|

市場調查報告書

商品編碼

1636110

歐洲葉輪:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

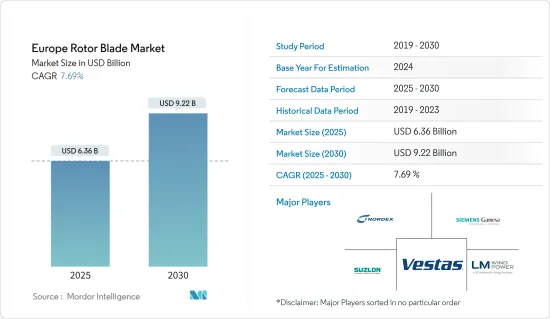

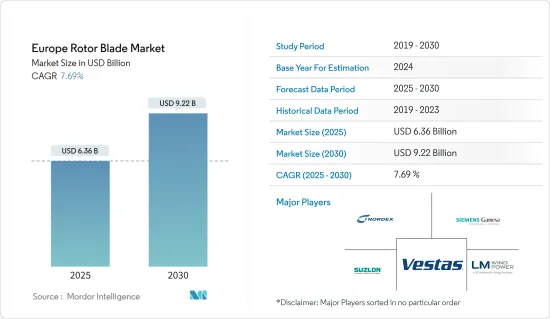

歐洲葉輪市場規模預計到2025年為63.6億美元,預計2030年將達到92.2億美元,預測期內(2025-2030年)複合年成長率為7.69%。

主要亮點

- 從中期來看,海上和陸上風力發電裝置的增加、風力發電成本的下降以及風力發電領域投資的增加等因素預計將在預測期內推動歐洲葉輪市場的發展。

- 另一方面,運輸成本的相關上升以及太陽能和水力發電等替代清潔能源的成本競爭等因素可能會限制預測期內的市場成長。

- 風能產業需要具有成本效益的解決方案,而高效的產品有能力改變產業的動態。舊渦輪機被更換並不是因為它們損壞了,而是因為市場上出現了更有效的葉片。因此,技術進步最終為葉輪市場創造了巨大的機會。

歐洲葉輪市場趨勢

近海領域佔據市場主導地位

- 2022年歐洲新增風力發電容量為1859千萬瓦。疫情結束後,隨著工業活動的開始和快速都市化,歐洲的電力需求正在增加。該地區的可再生能源佔有率也不斷增加,以滿足不斷成長的電力需求。

- 歐洲被認為擁有豐富的可再生能源發電資源,包括太陽能、風能、水力、生質能和地熱能。許多歐洲國家處於全球利用可再生能源的前沿。脫碳、電網永續性、雄心勃勃的目標以及向清潔能源的過渡等因素正在推動歐洲風力發電市場的發展。

- 2022年12月,歐盟委員會核准了《2023年再生能源來源法案》,《2023年海上風力發電法案》將聚焦在改善環境、實現歐洲電力市場溫室氣體中和的電力供應。

- 此外,2022年5月,歐盟委員會宣布了REPowerEU計劃。該計劃包括一系列旨在逐步淘汰俄羅斯石化燃料和促進歐盟可再生能源生產的具體措施。該計劃預計將有助於該地區海上風力發電的進一步發展。

- 隨著REPowerEU的宣布,形成了埃斯比爾宣言,以實現離岸風電這一連接比利時、丹麥、德國和荷蘭的海上可再生能源系統以及北海150GW的新目標。 ,並決定共同開發其他北海合作夥伴,在某些情況下包括北海能源合作(NSEC) 成員國。

- 據國際可再生能源機構稱,歐洲是全球離岸風電市場的領先地區之一。 2022年新增裝置4264兆瓦,達3066千萬瓦。 2022年3月,法國政府與法國風電產業簽署了海上部門協議。該協議認知到離岸風電是一個重要且必不可少的機會,並承諾到2050年在50個風力發電廠開發40GW的離岸風電。預計這將導致海上風力發電的重大發展。

- 此外,2022年6月,基利貝格斯漁業協會和辛巴德海洋服務公司提案在愛爾蘭多尼戈爾海岸建造浮動式風力發電,並與瑞典浮動式風力發電開發技術提供商Hexicon簽署了合作備忘錄。

