|

市場調查報告書

商品編碼

1635479

南美可攜式發電機:市場佔有率分析、行業趨勢和成長預測(2025-2030)South America Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

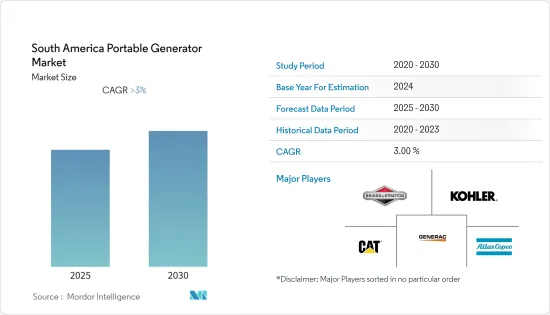

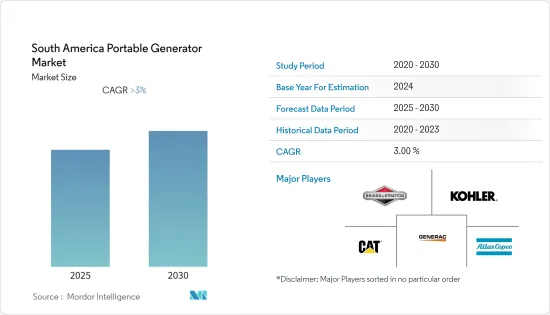

預計南美洲可攜式發電機市場在預測期內的複合年成長率將超過 3%。

COVID-19大流行對2020年市場產生了負面影響,減少了工業和商業部門的電力需求。

主要亮點

- 從長遠來看,南美洲可攜式發電機市場預計將由缺乏可靠的電網基礎設施、對緊急備用電源解決方案的需求以及該地區一些偏遠和農村地區新興市場開發業務的增加推動成長。的推動,包括:

- 同時,對電池儲存系統和其他清潔備用電力源的需求不斷成長預計將抑制市場成長。

- 然而,南美地區新興經濟體的商業和工業部門、新興經濟體的住宅部門以及國防行動日益成長的電力需求將很快為市場參與企業創造巨大的商機。

- 由於對可靠電力的需求不斷增加,巴西在該地區佔據主導地位。

南美洲可攜式發電機市場趨勢

住宅領域預計將主導市場

- 隨著發電機在每個家庭中越來越受歡迎,以確保緊急情況下的電力供應,可攜式發電機市場的住宅部分預計將擴大並推動市場。

- 此外,南美洲對住宅能源的需求正在增加。根據 Empresa de Pesquisa Energetica(巴西能源研究辦公室)的數據,2021 年住宅能源消費量比 2013 年的 124.91 兆瓦增加了約 149.8 兆瓦。然而,該地區的電力品質較差,這可能會推動可攜式發電機市場的發展。

- 2022年1月,阿根廷首都布宜諾斯艾利斯酷暑超過攝氏40度,70萬戶家庭停電。

- 總體而言,南美洲不斷成長的住宅電力需求和不斷下降的電能品質可能會提振可攜式發電機市場。

巴西可望主導市場

- 巴西是南美洲最大的國家之一,也是經濟快速成長的國家之一。此外,巴西的電力主要依賴水力發電,其可靠性成為挑戰。

- 截至 2021 年,水力發電約佔總發電量的 55%(362.8TWh)。水力發電和需求中心之間的距離較長,造成了電力問題,並推動了可攜式發電機市場的發展。

- 巴西政府也增加了基礎設施的私人投資,特別是鐵路、港口、高速公路和機場,以滿足該國的需求。隨著基礎建設的進展,電力供需缺口將擴大,並支撐目標市場。

- 2021年,巴西經歷了最嚴重的乾旱。由於該國依賴水力發電,乾旱威脅該國的電力供應。這一發展將對可攜式發電機市場產生積極影響。

- 總體而言,該國對水力發電的依賴以及發電與需求之間不斷擴大的差距支撐著可攜式發電機市場。

南美洲可攜式發電機產業概況

南美洲可攜式發電機市場適度分散。該市場的主要企業(排名不分先後)包括 Generac Holdings Inc.、Caterpillar Inc.、Kohler Power Systems、Briggs &Stratton Corporation 和 Atlas Copco AB。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按額定功率

