|

市場調查報告書

商品編碼

1635525

亞太地區太陽能逆變器市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Asia Pacific Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

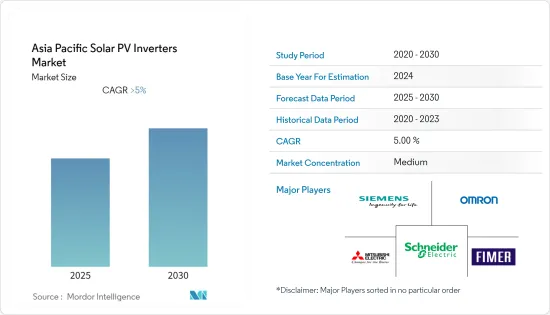

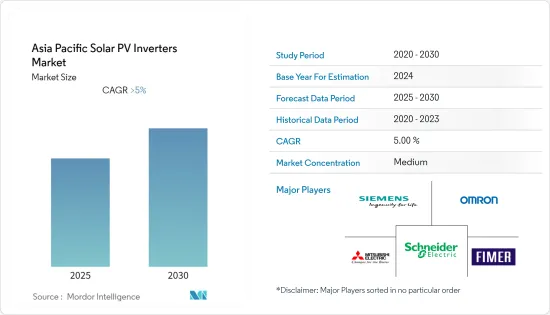

預計亞太地區太陽能逆變器市場在預測期內的複合年成長率將超過 5%。

2020 年市場受到 COVID-19 大流行的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,增加投資和雄心勃勃的太陽能目標預計將推動市場成長。

- 另一方面,組串式逆變器的技術缺陷預計將阻礙太陽能逆變器在預測期內的成長。

- 太陽能逆變器的產品創新和最新技術的採用預計將在預測期內為亞太地區太陽能逆變器市場提供利潤豐厚的成長機會。

- 中國在市場上佔據主導地位,並可能在預測期內保持最高的複合年成長率。這一成長是由投資增加和政府支持措施推動的。

亞太太陽能逆變器市場趨勢

中央逆變器市場預計將出現高成長

- 中央逆變器是一個大型電網饋線。常用於額定輸出100kWp以上的太陽能發電系統。通常,落地式或地面安裝式逆變器將從太陽能電池陣列收集的直流電轉換為交流電以用於並聯型。這些設備的容量約為50kW至1MW,可在室內或室外使用。

- 通常,中央逆變器由一個直流-交流轉換級組成。一些逆變器具有 DC-DC 升壓級,以擴展 MPP(最大功率點)電壓範圍。低頻變壓器有時用於升高交流電壓並隔離輸出。然而,這會降低效率並增加逆變器的尺寸、重量和成本。

- 2021年,中國新增太陽能光電裝置容量佔全球的31%,佔比最大。相比之下,印度太陽能發電裝置容量約佔全球的7%。

- 2022年3月,中國逆變器製造商陽光電源開始擴大在印度的產能。該公司已將其印度工廠開發並擴大至每年 10 吉瓦的產能,為印度和全球客戶提供更短的前置作業時間和更好的服務體驗。在竣工儀式上,我們發布了新的組串式逆變器和集中式逆變器產品,包括SG350HX和1+X模組化逆變器。

- 因此,電力需求的增加、政府對電力產業脫碳的努力以及中央逆變器成本的下降預計將在未來幾年推動這一領域的發展。

中國主導市場

- 中國幾乎擁有全球所有最大的光伏(PV)面板和設備製造商及設施,約佔中國太陽能光電總產能的70%。這些公司也控制著太陽能供應鏈中的其他業務。例如,製造多晶矽、矽錠、面板晶圓以及逆變器和相關硬體等設備。

- 中國是全球太陽能發電的主要市場之一,也是太陽能逆變器最大的市場之一。根據IRENA統計,2021年,中國總設備容量為306.97GW。 2021年,中國太陽能裝機約5,000萬千瓦。

- 中國市場正在大幅成長。根據工業信部統計,2022年4月至5月,全國太陽能逆變器產量31GW。推動市場的關鍵因素之一是國內需求的快速成長。

- 根據中國光伏產業協會(CPIA)統計,2021年我國太陽能發電裝置容量總合5488萬千瓦,與前一年同期比較成長13.9%,預計2022年將成長75至9000萬千瓦。此外,2021年中國製造產品出口額創歷史新高,超過280億美元,與前一年同期比較去年同期成長72%。這顯示海外對中國製造的逆變器等太陽能硬體的需求強勁。

- 人事費用和採購成本降低等宏觀經濟因素推動了經濟擴張,導致中國企業的太陽能硬體(包括逆變器)的全球成本趨勢下降。因此,國內價格處於全球最低水平,降低了國際逆變器成本。

