|

市場調查報告書

商品編碼

1644396

中東和非洲商用航空燃料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Middle East And Africa Commercial Aircraft Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

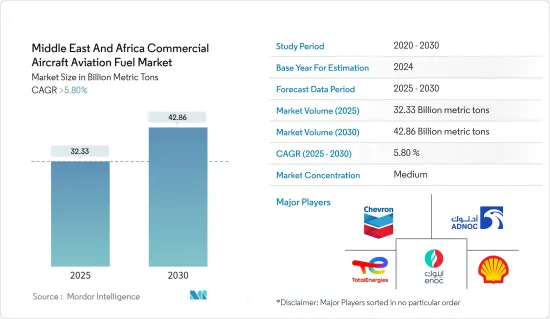

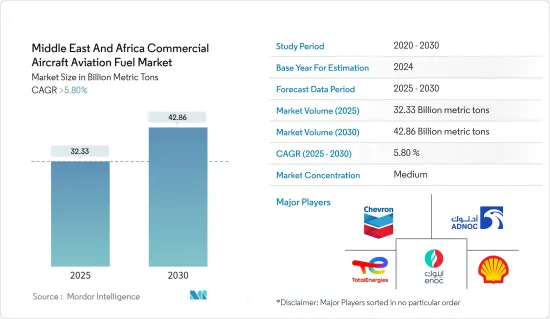

中東和非洲民航機航空燃料市場規模預計在 2025 年為 323.3 億噸,預計到 2030 年將達到 428.6 億噸,預測期內(2025-2030 年)的複合年成長率將超過 5.8%。

關鍵亮點

- 從中期來看,航空公司持有規模預計的增加加上該地區的經濟發展將在預測期內推動市場發展。

- 然而,預測期內全球原油價格的波動預計將阻礙市場成長。

- 生質燃料等永續航空燃料的採用預計將為中東和非洲的民航機航空燃料市場創造重大機會。

- 由於沙烏地阿拉伯新興市場的發展和遊客數量的不斷增加,預計該國將成為該市場的主導地區。

中東和非洲民航機航空燃料市場趨勢

航空生質燃料顯著成長

- 在中東和非洲,人們認知到必須將航空營運與全球永續性目標結合,並與航空生質燃料減輕航空旅行對環境影響的潛力完美結合。與傳統航空燃料相比,生質燃料能夠減少溫室氣體排放,這與該地區日益增強的環保努力相呼應。

- 此外,中東地區豐富的生質能資源使其具有戰略優勢。在中東,有潛力利用當地可用的原料(如農業廢棄物和藻類)來生產生生質燃料,這符合建立永續供應鏈和減少對石化燃料依賴的努力。當地資源和航空燃料生產之間的內在匹配促進了航空生質燃料作為在地採購可再生能源解決方案的可行性。

- 例如,根據能源研究所《2023年世界能源統計評論》,該地區的生質燃料消費量在2012年至2022年的年均成長率為11.3%,而到2021年至2022年,這一數字將成長9.3%。這意味著該地區生質燃料消耗量的增加,可以推斷出航空業生質燃料使用量的增加。

- 此外,全球夥伴關係和研究計畫也正在推動航空生質燃料的發展。航空公司、政府和生質燃料生產商之間的合作將增強生質燃料的應用勢頭,並鼓勵研究、創新和擴大生產。永續航空燃料標準和認證的建立進一步增強了人們對生質燃料作為主流航空燃料的可行性的信心。

- 例如,2022 年 11 月,全球航空公司阿提哈德航空宣布與 Cepsa 建立合作夥伴關係。兩家公司正在加快航空生質燃料的研究力道。兩家公司計劃在 2030年終生產 80 萬噸航空生質燃料,以實現永續性目標。

- 因此,如上所述,預計預測期內航空生質燃料的需求將會增加。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯作為國際中轉站的中心地位及其不斷發展的世界級機場網路使其成為航空生態系統中越來越重要的組成部分。這項戰略優勢增強了沙烏地阿拉伯作為向國內外航空公司分銷航空燃料的關鍵樞紐的地位。