- 小於5kW

- 5~10 kW

- 10kW以上

- 按燃料類型

- 氣體

- 柴油引擎

- 其他燃料

- 按最終用戶

- 產業

- 商業的

- 住宅

- 按地區

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- Generac Holdings Inc.

- Caterpillar Inc.

- Kohler Power Systems

- Briggs & Stratton Corporation

- Atlas Copco AB

第7章 市場機會及未來趨勢

The South America Portable Generator Market is expected to register a CAGR of greater than 3% during the forecast period.

The COVID-19 pandemic negatively impacted the market in 2020, with reduced power demand in industrial and commercial sectors.

Key Highlights

- Over the long term, the South American portable generator market is expected to thrive due to various factors, such as the lack of reliable grid infrastructure, the need for emergency backup power solutions, and increasing development operations in several remote and rural areas in the region.

- On the other hand, increasing demand for battery storage systems and other cleaner sources of standby power is expected to restrain the market's growth.

- Nevertheless, the commercial and industrial sectors of emerging economies in the South American region, the residential sector of developing economies, and the increasing need for power in defense operations will create significant opportunities for market participants shortly.

- Brazil dominates the geographical segment as the country has an increased demand for reliable power.

South America Portable Generator Market Trends

Residential Segment Expected to Dominate the Market

- Because of the prevalent installation of gensets across households to ensure the availability of emergency power supply, the residential segment of the portable generators market is predicted to expand and drive the market.

- Further, South America has an increasing demand for residential energy. According to the Empresa de Pesquisa Energetica (Brazil's Energy Research Office), in 2021, residential energy consumption increased from 124.91 terawatt-hours in 2013 to about 149.8 terawatt-hours. However, the region has poor power quality, which could drive the market for portable generators.

- In January 2022, Argentina's capital, Buenos Aires, witnessed a power outage that left 700,000 households without electricity amid a heat wave with temperatures above 40 degrees Celsius.

- Overall, South America's increasing residential power demand and poor power quality would aid the portable generator market.

Brazil Expected to Dominate the Market

- Brazil, one of South America's largest countries, is among the fastest-growing economies. Furthermore, Brazil's national electricity reliability is challenged because it largely depends on hydropower.

- As of 2021, hydro energy constituted around 55% (362.8TWh) of the total generated power. The long-distance between hydropower generation and demand centers causes power issues which drives the portable generator market.

- The Brazilian government is also increasing private investment in infrastructure to meet the country's demand, especially in railways, ports, highways, and airports. The increasing infrastructure growth widens the power supply and demand gap, which aids the studied market.

- In 2021, Brazil witnessed the worst drought. The drought threatened the nation's electricity supply since the country is dependent on hydropower. Such instances positively affect the portable generator market, as it supports essential businesses and industries during such times.

- Overall, the country's dependence on hydropower and the widening gap between electricity generation and demand aid the portable generator market.

South America Portable Generator Industry Overview

The South American portable generator market is moderately fragmented. Some of the key players in this market (in no particular order) include Generac Holdings Inc., Caterpillar Inc., Kohler Power Systems, Briggs & Stratton Corporation, and Atlas Copco AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Billion, Till 2027

- 4.3 Recent Trends And Developments

- 4.4 Government Policies And Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 By Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 By End-user

- 5.3.1 Industrial

- 5.3.2 Commercial

- 5.3.3 Residential

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.4.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration And Joint Ventures

- 6.2 Strategies Adopted By Key Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Kohler Power Systems

- 6.3.4 Briggs & Stratton Corporation

- 6.3.5 Atlas Copco AB