|

市場調查報告書

商品編碼

1636177

歐洲 SLI 電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

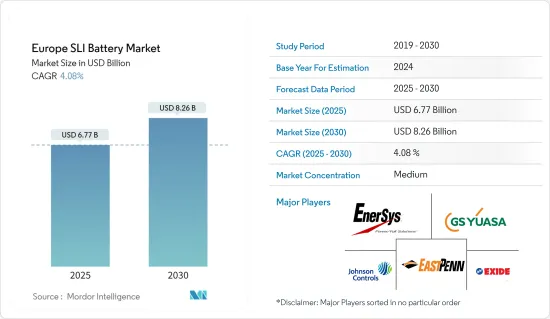

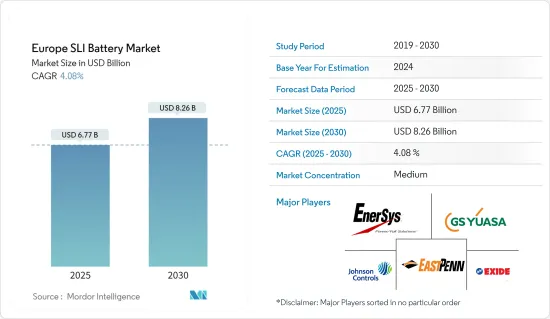

2025年歐洲SLI電池市場規模預估為67.7億美元,預估至2030年將達82.6億美元,預測期間(2025-2030年)複合年成長率為4.08%。

主要亮點

- 從中期來看,該地區汽車普及率的提高以及工業和農業部門對電池的需求增加等因素預計將成為預測期內歐洲 SLI 電池市場的最大推動力之一。

- 同時,在預測期內,替代電池化學品的競爭日益激烈,對歐洲 SLI 電池市場構成威脅。

- 儘管如此,隨著新車和售後市場更換的不斷努力,在新興市場的擴張預計將在未來創造一些市場機會。

- 德國預計將出現顯著成長,並預計在預測期內保持最高的複合年成長率。這是由於該地區製造業規模龐大。

歐洲SLI電池市場趨勢

汽車最終用戶產業經歷顯著成長

- 汽車終端用戶產業是歐洲SLI(啟動、照明、點火)電池市場的基石。該行業包括乘用車、輕型商用車和重型卡車等多種車輛,所有這些車輛都依賴 SLI 電池來實現關鍵功能。

- 根據國際汽車工業協會的數據,自2020年以來歐洲汽車產量持續持續成長。 2022年至2023年,產量將成長13%以上,過去五年複合年成長率超過2%。這意味著該地區汽車產量的增加,推動了 SLI 電池市場的發展。

- 歐洲汽車產業以注重創新和品質而聞名,正在幫助塑造 SLI 電池市場。製造商不斷突破電池技術的極限,以提高性能、耐用性和環境永續性,以滿足現代車輛不斷變化的需求和嚴格的監管要求。

- 例如,2023年5月,葡萄牙新興企業C2C-NewCap開發了GO-START,這是一種環保超級電容模組,將徹底改變能源儲存環境。在歐盟資助的HYCAP計劃的支持下,該公司不僅推出了一條試點生產線,還磨練了其供應鏈,為首次商業性迭代的市場亮相做好準備。此綜合套件採用深迴圈電池,其使用壽命比傳統 SLI 電池顯著更長,並且專為為車輛的電氣配件供電而量身定做。

- 例如,啟動停止系統和輕度混合動力汽車的日益普及需要開發更先進的 SLI 電池,以承受頻繁的充電/放電循環並提供更高的功率輸出。這項變化不僅推動了電池設計的創新,再形成了歐洲SLI電池市場的競爭格局。

- 近年來,受更嚴格的廢氣法規、加速向電氣化轉型以及消費者偏好變化等因素的綜合影響,歐洲汽車製造業進入了重大變革時期時期。雖然這些變化主要影響動力傳動系統系統,但它們也會對 SLI 電池等輔助組件產生連鎖反應。

- 因此,如前所述,汽車最終用戶產業預計在預測期內將出現顯著成長。

德國主導市場

- 作為歐洲汽車工業的強國,德國在歐洲啟動、照明和點火(SLI)電池市場中發揮著至關重要的作用。德國憑藉其豐富的工業專業知識和創新歷史,在該領域的製造能力很強。這家德國 SLI 電池製造商已成為生產效率、品管和技術進步的領導者。

