|

市場調查報告書

商品編碼

1635492

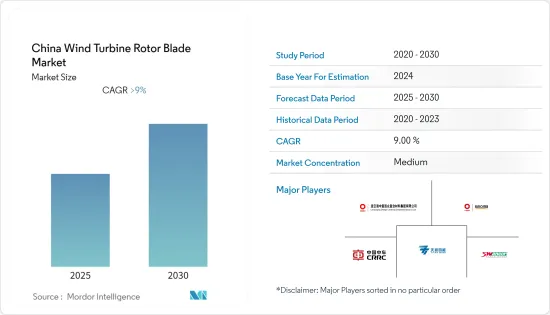

中國風力發電機葉輪:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China Wind Turbine Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計中國風力發電機葉輪市場在預測期內將以超過9%的複合年成長率成長。

2020 年市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從長遠來看,供應鏈控制和強大的國內製造業是關鍵促進因素。

- 另一方面,運輸成本上升以及太陽能和水力發電等替代清潔能源的市場競爭可能會阻礙市場成長。

- 風電產業需要具有成本效益的解決方案,而高效的產品有可能改變產業的動態。在某些情況下,舊渦輪機被更換,不是因為損壞,而是因為市場上出現了更有效率的葉片。因此,技術發展為風力發電機葉輪市場帶來了機會。

中國風力發電機葉輪市場趨勢

土地領域主導市場

- 陸域風電技術在過去五年中不斷發展,以最大限度地提高每兆瓦裝置容量的發電量,並覆蓋更多風速較低的地區。除此之外,近年來風力發電機變得越來越大,輪轂更高,直徑更寬,風力發電機葉片也更大。

- 根據全球風能理事會統計,2021年中國新增陸上風力發電機組容量為37.35吉瓦,較2020年成長11.03%。這種爆炸性成長得益於中國對可再生能源的大量投資。中國陸域風電裝置容量從2020年的279.95吉瓦增加到2021年的310.62吉瓦。

- 根據國際可再生能源機構(IRENA)預測,到2050年,中國預計將主導陸上風電產業,佔全球裝置容量的50%以上。此外,由於人口眾多,電力需求旺盛,風力發電預計將成長。在全國聯邦和州政府的支持下,包括中國企業在內的許多跨國公司正在該領域進行投資。

- 中國正在加倍投資風電場以改善其能源安全,這主要是由於俄羅斯和烏克蘭之間持續的戰爭導致天然氣價格上漲。例如,2022年,中國政府宣布計劃在戈壁沙漠建設450吉瓦的太陽能和風能發電站,以實現2030年的可再生能源目標。

- 此外,2021年3月,中國全國人大公佈了《「十四五」規劃和2035年國民經濟和社會發展遠景目標》,積極增加風能、太陽能發電,重點發展風電、太陽能發電。因此,中國政府的此類舉措預計將在預測期內推動中國風力發電市場的發展。

- 2022年6月,中國廣核集團(中廣核)建成100千萬瓦陸上風發電工程,年併網電量超過30億度。陸域風發電工程每年可節省標準煤92萬噸以上,減少二氧化碳排放近250萬噸。因此,該國的此類計劃可能會增加該國陸上風力發電的佔有率。

- 因此,基於上述因素,由於政府的支持措施和舉措以及陸上風力發電計劃的增加,陸上風力發電機葉輪預計將出現成長。

供應鏈管理和強大的國內製造實力。

- 中國是全球最大的可再生能源市場,也是主要可再生能源中心中成長最快的可再生能源市場。這種快速成長主要得益於中國政府採取的措施,中國政府尋求加強國內製造業以滿足強勁的內需。過去30年,這是透過對消費品進口徵收重稅,同時減少對製造業所需的機械和設備等資本財的進口稅收來實現的。

