|

市場調查報告書

商品編碼

1641872

可攜式發電機:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

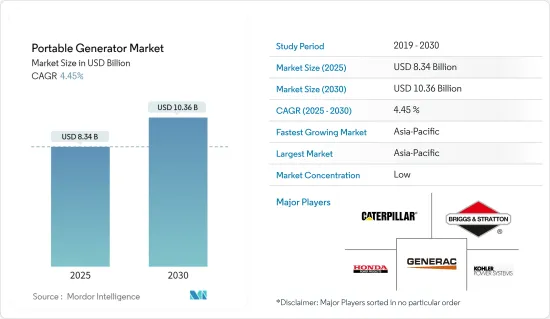

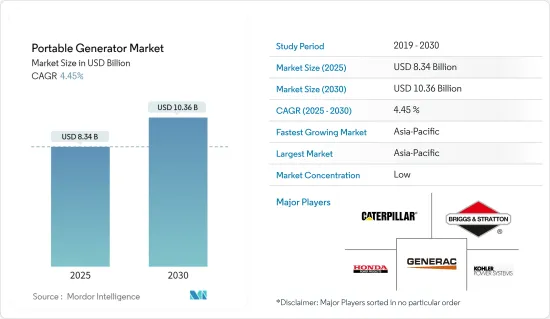

可攜式發電機市場規模預計在 2025 年為 83.4 億美元,預計到 2030 年將達到 103.6 億美元,預測期內(2025-2030 年)的複合年成長率為 4.45%。

關鍵亮點

- 從中期來看,不斷成長的電力需求、缺乏可靠的電網基礎設施、對緊急備用電源解決方案的需求以及對穩定電源供應的需求等因素正在推動可攜式發電機市場的發展。

- 另一方面,可攜式發電機面臨來自電池儲存系統的激烈競爭。更清潔的備用電源預計也會阻礙可攜式發電機市場的發展。

- 新興經濟體商業和工業領域、新興經濟體住宅領域以及國防活動對電力的需求日益成長,預計在不久的將來為市場參與企業創造巨大的商機。

- 預計北美將佔據主要市場佔有率,大部分需求來自美國和加拿大等國家。

可攜式發電機市場趨勢

工業領域預計將成為關鍵市場領域

- 在建立電力供應之前,可攜式發電機是工業場所的絕佳選擇。當現場需要大量電力時,緊急應變也經常使用它們。

- 由於基礎設施建設、都市化進程加快以及對可靠備用電源的需求不斷成長,預計未來對工業可攜式發電機的需求將保持強勁。柴油引擎驅動的可攜式發電機由於其高能量密度和在各種條件下運行的能力,很可能成為主導燃料類型。

- 世界上大多數國家都正在進行多個基礎設施建設計劃。這導致鋼鐵需求增加。 2023年鋼鐵總產量將達到約18.92億噸,高於2019年的18.78億噸。

- 沙烏地阿拉伯已宣布計劃向水務領域投資約 380 億美元。此外,未來幾年私人企業可能會投資 100 億美元用於該產業的發展。此外,沙烏地阿拉伯於2023年8月宣布了12,000公里計劃計畫。

- 沙烏地阿拉伯的基礎設施發展領先世界。沙烏地阿拉伯 NEOM 等計劃預計將對可攜式發電機產生巨大的需求。在 NEOM計劃下,沙烏地阿拉伯可能會透過幾個未來計劃開發西北地區。

- 此外,根據“2030願景”,沙烏地阿拉伯計劃在醫療保健和能源基礎設施方面投資近666.7億美元。因此,所有這些建設活動都可能為發電機創造機會,這些發電機可用作沙烏地阿拉伯各地無電和偏遠地區的主要電源。

- 此外,全球範圍內還有可再生能源、製造業、食品和飲料以及其他幾個行業的開發計劃。這些行業的擴張可能會產生對建築工地使用的可攜式發電機的需求。

預計北美將佔據較大的市場佔有率

- 可攜式發電機在北美,尤其是美國和加拿大被廣泛使用。它們受到需要在傳統電網無法覆蓋的地區或停電期間使用電力的住宅、小型企業主和承包商的歡迎。

- 2024年上半年,美國電力消耗量約1.95兆度。商業部分佔期間總用電量約34.6%。商業部門包括辦公、零售、教育、公共和政府設施、水、通訊設備以及戶外和公共街道照明等公共。根據美國能源資訊署的數據,電腦、辦公設備和冷凍合計佔電力消耗量的最大佔有率。

