|

市場調查報告書

商品編碼

1635491

南美洲葉輪:市場佔有率分析、產業趨勢、成長預測(2025-2030)South America Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

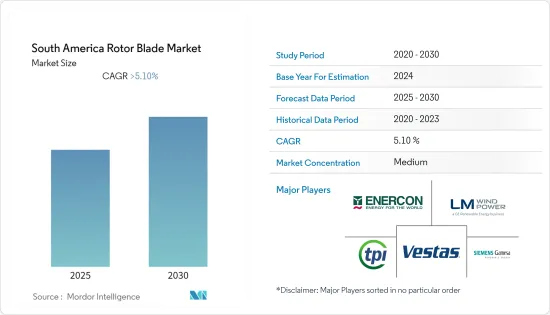

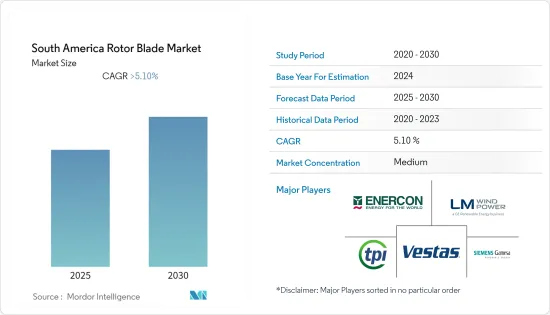

南美洲葉輪市場預計在預測期內將維持超過5.1%的複合年成長率。

2020 年市場受到 COVID-19 的中等程度影響。目前已達到疫情前水準。

主要亮點

- 從長遠來看,該全部區域海上和陸上風力發電裝置數量的增加預計將成為市場的主要驅動力。

- 另一方面,高昂的運輸成本以及來自太陽能和水力發電等替代清潔能源的市場競爭可能會阻礙市場成長。

- 風電產業需要具有成本效益的解決方案,而高效的產品有可能改變產業的動態。在某些情況下,舊渦輪機被更換,不是因為損壞,而是因為市場上出現了更有效率的葉片。因此,技術發展對於南美洲葉輪市場來說是一個機會。

- 隨著全國風力發電裝置的增加,巴西預計將主導葉輪市場。

南美洲葉輪市場趨勢

土地領域主導市場

- 陸域風電技術在過去五年中不斷發展,以最大限度地提高每兆瓦裝置容量的發電量,並覆蓋更多風速較低的地區。除此之外,近年來風力發電機變得越來越大,輪轂高度更高,直徑更寬,風力發電機葉片也更大。

- 截至2021年11月,風力發電裝置容量已超過20GW。巴西有750個風力發電場,擁有10,000多風力發電機。巴西電力監管機構(ANEEL)已核准350多個新風發電工程,總容量超過12吉瓦,其中計劃正在建設中。

- 根據《2022年全球風能報告》,巴西陸上風電裝置容量為21.5GW,排名全球第六。此外,根據巴西風力發電協會(ABEEolica)的數據,到2024年,巴西將擁有至少3,000萬千瓦的風電裝置容量。這推動了全部區域風電場葉輪的普及。

- 智利陸域風電裝置容量超過1吉瓦,位居南美洲第二位。智利制定了雄心勃勃的可再生能源計劃,預計將推動該地區陸上市場的發展。

- 此外,發電成本的下降和投資的增加,特別是在巴西、智利和阿根廷,預計將推動陸上風力發電機的安裝,進而預計在預測期內推動該地區的風力葉輪市場。

- 由於這些因素,預計土地領域將在預測期內主導市場。

巴西可望主導市場

- 風力發電是巴西第二大發電來源,其重要性逐年增加。 2021年該國風力發電產量創歷史新高,裝置容量超過20GW,風力發電量約72.286Gwh。

- 此外,大型風力發電機有助於降低風力發電成本,事實證明,與石化燃料替代品相比,風能在經濟上具有競爭力。截至2022年6月,未來五年規劃65個陸域風發電工程,總投資230億美元。巴伊亞州(70 億美元)、北里奧格蘭德州(60 億美元)、南里奧格蘭德州(30 億美元)和皮奧伊州(20 億美元)是陸上風發電工程。你正在投資。

- 2022年4月,丹麥風電巨頭維斯塔斯與葉片製造商LM Wind Power簽署了一份多年供應協議,重點關注具有出口彈性的巴西陸上市場。根據協議,LM Wind Power 將從其位於伯南布哥州伊波茹卡的工廠交付維斯塔斯的 V150-4.2MW 渦輪機葉片。

- 2021年12月,中國製造商中材科技宣布計劃擴大在巴西的業務,投資2,880萬美元建造一座工廠來製造風力發電機葉片。中材股份將與中材科技母公司中國建材集團(CNBMG)旗下承包商中材海外成立合資公司,在薩爾瓦多興建工廠。新工廠計劃每年生產260套轉子葉片。

