|

市場調查報告書

商品編碼

1685776

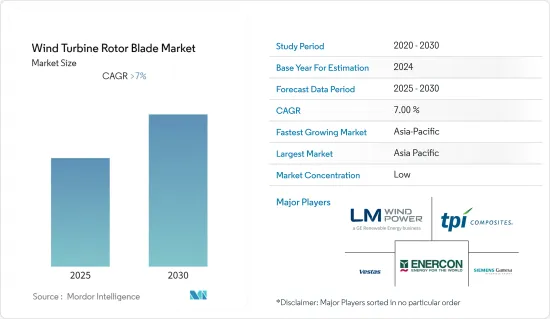

風力發電機葉輪:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wind Turbine Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,風力發電機葉輪市場預計將以超過 7% 的複合年成長率成長。

2020年市場受到新冠肺炎疫情影響較小,目前市場已恢復到疫情前的水準。

主要亮點

- 市場的主要驅動力是全球海上和陸上風電裝置數量的增加。

- 另一方面,高昂的運輸成本和來自太陽能、水力發電等替代清潔能源的市場競爭可能會阻礙市場成長。

- 風能產業需要具有成本效益的解決方案,高效的產品有可能改變產業的動態。在某些情況下,老舊的渦輪機之所以被更換,並不是因為損壞,而是因為市場上出現了更有效率的葉片。因此,技術發展為風力發電機葉輪市場帶來了機會。

- 2022 年風力發電機葉輪市場將由亞太地區主導,大部分需求來自中國、印度和澳洲等國家。

風力發電機葉輪市場趨勢

土地部分佔市場主導地位

- 過去五年來,陸上風電技術不斷發展,最大程度地提高了每兆瓦裝置容量的發電量並覆蓋了更多風速較低的地區。此外,近年來風力發電機的體積越來越大,輪轂高度更高、直徑更寬、風力發電機葉片也更大。

- 根據全球風力發電理事會(GWEC)預測,2021年全球陸上風電市場新增7,250萬千瓦,較2020年下降18%,原因是全球兩大風電市場中國和美國的陸上風電市場成長放緩。然而,2021年歐洲、拉丁美洲、非洲和中東地區出現了爆炸性成長,陸上新建油氣儲量分別成長了19%、27%和120%。

- 亞太地區和北美的陸上風電與 2020 年相比分別下降了 31% 和 21%,但這兩個地區的合計仍佔 2021 年全球陸上風電的三分之二以上。然而,預計在預測期內,中國、美國和印度等幾個主要國家的投資和雄心勃勃的可再生能源目標將推動對風力發電機葉輪的需求。

- 此外,根據國際可再生能源機構 (IRENA) 的數據,平準化能源成本 (LCOE) 和全球加權平均總安裝成本從 2016 年的 0.060 美元/千瓦時和 1,652 美元/千瓦下降到 2020 年的 0.039 美元/kWh。此外,由於資本成本降低、產業成熟帶來的競爭加劇以及技術的改進,預計預測期內 LCOE 和加權平均成本將進一步下降。

- 印度是風力發電成長最快的國家之一。根據印度新可再生能源部統計,截至2021年,該國風電裝置容量位居全球第四,總設備容量為40.08吉瓦。不斷擴張的風電產業已經創造了強大的生態系統、計劃營運能力和每年約 10,000 兆瓦的製造地。中國也正遵循同樣的趨勢。根據國家能源局統計,2021年風電併網容量4,750萬千瓦,陸域風電總設備容量達31,062萬千瓦。由於大量投資和政府政策的變化,陸上市場預計將引領印度和中國風力發電機葉輪市場的成長。

- 根據 GWEC 的數據,2021 年美國陸域風電領域新增裝置量位居全球第二,全年運作裝置量約 1,274 萬千瓦。美國陸上風電的採用已經放緩,主要原因是計劃開發商必須按時完成任務,計劃取消生產稅額扣抵,這也直接影響了陸上風力發電機葉輪市場。

