|

市場調查報告書

商品編碼

1636173

SLI 電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030 年)SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

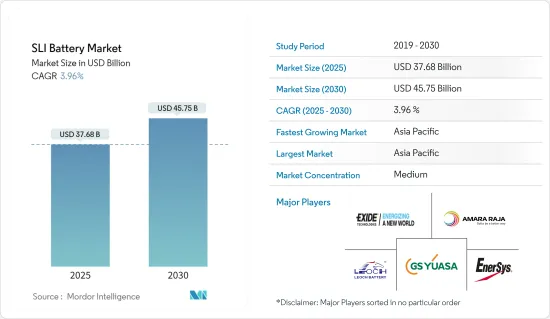

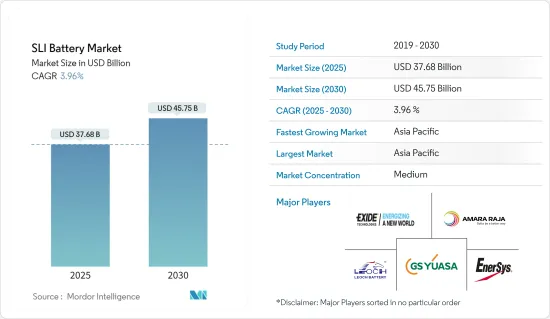

SLI電池市場規模預計到2025年為376.8億美元,預計到2030年將達到457.5億美元,預測期內(2025-2030年)複合年成長率為3.96%。

主要亮點

- 從中期來看,汽車的普及以及工業和農業應用對 SLI 電池日益成長的需求預計將在預測期內推動 SLI 電池市場的發展。

- 另一方面,替代電池的擴散和嚴格的政府監管預計將阻礙預測期內的市場成長。

- 對電池回收的日益關注以及新車和售後市場替換新興市場的擴張可能會為 SLI 電池市場創造機會。

SLI電池市場趨勢

汽車板塊實現顯著成長

- 由於汽車行業的不斷擴張以及對可靠電源的持續需求,汽車領域的啟動、照明和點火 (SLI) 電池市場預計將顯著成長。 SLI 電池是汽車的重要組成部分,提供啟動引擎、運作電氣系統以及正確點火汽車所需的電力。

- 隨著全球汽車持有持續成長,對 SLI 電池的需求依然強勁。例如,根據國際汽車工業協會(OICA)的數據,2023年全球汽車銷售量約為9,272.4萬輛,與前一年同期比較2022年成長11.89%。

- 2023年全球汽車銷售中,乘用車銷量超過65,272,000輛,商用車銷量超過27,452,000輛。預計這種趨勢將在短期內持續下去,並在預測期內對 SLI 電池產生巨大的需求。此外,SLI 電池技術的進步,例如增強型富液電池 (EFB) 和吸收玻璃氈 (AGM) 電池,可提高性能和耐用性,進一步推動市場成長。

- 儘管前景樂觀,但 SLI 電池市場將逐漸開始面臨電動車 (EV) 日益普及以及轉向更永續能源解決方案的挑戰。電動車通常使用鋰離子電池,從長遠來看,這可能會減少對傳統 SLI 電池的需求。

- 在一些國家,汽油和柴油汽車的滲透率在未來幾年短期內將繼續保持穩定。例如,2023年9月,英國首相確認將計畫中的禁令延長五年,從2030年延長至2035年。在英國宣布政策改變之前,政府曾計劃在2030年禁止銷售新的純汽油和柴油汽車。目前的計劃是從2035年開始禁止。

- 據政府稱,根據該禁令,從 2035 年起,只能購買電動車和零排放汽車作為新車。然而,由於大多數駕駛者購買二手車,因此大多數人可能不會受到這項禁令的影響。只有新的汽油和柴油車銷售會受到影響;現有車輛不會受到影響。此外,延長禁令將使英國與歐盟保持一致。歐盟也計劃在2035年禁止銷售新的汽油和柴油汽車。

- 總體而言,SLI電池市場預計將保持適度的成長軌跡。對汽車基礎設施的持續投資以及電池設計和製造的技術進步預計將在市場成長中發揮關鍵作用。此外,我們對環保 SLI 電池開發和回收的承諾符合全球永續性目標,並確保在不斷發展的汽車領域的市場相關性。

亞太地區預計將主導市場

- 預計亞太地區的 SLI(啟動、照明、點火)電池市場將顯著成長。這可能是由多種因素造成的,包括快速都市化、汽車產量增加以及消費者對汽車的需求不斷成長。中國、印度、日本和韓國等國家由於其龐大的汽車市場和對汽車製造基礎設施的大量投資,對這一成長做出了重大貢獻。

- 根據國際汽車工業協會(OICA)預測,2023年中國汽車產量約30,161,000輛,日本超過8,990,000輛,韓國為4,243,000輛,印度超過5,850,000輛。這使得該地區成為全球 SLI 電池的主要市場之一。此外,由於道路上車輛數量眾多,SLI電池更換市場也相當大。