- 鑑於上述情況,預計巴西將在預測期內主導市場。

南美洲葉輪產業概況

南美洲葉輪市場較為分散。市場上的主要企業包括(排名不分先後)TPI Composites SA、LM Wind Power(GE 再生能源業務)、Siemens Gamesa Renewable Energy SA、Vestas Wind Systems A/S 和 Enercon GmbH。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 風力發電機葉輪價格分析

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 市場促進因素

- 市場限制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按地點

- 陸上

- 離岸

- 按刀片材質分

- 碳纖維

- 玻璃纖維

- 其他刀片材料

- 按地區

- 巴西

- 阿根廷

- 哥倫比亞

- 秘魯

- 智利

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- LM Wind Power(a GE Renewable Energy business)

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- Enercon GmbH

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92864

The South America Rotor Blade Market is expected to register a CAGR of greater than 5.1% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors of the market are expected to be the growing number of offshore and onshore wind energy installations across the region.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder market growth.

- The wind power industry has been in demand for cost-effective solutions, and a highly efficient product can change the industry's dynamics. There were instances where old turbines were replaced, not because of the damage but due to the availability of more efficient blades in the market. Hence, technological developments are opportunities for the South American rotor blade market.

- Brazil is expected to dominate the rotor blade market, with growing wind power installations across the country.

South America Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- As of November 2021, the installed wind power capacity surpassed 20 GW. The nation has over 10,000 wind turbines installed across 750 operational wind parks. The Brazilian Electricity Regulatory Agency (ANEEL) has approved more than 350 new wind power projects with a total capacity of over 12 GW, out of which 170 projects are under construction.

- According to the Global Wind Energy Report 2022, Brazil is in sixth place in the global ranking, with 21.5 GW of onshore wind installed capacity. Furthermore, according to the Brazilian Association of Wind Energy (ABEEolica), Brazil will have at least 30 GW of installed wind energy capacity by 2024. This, in turn, aids the growth of using rotor blades for wind plants across the region.

- Chile has more than a gigawatt of installed onshore wind capacity, which is the second-highest in South America. Chile has ambitious plans for renewable energy, which, in turn, is expected to drive the onshore market in the region.

- Furthermore, decreasing the cost of power generation and growing investments, particularly in Brazil, Chile, and Argentina, are expected to drive the onshore wind turbine installation, which, in turn, is expected to drive the wind rotor blade market in the region during the forecast period.

- Owing to these factors, the onshore segment is expected to dominate the market during the forecast period.

Brazil is Expected to Dominate the Market

- Wind energy is Brazil's second-largest source of power generation, and its importance grows yearly. Wind energy production in the country hit a record in 2021, exceeding 20 GW of installed capacity, and wind power generation was about 72.286 Gwh.

- In addition, the growing size of wind turbines has assisted in lowering the cost of wind energy, indicating that it is economically competitive with fossil fuel alternatives. As of June 2022, 65 onshore wind projects are planned over the next five years, with a total investment of USD 23 billion. The Bahia (USD 7 billion), Rio Grande do Norte (USD 6 billion), the Rio Grande do Sul (USD 3 billion), and Piaui (USD 2 billion) are the states investing the most in onshore wind energy projects.

- In April 2022, Danish wind giant Vestas finalized a multi-year supply agreement with blade maker LM Wind Power, focused on the onshore Brazilian market with the flexibility for export. Under the deal, LM Wind Power will deliver Vestas's V150-4.2MW turbine blades from its factory in Ipojuca in Pernambuco.

- In December 2021, Chinese manufacturer Sinoma Science and Technology announced its plan to expand business in Brazil by building a USD 28.8 million plant to manufacture wind turbine blades. Sinoma will set up a joint venture with Sinoma Overseas Development, a contractor under Sinoma Science's parent company China National Building Material Group (CNBMG), to build the plant in Salvador. The new plant will produce 260 power blade sets a year.

- Owing to the above points, Brazil is expected to dominate the market during the forecast period.

South America Rotor Blade Industry Overview

The South American rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include TPI Composites SA, LM Wind Power (a GE Renewable Energy business), Siemens Gamesa Renewable Energy SA, Vestas Wind Systems A/S, and Enercon GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Wind Turbine Rotor Blades Price Analysis

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.2 Market Restraints

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Peru

- 5.3.5 Chile

- 5.3.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TPI Composites Inc.

- 6.3.2 Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- 6.3.3 LM Wind Power (a GE Renewable Energy business)

- 6.3.4 Nordex SE

- 6.3.5 Siemens Gamesa Renewable Energy SA

- 6.3.6 Vestas Wind Systems A/S

- 6.3.7 MFG Wind

- 6.3.8 Sinoma wind power blade Co. Ltd

- 6.3.9 Aeris Energy

- 6.3.10 Suzlon Energy Limited

- 6.3.11 Enercon GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219