|

市場調查報告書

商品編碼

1636109

北美葉輪:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

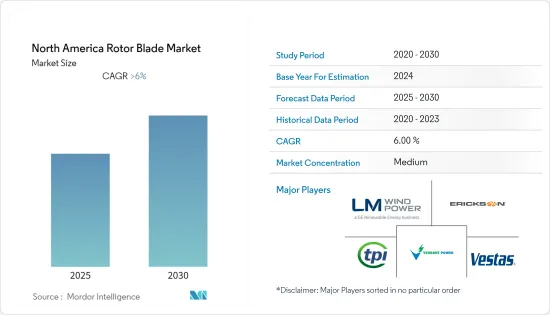

預計北美葉輪市場在預測期內複合年成長率將超過 6%

主要亮點

- 2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。從長遠來看,政府的支持措施和私人投資將推動該國對葉輪的需求。

- 另一方面,高昂的相關運輸成本以及來自太陽能和水力發電等替代清潔能源的成本競爭有可能阻礙市場成長。

- 產品創新和最新葉輪技術的採用預計很快就會為葉輪市場創造利潤豐厚的成長機會。由於對風力發電的需求不斷增加,美國預計將主導風力發電機葉輪市場。

北美葉輪市場趨勢

土地領域主導市場

- 陸域風電技術在過去五年中不斷發展,以最大限度地提高每兆瓦裝置容量的發電量,並覆蓋更多風速較低的地區。除此之外,近年來風力發電機變得越來越大,輪轂更高,直徑更寬,風力發電機葉片也更大。

- 根據國際可再生能源機構(IRENA)預測,2022年北美陸上風電裝置容量預計為163.42兆瓦,較2021年成長約5.9%。

- 此外,根據國際能源總署(IEA)的數據,平準化能源成本(LCOE)和全球加權平均總資本支出將從2016年的76.1美元/兆瓦時和1,730.5美元/兆瓦時增至2021年的48.2美元/兆瓦時及1,396.3美元減少至美元/兆瓦時。此外,到 2025 年,LCOE 和平均加權資本支出預計將分別降至 44.6 美元/MWh 和 1,338.2 美元/MWh。

- 加拿大擁有北美第二大風力發電裝置容量,2022年總設備容量為1529千萬瓦。 2021年,風力發電容量新增約991MW。

- 截至2021年,加拿大陸域風電總合裝置容量排名全球第八,約佔全球陸上風電裝置容量的2%。根據加拿大可再生能源協會(CREA)統計,加拿大有317個發電工程。此外,未來五年內還計劃建造約 31 個陸上和離岸風力發電計劃。

- 2021年,風力發電佔加拿大總發電量的比例達5.86%,高於2015年的4.21%。發展趨勢不僅體現在風電領域投資增加,而且風電場規模不斷擴大。在該國,超過1.5兆瓦的大型風電廠數量正在增加,例如截至2022年在建的Grizzly Bear Creek風發電工程(152兆瓦)和Wild Rose 2風發電工程(192兆瓦) 。大型風電場預計需要更高、更高容量的風力發電機。因此,預計在預測期內對葉輪的需求將會增加。

- 因此,由於上述因素,由於LCOE較低和資本支出減少,加上清潔能源來源帶來的高能源需求,陸上風力發電機的葉輪預計在預測期內成長。

美國主導市場

- 近年來,美國風力發電顯著成長。風力發電技術的進步正在降低風力發電的成本。美國和其他國家針對可再生能源的各種政府法規和財政獎勵正在促進大規模風電的成長。

- 美國的大規模風能產業透過旨在提高國內能源生產的「美國優先」計劃得到了政府的大力支持。由於該國擁有廣泛的沿海租賃地區,離岸風力發電領域被認為是重要的發展領域。

- 根據國際可再生能源機構(IRENA)的數據,風力發電市場的總設備容量顯著增加。 2022年美國風電裝置容量為14,082萬千瓦,較2021年成長約5.9%。

- 此外,2021 年 12 月,美國國家可再生能源實驗室 (NREL) 的研究人員將可回收熱塑性塑膠與積層製造(稱為3D[3D] 列印)相結合,製造出了先進的風力發電機葉片。這項進展得到了美國能源局先進製造辦公室的資助,該辦公室旨在刺激創新,提高美國製造業的能源生產率,並使尖端產品的製造能夠在美國實現。

- 2022年9月,拜登-哈里斯政府宣布,各國政府將開始採取協調行動,開發新的浮體式海上風電平台。該國總統拜登設定了到 2030 年安裝 30 吉瓦 (GW) 離岸風電的目標。

- 因此,預測期內風力發電機葉輪的需求預計將增加,這主要是由於已規劃和規劃的離岸風發電工程數量的增加。

北美葉輪產業概況

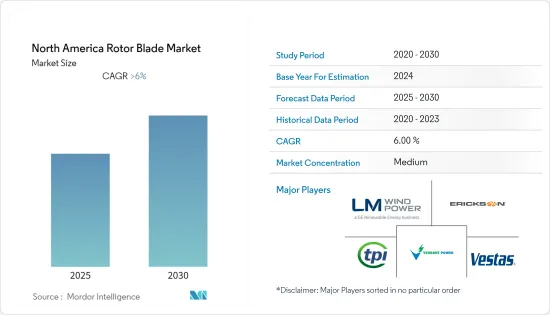

北美風力發電機葉輪市場較為分散。市場上的主要企業包括(排名不分先後)TPI Composites SA、LM Wind Power(GE 再生能源業務)、Siemens Gamesa Renewable Energy, SA、Vestas Wind Systems A/S 和 Enercon GmbH。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 部署地點

- 陸上

- 離岸

- 刀片材質

- 碳纖維

- 玻璃纖維

- 其他刀片材料

- 地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- TPI Composites Inc.

