|

市場調查報告書

商品編碼

1630441

北美民航機航空燃料:市場佔有率分析、產業趨勢和成長預測(2025-2030)North America Commercial Aircraft Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

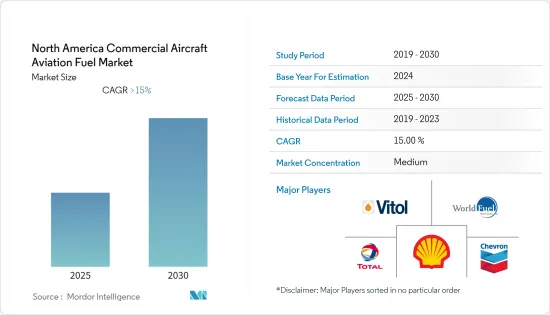

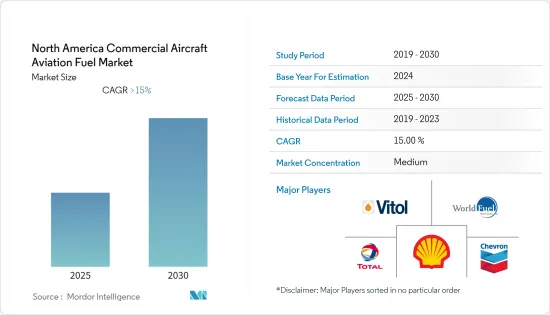

預計北美民航機航空燃油市場在預測期內的複合年成長率將超過15%。

COVID-19 的爆發導致地區關閉和航班限制,對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 航空客運量增加、全部區域廉價航空公司(LCC) 數量增加以及航空貨運需求不斷成長等因素預計將在預測期內推動市場發展。

- 然而,原油和噴射機燃料價格的波動預計將限制目標市場。

- 民航業的目標是增加國內可再生噴射機燃料供應,以減少碳排放。因此,對可再生航空燃料等替代燃料的需求不斷成長,這在不久的將來很可能是一個機會。

- 預計在預測期內,美國將主導北美民航機航空燃油市場。

北美民航機航空燃油市場趨勢

航空渦輪燃料(ATF)領域預計將主導市場

- 航空渦輪燃料(ATF)或噴射機燃料是一種航空燃料,設計用於配備燃氣渦輪機引擎的飛機。 Jet A1 和 Jet A 是民航機使用的兩種主要航空燃油等級。

- 航空旅行的增加、全球經濟狀況以及飛機燃油燃燒效率的提高等因素正在影響民航機航空燃油市場對噴射機燃料的需求。

- 在美國以外的地區,就消費量, Jet A1 預計仍將是僅次於 Jet A1 的主要航空燃料。 Jet A-1的凝固點必須低於-47度C。這種燃料通常含有靜電耗散器。

- Jet A 規格燃油主要在美國使用,在美國以外地區以及多倫多和溫哥華等加拿大一些機場通常不提供。 Jet A 燃料的凝固點必須低於 -40°C,且通常不含靜電耗散劑。

- LanzaTech 的乙醇基 ATJ-SPK(酒精噴射合成石蠟煤油)現已作為標準 Jet A 的混合成分供美國商業航空公司使用。隨著 ASTM D7566 的修訂,LanzaTech ATJ-SPK 現在可以與商業航班的傳統噴射機燃料混合高達 50%。

- 因此,鑑於此類發展,預計預測期內對 Jet A 燃料(空氣渦輪燃料)的需求將會增加。

- 此外,根據國際航空運輸協會的數據,到 2037 年,從加拿大出發的乘客數量預計將增加到 1.18 億人次。因此,民航機對航空渦輪燃料的需求預計在未來幾年將會增加。

預計美國將主導市場

- 通用航空包括2021年在全球飛行的通用航空飛機(GAMA)總數為44萬架,範圍從兩座教練機和通用直升機到洲際噴射機。美國擁有超過 211,000 架商用飛機,在這一美國佔據主導地位。

- 根據美國航空公司 (A4A) 統計,2021 年,該國航空公司每天在全球運送 250 萬名乘客,這是該國航空公司歷史上的最高數字。此外,2020年,該國航空公司每天運輸貨物68,000噸。

- 因此,該國航空旅行和貨運量的強勁成長導致過去幾年對航空燃油的需求增加。

- 由於過去實際機票價格暴跌,國內航空旅行增加。這導致人們對國內和國際航空旅行的偏好增加,導致航空燃料消費量增加。

- 因此,由於客運和貨運航空交通量高等因素,預計美國將在預測期內主導北美民航機燃油市場。

北美民航機航空燃油產業概況

北美民航機燃油市場適度細分。市場的主要企業包括(排名不分先後)雪佛龍公司、世界燃料服務公司、道達爾公司、維托控股公司和荷蘭皇家殼牌公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 燃料類型

- 空氣渦輪燃料 (ATF)

- 航空生質燃料

- 其他

- 地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- World Fuel Services Corp

- Chevron Corporation

- TotalEnergies SE

- Vitol Holding BV

- Shell Plc

- Mercury Air Group, Inc.