- 此外,政府在研發和技術轉移協議方面投入巨資,同時獎勵國內創新。這為國內可再生能源製造業在強勁內需的支撐下奠定了基礎,現已成為全球可再生能源製造業的領導者。

- 此外,為了維持國內市場的風力發電,並確保國內製造商能夠輕鬆廉價地獲得原料,中國在全球地緣政治中精明地轉向生產葉輪、渦輪機和其他相關零件。需原料的供應鏈。中國全球供應鏈和國內製造業的實力保證了中國國內市場風力發電硬體的全球最低價格,這將是預測期內推動中國風力發電需求的關鍵因素。

- 根據全球風能理事會(GWEC)預測,截至2022年,中國將成為全球最大的渦輪機製造地之一,佔全球渦輪機機艙和齒輪箱、發電機和葉片等關鍵部件產量的60-65%。

- 由於市場集中度高,市場競爭激烈,硬體成本大幅下降。

- 此外,激烈的國內競爭帶來的價格壓力刺激了該領域的非凡創新。大多數中國製造商在研發方面投入巨資,將更新的渦輪轉子和葉片模型商業化。

- 這也導致了一支高素質的勞動力隊伍的發展,他們具備風力發電機技術設計和工程、風資源估算、業務開發和研究、製造、運輸、安裝和運維方面的技能。

- 這種向新興市場的擴張凸顯了中國OEM如何主導全球和國內風力發電市場,其主導地位壓低了硬體成本,並在預測期內擴大了市場。

中國風力發電機葉輪產業概況

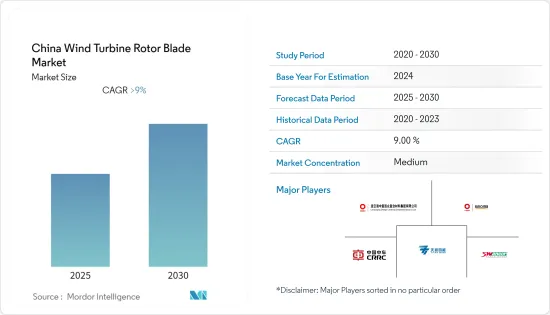

中國風力發電機葉輪市場細分:市場主要企業(排名不分先後)包括連雲港中復連眾複合材料集團、中材風電葉片、株洲時代新材料科技、天順風能(蘇州)、上緯新材等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 部署地點

- 陸上

- 離岸

- 刀片材質

- 碳纖維

- 玻璃纖維

- 其他刀片材料

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- Sinoma wind power blade Co. Ltd

- Zhuzhou Times New Material Technology Co. Ltd

- Tianshun Wind Energy(Suzhou)Co. Ltd

- Swancor Advanced Materials Co. Ltd

- TPI Composites Inc.

- LM Wind Power(GE 再生能源業務)

- Nordex SE

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy

第7章市場機會與未來趨勢

The China Wind Turbine Rotor Blade Market is expected to register a CAGR of greater than 9% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors are control of the supply chain and the presence of a strong domestic manufacturing industry.

- On the other hand, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder the market's growth.

- Nevertheless, the wind power industry has been in demand for cost-effective solutions, and a highly efficient product has the potential to change the dynamics of the industry. There were instances where old turbines were replaced, not because of the damage but due to the availability of more efficient blades in the market. Hence, technological developments present themselves as opportunities for the wind turbine rotor blade market.

China Wind Turbine Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- According to the Global Wind Energy Council, in 2021, the onshore wind turbine capacity additions in China registered 37.35 GW, with an 11.03% growth compared to 2020. This explosive growth was due to high investments in renewable energy in China. The country's onshore wind energy installed capacity increased to 310.62 GW in 2021 from 279.95 GW in 2020.

- According to International Renewable Energy Agency (IRENA), China is expected to dominate the onshore wind power industry, with more than 50% of global installations by 2050. Also, due to the high population, high electricity demand in the country is expected to promote growth in wind energy. Many multinational corporations, including Chinese firms, are investing in this sector with the help of the federal and provincial governments across the country.

- China is doubling down on its wind power plants to improve its energy security primarily due to the increased natural gas prices mainly occurred by the ongoing war between Russia and Ukraine. For instance, in 2022, the government of China announced that it plans to build 450 gigawatts of solar and wind energy power plants in the Gobi desert regions to achieve the renewable energy target by 2030.

