|

市場調查報告書

商品編碼

1635488

印度可攜式發電機:市場佔有率分析、行業趨勢和成長預測(2025-2030)India Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

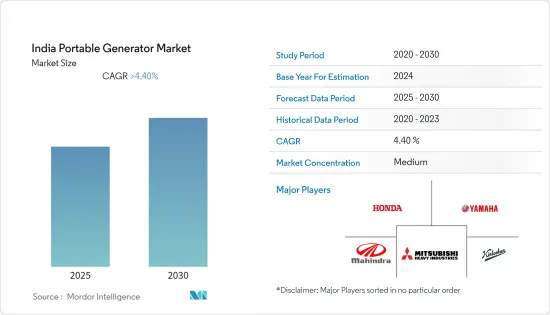

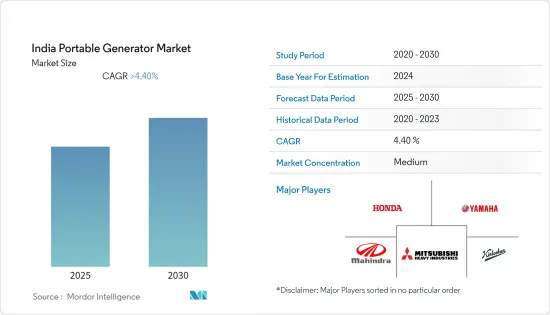

印度可攜式發電機市場預計在預測期內複合年成長率將超過 4.4%。

COVID-19 對 2020 年市場產生了負面影響。目前市場處於大流行前的水平。

主要亮點

- 預計在預測期內,各種因素將推動市場發展,包括政府為減少評級柴油發電機組排放氣體而製定的有利法規。

- 另一方面,由於可再生能源發電的成長趨勢,特別是在旨在減少溫室氣體排放的行業中,正在調查的市場可能很快就會面臨障礙。

- 也就是說,可攜式混合發電機的日益普及和混合動力系統可靠性的提高可能為該行業帶來機會。可攜式發電機可能會降低成本並減少對單一燃料的依賴。預計這將在不久的將來為可攜式發電機製造商創造重大商機。

印度可攜式發電機市場趨勢

工業部門預計將顯著成長

- 工業部門,包括中小型製造設備、農業和建設業,是所有終端用戶產業中能源消費量最高的。因此,它是印度發電機的重要終端用戶部門。

- 根據聯合國經濟和社會事務部預測,到2022年,印度將成為成長最快的經濟體之一。預計 2022 年全球經濟僅成長 3.1%。同時,印度經濟預計將成長6.4%。

- 由於最近的COVID-19危機,印度工業生產年成長率下降了8.4%。不過,2022年工業生產呈現顯著成長。預計這將影響中小型工業發電機的使用增加,以確保高效的燃料供應。

- 同樣,可攜式氣體發生器正在成為許多小型工業應用的首選解決方案。燃氣發電機的運作時間明顯更長,更容易獲得許可證,使用天然氣的機組的排放氣體量比柴油發電機少 90%。

- 2022年2月,中央污染控制委員會(CPCB)宣布了一項三管齊下的措施:報廢超過15年的柴油發電機,要求發電機安裝廢氣控制裝置,並對新發電機實施更嚴格的廢氣提案。這些措施將有助於擴大攜帶式氣體發生器的使用,以減少全國範圍內的污染。

- 此外,2021 年 12 月,政府市場 (GEM) 對新德里工商部辦公室的柴油發電機組安裝計劃進行了競標。競標需要至少五台可攜式發電機組作為備用電源。

- 鑑於上述情況,印度可攜式發電機市場預計在預測期內工業領域將顯著成長。

有利的政府法規推動市場

- 柴油發電機是印度商業、住宅和工業用途中最常用的發電機。由於污染、噪音和維護成本等缺點,消費者正在尋找備用電源替代品,例如燃氣發電機。

- 2022年2月,印度環境、森林和氣候變遷部修訂了自2023年7月起所有發電機必須遵守的排放標準。印度發電機排放標準 IV+ 適用於運作所有燃料(包括氫氣)的發電機。

- 此外,人們對使用天然氣(一種清潔可靠的燃料)發電的認知不斷增強,加上對柴油發電機的維護和負面環境影響的日益擔憂,導致全國範圍內攜帶式燃氣發電機的使用量增加。它會變得更受歡迎。

- 此外,五年後的2022年4月,為了遏制柴油發電,政府修改規定,要求配電公司在地鐵和大城市每年365天、每天24小時供電。因此,可攜式發電機可能很快就會在全國範圍內使用。

- 鑑於上述情況,預計強力的政府法規將在預測期內主導印度可攜式發電機市場。

印度可攜式發電機產業概況

印度可攜式發電機市場較為分散。市場的主要企業包括(排名不分先後)本田印度動力產品有限公司、雅馬哈汽車、三菱重工有限公司、Mahindra & Mahindra Limited 和 Kirloskar Oil Engines Ltd。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 政府法規政策

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- PESTLE分析

第5章市場區隔

- 按額定功率

- 小於5kW

- 5~10 kW

- 10kW以上

- 按燃料類型

- 氣體

- 柴油引擎

- 其他燃料

- 按最終用戶

- 產業

- 業務

- 住宅

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Honda India Power Products Ltd

- Yamaha Motor Co. Ltd

- Mitsubishi Heavy Industries Ltd

- Mahindra & Mahindra Limited

- Kirloskar Oil Engines Ltd

- Generac Holdings Inc.