- 製造業是德國經濟的主要貢獻者之一,自2020年以來已達到疫情前的水準。 2023年,製造業對德國GDP的貢獻率為18.96%,較2022年成長2.81%。這意味著該國的製造業正在成長,推動了對 SLI 電池的需求。

- 該國的公司正在大力投資最先進的生產設備,這些設備採用高度自動化和機器人技術,以確保穩定的品質和高產量。德國製造業格局的特點是既有能夠大規模生產的大型製造商,也有專注於利基市場和高性能應用的小型專業製造商。

- 德國 SLI 電池市場的最新發展反映了汽車產業向電氣化和車輛電氣化的更廣泛轉變。向電動車的過渡衝擊了傳統的 SLI 電池市場,但也創造了新的機會。德國製造商迅速適應並開發了先進的 SLI 電池,以滿足具有啟動停止系統和再生煞車的現代車輛不斷成長的電力需求。

- 增強型電解鉛酸電池(EFB)和吸收性玻璃氈(AGM)電池的生產也呈現成長趨勢,與傳統鉛酸電池相比,它們具有更高的性能和更長的使用壽命。這些先進的電池特別適合配備先進電氣系統和耗電配件的現代車輛的需求。

- 這種趨勢在電池製造商推出的新產品中表現得很明顯。例如,2024 年 3 月,Trojan Battery Company 將透過在 Trojan AES 系列中推出兩種 DIN 尺寸電池來加強其全球電池市場產品。 TE35-AES和5SHP-AES繼承了Trojan AES AGM電池的特性。這為原始設備製造商和租賃公司提供了更高的價值和投資回報,並為最終用戶減少了設備停機時間。

- 因此,鑑於以上幾點,預計德國將在預測期內佔據市場主導地位。

歐洲SLI電池產業概況

歐洲SLI電池市場已被削減一半。該市場的主要企業(排名不分先後)包括 GS Yuasa International Ltd、Exide Technologies、Johnson Controls、EnerSys 和 East Penn Manufacturing Company。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 汽車普及率不斷提高

- 工業和農業應用對 SLI 電池的需求不斷成長

- 抑制因素

- 替代電池的擴展

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按類型

- 電池被淹

- VRLA 電池

- EBF電池

- 按最終用戶

- 用於汽車

- 其他

- 按地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 其他歐洲國家

第6章 競爭狀況

- 併購、合資、聯盟、協議

- Strategies Adopted & SWOT Analysis for Leading Players

- 公司簡介

- GS Yuasa International Ltd.

- Exide Technologies

- Johnson Controls

- EnerSys

- Leoch International Technology Limited Inc.

- East Penn Manufacturing Company

- C&D Technologies Inc.

- Clarios International Inc.

- Trojan Battery Company

- Crown Battery Manufacturing Company

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第7章 市場機會及未來趨勢

- 新興市場擴大新車和售後更換

簡介目錄

Product Code: 50002586

The Europe SLI Battery Market size is estimated at USD 6.77 billion in 2025, and is expected to reach USD 8.26 billion by 2030, at a CAGR of 4.08% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in the adoption of motor vehicles in the region coupled with growing demand for batteries from industrial and agricultural industries are expected to be among the most significant drivers for the Europe SLI battery market during the forecast period.

- On the other hand, increasing competition from alternate battery chemistries poses a threat to the European SLI battery market during the forecast period.

- Nevertheless, continued efforts to expand in emerging markets for new vehicles and after-market replacements are expected to create several opportunities for the market in the future.

- Germany is expected to witness significant growth and is expected to register the highest CAGR during the forecast period. This is due to the region's significant manufacturing industry.

Europe SLI Battery Market Trends

Automotive End User Industry to Witness Significant Growth

- The automotive end-user industry stands as a cornerstone of the Europe SLI (Starting, Lighting, and Ignition) battery market. This sector encompasses a diverse array of vehicles, including passenger cars, light commercial vehicles, and heavy-duty trucks, all of which depend on SLI batteries for critical functions.

- According to the International Organization of Motor Vehicle Manufacturers, automobile production in Europe has been witnessing consistent growth since 2020. Between 2022 and 2023, production increased by more than 13%, whereas the annual average growth rate in the past five years was over 2%. This signifies the growing production of automobiles in the region, which in turn drives the SLI batteries market.