- 最近的進展包括幾家主要汽車製造商計劃在該地區開發和擴大汽油和柴油動力汽車製造設施。例如,2023年11月,日本主要汽車製造商豐田與卡納塔克邦政府簽署合作備忘錄,在印度建立第三家製造工廠,年產能增加10萬輛。新工廠將建在班加羅爾附近的比達迪,靠近該公司現有的兩座工廠,預計投資約330億印度盧比。

- 豐田現有的比達迪工廠年產能總計總合4,000輛,新工廠將於2026年投入運作,計劃將豐田的產能提高約30%。這項宣布對在印度擁有 25 年歷史的豐田品牌來說是一個提振。據該公司介紹,新工廠將成為下一代三排SUV的主要生產基地。豐田計劃每年生產6萬輛,預計2026年上市。汽車製造領域的此類發展預計將在未來幾年推動 SLI 電池的採用。

- 此外,一些主要企業,如GS Yuasa Corporation,包括印度Tata AutoComp GY Batteries Private Ltd (TGY),其子公司GS Yuasa International Ltd (GS Yuasa)的權益法附屬公司,部分公司已擁有該公司。 TGY成立於2005年10月,旨在擴大其在亞洲最大摩托車生產國印度的市場佔有率。

- TGY於2021年在工廠內新擴建的大樓開始生產,並於2022年新增一條生產線並開始全面量產。藉此,TGY將繼續擴大產能,目標是建立年產840萬隻摩托車鉛酸蓄電池的生產體系,較擴產前的420萬隻增加一倍。工廠的擴建預計將擴大該公司生產的電池型號範圍。 TGY也預計將加強其汽車鉛酸電池的生產,重點關注啟停汽車等環保汽車的高性能鉛酸電池,預計此類電池的需求將持續成長。

- 因此,由於上述因素,預計亞太地區SLI電池市場在預測期內將顯著成長。

SLI電池產業概況

SLI 電池市場呈現半分裂狀態。市場的主要企業包括(排名不分先後)GS Yuasa International Ltd、Exide Technologies、Amara Raja Energy & Mobility Limited、EnerSys 和 Leoch International Technology Limited Inc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 汽車普及率不斷提高

- 工業和農業應用對 SLI 電池的需求不斷成長

- 抑制因素

- 替代電池的擴展

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 電池被淹

- VRLA 電池

- EBF電池

- 最終用戶

- 用於汽車

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 卡達

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略及SWOT分析

- 公司簡介

- GS Yuasa International Ltd.

- Exide Technologies

- Amara Raja Energy & Mobility Limited

- EnerSys

- Leoch International Technology Limited Inc.

- East Penn Manufacturing Company

- C&D Technologies Inc.

- Clarios International Inc.

- Trojan Battery Company

- Crown Battery Manufacturing Company

- 其他知名公司名單(公司名稱、總部地點、相關產品及服務、聯絡資訊等)

- 市場排名分析

第7章 市場機會及未來趨勢

- 人們越來越關注電池回收

- 拓展新車和售後市場應用的新興市場

簡介目錄

Product Code: 50002581

The SLI Battery Market size is estimated at USD 37.68 billion in 2025, and is expected to reach USD 45.75 billion by 2030, at a CAGR of 3.96% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of motor vehicles and the growing demand for SLI batteries from industrial and agricultural applications are expected to drive the SLI batteries market during the forecast period.

- On the other hand, the increasing penetration of alternative battery chemistries and the stringent government regulations are expected to hinder the market's growth during the forecast period.

- Nevertheless, the increased focus on battery recycling and the expansion in emerging markets for both new vehicles and after-market replacements will likely create opportunities for the SLI battery market.

SLI Battery Market Trends

Automotive Segment to Witness Significant Growth

- The market for starting, lighting, and Ignition (SLI) batteries in the automotive segment is expected to witness notable growth, driven by the expanding automotive industry and the continuous need for reliable power sources. SLI batteries are essential components in motor vehicles, providing the necessary power to start the engine, run electrical systems, and ensure proper ignition.

- As the global vehicle fleet continues to grow, the demand for SLI batteries remains robust. For example, as per the International Organization of Motor Vehicle Manufacturers(OICA), the total global motor vehicle sales stood at around 92.724 million in 2023, recording over 11.89% growth compared to the previous years in 2022.

- Of the total global motor vehicle sales in 2023, the total passenger vehicles and commercial vehicle sales stood at over 65.272 million and 27.452 million, respectively. Such trends are expected to continue over the short term and create a substantial demand for the SLI battery during the forecast period. In addition, advancements in SLI battery technology, such as enhanced flooded batteries (EFB) and absorbent glass mat (AGM) batteries, are providing improved performance and durability, further propelling market growth.

- Despite the positive outlook, the SLI battery market will gradually start facing challenges from the growing popularity of electric vehicles (EVs) and the shift toward more sustainable energy solutions. EVs typically use lithium-ion batteries, which may reduce the demand for traditional SLI batteries in the long term.