- 其中最主要的因素是沙烏地阿拉伯的戰略地理位置及其作為全球航空樞紐的地位。沙烏地阿拉伯作為國際航班中轉站的中心地位及其不斷擴大的世界級機場網路使其在航空生態系統中的重要性日益提高。這個戰略位置使沙烏地阿拉伯成為國內外航空公司航空燃料分銷的重要樞紐。

- 根據土耳其統計總局 (GASTAT) 的數據,2022 年的乘客人數約為 8,800 萬人次,比 2021 年增加 82%。 2022年,國際機場平均每天起降國際國內航班131.29個,國內機場平均每天起降國內航班5.94個。

- 此外,沙烏地阿拉伯能源生質燃料。該國廣闊的土地資源和對可再生能源的持續投資為生質燃料原料的生產提供了有利的環境。沙烏地阿拉伯在永續航空燃料生產方面表現出良好的前景,並有可能成為該地區生質燃料供應的中心。

- 此外,沙烏地阿拉伯政府致力於「2030願景」等變革性經濟舉措,旨在提高該國的全球地位並建立知識密集型經濟。尖端航空領域解決方案的整合符合「2030願景」的創新目標。

- 例如,沙烏地阿拉伯根據其「2030願景」決定利用政府資金擴大其體育基礎設施,尤其是足球。沙烏地阿拉伯聯賽吸引了大多數國際足球明星來該國踢球。預計富裕程度的提高最終將促進該國的航空旅行,從而進一步推動該地區對航空燃料的需求。

- 因此,如上所述,預計沙烏地阿拉伯將在預測期內佔據市場主導地位。

中東和非洲民航機航空燃料產業概況

中東和非洲民航機航空燃料市場中等細分。主要企業(不分先後順序)包括阿拉伯聯合大公國國家石油公司、雪佛龍公司、殼牌公司、道達爾能源公司和阿布達比國家石油公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:噸)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 飛機擴張

- 經濟發展

- 限制因素

- 原油價格波動

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 燃料類型

- 空氣渦輪燃料 (ATF)

- 航空生質燃料

- 阿布古斯

- 2028 年市場規模與需求預測(按地區)

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 埃及

- 南非

- 其他中東和非洲地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Emirates National Oil Company

- Repsol SA

- BP PLC

- Shell PLC

- TotalEnergies SE

- Chevron Corporation

- Exxon Mobil Corporation

- Abu Dhabi National Oil Company

- Market Ranking

第7章 市場機會與未來趨勢

- 永續航空燃料

簡介目錄

Product Code: 71525

The Middle East And Africa Commercial Aircraft Aviation Fuel Market size is estimated at 32.33 billion metric tons in 2025, and is expected to reach 42.86 billion metric tons by 2030, at a CAGR of greater than 5.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing airline fleets coupled with economic development in the region are expected to drive the market during the forecasted period.

- On the other hand, global oil price volatility is expected to hinder the market's growth during the forecasted period.

- Nevertheless, the introduction of sustainable aviation fuels like biofuels is expected to create huge opportunities for the Middle-East and African commercial aircraft aviation fuel markets.

- Saudi Arabia is expected to be a dominant region for the market due to the country's increasing economic development and increasing tourism.

MEA Commercial Aircraft Aviation Fuel Market Trends

Aviation Biofuel to Witness Significant Growth

- Middle-East and Africa's recognition of the imperative to align aviation operations with global sustainability goals converge seamlessly with the potential of aviation biofuel to mitigate the environmental impact of air travel. The inherent capacity of biofuels to reduce greenhouse gas emissions as compared to conventional aviation fuels resonates resoundingly with the region's growing commitment to environmental stewardship.

- Moreover, the region's abundant biomass resources offer a strategic advantage. The Middle East's potential to leverage locally available feedstock for biofuel production, such as agriculture waste and algae, aligns with efforts to establish sustainable supply chains and reduce dependence on fossil fuels. This intrinsic alignment between regional resources and aviation fuel production promotes the viability of biofuels for aviation purposes as a locally sourced and renewable energy solution.

