|

市場調查報告書

商品編碼

1635482

歐洲可攜式發電機:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

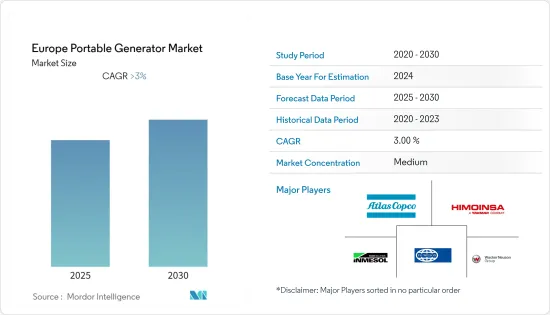

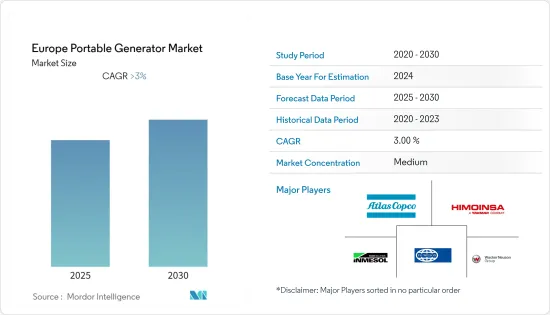

預計歐洲可攜式發電機市場在預測期內的複合年成長率將超過 3%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。從中期來看,不斷成長的電力需求、缺乏可靠的電網基礎設施、對緊急備用電源解決方案的需求以及對穩定電力供應的需求等因素正在推動歐洲可攜式發電機市場的發展。同時,對電池儲存系統和其他清潔備用電力源的需求不斷成長預計將抑制歐洲可攜式發電機市場的成長。

新興經濟體的商業和工業部門、新興經濟體的住宅部門以及國防業務不斷成長的電力需求預計將在不久的將來為市場相關人員創造巨大的商機。由於都市化的提高導致電力需求增加,德國在 2021 年佔據了最大的市場佔有率。

歐洲可攜式發電機市場趨勢

住宅領域成為重要細分市場

對穩定電源的需求激增預計將推動住宅應用的成長。需要緊急備用電源解決方案,以促進家用電子電器產品在停電期間的持續運作,從而推動產品需求。客戶對備用電源解決方案的認知不斷提高,加上頻繁停電作為應對尖峰負載的手段,預計將進一步改善商業環境。

根據Ember統計,2021年歐盟能源需求為2,865.44太瓦時,較2020年成長4%。這一趨勢預計將持續到 2030 年。該地區正在經歷快速的都市化,許多人從村莊遷移到城市。都市區對 GDP 成長做出了巨大貢獻,鼓勵投資者擴大業務並增加電力需求。大城市提供大量就業、商業和人類生活的機會。城市部門具有很高的成長潛力,因此越來越多的人正在遷移到大城市。人口密度的增加以及住宅和城市部門的擴張預計將導致市場規模的擴大。

可攜式發電機可以從一個工地帶到另一個工地,確保每個建築工地都有順利運作所需的電力。如果沒有可攜式發電機,就很難從中心位置向當地工廠供電。無論工作大小,都應始終配備可攜式發電機。例如,作為 REACT-EU 2022 年部分的一部分,歐盟委員會提供了 3.827 億歐元來支持西班牙的經濟復甦和數位轉型。在加泰隆尼亞,1.301億歐元主要用於支持健康教育基礎設施(基層醫療和醫院)的建設和維修。在穆爾西亞,投資了3,280萬歐元,主要用於衛生基礎建設;在納瓦拉,投資1,390萬歐元用於為5,500名學生維修教育基礎設施。

因此,該地區都市化進程的不斷加快、對自然災害造成的住宅電力不穩定的日益擔憂以及不間斷運行的需求正在推動歐洲可攜式發電機市場的發展。

德國可望主導市場

- 由於計劃的增加、電力供需缺口的擴大以及全國製造設施的擴張,德國預計將引領可攜式發電機市場。在該國,可攜式發電機已經變得經濟實惠且有效,而且生活水準的提高增加了對備用電源系統的需求。

- 2021年,德國是歐洲最大的電力消耗,人均總電力消耗量為6,030千瓦時,能源消費量總量2016年至2019年每年成長1.2%,2020年下降約10%,2021年成長約2.5% % 。

- 德國聯邦經濟部預計,德國總電力消耗量將從2018年的595太瓦時增加到2020年的658太瓦時,成長11%。交通部門、建築物中的電熱泵和供熱網路是電力消耗量增加的主要貢獻者。

- 考慮到該國的建設計劃,預計對可攜式發電機的需求巨大。例如,2022 年 1 月,Patrizia SE 獲得了德國漢堡住宅開發人員Instone Real Estate 的住宅承包開發機會。 Urban 預計將於 2024 年秋季完工。 Isle Campus 為學生和年輕專業人士,提供 469 間豪華微型公寓,面積達 10,100平方公尺,平均面積為 23平方公尺。

- 因此,由於上述因素,德國預計在預測期內將主導可攜式發電機市場。

歐洲可攜式發電機產業概況

歐洲可攜式發電機市場是細分的。市場上的主要企業包括(排名不分先後)阿特拉斯·科普柯、伊蒙妮莎、Inmesol SLA、FG Wilson 和 Wacker Neuson SE。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 額定輸出

- 5kW以下

- 5~10kW

- 10kW以上

- 燃料類型

- 氣體

- 柴油引擎

- 其他燃料

- 最終用戶

- 工業的

- 商業的

- 住宅

- 地區

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Atlas Copco

- HIMOINSA

- Inmesol SLA

- FG Wilson

- Wacker Neuson SE

- PRAMAC

- Briggs & Stratton Corporation

- Honda Motor Co. Ltd

- Caterpillar Inc.

