|

市場調查報告書

商品編碼

1639446

南美油漆和塗料:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)South America Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

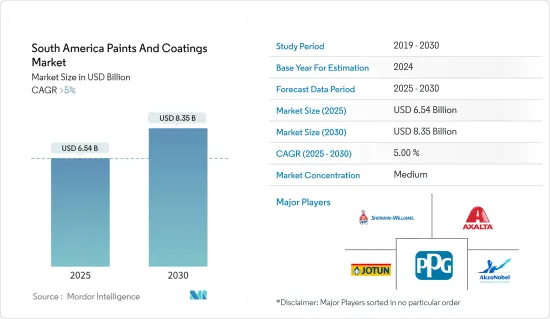

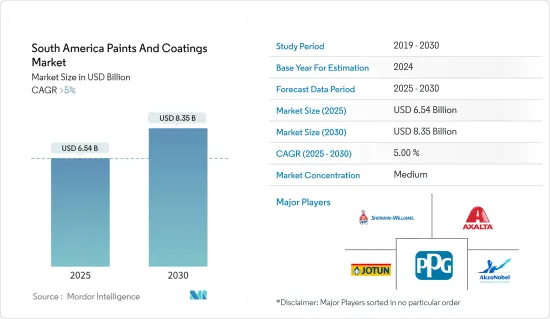

南美油漆和塗料市場規模預計在 2025 年為 65.4 億美元,預計到 2030 年將達到 83.5 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5%。

COVID-19疫情對南美的油漆和塗料行業產生了負面影響。在最初的影響之後,由於許多工廠和建築工地關閉,該行業的需求下降。這導致油漆和塗料產量下降並擾亂了供應鏈。現在,市場正從疫情中復甦。預計市場將在 2022 年達到疫情前的水平,並在未來幾年以溫和的速度成長。

主要亮點

- 推動市場發展的關鍵因素是該地區建設產業的成長和汽車行業不斷成長的需求。

- 有關使用無 VOC 材料的嚴格規定預計會阻礙市場成長。

- 預計生物基油漆和塗料的需求不斷增加以及該地區航太業的不斷成長將為市場提供成長機會。

- 在南美,建築業佔據市場最終用戶部分的主導地位。

南美洲油漆和塗料市場趨勢

建築塗料和塗料佔據市場主導地位

- 建築油漆和塗料是迄今為止油漆和塗料行業最大的細分市場。建築塗料的目的是保護和裝飾表面。它被用來粉刷建築物和住宅。許多都有特定用途,例如屋頂、牆壁或地板。無論用於何種用途,建築塗料都必須提供一定程度的裝飾性、耐用性和保護性。

- 建築塗料應用於辦公大樓、倉庫、便利商店、商場、住宅等商業建築。這些塗料可以應用於外部和內部表面,還可以包括密封劑和特殊產品。

- 巴西是南半球最大的國家之一,近年來各類建築計劃的投資增加。

- 2023年8月,巴西啟動了「新加速發展計畫」(Novo PAC),計畫在2023年至2026年期間投資3,450億美元用於該國各類基礎設施和建築建設。

- 該地區的商業建築正在發生顯著轉變。值得注意的計劃包括巴西的保利尼亞資料中心和阿雷格里港資料中心 i,它們均於 2023 年啟動,是該地區最大的專案之一。

- 一些南美國家正在採取措施,讓不斷成長的人口更便宜地負擔住宅。例如,巴西於2023年2月重啟了全國針對低收入者的聯邦住宅計畫。 2023年10月,世界銀行核准向厄瓜多爾提供1億美元貸款,旨在加強經濟適用房和彈性住宅。

- 預計該地區的這些趨勢將在預測期內促進建築塗料的成長。

巴西佔市場主導地位

- 由於巴西擁有成熟的汽車和建築行業以及在工業領域的強勁投資,預計預測期內巴西將在該地區佔據主導地位。

- 根據OICA預測,2022年該國汽車產量將達237萬輛,與前一年同期比較增加約5%。根據OICA預測,2022年巴西汽車總銷量將為183萬輛,較2021年的186萬輛下降約1.9%。

- 2022年,由於車輛成本上升,乘用車、輕型商用車和重型商用車銷售量均下降。不過,2022年客車和乘用車銷量佔比為23.4%,創下汽車領域最高增幅。

- 然而,巴西擁有南美洲最大的電動車市場。 1月中旬,巴西憲法和司法委員會(CCJ)核准了一項法案,從2030年1月起禁止在該國銷售新的汽油和柴油汽車。預計到 2030 年,巴西將有約 70 萬輛電動車投入營運。