- 綜上所述,預計離岸風電領域將在預測期內佔據市場主導地位。

英國主導市場

- 英國是風力發電發展最快的國家之一。該國被定位為歐洲風力發電的最佳地點。到2022年,英國風電裝置容量將達到28.54GW。

- 此外,英國不依賴俄羅斯天然氣供應,因此與其他歐盟國家相比,受俄烏衝突影響較小。然而,2022年4月,英國前首相實施了能源安全戰略,以減少戰爭影響,促進國內可再生能源發展。這反過來預計將支持風力發電市場的成長,並進一步支持風力葉輪市場的發展。

- 2016年至2021年間,英國離岸風電投資約257.9億美元,為離岸風電領域提供了有利的投資環境,因為英國是離岸風發電工程的先驅之一。

- 此外,2022年4月,政府宣布了一項加強英國能源安全的戰略計劃,目標是到2030年運作離岸風電裝置容量提高到50GW。 50GW離岸風電目標包括5GW大型浮體式離岸風電設施。

- 此外,2022年1月,英國政府宣布將投入超過8,250萬美元的公共和私人資金,以推動浮體式風電發電工程的研發。作為浮體式離岸風電示範計畫的一部分,政府將在 11 個計劃上投資 4,190 萬美元。

- 因此,鑑於上述幾點,預計英國將在預測期內主導市場。

歐洲葉輪產業概況

歐洲葉輪市場較為分散。市場上的主要企業(排名不分先後)包括 Nordex SE、Siemens Gamesa Renewable Energy, SA、Vestas Wind Systems A/S、Suzlon Energy Limited 和 LM Wind Power(GE 再生能源業務)。

2022年2月,Nordex宣布德國羅斯托克GVZ葉輪工廠的葉輪生產將於2022年6月底停止。這項決定主要是由於轉向羅斯托克無法製造的更大葉片。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 海上和陸域風力發電裝置的增加

- 降低風電成本

- 抑制因素

- 與替代可再生能源的競爭加劇

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 部署地點

- 陸上

- 離岸

- 刀片材質

- 碳纖維

- 玻璃纖維

- 其他刀片材料

- 地區

- 德國

- 法國

- 西班牙

- 英國

- 義大利

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- Suzlon Energy Limited

- Enercon GmbH

- LM Wind Power(GE 再生能源業務)

- BayWa RE AG

- Market Ranking/Share Analysis

第7章 市場機會及未來趨勢

- 開發高效能、輕量化風力發電機

The Europe Rotor Blade Market size is estimated at USD 6.36 billion in 2025, and is expected to reach USD 9.22 billion by 2030, at a CAGR of 7.69% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing number of offshore and onshore wind energy installations, the declining cost of wind energy, and increasing investments in the wind power sector are anticipated to drive the Europe rotor blade market during the forecast period.

- On the other hand, factors such as the accompanying high cost of transportation and cost competitiveness of alternate clean power sources like solar power, hydropower, etc., can potentially restrain the market growth during the forecast period.

- Nevertheless, the wind power business has sought cost-effective solutions, and a highly efficient product has the ability to alter the industry's dynamics. There were instances where old turbines were replaced not owing to damage but because more effective blades were sold in the market. Thus, technological advancements eventually create a wonderful opportunity for the market of rotor blades.

Europe Rotor Blade Market Trends

Offshore Segment to Dominate the Market

- Europe accounted for 18.59 GW of new wind installed capacity in 2022. The electricity demand in Europe has increased after the departure of the pandemic, coupled with the commencement of industrial activities and rapid urbanization. The region has also witnessed a growing share of renewables to fulfill the increasing electricity demand.

- Europe is considered to have ample renewable energy resources to generate electricity, such as solar, wind, hydro, biomass, geothermal, etc. A good number of countries in Europe have become at the forefront of utilizing renewable energy globally. Factors such as decarbonization, sustainability of power systems, ambitious targets, and clean energy transition have driven the offsore wind energy market of Europe.

