|

市場調查報告書

商品編碼

1630438

北美航空燃油:市場佔有率分析、產業趨勢與成長預測(2025-2030)North America Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

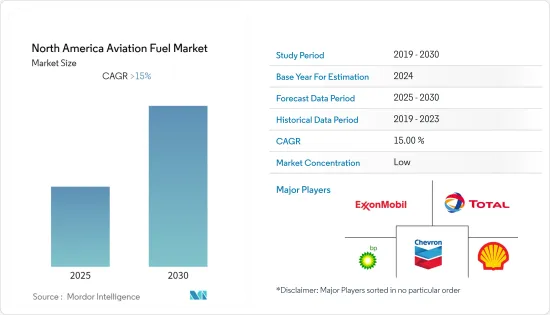

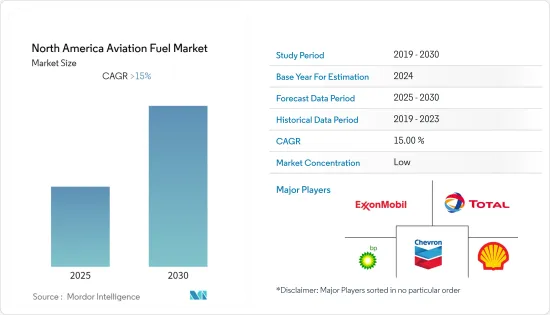

預計北美航空燃油市場在預測期內的複合年成長率將超過15%。

市場受到 COVID-19 爆發的負面影響,導致地區關閉和航班限制。目前,市場已達到疫情前水準。

主要亮點

- 近年來,在機票價格下降、經濟狀況改善和可支配收入增加的推動下,航空乘客數量增加,一直是市場的主要推動力。

- 然而,航空燃油成本的上漲和波動預計將抑制市場。

- 到 2037 年,航空旅客人數預計將達到 82 億人次。其中,北美預計將佔據主要佔有率,為市場相關人員創造充足的機會。

- 在北美地區,美國是市場的領導者。按照預期的成長,美國可能會繼續保持其主導地位。

北美航空燃油市場趨勢

私部門主導市場

- 民用航空包括定期和不定期飛機的營運,涉及乘客或貨物的商業航空運輸。私營部門是航空燃油的最大消費者之一,佔航空公司總營運支出的四分之一。

- 2021年,私營部門將在北美市場佔有率中佔據主導地位,其次是通用航空和國防部門。

- 截至2021年,航空燃油佔商業航空公司總成本的20%以上。因此,隨著商業航班乘客數量的增加,航空燃油的需求預計將增加,並在預測期內推動調查市場。

- 2021年,商業航空公司運載旅客總數約45.4億人次,較2020年成長5.58%。

- 2021年12月,Aemetis與達美航空簽署了價值21億美元的永續航空燃油供應協議,在為期10年的協議中供應約2.5億加侖。除了美國外,Aemetis 還簽署向舊金山機場供應 2.8 億加侖的合作備忘錄。

- 因此,由於上述因素,預計商業領域將在預測期內主導市場。

美國主導市場

- 國防部門消耗大量航空燃料。例如,美國平均每年消耗約 48 億加侖航空燃料,約佔空軍總能源預算的 81%。其中近一半由空軍使用,約三分之一由海軍使用。因此,隨著國防部門預算的增加,空軍持有預計也會增加,這將對航空燃油市場產生正面影響。

- 美國的目標是透過替代燃料來滿足一半的國內燃料需求,軍用和商業航空公司正在 A-10 地面攻擊機上測試酒精噴射 (ATJ) 燃料。此外,霍尼韋爾等公司正在為美國和空軍使用這種可再生噴射機燃料加工技術。

- 截至2021年,通用航空包括總合44萬架通用航空飛機(GAMA)在全球飛行,範圍從兩座教練機和通用直升機到洲際噴射機。美國擁有超過 211,000 架商用飛機,在這一美國佔據主導地位。

- 根據美國航空公司 (A4A) 的數據,2021 年,該國的航空公司每天在世界各地運送 290 萬名乘客,這是該國航空史上的最高數字。

- 此外,該國航空公司 2021 年每天運輸貨物量為 58,000 噸 (A4A)。因此,中國航空客運量和貨運量的強勁成長導致過去幾年對航空燃油的需求增加。

- 2022年3月,Aemetis Inc.宣布與澳洲航空有限公司簽署契約,從2025年起供應2,000萬公升混合航空燃油。該混合燃料將在加州的一家工廠生產,主要用於為兩國之間營運的波音和空中巴士飛機提供燃料。

- 因此,由於上述因素,預計美國將在預測期內主導市場。

北美航空燃油產業概況

北美航空燃油市場適度細分。主要企業(排名不分先後)包括埃克森美孚公司、英國石油公司、殼牌公司、TotalEnergies SE 和雪佛龍公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 燃料類型

- 空氣渦輪燃料 (ATF)

- 航空生質燃料

- AV 氣體

- 目的

- 商業的

- 防禦

- 通用航空

- 地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BP PLC

- Shell PLC

- TotalEnergies SE

- Pan American Energy SL

- Exxon Mobil Corporation

- Allied Aviation Services Inc

- Chevron Corporation

- Honeywell International Inc

- Valero Marketing and Supply

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 71497

The North America Aviation Fuel Market is expected to register a CAGR of greater than 15% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and flight restrictions. Currently, the market has reached pre-pandemic levels.