- Furthermore, in March 2021, the National People's Congress of China announced the 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035, which focuses on vigorously increasing wind scale and photovoltaic power generation and orderly develop onshore wind power. Thus, such initiatives by the Chinese government are likely to drive the wind energy market in China during the forecast period.

- In June 2022, China General Nuclear Power Group (CGN) completed the construction of a one million-kilowatt onshore wind project capable of generating more than 3 billion kWh of on-grid electricity annually. The onshore wind energy projects are likely to save more than 920,000 tonnes of standard coal and reduce nearly 2.5 million tonnes of carbon dioxide emissions every year. Thus, such projects in the country are likely to increase the share of onshore wind energy in the country.

- Therefore, based on the above-mentioned factors, the onshore wind turbine rotor blade is expected to grow due to supportive government policies and initiatives, coupled with the increasing number of onshore wind energy projects.

Control of the supply chain and the presence of a strong domestic manufacturing industry.

- China is the largest renewable energy market globally and the fastest-growing renewable energy market among major renewable energy hubs. This rapid growth has been made possible primarily by the Chinese government policies, which have sought to consolidate China's domestic manufacturing industry to satiate the solid domestic demand. This has been achieved by levying heavy taxes on imports of consumer goods while reducing taxes on the import of capital goods, such as machinery and equipment required for manufacturing, over the last three decades.

- Additionally, the government invested heavily in R&D and Technology Transfer agreements while incentivizing domestic innovation, which has created the foundation of a competent domestic renewable energy manufacturing industry, bolstered by robust domestic demand, now transformed into a global leader in renewable energy manufacturing.

- Additionally, to ensure domestic manufacturers have easy and cheap access to raw materials to maintain low prices in the domestic market, China has shifted shrewdly in global geopolitics to strengthen its supply chain of raw materials required for manufacturing wind energy hardware such as rotor blades, turbines, and other related components and accessories. The strength of China's global supply chain and domestic manufacturing sector ensures some of the lowest prices for wind energy hardware in the domestic Chinese market globally, and this is expected to be a significant factor driving the demand for wind energy in China during the forecast period.

- According to Global Wind Energy Council (GWEC), as of 2022, China is one of the world's largest turbine manufacturing hubs, accounting for 60-65% of global production of turbine nacelles and critical components including gearboxes, generators, and blades.

- Due to the high concentration in the market, competition in the market is fierce, which has driven down hardware costs significantly.

- Additionally, the fierce domestic competition leading to immense price pressure spurned extraordinary technological innovation in the field. Most Chinese manufacturers have invested heavily in R&D to commercialize newer turbine rotor, blade models.

- This has also led to the development of a highly qualified workforce with skills in wind turbine technology design and engineering, wind resource estimation, business development and research, manufacturing, transportation, installation, and O&M.

- Such developments highlight how Chinese OEMs are dominating the global and domestic Chinese wind energy market, and their dominance is expected to reduce hardware costs and drive the market during the forecast period

China Wind Turbine Rotor Blade Industry Overview

China wind turbine rotor blade market is fragmented. Some of the major players in the market (in no particular order) include Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd, Sinoma wind power blade Co. Ltd, Zhuzhou Times New Material Technology Co., Ltd, Tianshun Wind Energy (Suzhou) Co., Ltd. and Swancor Advanced Materials Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployement

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- 6.3.2 Sinoma wind power blade Co. Ltd

- 6.3.3 Zhuzhou Times New Material Technology Co. Ltd

- 6.3.4 Tianshun Wind Energy (Suzhou) Co. Ltd

- 6.3.5 Swancor Advanced Materials Co. Ltd

- 6.3.6 TPI Composites Inc.

- 6.3.7 LM Wind Power (a GE Renewable Energy business)

- 6.3.8 Nordex SE

- 6.3.9 Vestas Wind Systems A/S

- 6.3.10 Siemens Gamesa Renewable Energy