|

市場調查報告書

商品編碼

1630444

民航機航空燃油:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Commercial Aircraft Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

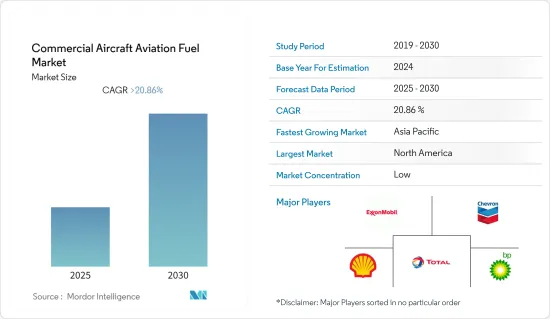

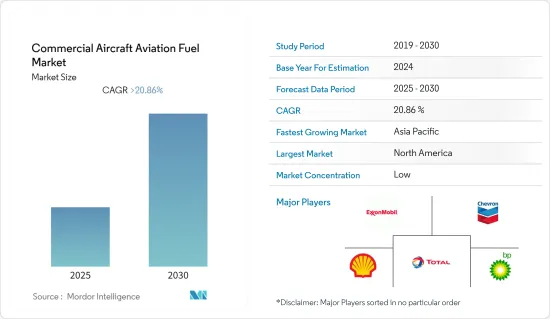

預計民航機航空燃油市場在預測期內複合年成長率將超過20.86%。

由於地區關閉,民航機燃油市場受到了 COVID-19 的負面影響。然而,市場在2021年開始復甦。

主要亮點

- 定期和不定期飛機都是民用航空的一部分。未來幾年,市場將受到全球航空旅客數量和機持有數量增加的推動。

- 然而,航空燃油的高成本預計將抑制市場成長。

- 航空業的排放氣體日益引起人們的關注,新興經濟體的政府正在採取措施減少航空業的排放氣體。未來幾年,民航機航空燃油可能會出現許多商機。

- 預計亞太地區將成為預測期內成長最快的市場,大部分需求來自中國、印度和日本等國家。

民航機航空燃油市場趨勢

空氣渦輪燃料 (ATF) 類型主導市場

- Jet-A 燃油自 20 世紀 50 年代起就在美國使用,但在美國以外以及多倫多和溫哥華等加拿大一些機場通常不提供。 Jet-A 與 Jet-A1 具有相同的閃點,但其最高凝固點較高(-40°C)。根據 ASTM D1655 (Jet A) 規格提供。 Jet A1 適用於大多數渦輪引擎飛機。最低閃點為 38 度C(100 °F),最高凝固點為 -47 度C。 Jet A1 在美國以外廣泛使用。

- LanzaTech 的乙醇基 ATJ-SPK 現在可作為標準 Jet A 的混合組件,供美國和世界上大多數國家的商業航空公司使用。隨著 ASTM D7566 的修訂,LanzaTech ATJ-SPK 可以與商業航班的傳統噴射機燃料混合高達 50%。

- Jet A燃料見證了大學最近的發展趨勢。例如,2021 年 6 月,華盛頓州立大學的研究人員開發了一種將廢棄塑膠轉化為永續 Jet A 燃料的製程。希望這項製程如果能改進並大規模應用,能夠解決溫室氣體排放和塑膠污染等重大環境問題。

- 一級產業將航線數量和國際旅客數量最多的城市歸類為「航空特大城市」(AMC)。據空中巴士稱,共有66個AMC,超過60%的航班在這些城市起降,光是AMC之間就有17%的航班。隨著世界各地 AMC 的增加,遠距航班呈指數級成長,推動了對噴射機燃料的需求,從而推動了商業部門對航空燃油的需求。

- 因此,基於上述因素,航空渦輪燃油(ATF)預計將在預測期內主導民航機航空燃油市場。

亞太地區主導市場

- 亞太地區是民用領域重要的航空燃油市場之一。近年來,印度和東南亞等快速成長的市場對該地區的成長做出了越來越大的貢獻,因為這些新興經濟體支持了強勁的客戶成長。根據國際航空運輸協會 (IATA) 的數據,到 2035 年,中國、印度、印尼和越南等亞太國家的客運量預計將達到最高水準。

- 此外,根據波音2021-2040年商業市場展望(CMO),到2040年,地區間流動的人數將大幅增加。因此,客運量的增加可能會為供應鏈中的每個人(尤其是新興地區)帶來許多機會來滿足未來需求的增加和成長。

- 此外,商業航空公司的機隊在過去十年中持續成長,截至 2022 年 1 月,全球共有 22,799 架飛機在使用。乘客數量與營運的商業航班數量直接相關,波音和空中巴士都在穩步增加訂單和交付。

- 中國是世界上最大的航空燃油市場之一,也是航空客運量最大的市場之一。截至2021年,中國國內客運量已成為僅次於美國的第二大航空市場。

- 日本航空 (JAL) 和全日空航空 (ANA) 是日本的兩大航空公司。然而,樂桃航空、捷星日本航空和香草航空等廉價航空公司(LCC) 正在增加市場佔有率,並推動日本航空市場的發展。

- 由於所有這些因素,預計亞太地區將在預測期內引領民航機燃油市場。

民航機航空燃油產業概況

民航機燃油市場是細分的。主要參與企業(排名不分先後)包括埃克森美孚公司、雪佛龍公司、殼牌公司、TotalEnergies SE 和英國石油公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 燃料類型

- 空氣渦輪燃料 (ATF)

- 航空生質燃料

- 其他燃料類型

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- 傳統航空燃油供應商

- Exxon Mobil Corporation

- Shell PLC

- TotalEnergies SE

- BP PLC

- Chevron Corporation

- 可再生航空燃料供應商

- Neste Oyj

- Swedish Biofuels AB

- Gevo Inc.