- 此外,2023年3月巴西建設產業依然疲軟,活動和就業連續第五個月下降。然而,巴西建築業商會(CBIC)支持的全國工業聯合會(CNI)最新資料顯示,建築活動的下降並不嚴重,但卻十分普遍。此外,2023 年 2 月至 3 月的活動下降將是自 2022 年 11 月開始的一系列下降中最溫和的。

- 經濟活動下降的原因是能源和建築材料價格高漲、通膨壓力上升、利率高企、需求水準疲軟以及家庭債務過高。 2023年3月建築活動指數為49.5,連續第五個月低於50。 2月份為47.6,1月份為45.9。

- 過去三年來,巴西家具產業一直穩定成長,目前新家具設計的需求很高。

- 巴西是世界第六大家俱生產國,許多巴西家具公司和設計師都投資了創新解決方案,以加速生產、運輸和交付。由於這些努力,2020 年至 2021 年巴西家具出口增加了 50.9%,其中 35% 的巴西家具出口專門銷往美國商店。

- 據巴西家具製造商協會(ABIMOVEL) 稱,巴西家具業由19,000 家公司組成,其中80% 位於聖保羅州、南里奧格蘭德州、米納斯吉拉斯州、巴拉那州和菲律賓州。包括集中在聖卡塔琳娜州的南部和東南部。

- 據IEMI Inteligencia de Mercado稱,2022年巴西的家具產量將超過3.67億件,而2021年為4.05億件。不過,預計巴西幣巴西幣億雷亞爾。

- 因此,隨著建築、基礎設施和汽車行業的成長,未來幾年對油漆和被覆劑的需求預計會增加。

南美洲油漆和塗料行業概況

南美洲油漆和塗料市場部分合併。主要企業(不分先後順序)包括 PPG Industries, Inc.、Akzo Nobel NV、Jotun、Axalta Coating Systems 和 The Sherwin William Company。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 當地建築業的成長

- 在汽車領域的應用和使用日益增多

- 其他促進因素

- 限制因素

- 有關 VOC排放的嚴格環境法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 丙烯酸纖維

- 環氧樹脂

- 醇酸

- 聚酯纖維

- 聚氨酯

- 其他樹脂(聚丙烯等)

- 依技術分類

- 水性

- 溶劑型

- 粉末塗料

- UV 固化塗料

- 按最終用戶產業

- 建築學

- 車

- 木頭

- 工業

- 其他最終用戶產業

- 按地區

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 南美洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE

- Hempel

- Jotun

- Lanco Paints

- PPG Industries, Inc.

- Renner Herrmann SA

- The Sherwin William Company

- WEG Coatings

第7章 市場機會與未來趨勢

- 對生物基和環保油漆和塗料的需求不斷增加

- 航太成長機會

The South America Paints And Coatings Market size is estimated at USD 6.54 billion in 2025, and is expected to reach USD 8.35 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the South American paints and coatings industry. Following the initial impact, the industry has experienced a decline in demand due to the shutdown of numerous factories and construction sites. Consequently, paint and coating production declined and disrupted the supply chain. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow at a moderate pace in the coming years.

Key Highlights

- Major factors driving the market studied are the growing construction industry in the region and the increasing demand from the automotive sector.

- It is anticipated that stringent regulations on using VOC-free materials are expected to hinder market growth.

- The increasing demand for bio-based paints and coatings and the growing presence of the aerospace sector in the region are expected to provide growth opportunities in the market.

- The architectural sector dominated the end-user segment of the market in South America.

South America Paints and Coatings Market Trends

Architectural Paints and Coatings to Dominate the Market

- Architectural paints and coatings are by far the largest segment in the paints and coatings industry. Architectural coatings are meant to protect and decorate surface features. They are used to coat buildings and homes. Most are designated for specific uses, such as roof coatings, wall paints, or deck finishes. No matter its use, each architectural coating must provide certain decorative, durable, and protective functions.

- Architectural coatings are used in applications for commercial purposes, such as office buildings, warehouses, retail convenience stores, shopping malls, and residential buildings. Such coatings can be applied on outer surfaces and inner surfaces and include sealers or specialty products.

- Brazil is one of the largest countries in the South that has seen a rise in investments for various construction projects in recent times.

- In August 2023, Under the Novo Programa de Aceleracao do Crescimento (Novo PAC), the government planned to invest USD 345 billion between 2023 and 2026 in the construction of various infrastructure and buildings in the country.