Key Highlights

- The increasing number of air passengers, on account of the cheaper airfare in recent times, stronger economic conditions, and increasing disposable income, are among the major driving factors for the market.

- However, the high and volatile cost of aviation fuel is expected to restrain the market.

- The air passenger number is expected to touch 8.2 billion by 2037. North America is expected to hold a significant share in this, creating ample opportunities for market players.

- The United States is leading the market in the North American region. With forecast growth, the United States is likely to continue its dominance.

North America Aviation Fuel Market Trends

Commercial Sector to Dominate the Market

- Commercial aviation includes operating scheduled and non-scheduled aircraft, which involves commercial air transportation of passengers or cargo. The commercial segment is one of the largest consumers of aviation fuel, and it accounts for a quarter of the total operating expenditure for an airline operator.

- The market share is dominated by the commercial sector in 2021 in North America, followed by general aviation and defense, respectively.

- As of 2021, aviation fuel accounted for more than 20% (IATA) of the total expenses for commercial airlines. Hence, as the number of passengers is increasing on commercial flights, the demand for aviation fuel is expected to increase, in turn driving the market studied during the forecast period.

- In 2021, the total number of passengers carried by commercial airlines rose to around 4.54 billion, which was 5.58% higher than in 2020.

- In December 2021, Aemetis signed a USD 2.1 billion sustainable aviation fuel supply agreement with Delta Air Lines to supply approximately 250 million gallons under a 10-year agreement. In addition to America, Aemetis has also signed memorandums of understanding to supply 280 million gallons for delivery to the San Francisco Airport.

- Therefore, due to the aforementioned factors, the commercial sector is expected to dominate the market during the forecast period.

The United States to Dominate the Market

- The defense sector consumes a large amount of aviation fuel. For instance, on average, the US Air Force consumes approximately 4.8 billion gallons of aviation fuel annually, about 81% of the total Air Force energy budget. Nearly half of that goes to the Air Force and around one-third to the Navy. Therefore, as the budget increases for the defense sector, the air force fleet is expected to increase, positively affecting the aviation fuel market.

- As part of the United States Air Force's goal of achieving half of its domestic fuel needs drawn from alternative sources, the military and commercial airlines tested alcohol-to-jet (ATJ) fuel on A-10 ground attack aircraft. Moreover, companies such as Honeywell use this renewable jet fuel process technology for the US Navy and Air Force.

- General Aviation included a total of 440,000 general aircraft flying worldwide (GAMA) as of 2021, ranging from two-seat training aircraft and utility helicopters to intercontinental business jets. Over 211,000 general planes are based in the United States, which makes the nation dominate the sector.

- According to the Airlines for America (A4A), in 2021, the country's airlines carried 2.9 million passengers worldwide daily, which was an all-time high number of passengers in the country's airline history.

- Moreover, 58,000 metric tons of cargo per day were ferried by the country's airlines in 2021 (A4A). Therefore, the country's robust growth in air travel and cargo volumes has resulted in higher demand for aviation fuel in past years.

- In March 2022, Aemetis Inc announced that it had made an agreement with Qantas Airways Limited to supply 20 million liters of blended aviation fuel from 2025. The blended fuel will be produced at a facility in California and will primarily be used to power Boeing and Airbus planes being operated between the countries.

- Therefore, due to the aforementioned factors, the United States is expected to dominate the market during the forecast period.

North America Aviation Fuel Industry Overview

The North American aviation fuel market is moderately fragmented. Some of the major companies (in no particular order) include Exxon Mobil Corporation, BP PLC, Shell PLC, TotalEnergies SE, Chevron Corporation, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 AVGAS

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Defense

- 5.2.3 General Aviation

- 5.3 Geography

- 5.3.1 The United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BP PLC

- 6.3.2 Shell PLC

- 6.3.3 TotalEnergies SE

- 6.3.4 Pan American Energy S.L.

- 6.3.5 Exxon Mobil Corporation

- 6.3.6 Allied Aviation Services Inc

- 6.3.7 Chevron Corporation

- 6.3.8 Honeywell International Inc

- 6.3.9 Valero Marketing and Supply

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219