- 此外,根據WindEurope稱,到2030年,陸上風力發電將引領歐洲地區實現淨零碳排放的市場需求。據GWEC稱,陸上風力發電容量約佔風力發電的90%。減少碳排放和逐步淘汰傳統電力系統的嚴格法規預計將推動市場發展。

- 因此,基於上述因素,由於平準化電力成本(LCOE)降低、資本支出減少,加上清潔能源來源需求旺盛,預計陸上風力發電機葉輪部分將在預測期內實現成長。

亞太地區佔市場主導地位

- 亞太地區是全球風力發電機葉輪市場最大的地區之一。大部分需求來自中國、印度和日本。自1891年發明現代風力發電機發電機(WTG)以來,中國已經意識到風力發電技術是向農村和偏遠地區提供電力的有效方法。由於政策改革、專門的研究和開發計劃、新的資金籌措機制和最新五年規劃中的明確目標,中國風電裝置容量已從 1990 年的僅 4 兆瓦成長至 2021 年的 338.30 吉瓦。

- 2021年中國裝置容量和新增容量均為全球第一。根據IRENA預測,中國將持續主導陸上風電產業,預計2050年將佔全球裝置容量的50%以上。此外,由於中國人口眾多,電力需求旺盛,預計將推動風電的成長。在聯邦政府和全國各州政府的支持下,包括中國公司在內的多家跨國公司正在投資該領域。

- 根據國家能源局的數據,2021年中國將新增陸域風電裝置容量4,750千萬瓦,使陸上風電總裝置容量達到3.1062億千瓦。此外,預計未來幾年中國陸上風電市場將穩定成長,不僅國內市場而且國際出口對關鍵零件和材料的需求也將增加。此外,中國近70%的發電量來自火力發電廠。隨著火力發電污染的不斷增加,國家正致力於提高更清潔、可再生電力的比重。

- 此外,2021年全球新增離岸風力發電裝置容量2,110萬千瓦,總合80%(1,690萬千瓦)將來自中國,使中國累積離岸風力發電裝置容量達2,768萬千瓦。這顯示中國有望成為亞太地區最大的風力發電機葉輪市場。

- 截至2021年,印度的風電裝置持有世界第四。這些計劃主要位於該國北部、南部和西部。截至2021年,印度風電裝置容量為4,008萬千瓦,較2020年的3,862萬千瓦成長4%。目前非石化燃料在總發電量中的佔比為395吉瓦中的38.5%。目前,風能佔其中的 10.2%,但為了進一步履行我們對 2030 年氣候變遷的承諾,新和可再生能源部 (MNRE) 估計,到 2030 年需要 140GW 的風力發電容量。為了實現這些目標,預計未來幾年風力發電工程的數量將呈指數級成長,從而推動該國對風力發電設備的需求。

- 印度還希望透過挖掘其 7,600 公里海岸線上尚未開發的離岸風力發電潛力來擴大其綠色能源組合。近年來,人們對離岸投資的興趣日益濃厚。可再生能源部已設定了2030年安裝30吉瓦離岸風力發電的目標。

- 因此,預計在預測期內,亞太地區即將推出的風力發電工程以及各國政府的支持性政策和計畫等因素將推動亞太地區對風力發電機葉輪的需求。

風力發電機葉輪產業概況

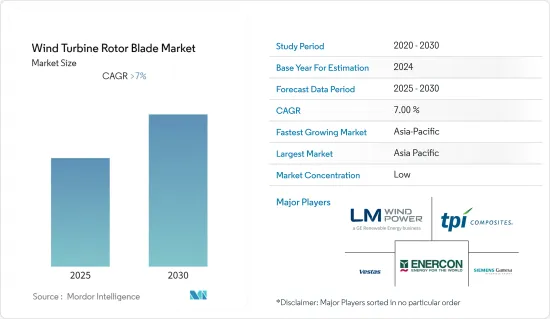

風力發電機葉輪市場較為分散。市場的主要企業(不分先後順序)包括 TPI Composites SA、LM Wind Power(通用電氣再生能源業務部門)、Siemens Gamesa Renewable Energy, SA、Vestas Wind Systems A/S 和 Enercon GmbH。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 調查前提條件

