|

市場調查報告書

商品編碼

1644924

歐洲太陽能逆變器市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

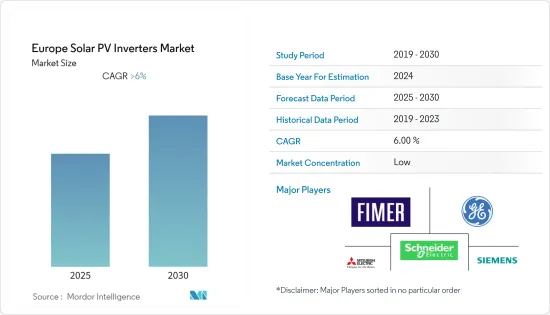

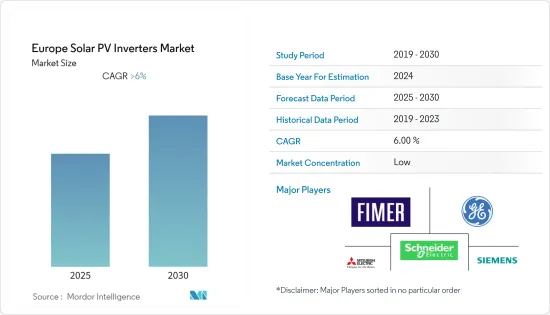

預測期內歐洲太陽能逆變器市場預計複合年成長率將超過 6%

2020 年,市場受到了 COVID-19 的不利影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 短期內,由於政府擴大太陽能市場的舉措和對太陽能電氣化的投資,歐洲太陽能逆變器市場預計將實現成長。

- 另一方面,預計未來幾年來自其他再生能源的競爭將威脅市場成長。

- 預計太陽能逆變器行業的技術發展將為市場提供充足的機會。例如,2022年3月,台灣太陽能變頻器製造商台達推出了新的逆變器系列,最高效率可達98.7%,歐洲效率等級可達98.5%。該公告是在荷蘭舉行的 2022 年國際太陽能解決方案盛會上發布的。

- 由於住宅和公共產業太陽能裝置的需求旺盛,預計德國將實現強勁成長。

歐洲光電逆變器市場趨勢

集中式逆變器可望主導市場

- 集中逆變器是大型併網設備。它常用於額定輸出功率超過100kWp的太陽能發電系統。逆變器通常安裝在地板或地面,將從太陽能電池陣列收集的直流電轉換為交流電以用於並聯型。這些設備的容量範圍從大約 50kW 到 1MW,可在室內和室外使用。

- 中央逆變器的最大輸入電壓通常為 1,000V。一些中央逆變器的輸入電壓已經達到1,500V。這些逆變器可使光伏陣列的電壓高達 1,500V,從而減少系統平衡 (BOS) 組件的數量。

- 此外,2021年歐洲太陽能光電裝置容量為647.61 GW,其中集中式逆變器裝置容量最大。政府舉措預計將在未來幾年進一步增加產能,例如歐盟委員會於 2022 年 10 月成立光伏產業聯盟,以擴大創新太陽能光電產品和組件的製造技術。

- 此外,技術發展也有望推動市場發展。例如,2022年1月,陽光電源在阿布達比世界未來能源高峰會上推出了其全新「1+X」中央模組化逆變器,輸出容量為1.1兆瓦。本款1+X模組化逆變器可組合8台單元,達到8.8MW的輸出功率,並具有DC/ESS介面,可連接能源儲存系統(ESS)。

- 預計此類發展將在未來幾年推動中央太陽能逆變器市場的發展。

德國可望主導市場

- 以裝置容量計算,德國是歐洲最大的太陽能光電市場,確立了其在全球能源和氣候安全領域的領先地位。該國的太陽能市場取得了長足的發展。自給自足和具有吸引力的上網電價相結合可能會延續這一趨勢,特別是對於 40kW 至 750kW 的大中型商業系統而言。

- 該國太陽能逆變器市場的主要驅動力是上網電價計劃,該計劃為住宅和中小型企業選擇太陽能提供了便利。

- 德國光伏累積設置容量正在經歷強勁成長。 2021年太陽能發電裝置容量為5,840萬千瓦,2020年為5,377千萬瓦。 2021與前一年同期比較成長率為9.1%。隨著政府和私人投資者即將推出的計劃,市場預計將擴大。

- 例如,2022年5月,德國聯邦網路局(Bundesnetzagentur)舉行了第三次屋頂太陽能光電競標,平均價格為0.0853歐元/kWh。該機構審查了 171 個競標(總發電容量為 212 兆瓦),並選定了 163 個計劃(總發電容量為 204 兆瓦)。最終價格從 0.07 歐元/kWh到 0.0891 歐元/kWh。

- 此外,2022 年 4 月,德國聯邦網路局宣佈在太陽能光電競標中選出了 201 項提案,總合容量為 1.084 吉瓦,高於 2021 年 7 月的 510.34 兆瓦。競標價格範圍為每千瓦時 0.040 歐元至 0.055 歐元。數量加權平均價格為每千瓦時 0.0519 歐元(0.057 美元),高於先前的 0.050 歐元。

- 由於這些新興經濟體的發展,預計該國將在不久的將來佔據太陽能光電逆變器市場的最高佔有率。

歐洲光電逆變器產業概況

歐洲光電逆變器市場較為分散。市場的主要企業(不分先後順序)包括 Fimer SpA、施耐德電氣 SE、三菱電機公司、通用電氣公司和西門子股份公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 類型

- 集中式逆變器

- 組串式逆變器

- 微型逆變器

- 應用

- 住宅

- 商業/工業

- 實用規模

- 地區

- 德國

- 法國

- 英國

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Fimer SpA

- Siemens AG

- Mitsubishi Electric Corporation

- General Electric Company

- Schneider Electric SE

- SMA Solar Technology AG

- Omron Corporation

- Delta Energy Systems Inc.