- Honeywell International Inc.

- 傳統航空燃油供應商

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 71516

The Commercial Aircraft Aviation Fuel Market is expected to register a CAGR of greater than 20.86% during the forecast period.

The commercial aviation fuel market was adversely affected by COVID-19 due to regional lockdowns. However, the market rebounded in 2021.

Key Highlights

- Scheduled and non-scheduled aircraft are a part of commercial aviation. These planes carry people or goods for a fee.During the next few years, the market is likely to be driven by things like the growing number of air travelers and aircraft fleets around the world.

- However, the high cost of aviation fuel is expected to restrain market growth.

- Concerns about emissions from the airline industry are growing, and governments in developed economies are taking steps to reduce airline emissions. In the coming years, this is likely to create a lot of opportunities for commercial aircraft aviation fuel.

- Asia-Pacific is expected to be the fastest-growing market during the forecast period, with the majority of the demand coming from countries like China, India, Japan, etc.

Commercial Aircraft Aviation Fuel Market Trends

Air Turbine Fuel (ATF) Type to Dominate the Market

- Jet-A-specified fuel has been used in the United States since the 1950s, and it is usually not available outside the United States and a few Canadian airports, such as Toronto and Vancouver. Jet-A has the same flash point as Jet-A1 but a higher freeze point maximum (-40°C). It is supplied against the ASTM D1655 (Jet A) specification. Jet A1 is suitable for most turbine-engine aircraft. It has a flash point minimum of 38 °C (100°F) and a freeze point maximum of -47 °C. Jet A1 is widely available outside of the United States.

- LanzaTech's ethanol-based ATJ-SPK was made eligible for use as a blending component with standard Jet-A for commercial airline use in the United States and in most countries around the world. Under the revised ASTM D7566, LanzaTech ATJ-SPK is eligible to be used up to a 50% blend in conventional jet fuel for commercial flights.

- Jet-A fuels have been witnessing developments from universities in recent years. For instance, in June 2021, researchers at Washington State University developed a process for turning waste plastics into sustainable jet-A fuel. If the process is refined and applied on a large scale, the procedure is expected to address major environmental problems, including greenhouse gas emissions and plastic pollution.

- The primary industry classifies the cities with the most aviation connectivity and international passengers as "aviation megacities" (AMC). According to Airbus, there are 66 AMCs, with over 60% of traffic flying to and from these cities and 17% between AMCs alone. With the increase in AMCs across the world, long-haul flights are increasing exponentially, driving the demand for jet fuels and thus increasing the demand for aviation fuel in the commercial sector.

- Therefore, based on the above-mentioned factors, air turbine fuel (ATF) is expected to dominate the commercial aircraft aviation fuel market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is one of the significant aviation fuel markets in the commercial segment. In recent years, the fastest-growing markets, such as India and Southeast Asia, are increasingly contributing to the region's growth as these emerging economies have been endorsing robust passenger growth. As per the International Air Transport Association (IATA), in the Asia-Pacific region, countries including China, India, Indonesia, and Vietnam are expected to witness the highest passenger traffic by 2035.

- Furthermore, the Boeing Commercial Market Outlook (CMO) 2021-2040 says that the number of people traveling between the regions will go up a lot by 2040. So, the rise in passenger traffic is likely to give everyone in the supply chain, especially in emerging regions, a lot of chances to grow and meet the growing demand in the future.

- Also, commercial airline fleets have been growing over the past ten years, and as of January 2022, there were 22,799 planes in use around the world. The number of passengers is directly related to the number of commercial flights, and both Boeing and Airbus are steadily getting more orders and delivering more planes.

- China is one of the largest aviation fuel markets globally, and it is also one of the largest in terms of air passengers carried. As of 2021, domestic passengers in China were the second largest in the aviation market after the United States.

- Japan Airlines (JAL) and All Nippon Airways (ANA) are the two largest commercial airlines in Japan. However, low-cost carriers (LCCs) like Peach Aviation, Jetstar Japan, and Vanilla Air are gaining market share and boosting the aviation market in the country.

- Based on all of these factors, Asia-Pacific is expected to lead the market for aviation fuel for commercial aircraft during the forecast period.

Commercial Aircraft Aviation Fuel Industry Overview

The commercial aviation fuel market is fragmented. Some of the major players (in no particular order) include Exxon Mobil Corporation, Chevron Corporation, Shell PLC, TotalEnergies SE, and BP PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 Other Fuel Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Conventional Aviation Fuel Suppliers

- 6.3.1.1 Exxon Mobil Corporation

- 6.3.1.2 Shell PLC

- 6.3.1.3 TotalEnergies SE

- 6.3.1.4 BP PLC

- 6.3.1.5 Chevron Corporation

- 6.3.2 Renewable Aviation Fuel Suppliers

- 6.3.2.1 Neste Oyj

- 6.3.2.2 Swedish Biofuels AB

- 6.3.2.3 Gevo Inc.

- 6.3.2.4 Honeywell International Inc.

- 6.3.1 Conventional Aviation Fuel Suppliers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219