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模與需求預測

- 風力發電機葉輪價格分析

- 最新趨勢和發展

- 政府政策、法規和政策目標

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 部署位置

- 陸上

- 海上

- 刀片材質

- 碳纖維

- 玻璃纖維

- 其他刀片材料

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- LM Wind Power(a GE Renewable Energy business)

- Nordex SE

- Siemens Gamesa Renewable Energy, SA

- Vestas Wind Systems A/S

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- Enercon GmbH

第7章 市場機會與未來趨勢

The Wind Turbine Rotor Blade Market is expected to register a CAGR of greater than 7% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- The major driving factor of the market is the growing number of offshore and onshore wind energy installations across the world.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder market growth.

- The wind power industry has been in demand for cost-effective solutions, and a highly efficient product has the potential to change the dynamics of the industry. There were instances where old turbines were replaced, not because of the damage but due to the availability of more efficient blades in the market. Hence, technological developments present themselves as opportunities for the wind turbine rotor blade market.

- Asia-Pacific dominated the wind turbine rotor blade market in 2022, with the majority of the demand coming from countries like China, India, and Australia.

Wind Turbine Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- The onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- According to the Global Wind Energy Council (GWEC), the onshore wind market added 72.5 GW worldwide in 2021, 18% lower than in 2020, due to a slowdown in the growth of the onshore wind market in China and the United States, the world's two largest wind markets. However, in 2021, explosive growth was witnessed in Europe, Latin America, Africa, and the Middle East, where new onshore installations increased by 19%, 27%, and 120%.

- Onshore wind additions in the Asia-Pacific and North America have decreased by 31% and 21% compared to 2020, but the two regions combined still made up more than two-thirds of global onshore wind installations in 2021. However, investments and ambitious renewable targets from several major countries, such as China, the United States, and India, are expected to drive the demand for wind turbine rotor blade during the forecast period.

- Further, according to the International Renewable Energy Agency (IRENA), the levelized cost of energy (LCOE) and global weighted average total installed cost decreased from 0.060 USD/kWh and 1652 USD/kW in 2016 to 0.039 USD/kWh and 1355 USD/kW in 2020. In addition, the LCOE and the weighted average cost are expected to decline further owing to the reductions in capital costs, increased competition as the sector continues to mature, and improvements in technology during the forecast period.

- India is one of the fastest-growing wind power generators. According to India's Ministry of New and Renewable Energy, as of 2021 the country had the fourth-highest installed wind energy capacity in the world, with a total installed capacity of 40.08 GW. The expansion of the wind industry has resulted in a robust ecosystem, project operation capabilities, and a manufacturing base of about 10,000 MW per annum in the country. China follows the same trend. According to the National Energy Administration (NEA), 47.5 GW of wind capacity was grid-connected in 2021, and the total onshore installed wind capacity registered at 310.62 GW. Due to high investment and changes in government policy, the onshore segment is expected to lead the growth of the wind turbine rotor blade market in India and China.

- According to the GWEC, the United States' onshore wind sector reported the second-highest annual new installations in the world in 2021, with around 12.74 GW commissioned. The onshore wind installation in the United States was driven primarily due to the planned Production Tax Credit phase-out as project developers had to meet their deadline, which also directly aids the onshore wind turbine rotor blade market.

- Further, according to WindEurope, onshore wind energy will lead the market demand in the European region to achieve net-zero carbon emissions by 2030. According to GWEC, onshore wind energy capacity takes around 90% of wind energy. Strict regulations to reduce carbon emissions and phase out conventional power systems are expected to drive the market.