- 儘管存在複雜的電網基礎設施且全國 100% 可連接電力,但停電和備用電源需求增加等問題預計將推動美國備用發電市場的需求。停電每年平均造成美國約 180 億至 330 億美元的損失。因此,備用發電機或UPS被認為是保持業務運作不間斷的最可行選擇。

- 此外,客戶對備用電源的功能和優點以及個人使用的最佳設備組合的認知不斷提高,推動了對可攜式發電機的需求,尤其是在住宅和商業領域。

- 美國正經歷日益惡劣的天氣模式,包括嚴重的風暴、颶風和氣旋。令人震驚的是,全國 80% 的停電都是由這些極端天氣事件引起的。

- 德克薩斯州、密西根州、加州和北卡羅來納州是美國停電時間最長的州之一。 2024 年 7 月,颶風貝麗爾嚴重影響了市場,導致約 300 萬戶家庭和企業斷電。此外,2024 年 5 月,德克薩斯州遭遇雷暴襲擊,近 60 萬客戶斷電。因此,在這些州,這樣的天氣條件對可攜式發電機等備用電源解決方案產生了需求。

- 此外,加州等地因極端天氣事件而頻繁遭遇天災。 2024 年 2 月,加州遭受嚴重風暴襲擊,引發近 475 起土石流和山崩。因此,該國的這種情況對可攜式發電機產生了巨大的需求。

- 因此,由於上述發展,北美的可攜式發電機市場將在預測期內呈現成長。

可攜式發電機行業概況

可攜式發電機市場較為分散。該市場的主要企業(不分先後順序)包括 Generac Holdings Inc.、Caterpillar Inc.、Kohler Power Systems、Honda Siel Power Products Limited 和 Briggs & Stratton Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 電力需求不斷成長

- 限制因素

- 對電池儲存系統和其他清潔備用電力源的需求不斷增加

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 投資分析

第5章 市場區隔

- 額定功率

- 小於5kW

- 5~10kW

- 10kW以上

- 燃料類型

- 氣體

- 柴油引擎

- 其他燃料

- 最終用戶

- 工業的

- 商業的

- 住宅

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Generac Holdings Inc.

- Caterpillar Inc.

- Honda Siel Power Products Ltd

- Briggs & Stratton Corporation

- Kohler Power Systems

- Wacker Neuson SE

- Atlas Copco AB

- Eaton Corporation PLC

- Yamaha Motor Co. Ltd

- 市場排名/佔有率分析

- 其他知名公司名單

第7章 市場機會與未來趨勢

- 新興國家不斷成長的商業和工業部門

簡介目錄

Product Code: 61058

The Portable Generator Market size is estimated at USD 8.34 billion in 2025, and is expected to reach USD 10.36 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the ever-increasing demand for power, lack of reliable grid infrastructure, the need for emergency backup power solutions, and the demand for steady power supply are driving the portable generators market.

- On the other hand, portable generators face tough competition from battery storage systems. Other cleaner standby power sources are also expected to hinder the portable generators market.

- Nevertheless, the commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market participants in the near future.

- North America is expected to hold a significant market share, with most of the demand coming from countries such as the United States and Canada.

Portable Generator Market Trends

Industrial Sector Projected to be a Significant Market Segment

- Portable generators are an excellent choice for industrial sites before an electrical supply is established. They are also frequently used by emergency responders when a large amount of power is needed on location.

- The demand for portable industrial generators is expected to remain strong over the coming years, driven by increasing infrastructure development, urbanization, and the growing need for reliable backup power. Diesel-powered portable generators are likely to be the dominant fuel type due to their high energy density and performance in various conditions.

- The majority of the countries worldwide have several infrastructure development projects in the works. Hence, the demand for steel is increasing. In 2023, total steel production was around 1.892 billion tonnes, having increased from 1.878 billion tonnes in 2019.