- In December 2022, the European Commission approved the 2023 Renewable Energy Sources Act, and the 2023 Offshore Wind Energy Act aims to improve the environment and focus on achieving a greenhouse gas-neutral electricity supply in the power market of Europe.

- Further, in May 2022, the European Commission published the REPowerEU plan, which contains a series of concrete measures designed to phase out Russian fossil fuels and boost the production of renewable energy in the EU. This plan would help further develop offshore wind energy in the region.

- With the REPowerEU announcement, the Esbjerg Declaration was formed to achieve the further expansion of offshore wind and decided to jointly develop The North Sea as a Green Power Plant of Europe, an offshore renewable energy system connecting Belgium, Denmark, Germany, and the Netherlands, and possibly other North Sea partners, including the members of the North Seas Energy Cooperation (NSEC) and set out a new target of 150 GW of offshore wind by 2050.

- According to International Renewable Energy Agency, Europe is among the leading regions in the global offshore wind power market. In 2022, it added 4,264 MW, reaching 30.66 GW. In March 2022, the French government entered into an offshore sector agreement with France's wind industry. The agreement recognizes that offshore wind is a significant and vital opportunity and commits to developing 40 GW of offshore wind by 2050 spread over 50 wind farms. This is expected to witness considerable development in offshore wind power.

- Also in June 2022, The Killybegs Fishermen's Organization and Sinbad Marine Services have proposed a floating wind farm to be built offshore Donegal, Ireland, and have signed a Memorandum of Understanding with Swedish floating wind developer and technology provider, Hexicon.

- Therefore, owing to the above points, the offshore segment is anticipated to dominate the market during the forecast period.

United Kingdom to Dominate the Market

- The United Kingdom is one of the growing countries in wind energy generation. The country stands as the best location for wind power in Europe. By 2022, the United Kingdom installed a wind capacity of 28.54 GW.

- Moreover, the United Kingdom is not heavily affected by the Russia-Ukraine conflict compared to the other EU countries, Since the country is not dependent on the Russian gas supply. However, in April 2022, the former UK Prime Minister implemented an energy security strategy to lessen the war impact and boost renewable energy development within the country. This will, in turn, support the growth of the wind energy market and further aid the development of the wind rotor blade market.

- Since the country is one of the forerunners in offshore wind projects, between 2016 and 2021, nearly USD 25.79 billion was invested in offshore wind in the United Kingdom, witnessing a favorable investment environment in the offshore wind sector.

- Furthermore, in April 2022, the government announced a strategic plan to boost Britain's energy security, including an increased target of up to 50 GW of operating offshore wind capacity by 2030. The 50GW offshore wind target includes 5 GW of large-scale floating wind installations.

- Moreover, in January 2022, the UK government announced more than USD 82.5 million of public and private funding to advance research and development in floating offshore wind projects. The government plans to invest USD 41.9 million in 11 projects as part of the Floating Offshore Wind Demonstration Program.

- Therefore, owing to the above points, the United Kingdom is anticipated to dominate the market during the forecast period.

Europe Rotor Blade Industry Overview

The Europe rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include Nordex SE, Siemens Gamesa Renewable Energy, SA, Vestas Wind Systems A/S, Suzlon Energy Limited, and LM Wind Power (a GE Renewable Energy business), among others.

In February 2022, Nordex announced that it would cease the production of rotor blades at the Rostock GVZ rotor blade site in Germany by the end of June 2022. The decision has been taken primarily due to a shift towards larger blades that are not manufactured at Rostock.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing number of offshore and onshore wind energy installations

- 4.5.1.2 Declining cost of wind energy

- 4.5.2 Restraints

- 4.5.2.1 Increasing Competition from Alternate Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 Spain

- 5.3.4 United Kingdom

- 5.3.5 Italy

- 5.3.6 NORDIC

- 5.3.7 Turkery

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 Vestas Wind Systems A/S

- 6.3.4 Suzlon Energy Limited

- 6.3.5 Enercon GmbH

- 6.3.6 LM Wind Power (a GE Renewable Energy business)

- 6.3.7 BayWa R.E AG

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of High Efficiency and light weight wind turbines