- Therefore, based on the above-mentioned factors, the onshore wind turbine rotor blade segment is expected to grow due to declining LCOE and reduced CAPEX, coupled with high energy demand through clean sources, during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is one of the largest regions in the global wind turbine rotor blade market. Most of the demand is generated from China, India, and Japan. Since the invention of the modern wind turbine generator (WTG) in 1891, China has recognized that wind energy technology offers an effective way to provide electricity to rural and isolated areas. China's installed wind capacity grew from a mere 4 MW in 1990 to 338.30 GW in 2021 due to policy reforms, dedicated R&D initiatives, new financing mechanisms, and clear goals in the most recent Five-Year Plans.

- Both China's installed capacity and new capacity in 2021 were the largest in the world by a wide margin. According to IRENA, China is expected to continue to dominate the onshore wind power industry, with more than 50% of global installations by 2050. Also, due to the high population, high electricity demand in the country is expected to promote growth in wind energy. Several multinational corporations, including Chinese firms, are investing in this sector with the help of federal and provincial governments across the country.

- According to the National Energy Administration (NEA), China connected 47.5 GW of onshore wind capacity in 2021, boosting its total onshore installations to 310.62 GW. Further, the Chinese onshore wind market is expected to grow steadily in the coming years, with rising needs for key components and materials, not only for the national market but also for international exports. Besides, in China, nearly 70% of the electricity produced is from thermal energy sources. As there is increasing pollution from thermal sources, the country has been focusing on increasing the share of cleaner and renewable sources in power generation.

- Furthermore, out of the total 21.10 GW of newly installed offshore capacity worldwide, 80% (16.90 GW) of the new installations came from China in 2021, and China's cumulative offshore wind capacity stood at 27.68 GW. All of this indicates that China is expected to be the largest market for wind turbine rotor blades market in the Asia-Pacific region.

- India held the fourth-largest wind power installed capacity globally as of 2021. These projects are majorly spread in the northern, southern, and western parts of the country. As of 2021, India's total installed wind capacity was 40.08 GW, witnessing an increase of 4% compared to the 38.62 GW in 2020. The country's current share of non-fossil fuels in overall generation capacity stands at 38.5% out of 395 GW. While wind currently accounts for 10.2% of this, to further realize its 2030 climate commitments, the Ministry of New and Renewable Energy (MNRE) has estimated that 140 GW of wind energy capacity is required by 2030. In order to reach such a target, the number of wind projects is expected to increase drastically in the coming years, driving the demand for wind power equipment in the country.

- Furthermore, India is trying to expand its green energy portfolio by harnessing the entirely unexploited offshore wind energy potential along its 7,600-kilometer coastline. The focus on offshore increased in recent years. The renewable energy ministry has set a target of 30 GW of offshore wind installations by 2030.

- Therefore, factors, such as upcoming wind power projects, along with supportive government policies and regulations in different countries across the region, are expected to increase the demand for wind turbine rotor blades in the Asia-Pacific during the forecast period.

Wind Turbine Rotor Blade Industry Overview

The wind turbine rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include TPI Composites SA, LM Wind Power (a GE Renewable Energy business), Siemens Gamesa Renewable Energy, S.A., Vestas Wind Systems A/S, and Enercon GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Wind Turbine Rotor Blades Price Analysis

- 4.4 Recent Trends and Developments

- 4.5 Government Policies, Regulations, and Targets

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TPI Composites Inc.

- 6.3.2 Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- 6.3.3 LM Wind Power (a GE Renewable Energy business)

- 6.3.4 Nordex SE

- 6.3.5 Siemens Gamesa Renewable Energy, S.A.

- 6.3.6 Vestas Wind Systems A/S

- 6.3.7 MFG Wind

- 6.3.8 Sinoma wind power blade Co. Ltd

- 6.3.9 Aeris Energy

- 6.3.10 Suzlon Energy Limited

- 6.3.11 Enercon GmbH