|

市場調查報告書

商品編碼

1644979

德國太陽能逆變器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Germany Solar Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

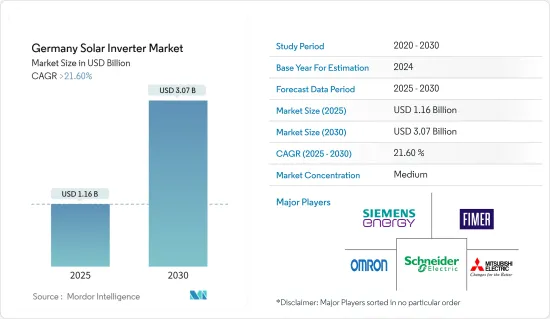

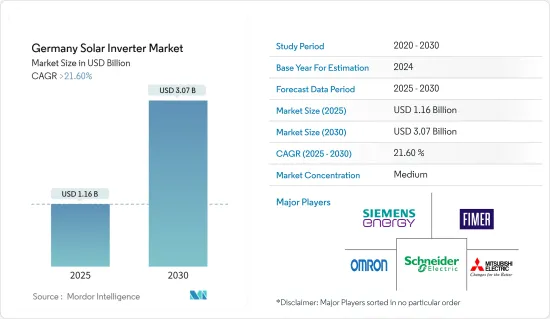

預計 2025 年德國太陽能逆變器市場規模為 11.6 億美元,到 2030 年將達到 30.7 億美元,預測期內(2025-2030 年)的複合年成長率將超過 21.6%。

主要亮點

- 從中期來看,商業和工業領域擴大採用太陽能以及對太陽能計劃的投資增加等因素預計將推動市場的發展。

- 另一方面,歐洲地區政府最近削減了太陽能電池板的補貼,預計將在研究期間阻礙市場的成長。

- 話雖如此,許多逆變器製造商正在努力創新和採用由太陽能動力來源的最新技術。預計這一因素將在不久的將來為德國太陽能逆變器市場創造巨大的機會。

德國太陽能逆變器市場趨勢

集中式逆變器市場預計將佔據市場主導地位

- 集中逆變器是大電網供電設備。它常用於額定輸出功率超過100kWp的太陽能發電系統。落地式或地面安裝的逆變器將從太陽能電池陣列收集的直流電轉換為交流電以用於並聯型。這些設備的容量範圍從大約 50kW 到 1MW,可在室內和室外使用。

- 中央逆變器用於公共事業規模的應用,因此必須與其所使用的電網的電壓和頻率相符。由於世界各地的電網標準差異很大,製造商可以自訂這些參數以滿足他們的特定要求,例如相數。

- 根據國際可再生能源機構(IRENA)預測,到2022年12月底,日本太陽能發電裝置容量將達到5,872.6萬千瓦。

- 此外,還有多家公司聯合起來推動集中式逆變器的使用。例如,2022年5月,Gamesa Electric與西門子股份公司簽署了一項策略夥伴關係協議,針對光伏和能源儲存計劃採用中央逆變器Proteus。根據該協議,西門子將能夠在其光伏和BESS計劃中使用Gamesa Electric的Proteus逆變器。這些中央逆變器具有高達 4700kVA 的高功率和 99.45% 的創紀錄效率,為太陽能和儲能計劃提供了整合解決方案。

- 2022年1月,陽光電源推出全新「1+X」集中模組化逆變器,輸出容量為1.1MW。本款1+X模組化逆變器可組合成8台單元,達到8.8MW的輸出功率,並配備DC/ESS介面,可連接能源儲存系統(ESS)。

- 因此,由於上述電力需求增加等因素,預計中央逆變器領域將佔據市場主導地位。

太陽能計劃投資增加推動市場

- 以裝置容量容量計算,德國是歐洲最大的太陽能光電市場,確立了其作為全球能源和氣候安全領跑者之一的地位。該國太陽能發電市場正在快速發展。由於上網電價和自用電相結合的吸引力,這一趨勢可能會持續下去,特別是對於 40kW 至 750kW 的大中型商業系統而言。

- 德國光伏累積設置容量正在大幅成長。 2022年太陽能發電裝置容量達6,650萬千瓦,2021年達5,870萬千瓦。 2022年與前一年同期比較成長13.2%。

- 在太陽能領域,人們正在進行大量投資來建立新的太陽能計劃。例如,2022年3月,德國表示打算在可再生能源領域投資2,160億美元,減少對易受烏克蘭衝突影響的俄羅斯天然氣的依賴。

- 此外,2022 年 4 月,德國聯邦網路局宣布,在太陽能光電競標中已授予 201 份提案,總合容量為 108.4 吉瓦,高於 2021 年 7 月的 510.34 兆瓦。競標價格範圍為每千瓦時 0.040 歐元至 0.055 歐元。數量加權平均價格為每千瓦時 0.0519 歐元(0.057 美元),高於先前的 0.050 歐元。

- 此外,2022年7月,德國同意政府提出的設立專案「氣候變遷和轉型基金」的建議,該基金將在未來四年內投資1,800億美元,用於推動向不依賴俄羅斯能源來源的清潔經濟的能源提案。

- 截至2022年10月,德國擁有超過258萬座太陽能發電廠。該數字代表了審查期間記錄的站點峰值數量。

- 考慮到以上所有因素,預計該國太陽能市場的投資將會增加,並很快佔領德國太陽能逆變器市場。

德國光電逆變器產業概況

德國的光電逆變器市場減少了一半。市場的主要企業(不分先後順序)包括 FIMER SpA、施耐德電氣 SE、西門子能源股份公司、三菱電機株式會社和Omron Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

- 調查結果

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 商業和工業領域擴大採用太陽能

- 增加對太陽能計劃的投資

- 限制因素

- 歐洲政府近期削減太陽能板補貼

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 按逆變器類型

- 集中式逆變器

- 組串式逆變器

- 微型逆變器

- 按應用

- 住宅

- 商業和工業

- 公共事業規模

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- FIMER SpA

- Schneider Electric SE

- Siemens Energy AG

- Mitsubishi Electric Corporation

- General Electric Company

- SMA Solar Technology AG

- Omron Corporation

- Delta Energy Systems Inc.