- Kirloskar Group

第7章 市場機會及未來趨勢

The Europe Portable Generator Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels. Over the medium term, factors such as the ever-increasing demand for power, lack of reliable grid infrastructure, the need for emergency backup power solutions, and the demand for a steady power supply are driving the European portable generator market. On the other hand, increasing demand for battery storage systems and other cleaner sources of standby power is expected to restrain the growth of the European portable generator market.

The commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market players in the near future. Germany accounted for the largest share of the market in 2021 due to increasing urbanization leading to power demand.

Europe Portable Generator Market Trends

Residential Sector to be a Significant Market Segment

The surge in demand for consistent electrical supply is expected to drive residential application growth. Emergency power backup solutions are needed to facilitate the continuous operation of home appliances during power outages, driving product demand. Increasing awareness among customers about electricity backup solutions coupled with frequent power outages as a means to counter the peak load is expected to enhance the business environment further.

According to Ember, the energy demand from the European Union in 2021 was 2,865.44 TWh, a growth of 4% from 2020. This trend is expected to continue through 2030. As many people are moving from villages to cities, the region is experiencing exponential urbanization. Urban areas contribute to a significant increase in GDP, encouraging investors to expand their businesses and resulting in an increase in electricity demand. Metropolitan cities offer numerous opportunities for employment, business, and leveraging human life. As the urban sector has high growth potential, more people are moving to metropolises. The growth of population density and the expansion of the residential and urban sectors are expected to lead to an increase in market size.

Portable generators can be carried from one site to another, ensuring that all construction sites have the power necessary to run smoothly. Without them, it would be difficult to draw power from a central location to various plants in various regions. Regardless of whether the construction is large or medium, a portable generator should always be available. For instance, as part of the 2022 tranche of REACT-EU, the European Union Commission has granted EUR 382.7 million to support Spain's economic recovery and digital transition. In Catalonia, EUR 130.1 million was used primarily to support the construction and renovation of health and education infrastructure (primary care and hospitals). In Murcia, EUR 32.8 million was invested primarily in health infrastructure, and in Navarra, EUR 13.9 million was invested in renovating the educational infrastructure for 5,500 students.

Therefore, growing urbanization in the region, rising concerns about power instability in the residential sector due to events such as natural calamities, and the need for uninterrupted operations are driving the European portable generator market.

Germany is expected to dominate the Market

- As a result of increasing infrastructure projects, widening power demand-supply gaps, and the expansion of manufacturing facilities across the nation, Germany is expected to lead the portable generator market. Portable generators have become more affordable and effective in the country, and improved living standards have increased the demand for power backup systems.

- In 2021, Germany is the largest electricity consumer in Europe, the total electricity consumption per capita is 6,030 kWh, and the total energy consumption increased by 1.2% per year between 2016 and 2019 and declined by around 10% in 2020; the consumption increased by around 2.5% in 2021.

- The German Federal Ministry of Economics estimates that gross electricity consumption in Germany is expected to increase by 11% from 595 TWh in 2018 to 658 TWh in 2020. The transportation sector, electric heat pumps in buildings, and heating networks are the main drivers of the growth in electricity consumption.

- Considering the construction projects in the country there is expected to be huge demand for portable generators. For instance, in January 2022, Patrizia SE has acquired a residential turnkey development opportunity in Hamburg, Germany, from residential developer Instone Real Estate. Urban is scheduled for completion in autumn 2024. Students and young professionals are targeted by the Isle Campus, which will provide 10,100 square meters of rental space in 469 fully furnished, high quality micro apartments with an average size of 23 square meters.

- Therefore, based on the above-mentioned factors, Germany is expected to dominate the portable generator market during the forecast period.

Europe Portable Generator Industry Overview

The European portable generator market is fragmented. Some of the major players in the market (in no particular order) include Atlas Copco, HIMOINSA, Inmesol SLA, FG Wilson, and Wacker Neuson SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 End User

- 5.3.1 Industrial

- 5.3.2 Commercial

- 5.3.3 Residential

- 5.4 Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco

- 6.3.2 HIMOINSA

- 6.3.3 Inmesol SLA

- 6.3.4 FG Wilson

- 6.3.5 Wacker Neuson SE

- 6.3.6 PRAMAC

- 6.3.7 Briggs & Stratton Corporation

- 6.3.8 Honda Motor Co. Ltd

- 6.3.9 Caterpillar Inc.

- 6.3.10 Kirloskar Group