- LM Wind Power(GE 再生能源業務)

- Nordex SE

- Siemens Gamesa Renewable Energy, SA

- Vestas Wind Systems A/S

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Enercon GmbH

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 5000051

The North America Rotor Blade Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels. Over the long term, supportive government policies and private investments drive the country's rotor blade demand.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder the market's growth.

- Nevertheless, product innovation and adaptation of the latest rotor blade technologies are expected to create soon lucrative growth opportunities for the France rotor blade market. The United States is expected to dominate the wind turbine rotor blade market, with the increasing demand for wind energy in the country.

North America Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- According to the International Renewable Energy Agency (IRENA), in 2022, the North American onshore wind turbine capacity additions registered to be 163.42 GW, an increase of around 5.9% as compared to 2021.

- Moreover, according to the International Energy Agency (IEA), the levelized cost of energy (LCOE) and global weighted average total CAPEX decreased from 76.1 USD/MWh and 1730.5 USD/MWh in 2016 to 48.2 USD/MWh and 1396.3 USD/MWh in 2021. In addition, the LCOE and average weighted CAPEX are expected to decrease to 44.6 USD/MWh and 1338.2 USD/MWh, respectively, by 2025.

- Canada holds North America's second-largest installed wind power capacity, with a total installed capacity of 15.29 GW in 2022. The country increased its installed wind power capacity by around 991 MW in 2021.

- As of 2021, Canada ranked eighth in the globe in terms of total onshore installed capacity, around 2% of the world's onshore wind capacity. According to the Canadian Renewable Energy Association (CREA), Canada has 317 wind energy projects producing power. Additionally, around 31 onshore and offshore wind power projects are planned for five years.

- In 2021, the share of wind energy in the total electricity generation in Canada amounted to 5.86%, which grew as compared to 4.21% in 2015. The development trends indicate not only the increasing investments in the wind sector but also that the size of wind farms is growing. The country is witnessing an increasing number of large wind farms with more than 1.5 MW capacity, such as the Grizzly Bear Creek Wind Project (152 MW) and Wild Rose 2 Wind Project (192 MW) under construction as of 2022. Large-size wind farms are expected to require taller and higher-capacity wind turbines. Hence, the demand for rotor blades is expected to increase during the forecast period

- Therefore, based on the above-mentioned factors, the onshore wind turbine rotor blade is expected to grow due to declining LCOE and reduced CAPEX, coupled with high energy demand through clean sources, during the forecast period.

United States to Dominate the Market

- Wind power generation in the United States has grown significantly in recent years. Advances in wind energy technology have decreased the cost of producing electricity from wind. Various Government regulations and financial incentives for renewable energy in the United States and other countries have contributed to growth in large-scale wind power generation.

- The large-scale wind power sector in the United States is receiving immense support from the government due to the America First policy, which aims to boost domestic energy production. The offshore wind power sector is considered a significant development area, as the country has a large coastal area for leasing.

- According to the International Renewable Energy Agency (IRENA), the wind energy market witnessed a significant rise in the total installed wind power capacity. In 2022, the United States wind turbine capacity additions was140.82 GW, an increase of around 5.9% compared to 2021.

- Furthermore, in December 2021, National Renewable Energy Laboratory (NREL) researchers conducted research on a combination of recyclable thermoplastics and additive manufacturing (better known as three-dimensional [3D] printing) to manufacture advanced wind turbine blades. The advance was made possible by funding from the US Department of Energy's Advanced Manufacturing Office-awards designed to stimulate technology innovation, improve the energy productivity of American manufacturing, and enable the manufacturing of cutting-edge products in the United States.

- In September 2022, the Biden-Harris Administration announced that the country's government was launching coordinated actions to develop new floating offshore wind platforms. The country's president, Joe Biden, set a target of deploying 30 gigawatts (GW) offshore wind by 2030.

- Hence, with the number of wind power projects planned and in the pipeline, majorly in offshore locations, the demand for wind turbine rotor blades is expected to increase during the forecast period.

North America Rotor Blade Industry Overview

The North American wind turbine rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include TPI Composites SA, LM Wind Power (a GE Renewable Energy business), Siemens Gamesa Renewable Energy, S.A., Vestas Wind Systems A/S, and Enercon GmbH., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TPI Composites Inc.

- 6.3.2 LM Wind Power (a GE Renewable Energy business)

- 6.3.3 Nordex SE

- 6.3.4 Siemens Gamesa Renewable Energy, S.A.

- 6.3.5 Vestas Wind Systems A/S

- 6.3.6 MFG Wind

- 6.3.7 Sinoma wind power blade Co. Ltd

- 6.3.8 Aeris Energy

- 6.3.9 Enercon GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219