- The region is witnessing a notable shift in its commercial construction landscape. Notable projects like the Paulinia Data Center and Porto Alegre Data Center I of Brazil, initiated in 2023, are among the largest in the region.

- Several South American nations are rolling out initiatives to make housing more affordable for their growing populations. For Instance, in February 2023, Brazil relaunched its nationwide federal housing program, targeting low-income individuals. In October 2023, the World Bank approved a USD 100 million financing package for Ecuador, specifically aimed at bolstering affordable and resilient housing.

- Such trends in the region are expected to contribute to the growth of architectural coatings during the forecast period.

Brazil to Dominate the Market

- Brazil is expected to dominate in the region during the forecast period due to the presence of established automotive and construction industries and investments in the industrial sector.

- As per OICA, the production of automobiles in the country amounted to 2.37 million units in 2022, registering a growth of around 5% compared to the previous year. As per OICA, the total sales of vehicles in the country amounted to 1.83 million units in Brazil in 2022, as compared to 1.86 million units in 2021, registering a decline of around 1.9%.

- Passenger cars, light commercial vehicles, and heavy commercial vehicles witnessed a decline in 2022 sales in the country owing to the growing cost of vehicles. However, bus and coach sales registered the highest growth in the automotive segment, accounting for 23.4% in 2022.

- However, Brazil has the largest electric vehicle market in South America. In mid-January, Brazil's Constitution and Justice Commission (CCJ) approved a bill prohibiting the sale of new petrol and diesel-powered cars in the country as of January 2030. Around 700 thousand EVs are expected to be circulating in Brazil by 2030.

- Furthermore, The Brazilian construction industry remained weak in March 2023, with activity and employment falling for the fifth month. However, the most recent data by the National Confederation of Industry (CNI), with the support of the Brazilian Chamber of Construction Industry (CBIC), indicate that the fall in activity was not severe and broad. Furthermore, the reduction in activity from February to March 2023 is the mildest in the series of declines that began in November 2022.

- The reduction in activity is ascribed to high energy and construction material prices and soaring inflationary pressures, as are high-interest rates, decreasing levels of demand, and excessive household debt. In March 2023, the building activity index was 49.5, marking the fifth consecutive month with a score less than 50. This was preceded by February scores of 47.6 and January 2023 scores of 45.9.

- The Brazilian furniture industry has been growing steadily over the past three years, and the demand for newly designed furniture has been high recently.

- Brazil is the sixth largest producer of furniture globally, and many Brazilian furniture companies and designers have invested in innovative solutions that speed up production, shipping, and delivery. As a result of these efforts and more, furniture exports grew 50.9% from 2020 to 2021, with 35% of Brazil's exports in the furniture industry specifically destined for American stores.

- According to the Brazilian Association of Furniture Manufacturers (ABIMOVEL), Brazil's furniture industry is formed by 19,000 companies, 80% of which are concentrated in the country's South and Southeast regions, led by the state of Sao Paulo and followed by the conditions of Rio Grande do Sul, Minas Gerais, Parana, and Santa Catarina.

- According to IEMI Inteligencia de Mercado, the country produced more than 367 million furniture units in 2022 compared to 405 million units in 2021. However, the furniture production value in Brazil amounted to approximately 65 billion Brazilian reals in 2022 compared to 68.04 billion Brazilian reals in 2021.

- Hence, with the growth in the construction, infrastructure, and automotive sectors, the demand for paints and coatings is expected to witness growth over the coming years.

South America Paints and Coatings Industry Overview

The South American paints and coatings market is partially consolidated. The major companies (not in particular order) include PPG Industries, Inc., Akzo Nobel N.V., Jotun, Axalta Coating Systems, and The Sherwin William Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Industry in the Region

- 4.1.2 Increasing Applications and Usage in the Automotive Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Related to VOC-Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylics

- 5.1.2 Epoxy

- 5.1.3 Alkyd

- 5.1.4 Polyester

- 5.1.5 Polyurethane

- 5.1.6 Other Resin Types (Polypropylene, Etc.)

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 End-User Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Colombia

- 5.4.4 Chile

- 5.4.5 Peru

- 5.4.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE

- 6.4.4 Hempel

- 6.4.5 Jotun

- 6.4.6 Lanco Paints

- 6.4.7 PPG Industries, Inc.

- 6.4.8 Renner Herrmann S.A.

- 6.4.9 The Sherwin William Company

- 6.4.10 WEG Coatings

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based and Eco-friendly Paints and Coatings

- 7.2 Growing Opportunities in the Aerospace Sector