD 67.48 million) in the third quarter of 2023 from ARS 22,415.76 million (USD 87.55 million) in the second quarter of 2023.

- Argentina has a large structural housing deficit. According to the Department of Urban Development and Housing, 25% of Argentine families need improved housing. The strong and growing housing demand faces a daunting lack of supply. Hence, this is also expected to increase the demand for the market.

- Chile is focusing on improving its infrastructure. For instance, Chile's Foreign Investment Promotion Agency, InvestChile, launched an investment portfolio in 2023 called Investment Opportunities in Chile. This portfolio comprises a total of 54 infrastructure projects, including the construction of highways, air terminals, and other public facilities.

- Mexico's government spending is also boosting construction growth. According to the National Institute of Statistics and Geography (INEGI), the revenue of Mexico's construction industry registered a growth of about 2% in 2023 compared to 2022. The growth of the construction sector is expected to continue in 2024 due to the government's increasing expenditure on infrastructure projects, according to Mexico News Daily.

- Colombia planned to speed up investments of USD 2 billion under the regional development program PDET over the next three years as part of the government's reactivation strategy. The program involved improving economic conditions in 170 municipalities heavily affected by the armed conflict with the FARC guerrilla. The investments were for basic infrastructure, water, schools, and rural programs. The funds were originally allocated for 2021 to 2030. The government decided to speed up the investment rhythm by 70%, which is expected to boost the market during the forecast period.

- All the above factors are expected to drive the Latin American paints and coatings market during the forecast period.

Brazil is Expected to Dominate the Market

- In Latin America, Brazil is the largest economy. It had a GDP of over USD 2.2 trillion in 2023, according to IBGE (Brazilian Institute of Geography and Statistics). Furthermore, the country's construction sector's GDP was about USD 1,953.21 billion, the highest in the region, according to the Economic Commission for Latin America and the Caribbean.

- Brazil has the highest number of buildings, the largest infrastructure, and the most spending on construction compared to the rest of the countries in Latin America. Brazil is the 16th country with the most skyscrapers globally and the first in Latin America; it has over 62 buildings over 150 meters.

- A significant boost in the country's dominance in the paints and coatings market in the region during the forecast period will likely be provided by the government's USD 332.2 billion New Growth Acceleration Program. This program was launched in August 2023 for the development of schools, hospitals, highways, railways, ports, airports, waterways, 5G networks, housing, and sanitation by 2028.

- Brazil is the leader in terms of consumption of paints and coatings in Latin America. About 75.2% of The consumption of paints and coatings is the highest in the architectural segment, while 19.2% is in the industrial segment, 3.9% in the after-market automotive segment, and 1.7% in automotive OEMs.

- Brazil comes under the top 10 vehicle-producing countries in the world. The automotive industry is a major economic contributor to the country. According to the Brazilian Association of Automobile Manufacturers (Anfavea), production, registration, and export indicators rose steadily in October 2023 compared to the previous month. The month has recorded sales growth from 197,693 units to 217,738 units in October 2023.

- Thus, Brazil is expected to continue to dominate the paints and coatings market in Latin America.

Latin America Paints And Coatings Industry Overview

The Latin American paints and coatings market is partially consolidated in nature. Some of the major companies in the market include PPG Industries Inc., Akzo Nobel NV, Jotun, Axalta Coating Systems, and The Sherwin-Williams Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Industry in Major Economies of Latin America

- 4.1.2 Increasing Demand From the Automotive Sector

- 4.2 Restraints

- 4.2.1 Stringent Regulations Related to VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylics

- 5.1.2 Epoxy

- 5.1.3 Alkyd

- 5.1.4 Polyester

- 5.1.5 Polyurethane

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Industrial

- 5.3.5 Transportation

- 5.3.6 Packaging

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Colombia

- 5.4.4 Chile

- 5.4.5 Peru

- 5.4.6 Mexico

- 5.4.7 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE

- 6.4.4 Jotun

- 6.4.5 Lanco Paints

- 6.4.6 Pintuco SA

- 6.4.7 PPG Industries Inc.

- 6.4.8 Renner Herrmann SA

- 6.4.9 The Sherwin William Company

- 6.4.10 WEG Coatings

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in the Demand for Bio-based and Eco-friendly Paints and Coatings