- Nevertheless, several nations continue to experience a stable adoption of petrol and diesel vehicles over the short term in the coming years. For example, in September 2023, the United Kingdom's Prime Minister confirmed the planned ban was being pushed back five years from 2030 to 2035. Before the United Kingdom announced a shift in policy, the government had planned to ban the sale of new, pure petrol and diesel vehicles by 2030. Now, the plan is for the ban to begin in 2035.

- According to the government, under the ban, only electric battery-powered cars and zero-emission vehicles will be able to be bought new from 2035. However, most people will not be impacted by the ban, as most drivers buy vehicles secondhand. Only sales of new petrol and diesel models would be affected, not the existing ones. Moreover, the delay in the ban brings the United Kingdom into line with the European Union, which is also banning sales of new petrol and diesel cars by 2035.

- Overall, the SLI battery market is expected to maintain a growth trajectory, albeit at a moderate pace. Continued investments in automotive infrastructure, coupled with technological advancements in battery design and manufacturing, is expected to play a crucial role in market growth. In addition, the development of eco-friendly SLI batteries and recycling initiatives will align with global sustainability goals, ensuring the market's relevance in the evolving automotive landscape.

Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is expected to witness significant growth in the SLI (Starting, Lighting, and Ignition) battery market. This is likely to be driven by a combination of factors, including rapid urbanization, increasing vehicle production, and growing consumer demand for automobiles. Countries such as China, India, Japan, and South Korea are major contributors to this growth due to their large automotive markets and significant investments in automotive manufacturing infrastructure.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the total number of motor vehicles produced in China stood at around 30.161 million in 2023, Japan produced over 8.99 million, South Korea produced 4.243 million, and India produced over 5.85 million. This makes the region one of the significant markets for SLI batteries worldwide. Moreover, the replacement market for SLI batteries is also substantial due to the high number of vehicles on the road.

- Recently, some of the major automobile manufacturers have also planned to develop and expand automobile manufacturing facilities in the region, where the vehicles are fuelled by petrol and diesel. For example, in November 2023, Toyota, one of the largest Japanese automakers, signed a Memorandum of Understanding (MoU) with the government of Karnataka to set up a third manufacturing plant in India, which would increase its production capacity by 1 lakh units per annum. The upcoming plant will also be situated in Bidadi, near Bangalore, near the existing two, and is expected to attract an investment of around INR 3,300 crores.

- Toyota's existing plants at Bidadi have a combined output of about 4 lakh units per annum, and this new plant operational by 2026 is planned to add about 30% to Toyota's production capacity. This announcement comes on the back of the brand, which has been completing 25 years in India. According to the company, the new plant will be the primary production base for an upcoming three-row SUV. Toyota is planned to produce 60,000 units annually, with a launch likely by 2026. Such developments in automobile manufacturing are expected to boost the adoption of SLI batteries in the coming years.

- Furthermore, some of the leading SLI battery players, such as GS Yuasa Corporation, announced that their India-based company Tata AutoComp GY Batteries Private Ltd (TGY), an equity-method affiliate of subsidiary GS Yuasa International Ltd (GS Yuasa), aims to double its annual production capacity for motorcycle lead-acid batteries to 8.4 million units. TGY, which was established in October 2005, is aiming to boost its market share in India, Asia's largest motorcycle-producing country.

- TGY launched production in a newly added wing at its plant in 2021 and began full-fledged mass production with the addition of a new production line in 2022. With this, TGY aims to continue expanding production capacity and establish a production system capable of producing 8.4 million lead-acid motorcycle batteries per year, double its pre-expansion capacity of 4.2 million units. The plant expansion is expected to enable the company to expand the range of battery models it manufactures. In addition, TGY is expected to strengthen its production of automotive lead-acid batteries, with a focus on high-performance lead-acid batteries for environment-friendly vehicles, such as start & stop vehicles, demand for which is expected to continue growing in the coming years.

- Therefore, owing to the abovementioned factors, the Asia-Pacific region is anticipated to witness notable growth for the SLI battery market during the forecast period.

SLI Battery Industry Overview

The SLI battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include GS Yuasa International Ltd, Exide Technologies, Amara Raja Energy & Mobility Limited, EnerSys, and Leoch International Technology Limited Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Nordic

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Thailand

- 5.3.3.6 Malaysia

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Egypt

- 5.3.4.5 Nigeria

- 5.3.4.6 Qatar

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd.

- 6.3.2 Exide Technologies

- 6.3.3 Amara Raja Energy & Mobility Limited

- 6.3.4 EnerSys

- 6.3.5 Leoch International Technology Limited? Inc.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 C&D Technologies Inc.?

- 6.3.8 Clarios International Inc.?

- 6.3.9 Trojan Battery Company

- 6.3.10 Crown Battery Manufacturing Company

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Focus on Battery Recycling

- 7.2 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

02-2729-4219

+886-2-2729-4219