- Caterpillar Inc.

- Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- Yanmar Holdings Co. Ltd

- Kohler Co. Inc.

- Wartsila Corporation

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92850

The India Portable Generator Market is expected to register a CAGR of greater than 4.4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Various factors, such as favorable government regulations to reduce emissions generated from high-rated diesel-generated sets, are expected to drive the market during the forecast period.

- On the other hand, the market studied may face hurdles shortly due to the growing trend of renewable power generation, particularly in industries that have targeted reducing greenhouse gas emissions.

- Nevertheless, the increasing popularity of portable hybrid generators and the rising reliability of the hybrid system may be an opportunity for the industry. Portable generators will reduce costs and dependence on a single fuel. This, in turn, is expected to provide a significant opportunity for portable generator manufacturers in the near future.

India Portable Generator Market Trends

Industrial Sector Expected to Witness Significant Growth

- The industrial sector, which includes small & medium scale manufacturing units, agriculture, and construction, accounts for the most energy consumption of any end-user industry. Thus, it is an important end-user segment for generators in India.

- According to the United Nations Department of Economic and Social Affairs, by 2022, India will be one of the fastest-growing economies. The global economy was projected to incline by only 3.1% in 2022. At the same time, India was expected to grow by 6.4%.

- Due to the recent Covid-19 crisis, the annual growth rate of industrial production in India declined by 8.4%. However, in the year 2022, industrial production witnessed significant growth. This is expected to impact the growth in the usage of generators across small & medium-sized industries, as they ensure efficient fuel supply.

- Similarly, portable gas generators are becoming the preferred solution in many small-scale industrial applications. They provide much longer runtimes, permitting is more accessible, and units with natural gas have 90% fewer emissions than diesel generators.

- In February 2022, the Central Pollution Control Board (CPCB) proposed a strategy to reduce pollution from old diesel gensets via a 3-pronged approach: scrapping diesel gen-sets older than 15 years, mandating the retrofitting of gensets with emission control devices, and imposing tighter emission standards for newer gensets. Such measures will aid the growth in the usage of portable gas generators to reduce pollution across the country.

- Also, in December 2021, Government E-Marketplace (GEM) floated a tender for the installation project of diesel generator sets at the Ministry of Commerce & Industry office in New Delhi. The tender required at least five portable DG sets for the backup power supply.

- Owing to the above points, the industrial sector is expected to witness significant growth in the Indian portable generator market during the forecast period.

Favorable Government Regulations to Drive the Market

- Diesel generators are India's most used generators in commercial, residential, and industrial applications. Disadvantages, such as pollution, noise, and maintenance costs, are making consumers look for alternatives for backup power supply, such as gas generators.

- In February 2022, The Ministry of Environment, Forest and Climate Change revised the emission norms in India, effective from July 2023, with which all generators must comply. The India Genset Emission Standards- IV+ will apply for generators running on all fuels, including hydrogen.

- Also, increasing awareness regarding the use of natural gas in power generation, as it is a clean and reliable fuel, coupled with increased concerns over diesel generator maintenance and its negative impact on the environment, is expected to drive portable gas generators across the country.

- Moreover, in April 2022, in order to dissuade diesel generation in five years, the government amended rules mandating power distribution companies to supply 24x7 electricity in metros and large cities. This may, in turn, result in the utilization of portable generators across the country shortly.

- Owing to the above points, strong government regulations are expected to dominate the Indian portable generator market during the forecast period.

India Portable Generator Industry Overview

The Indian portable generator market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Honda India Power Products Ltd, Yamaha Motor Co. Ltd, Mitsubishi Heavy Industries Ltd, Mahindra & Mahindra Limited, and Kirloskar Oil Engines Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Billion, Till 2027

- 4.3 Government Policies And Regulations

- 4.4 Recent Trends And Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 By Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 By End-user

- 5.3.1 Industrial

- 5.3.2 Commerial

- 5.3.3 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1 Honda India Power Products Ltd

- 6.3.2 Yamaha Motor Co. Ltd

- 6.3.3 Mitsubishi Heavy Industries Ltd

- 6.3.4 Mahindra & Mahindra Limited

- 6.3.5 Kirloskar Oil Engines Ltd

- 6.3.6 Generac Holdings Inc.

- 6.3.7 Caterpillar Inc.

- 6.3.8 Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- 6.3.9 Yanmar Holdings Co. Ltd

- 6.3.10 Kohler Co. Inc.

- 6.3.11 Wartsila Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219