- Targray Technology International Inc.

- Valero Energy Corporation

- Irving Oil Ltd

- Phillips 66

第7章市場機會與未來趨勢

The North America Commercial Aircraft Aviation Fuel Market is expected to register a CAGR of greater than 15% during the forecast period.

The market has been negatively impacted by the outbreak of COVID-19 due to regional lockdowns and flight restrictions. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as increasing air passenger traffic, increasing the number of low-cost carriers (LCC) across the region, and growing demand for air cargo transportation, are expected to drive the market over the forecast period.

- However, volatile crude oil and jet fuel prices are expected to restrain the target market.

- The commercial aviation industry aims to increase domestic renewable jet fuel supply to reduce carbon emissions. Thus, there is an increasing demand for alternatives, such as renewable aviation fuel, which will likely provide an opportunity in the near future.

- The United States is expected to dominate the North American commercial aircraft aviation fuel market over the forecast period.

North America Commercial Aircraft Aviation Fuel Market Trends

Air Turbine Fuel (ATF) Segment is Expected to Dominate the Market

- Aviation turbine fuel (ATF) or jet fuel is a type of aviation fuel designed for use in aircraft powered by gas-turbine engines. Jet A1 and Jet A are two primary grades of aviation fuel used in commercial aircraft.

- Factors such as growth in air traffic passenger, global economic scenario, and improvement in aircraft fuel-burning efficiency are influencing demand for jet fuel in the commercial aircraft aviation fuel market.

- Jet A1 is likely to remain a dominant aviation fuel in terms of consumption, followed by the Jet A type, for locations outside the United States. Jet A-1 must have a freeze point of minus 47°C or below. This fuel normally contains a static dissipator additive.

- Jet A specification fuel is mainly used in the United States, and it is usually not available outside the United States and a few Canadian airports, such as Toronto and Vancouver. Jet A fuel must have a freeze point of minus 40oC or below and does not typically contain a static dissipator additive.

- LanzaTech's ethanol-based ATJ-SPK (alcohol-to-jet synthetic paraffinic kerosene) was made eligible for use as a blending component with standard Jet A for commercial airline use in the United States. Under the revised ASTM D7566, LanzaTech ATJ-SPK is eligible to be used up to a 50% blend in conventional jet fuel for commercial flights.

- Hence, such ongoing developments are expected to increase the demand for Jet A fuel (air turbine fuel) during the forecast period.

- Moreover, according to IATA, passengers traveling by air from Canada are expected to increase to 118 million by 2037. Therefore, the demand for aviation turbine fuel for commercial aircraft is expected to increase in the coming years.

The United States is Expected to Dominate the Market

- General Aviation included a total of 440,000 general aircraft flying worldwide (GAMA) as of 2021, ranging from two-seat training aircraft and utility helicopters to intercontinental business jets. Over 211,000 general planes are based in the United States, which makes the nation dominate the sector.

- According to the Airlines for America (A4A), in 2021, the country's airlines carried 2.5 million passengers worldwide daily, which was an all-time high number of passengers in the country's airline history. Moreover, 68,000 metric tons of cargo per day were ferried by the country's airlines in 2020 (A4A).

- Therefore, the country's robust air travel and cargo volume growth has resulted in greater demand for aviation fuel in the past years.

- Air travel in the country has increased as real airfares have plunged in the past. Therefore, the increased propensity of people to prefer domestic and international air travel has led to increased consumption of aviation fuel.

- Hence, due to factors such as high air traffic passenger and cargo, the United States is expected to dominate in the North American commercial aircraft fuel market over the forecast period.

North America Commercial Aircraft Aviation Fuel Industry Overview

The North American commercial aircraft aviation fuel market is moderately fragmented. Some of the major players in the market (in no particular order) include Chevron Corporation, World Fuel Services Corp, Total S.A., Vitol Holding BV, and Royal Dutch Shell Plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 Others

- 5.2 Geography

- 5.2.1 The United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 World Fuel Services Corp

- 6.3.2 Chevron Corporation

- 6.3.3 TotalEnergies SE

- 6.3.4 Vitol Holding BV

- 6.3.5 Shell Plc

- 6.3.6 Mercury Air Group, Inc.

- 6.3.7 Targray Technology International Inc.

- 6.3.8 Valero Energy Corporation

- 6.3.9 Irving Oil Ltd

- 6.3.10 Phillips 66