- Saudi Arabia has announced plans to invest around USD 38 billion in the water sector. Further, private parties are likely to invest USD 10 billion in the development of the sector over the coming years. In addition, in August 2023, Saudi Arabia announced 12,000 km of planned water projects.

- Saudi Arabia is leading in terms of infrastructure development worldwide. Projects like NEOM in Saudi Arabia are expected to create immense demand for portable generators. Under the NEOM project, Saudi Arabia is likely to develop its northwest region with several futuristic projects.

- Additionally, under Vision 2030, the country is likely to invest nearly USD 66.67 billion in healthcare and energy infrastructure. Hence, all such construction activities are likely to create opportunities for generators that can be utilized as prime power sources in off-grid or remote locations across Saudi Arabia.

- Further, globally, there are several development projects related to renewable, manufacturing, food and beverage, and several other industries. Expansion in these industries is likely to create demand for portable generators that are used on construction sites.

North America Projected to Hold a Significant Market Share

- Portable generators are widely used in North America, particularly in the United States and Canada. They are popular among homeowners, small business owners, and contractors who need access to power in locations where a traditional power grid is not available or during power outages.

- In H1 2024, the electricity consumption in the United States was about 1.95 trillion kWh. The commercial segment accounted for approximately 34.6% of the total electricity consumed in the period. The commercial segment includes offices, retail, educational, public, and government facilities and public services, such as water supply, telecommunications equipment, and outdoor and public street lighting. According to EIA, computers, office equipment, and refrigeration combined accounted for the largest share of electricity consumption.

- Despite the presence of a complex electricity grid infrastructure and 100% electricity access nationwide, problems like power outages and increasing demand for standby power sources are expected to drive the demand for the backup power generation market in the United States. Power outages cost an average of about USD 18 billion to USD 33 billion per year in the United States. Therefore, backup generators and UPS are considered the most viable options for making business operations run continuously without any interruption.

- Moreover, increasing awareness among customers about the features and benefits of backup power, as well as the best-suited equipment combination for personal use, is driving the demand for portable generators, especially in the residential and commercial segments.

- The United States has been grappling with increasingly severe weather patterns, including storms, hurricanes, and cyclones. A staggering 80% of power outages in the country are attributed to these extreme weather events.

- Texas, Michigan, California, and North Carolina are among regions across the United States that recorded the highest hours of power outages. In July 2024, Hurricane Beryl severely impacted the market, knocking out power for around 3 million homes and businesses. Further, Texas experienced a thunderstorm in May 2024, during which nearly 600,000 consumers were without electricity in the region. Hence, such weather conditions have created demand for backup power solutions like portable generators in these states.

- Additionally, places like California face frequent natural disasters due to extreme weather conditions. In February 2024, California faced a storm, with extreme rainfall leading to nearly 475 mudslides or debris flows. Hence, such conditions in the country have created significant demand for portable generators.

- Thus, owing to the abovementioned developments, North America is set to witness growth in the portable generators market during the forecast period.

Portable Generator Industry Overview

The portable generators market is semi-fragmented. Some of the key players in this market (in no particular order) include Generac Holdings Inc., Caterpillar Inc., Kohler Power Systems, Honda Siel Power Products Limited, and Briggs & Stratton Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Power

- 4.5.2 Restraints

- 4.5.2.1 Increasing Demand for Battery Storage Systems and Other Cleaner Sources of Standby Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 End User

- 5.3.1 Industrial

- 5.3.2 Commercial

- 5.3.3 Residential

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 NORDIC

- 5.4.2.6 Turkey

- 5.4.2.7 Russia

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Malaysia

- 5.4.3.6 Thailand

- 5.4.3.7 Indonesia

- 5.4.3.8 Vietnam

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Nigeria

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Honda Siel Power Products Ltd

- 6.3.4 Briggs & Stratton Corporation

- 6.3.5 Kohler Power Systems

- 6.3.6 Wacker Neuson SE

- 6.3.7 Atlas Copco AB

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Yamaha Motor Co. Ltd

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Commercial and Industrial Sectors of Emerging Economies

02-2729-4219

+886-2-2729-4219