- For instance, according to the Energy Institute Statistical Review Of World Energy 2023, biofuel consumption in the region increased by 9.3% between 2021 and 2022, while an annual average growth rate of 11.3% was recorded between 2012 and 2022. This signifies an increase in the consumption of biofuels in the region, which can be extrapolated to the increasing use of biofuels in the aviation industry.

- Furthermore, global partnerships and research initiatives propel aviation biofuel's prominence. Collaborations between airlines, governments, and biofuel producers amplify the momentum towards biofuel adoption, promoting research, technological innovation, and production scale-up. Establishing sustainable aviation fuel standards and certification further bolsters confidence in biofuels' viability as a mainstream aviation fuel.

- For instance, in November 2022, Etihad, a significant global airline company, announced a partnership with Cepsa. Both companies will accelerate the research activities for aviation biofuels. The companies aim to produce 800,000 tons of aviation biofuels by the end of 2030 to meet their sustainability goals.

- Therefore, as discussed above, the demand for aviation biofuels is expected to increase during the forecasted period.

Saudi Arabia to Dominate the Market

- The nation's central positioning as a transit point for international flights and its expanding network of world-class airports bolster its significance in the aviation ecosystem. This strategic vantage point elevates Saudi Arabia's role as a crucial hub for aviation fuel distribution catering to domestic and International Airlines.

- Foremost among these factors is Saudi Arabia's strategic geographical location and role as a global aviation hub. The nation's central positioning as a transit point for international flights and its expanding network of world-class airports bolster its significance in the aviation ecosystem. This strategic vantage point elevates Saudi Arabia's role as a critical hub for aviation fuel distribution catering to domestic and International Airlines.

- According to the General Authority for Statistics (GASTAT), the number of passengers in 2022 was almost 88 million, an increase of 82% over 2021. The average daily flights arriving and departing at international airports for international and domestic flights in 2022 was 131.29, and the average daily flights arriving and departing at domestic airports was 5.94.

- Moreover, Saudi Arabia's visionary commitment to diversifying its energy landscape aligns seamlessly with the potential of aviation biofuel. The nation's vast land resources and ongoing investments in renewable energy offer a conducive environment for biofuel feedstock production. This alignment proposes the viability of sustainable aviation fuel production, positioning Saudi Arabia as a potential epicenter for biofuel supply in the region.

- Furthermore, the Saudi Arabian government's dedication to transformative economic initiatives such as Vision 2030 amplifies the nation's prominence as it strives to enhance its global standing and establish our knowledge-based economy. The integration of cutting-edge aviation field solutions aligns with the innovative-driven aspirations of Vision 2030.

- For instance, under Vision 2030, the country has decided to expand its sports infrastructure, especially football, with the backing of government money resources. The Saudi Arabian league has attracted most international football icons to play in their country. The increase in high-net-worth individuals is consequently expected to drive airplane traffic in the country, which is further expected to drive the demand for aviation fuel in the region.

- Therefore, as mentioned above, Saudi Arabia is expected to dominate the market during the forecasted period.

MEA Commercial Aircraft Aviation Fuel Industry Overview

The Middle-East and African commercial aircraft aviation fuel market is moderately fragmented. Some of the major companies (in no particular order) include Emirates National Oil Company, Chevron Corporation, Shell PLC, TotalEnergies SE, and Abu Dhabi National Oil Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in metric ton, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Expanding Airline Fleet

- 4.5.1.2 Economic Development

- 4.5.2 Restraints

- 4.5.2.1 Volatility in Oil Price

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 AVGAS

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 The United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 Qatar

- 5.2.4 Egypt

- 5.2.5 South Africa

- 5.2.6 Rest of the Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Emirates National Oil Company

- 6.3.2 Repsol SA

- 6.3.3 BP PLC

- 6.3.4 Shell PLC

- 6.3.5 TotalEnergies SE

- 6.3.6 Chevron Corporation

- 6.3.7 Exxon Mobil Corporation

- 6.3.8 Abu Dhabi National Oil Company

- 6.4 Market Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Sustainable Aviation Fuel

02-2729-4219

+886-2-2729-4219