- Huawei Technologies Co. Ltd.

- KACO New Energy GmbH

第7章 市場機會與未來趨勢

- 創新並採用利用太陽能的最新技術

簡介目錄

Product Code: 5000152

The Germany Solar Inverter Market size is estimated at USD 1.16 billion in 2025, and is expected to reach USD 3.07 billion by 2030, at a CAGR of greater than 21.6% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing adoption of solar PV in commercial and industrial sectors and increasing investments in solar energy projects are expected to drive the market.

- On the other hand, the recent subsidy cuts on solar panels by governments in the Europe region is expected to hinder the market growth during the study period.

- Nevertheless, Many inverter manufacturers strive for innovation and adoption of the latest technologies powered by solar energy. This factor is expected to create immense opportunities for Germany's solar inverter market in the near future.

Germany Solar Inverter Market Trends

Central Inverters Segment Expected to Dominate the Market

- A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50kW to 1MW and can be used indoors or outdoors.

- As central inverters are used for utility-scale applications, they should produce the same voltage and frequency as that of the electric grid where they are used. As there are a lot of different electric grid standards worldwide, manufacturers are allowed to customize these parameters to match the specific requirements in terms of the number of phases; most central inverters manufactured are three-phase inverters.

- Acoriding to International Renewable Energy Agency (IRENA), by the end of December 2022, the country will have 58.726 GW of solar PV capacity.

- Moreover, to promote the utilization of central inverters, several companies collaborated. For instance, In May 2022, Gamesa Electric and Siemens AG signed a strategic partnership agreement addressing the employment of its Proteus central inverters for PV and Energy Storage projects. Under this agreement, Siemens could use Gamesa Electric Proteus inverters for PV and BESS projects. These central inverters are distinguished by their high-power output of up to 4700kVA and a record efficiency of 99.45%, providing integrated solutions for solar and storage projects.

- In January 2022, Sungrow launched its new '1+X' central modular inverter with an output capacity of 1.1MW. This 1+X modular inverter can be combined into eight units to reach a power of 8.8MW and features a DC/ESS interface for connecting energy storage systems (ESS).

- Therefore, the Central Inverters Segment is expected to dominate the market based on the above factors, like increased power demand.

Increasing Investments in Solar Energy Projects to Drive the Market

- Germany is the largest solar photovoltaic market in Europe in terms of installed capacity, which justifies it being one of the front runners in energy and climate security globally. The country has witnessed significant developments in the solar PV market. It will likely continue to do so due to a combination of self-consumption with attractive feed-in premiums, especially for medium- to large-scale commercial systems ranging from 40 kW to 750 kW.

- The cumulative solar photovoltaic installed capacity in Germany has witnessed significant growth. The solar PV installed capacity will be 66.5 GW in 2022 and 58.7 GW in 2021. There has been 13.2 % year-on-year growth in 2022 compared to the previous year.

- Significant investments in the solar energy sector are being made to set up new solar energy projects. For instance, In March 2022, Germany intends to invest USD 216 billion in renewable energy to reduce its reliance on Russian gas, which has left it susceptible to the effects of the conflict in Ukraine.

- Additionally, in April 2022, Germany's Federal Network Agency announced that the agency had selected 201 proposals with a combined output of 1.084 GW under the solar auction, up from 510.34 MW in July 2021. The bids in the round ranged from EUR 0.040 to EUR 0.055 per kWh. The volume-weighted average price stood at EUR 0.0519 (USD 0.057) per kWh, up from EUR 0.050 per kWh in the previous round.

- Furthermore, in July 2022, Germany agreed on proposals for the government's special "climate and transformation fund" to invest USD 180 billion over the following four years to expedite the energy shift to a cleaner economy and less reliant on Russian energy sources.

- As of October 2022, Germany was home to over 2.58 million energy-generating solar photovoltaic sites. This figure illustrates the peak number of sites recorded in the period of consideration.

- Owing to the above points, increasing investments in the country's solar energy market are expected to dominate the Germany solar inverter market soon.

Germany Solar Inverter Industry Overview

The Germany solar PV inverters market is semi-fragmented. Some of the major players in the market (in no particular order) include FIMER SpA, Schneider Electric SE, Siemens Energy AG, Mitsubishi Electric Corporation, and Omron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

- 1.4 Study Deliverables

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Solar PV in Commercial and Industrial Sectors

- 4.5.1.2 Increasing Investments in Solar Energy Projects

- 4.5.2 Restraints

- 4.5.2.1 Recent Subsidy Cuts on Solar Panels by Governments in the Europe Region

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-Scale

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIMER SpA

- 6.3.2 Schneider Electric SE

- 6.3.3 Siemens Energy AG

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 General Electric Company

- 6.3.6 SMA Solar Technology AG

- 6.3.7 Omron Corporation

- 6.3.8 Delta Energy Systems Inc.

- 6.3.9 Huawei Technologies Co. Ltd.

- 6.3.10 KACO New Energy GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Adoption of the Latest Technologies Powered by Solar Energy

02-2729-4219

+886-2-2729-4219