- Huawei Technologies Co Ltd.

- KACO New Energy GmBH

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93176

The Europe Solar PV Inverters Market is expected to register a CAGR of greater than 6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the European solar PV inverters market is expected to grow due to the factors such as government initiatives to expand the solar power market and investment in electrification using solar energy.

- On the other hand, the competition from other renewables is anticipated to threaten market growth in the coming years.

- Nevertheless, the technological developments in the solar PV inverters industry are predicted to create ample opportunities for the market. For example, in March 2022, Delta, the Taiwanese solar inverters maker, introduced a new inverter series that can achieve maximum efficiency of 98.7% and a European efficiency rating of 98.5%. It was unveiled at the Solar Solutions International Event 2022 in the Netherlands.

- Germany is expected to witness significant growth due to the high demand for solar PV installations in the residential and utility-scale sectors.

Europe Solar PV Inverters Market Trends

Central Inverters Expected to Dominate the Market

- A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50 kW to 1 MW and can be used indoors or outdoors.

- A central inverter typically has a maximum input voltage of 1,000 V. Certain central inverters already have a 1,500 V input voltage. These inverters allow PV arrays based on a maximum voltage of 1,500 V, requiring fewer BOS (balance of system) components.

- Moreover, in 2021, the solar PV installed capacity in the European region was recorded as 647.61 GW, in which the maximum installations were of central inverters. The capacity is expected to increase even more in the future due to the government initiatives like the establishment of the Solar Photovoltaic Industry Alliance by the European Commission in October 2022 to scale up manufacturing technologies of innovative solar photovoltaic products and components.

- Furthermore, technological developments are also expected to drive the market. For example, in January 2022, Sungrow launched its new '1+X' central modular inverter with an output capacity of 1.1 MW at the World Future Energy Summit in Abu Dhabi. This 1+X modular inverter can be combined into eight units to reach a power of 8.8 MW and features a DC/ESS interface for connecting energy storage systems (ESS).

- Such developments are forecasted to drive the central solar PV inverters market in the coming years.

Germany Expected to Dominate the Market

- Germany is the largest solar photovoltaic market in Europe regarding installed capacity, which justifies it being one of the front runners in energy and climate security across the world. The country has witnessed significant developments in the solar PV market. It is likely to continue to do so due to a combination of self-consumption with attractive feed-in premiums, especially for medium- to large-scale commercial systems ranging from 40 kW to 750 kW.

- The major driver for the country's solar inverters market has been the FiT scheme, which has made it lucrative for homeowners as well as small businesses to opt for solar power.

- The cumulative solar photovoltaic installed capacity in Germany has witnessed significant growth. The solar PV installed capacity was 58.4 GW in 2021 and 53.7 GW in 2020. There has been 9.1% year-on-year growth in 2021 compared to the previous year. The market is expected to expand due to the upcoming projects implemented by the government and private investors.

- For example, in May 2022, Germany's Federal Network Agency, the Bundesnetzagentur, concluded the third rooftop PV tender with an average price of EUR 0.0853/kWh. The agency reviewed 171 bids with a total capacity of 212 MW and selected 163 projects totaling 204 MW. The final prices ranged between EUR 0.07 /kWh and EUR 0.0891/kWh.

- In addition, in April 2022, the German Federal Network Agency announced that the agency had selected 201 proposals with a combined output of 1.084 GW under the solar auction, up from 510.34 MW in July 2021. The bids in the round ranged from EUR 0.040 to EUR 0.055 per kWh. The volume-weighted average price stood at EUR 0.0519 (USD 0.057) per kWh, up from EUR 0.050 per kWh in the previous round.

- Owing to such developments, the country is expected to have the highest share in the solar PV inverters market in the near future.

Europe Solar PV Inverters Industry Overview

The European solar PV inverters market is fragmented in nature. Some of the key players in the market (in no particular order) include Fimer SpA, Schneider Electric SE, Mitsubishi Electric Corporation, General Electric Company, and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial & Industrial

- 5.2.3 Utility-scale

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fimer SpA

- 6.3.2 Siemens AG

- 6.3.3 Mitsubishi Electric Corporation

- 6.3.4 General Electric Company

- 6.3.5 Schneider Electric SE

- 6.3.6 SMA Solar Technology AG

- 6.3.7 Omron Corporation

- 6.3.8 Delta Energy Systems Inc.

- 6.3.9 Huawei Technologies Co Ltd.

- 6.3.10 KACO New Energy GmBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219