|

市場調查報告書

商品編碼

1635489

亞太地區可攜式發電機:市場佔有率分析、行業趨勢和成長預測(2025-2030)Asia-Pacific Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

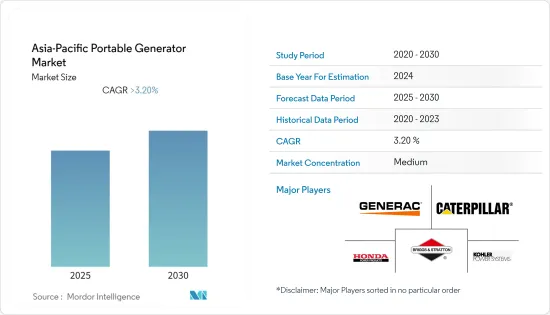

預計亞太地區可攜式發電機市場在預測期內的複合年成長率將超過 3.2%。

2020 年市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,不斷成長的電力需求、缺乏可靠的電網基礎設施、對緊急備用電源解決方案的需求以及對穩定電力供應的需求等因素正在推動亞太地區可攜式發電機市場的發展。此外,停電推動了備用電源和可攜式發電機的採用,它們滿足可靠、定期供電的要求,並且易於攜帶。

- 另一方面,對電池儲存系統和其他清潔備用電力源的需求不斷成長預計將抑製可攜式發電機市場的成長。

- 新興經濟體商業和工業部門、新興經濟體住宅部門以及國防業務日益成長的電力需求預計很快將為亞太地區的市場參與企業創造重大商機。

- 預計在預測期內,中國將主導亞太地區可攜式發電機市場。

亞太地區可攜式發電機市場趨勢

住宅行業將顯著成長

- 可攜式發電機市場的住宅部分預計將擴大並推動市場。主要原因是家庭中廣泛安裝了發電機,以確保在停電或電網故障時能夠獲得緊急電力。

- 據美國能源資訊署(EIA)稱,住宅能源消費量的成長中約70%將來自中國和印度,這主要是由於生活水準的提高以及對照明和用能電器產品和設備的需求增加所致。 。

- 此外,根據BP《2022年世界能源統計年鑑》,亞太地區初級能源消費量約272.45艾焦耳(EJ),較前一年(256.69EJ)成長近i.4%。

- 可攜式發電機可以從一個工地帶到另一個工地,確保每個建築工地都有順利運作所需的電力。如果沒有可攜式發電機,就很難從中心位置取得電力來為當地工廠供電。無論項目是大型還是中型,可攜式發電機都應該隨時可用。例如,2022年8月,韓國新政府宣布未來五年將在全國範圍內供應約270萬套新建住房,這意味著未來五年將在全國範圍內供應約270萬住宅住房,這意味著將在供不應求導致房價快速上漲的數十個大城市提供住房,並宣布計劃增加住宅供應,其中包括 10,000 套房產。此外,政府也為年輕人和低收入群體購屋或住宅提供各種財政、行政和稅收優惠。

- 隨著人口的成長,更多的邊緣化人群被迫生活在容易遭受颶風和洪水等自然災害的地區。因此,在印度、中國、東南亞國協等人口密集、容易發生颶風、地震、洪水等自然災害的地區,行動緊急應變系統在大規模天災發生後的防災策略中扮演重要角色。上。

- 因此,對自然災害導致的住宅電力不穩定的日益擔憂以及不間斷運行的需求正在推動預測期內亞太地區可攜式發電機市場的發展。

中國主導市場

- 由於基礎設施計劃的增加、電力供需缺口的擴大、全國製造設施的擴大以及商業辦公空間的增加,中國預計將引領亞太市場。

- 該國受益於可攜式發電機的成本和效率,生活水準的提高也增加了備用電源設備的需求。根據中國電力委員會 (CEC) 的數據,2021 年中國家庭用電量將約為 1,170兆瓦時 (TWh)。包括製造業在內的第二產業將成為最大的電力消耗產業,耗電量約為 5,610兆瓦時。

- 中國現有製造單位的擴張以及中國中央政府對「中國製造」計劃的推廣預計將推動柴油型可攜式發電機市場的發展。

- 此外,2021 年 5 月,由於廣東省電力短缺,中國的電力緊張工廠開始改用可攜式發電機。在中國,由於出口和重工業主導的經濟復甦,用電量激增,截至 2021 年 4 月,消費量較去年成長 20%,較 2019 年(未受 COVID-19 影響)的水平成長 1.5%。增加。廣東省氣溫也高於正常。

- 同時,雨季到來較晚意味著水力發電的水儲量仍然較低。由於政府主導的安全宣傳活動減少了採礦產量,而電力生產商不願增加火力發電,煤炭價格也飆升。電力短缺正在造成足夠的破壞,有可能減緩企業的復甦,這在某種程度上也是由於經濟活動的復甦。因此,由於電力短缺,該國許多行業正在改用可攜式發電機,增加了預測期內的市場需求。

- 因此,基於上述因素,預計中國將在預測期內主導亞太地區可攜式發電機市場。

亞太地區可攜式發電機產業概況

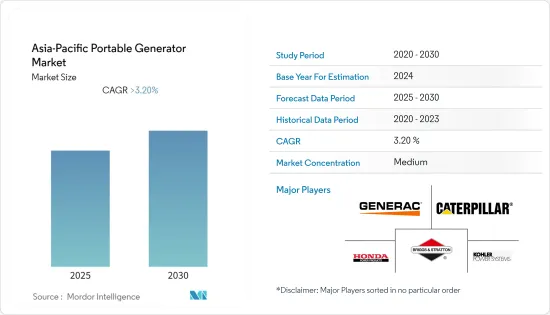

亞太地區可攜式發電機市場適度細分。市場上的主要企業(排名不分先後)包括 Generac Holdings Inc.、Caterpillar Inc.、Honda Siel Power Products Ltd.、Briggs & Stratton Corporation 和 Kohler Power Systems。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 額定輸出

- 5kW以下

- 5~10kW

- 10kW以上

- 燃料類型

- 氣體

- 柴油引擎

- 其他燃料

- 最終用戶

- 工業的

- 商業的

- 住宅

- 地區

- 中國

- 印度

- 日本

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Generac Holdings Inc.