- 因此,基於上述因素,中國可望繼續保持全球最大的太陽能及設備市場的地位。預計在預測期內,太陽能逆變器的需求將穩定成長。

亞太地區太陽能逆變器產業概況

亞太地區太陽能逆變器市場較為分散。市場主要企業包括(排名不分先後)FIMER SpA、施耐德電機、西門子、三菱電機和歐姆龍。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按逆變器類型

- 中央逆變器

- 組串式逆變器

- 微型逆變器

- 按用途

- 住宅

- 商業和工業

- 實用規模

- 按地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- FIMER SpA

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

- Omron Corporation

- General Electric Company

- SMA Solar Technology AG

- Delta Energy Systems Inc.

- Enphase Energy Inc.

- Genus Innovation Limited

- Huawei Technologies Co. Ltd

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 93042

The Asia Pacific Solar PV Inverters Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investments and ambitious solar energy targets are expected to drive the market's growth.

- On the other hand, technical drawbacks of the string inverters are expected to hamper the growth of solar PV inverters during the forecast period.

- Nevertheless, product innovation and adaptation of the latest technologies in solar PV inverters are likely to create lucrative growth opportunities for the Asia-Pacific solar PV inverters market in the forecast period.

- China dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies.

APAC Solar PV Inverters Market Trends

Central Inverters Segment Expected to Witness High Growth

- A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50 kW to 1 MW and can be used indoors or outdoors.

- Generally, a central inverter consists of one DC-AC conversion stage. Some inverters also have a DC-DC boost stage to increase their MPP (Maximum Power Point) voltage range. Low-frequency transformers are sometimes used to boost the AC voltage and provide isolation at the output. However, this reduces efficiency and increases the inverter's size, weight, and cost.

- In 2021, China installed the largest share of the world's new solar photovoltaic (PV) capacity, at 31% of the total capacity. In comparison, India accounted for about 7% of the world's solar PV installed capacity.

- In March 2022, Chinese inverter manufacturer Sungrow inaugurated its expanded scale of manufacturing capacity in India. The company developed and scaled the India factory to 10 GW/annum capacity for its customers locally and globally with lesser lead time and better service experience. At the inauguration ceremony, Sungrow launched new products in the string and central inverter categories, including models SG350HX and 1+X modular inverter.

- Therefore, the growing electricity demand, the government's efforts to decarbonize the power sector, and the declining costs of central inverters are expected to drive the segment in the coming years.

China to Dominate the Market

- China is home to nearly all the largest solar photovoltaic (PV) panel and equipment manufacturing companies and facilities globally, with about 70% of China's global solar PV manufacturing capacity. These companies also dominate other businesses in the solar energy supply chain. For example, the manufacture of polysilicon, ingot, and wafers for panels and equipment, such as inverters and related hardware.

- China is one of the major solar PV markets globally, and it is one of the largest markets for solar inverters. According to IRENA, in 2021, China had a total installed solar capacity of 306.97 GW. In 2021, China installed nearly 50 GW of solar power.

- The Chinese market has been growing considerably. According to the Ministry of Industry and Information Technology (MIIT), from April to May 2022, the country produced 31 GW of solar PV inverters. One of the primary factors driving the market is the burgeoning domestic demand.

- According to the China Photovoltaic Industry Association (CPIA), China installed a total of 54.88 GW solar capacity in 2021, up 13.9% year-on-year, and is expected to grow by 75-90 GW in 2022. Additionally, in 2021, Chinese-made products' export value hit a historic high at over USD 28 billion, witnessing a 72% year-on-year growth. It demonstrates the overseas demand for Chinese solar PV hardware, such as inverters.

- Due to several macroeconomic factors, such as lower labor and procurement costs enabling larger scales of economies, Chinese companies have driven down the global cost trends in solar PV hardware, including inverters. Due to this, domestic prices are among the lowest in the world, driving down international inverter costs.

- Hence, due to the above factors, China is expected to remain the world's largest solar energy and equipment market. The demand for solar inverters is expected to rise steadily during the forecast period.

APAC Solar PV Inverters Industry Overview

The Asia-Pacific solar PV inverters market is fragmented in nature. Some of the major players in the market (in no particular order) include FIMER SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and Omron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale

- 5.3 By Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIMER SpA

- 6.3.2 Schneider Electric SE

- 6.3.3 Siemens AG

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 Omron Corporation

- 6.3.6 General Electric Company

- 6.3.7 SMA Solar Technology AG

- 6.3.8 Delta Energy Systems Inc.

- 6.3.9 Enphase Energy Inc.

- 6.3.10 Genus Innovation Limited

- 6.3.11 Huawei Technologies Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219