- The European automotive landscape, renowned for its commitment to innovation and quality, has been instrumental in molding the SLI battery market. Manufacturers continually push the boundaries of battery technology, striving for enhancements in performance, durability, and environmental sustainability to meet the evolving needs of modern vehicles and stringent regulatory requirements.

- For instance, in May 2023, Portuguese start-up C2C-NewCap pioneered GO-START, an eco-friendly supercapacitor module poised to revolutionize the energy storage landscape. Backed by the EU-funded HYCAP project, the company has not only set up pilot production lines but also honed its supply chain for the market debut of the inaugural commercial iteration. The comprehensive package features a deep-cycle battery, boasting a significantly longer lifespan compared to conventional SLI batteries, tailored to power a vehicle's electrical accessories.

- The growing adoption of start-stop systems and mild hybrid vehicles, for instance, has necessitated the development of more advanced SLI batteries capable of withstanding frequent charge-discharge cycles and delivering higher power output. This shift has not only driven innovation in battery design but has also reshaped the competitive landscape of the SLI battery market in Europe.

- The automotive manufacturing sector in Europe has undergone significant transformations in recent years, propelled by a confluence of factors, including stricter emissions regulations, the accelerating transition toward electrification, and shifting consumer preferences. While these changes have predominantly affected powertrain systems, they have also had cascading effects on auxiliary components like SLI batteries.

- Therefore, as mentioned above, the automotive end-user industry is expected to witness significant growth during the forecast period.

Germany to Dominate the Market

- Germany, as a powerhouse of the European automotive industry, plays a pivotal role in the European Starting, Lighting, and Ignition (SLI) battery market. The country's manufacturing capabilities in this sector are formidable, leveraging a rich history of industrial expertise and technological innovation. German SLI battery manufacturers have established themselves as leaders in production efficiency, quality control, and technological advancement.

- The manufacturing industry is one of the leading contributors to the German economy, which has reached pre-pandemic levels since 2020. In 2023, the manufacturing sector contributed 18.96% to the German GDP, an increase of 2.81% compared to 2022. This signifies the growing manufacturing sector in the country, which drives the demand for SLI batteries.

- Companies in the country have invested heavily in state-of-the-art production facilities, incorporating high levels of automation and robotics to ensure consistent quality and high output volumes. The manufacturing landscape in Germany is characterized by a mix of large-scale producers capable of mass production and smaller, specialized manufacturers focusing on niche markets or high-performance applications.

- Recent trends in the German SLI battery market reflect broader shifts in the automotive industry towards electrification and increased vehicle electrification. While the transition to electric vehicles has impacted the traditional SLI battery market, it has also created new opportunities. German manufacturers have been quick to adapt, developing advanced SLI batteries capable of meeting the increased power demands of modern vehicles equipped with start-stop systems and regenerative braking.

- There's a growing trend toward the production of Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) batteries, which offer improved performance and longevity compared to conventional lead-acid batteries. These advanced batteries are particularly well-suited to the demands of modern vehicles with sophisticated electrical systems and numerous power-hungry accessories.

- This trend is pronounced in the new products launched by the battery manufacturers. For instance, in March 2024, Trojan Battery Company bolsters its global battery market offerings by introducing two DIN-size batteries to its Trojan AES family. These new additions, the TE35-AES and 5SHP-AES, inherit the hallmark features of Trojan AES AGM batteries. This translates to enhanced value and return on investments for original equipment manufacturers and rental firms, with the added benefit of reduced equipment downtime for end users.

- Therefore, as per the abovementioned points, Germany is expected to dominate the market during the forecast period.

Europe SLI Battery Industry Overview

The Europe SLI battery market is sem-fragmented. Some of the key players in this market (in no particular order) are GS Yuasa International Ltd, Exide Technologies, Johnson Controls, EnerSys, and East Penn Manufacturing Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Others

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd.

- 6.3.2 Exide Technologies

- 6.3.3 Johnson Controls

- 6.3.4 EnerSys

- 6.3.5 Leoch International Technology Limited Inc.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 C&D Technologies Inc.

- 6.3.8 Clarios International Inc.

- 6.3.9 Trojan Battery Company

- 6.3.10 Crown Battery Manufacturing Company

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

02-2729-4219

+886-2-2729-4219