- Caterpillar Inc.

- Honda Siel Power Products Ltd

- Briggs & Stratton Corporation

- Kohler Power Systems

- Wacker Neuson SE

- Atlas Copco AB

- Eaton Corporation PLC

- Yamaha Motor Co. Ltd

第7章市場機會與未來趨勢

The Asia-Pacific Portable Generator Market is expected to register a CAGR of greater than 3.2% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as the ever-increasing demand for power, lack of reliable grid infrastructure, the need for emergency backup power solutions, and the demand for a steady power supply are driving the portable generator market in the Asia-Pacific region. Moreover, power outages have led to the adoption of standby power sources and portable generators, which can meet the requirements for reliable and regular electricity supply and be transported easily.

- On the flip side, increasing demand for battery storage systems and other cleaner sources of standby power is expected to restrain the growth of the portable generators market.

- Nevertheless, the commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market participants in the Asia-Pacific region soon.

- During the forecast period, China is expected to dominate the portable generator market in the Asia-Pacific region.

APAC Portable Generator Market Trends

Residential Sector to Witness Significant Growth

- The residential segment of the portable generators market is predicted to expand and drive the market, majorly caused by the prevalent installation of gensets across households to ensure the availability of emergency power supply in the event of a blackout or grid failure.

- According to the Energy Information Administration (EIA), about 70% of the increase in residential energy consumption is occurring in Asia-Pacific, led by China and India, as standards of living increase and as demand for lighting and energy-using appliances and equipment increases.

- Additionally, according to BP Statistical Review of World Energy 2022, the primary energy consumption in the Asia-Pacific region accounted for about 272.45 exajoules (EJ), i.e., an increase of nearly 6.4%, when compared to the previous year's value (256.69 EJ).

- Portable generators can be carried from one site to another, ensuring that all construction sites have the power necessary to run smoothly. Without them, it would be difficult to draw power from a central location to power various plants in various regions. A portable generator should always be available whether your construction is large or medium. For instance, in August 2022, South Korea's new government unveiled plans to increase home supply, i.e., around 2.7 million new homes across the country over the next five years, including hundreds of thousands of properties in big cities where a short supply has been blamed for rapid price rises. Additionally, the government would provide various financial, administrative, and tax advantages to young and lower-income earners when they buy or rent homes.

- As the population has grown, more marginalized people have been forced to live in areas prone to natural disasters, such as cyclonic activity and floods. Due to this, densely populated nations, such as India, China, and the ASEAN countries, which are highly vulnerable to havoc wrecked by massive cyclonic activities, earthquakes, and floods, rely on mobile power generation units during emergency response, which forms an important part of disaster management strategies after major natural disasters.

- Therefore, rising concerns about power instability in the residential sector due to natural calamities and the need for uninterrupted operations are driving the portable generator market in the Asia-Pacific region during the forecast period.

China to Dominate the Market

- China is expected to lead the Asia-Pacific market due to increasing infrastructure projects, widening power demand-supply gap, expansion of manufacturing facilities across the nation, and rising commercial office spaces.

- The country benefits from the cost and effectiveness of portable generators, with improved living standards increasing the demand for power backup devices. According to China Electricity Council (CEC), Chinese households consumed around 1,170 terawatt hours (TWh) of electricity in 2021. The secondary sector, which includes the manufacturing industries happened to be the largest power-consuming sector, at some 5,610 terawatt hours.

- Factors, such as expanding existing manufacturing units across the country and the dedicated 'Made in China' initiative Lau China by the Chinese central government are expected to drive the portable generator market under the diesel-based fuel type segment.

- Also, in May 2021, owing to the electricity shortage in Guangdong province, China's power crunch China'sced factories to switch to portable generators. In China, the export- and the heavy-industry-led rebound had caused a surge in electricity use, with consumption climbing 20% through April 2021 compared with last year and up 15% from 2019 levels, when COVID-19 was not a factor. Temperatures in Guangdong, in the country's southern region, have also been higher than normal.

- At the same time, there has been a late start to the wet season, leaving hydropower reservoirs low. Coal prices have also surged as mining output has dropped amid a government-led safety campaign, making generators less keen to ramp up thermal power output. The electricity shortages, caused partly by the resurgence in economic activity, are causing disruptions to businesses that threaten to slow their recovery. Hence, due to the electricity shortages, many industries in the country have switched to portable generators, thus, increasing the market's demand during forecast period.

- Therefore, based on the above factors, China is expected to dominate the portable generators market in the Asia-Pacific region during the forecast period.

APAC Portable Generator Industry Overview

The Asia-Pacific portable generator market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Generac Holdings Inc., Caterpillar Inc., Honda Siel Power Products Ltd, Briggs & Stratton Corporation, and Kohler Power Systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 End-User

- 5.3.1 Industrial

- 5.3.2 Commercial

- 5.3.3 Residential

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Honda Siel Power Products Ltd

- 6.3.4 Briggs & Stratton Corporation

- 6.3.5 Kohler Power Systems

- 6.3.6 Wacker Neuson SE

- 6.3.7 Atlas Copco AB

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Yamaha Motor Co. Ltd