|

市場調查報告書

商品編碼

1636265

德國SLI電池:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

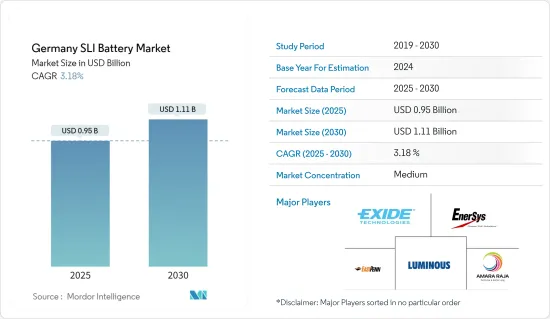

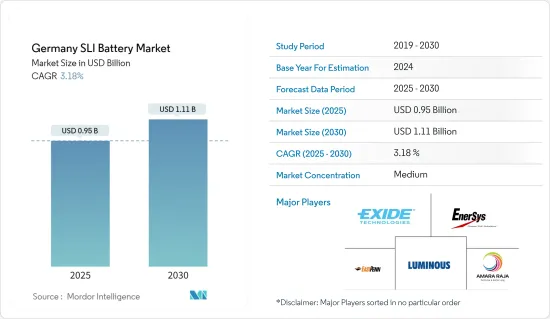

德國SLI電池市場規模預計到2025年為9.5億美元,預計2030年將達到11.1億美元,預測期間(2025-2030年)複合年成長率為3.18%。

主要亮點

- 從中期來看,工業和農業應用對 SLI 電池的需求不斷增加以及汽車普及率的提高預計將在預測期內推動 SLI 電池的需求。

- 另一方面,由於替代電池的日益普及,預計市場成長將受到限制。

- 人們對電池回收的日益關注及其在新興市場(無論是新車還是售後市場更換)的擴張預計將在不久的將來為市場參與企業提供重大機會。

德國SLI電池市場趨勢

汽車普及帶動市場

- 汽車在德國越來越受歡迎,並推動市場的成長。汽車的日益普及增加了對可靠、高效的汽車電池的需求。

- 強勁的汽車生產和銷售增強了歐洲對 SLI 電池的需求。英國和德國是重要的汽車市場,SLI 電池被用於新車和售後替換產品。研究期間電動車銷量大幅成長。

- 根據國際能源總署(IEA)的數據,2023年德國電動車總銷量為70萬輛,較2022年強勁,較2019年成長5.5倍。隨著眾多計劃的啟動,預計未來幾年銷售將呈指數級成長,預計將增加預測期內對 SLI 電池的需求。

- 此外,該國正在積極推廣電動車(EV)的使用,以實現永續交通。該地區的主要企業正在進行大量投資以提高汽車產量。

- 2024年1月,瑞典鋰離子電池製造商Northvolt宣布斥巨資9.02億歐元(合9.8643億美元)在德國海德建造電動車(EV)電池生產工廠,並獲得歐盟國家支持包裝核准。這項核准將有助於德國和整個歐盟實現淨零排放目標。在預測期內,此類投資可能會增加整個全部區域的電動車產量和對 SLI 電池的需求。

- 截至 2023 年,各公司正在電池技術方面取得進步,例如 VRLA 電池,由於其免維護和改進的性能而變得越來越受歡迎。這些電池在許多應用中逐漸取代傳統電解型鉛酸電池,預計這一因素將在預測期內為汽車應用創造更多機會。

- 此類計劃和投資可能會增加全部區域的汽車產量,並在預測期內推動對 SLI 電池的需求。

汽車最終用戶市場預計將成長

- 德國汽車工業正在擴張,對乘用車和商用車的需求不斷增加。這種成長增加了對可靠 SLI 電池的需求。過去幾年汽車銷量大幅成長,產業產生的收益也呈現線性成長。

- 例如,根據德國聯邦統計局的數據,2023年德國汽車銷售收益為1,711.6億歐元(1,841.3億美元),較2022年成長11.34%。隨著政府宣布一系列提高全部區域汽車產量的措施和計劃,汽車收益和銷售量預計將在未來幾年大幅成長。

- 德國政府透過旨在減少污染、減少對石化燃料的依賴和促進永續發展的各種舉措,積極推廣電動車(EV)。政府推出了《高科技戰略2025》,提供大量補貼以在全國推廣電動車。預計這將對全部區域的SLI 電池需求產生重大影響。

- 2023年,政府宣佈為新消費者提供高達6,000歐元(6,500美元)的電動車補貼,為插電式混合動力汽車提供高達4,500歐元(4,900美元)的補貼。這些舉措可能會在預測期內加速全國電動車的生產和需求,從而增加對 SLI 電池的需求。

- 向汽車的轉變是推動該領域成長的關鍵因素。預計該地區的主要企業將在未來幾年啟動許多計劃和投資,以增加全國的汽車產量。

- 例如,福特於2023年6月宣布,將斥資20億美元在德國科隆開設電動車工廠,每年生產25萬輛電動車。科隆電動車工廠預計將實現該汽車製造商到 2026 年年產 200 萬輛電動車的目標。這些產品類型將促進電動車產量,進而推動對 SLI 電池的需求。

- 此類措施和發展可能會促進汽車最終用戶領域的成長。

德國SLI電池產業概況

德國 SLI 電池市場較為分散。主要企業(排名不分先後)包括 Exide Technologies、EnerSys、East Penn Manufacturing Co、Luminous Power Technologies Pvt. Ltd. 和 Amara Raja Batteries Ltd.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 汽車普及率不斷提高

- 工業和農業應用對 SLI 電池的需求不斷成長

- 抑制因素

- 替代電池的擴展

- 促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 類型

- 電池被淹

- VRLA 電池

- EBF電池

- 最終用戶

- 用於汽車

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略及SWOT分析

- 公司簡介

- Amara Raja Batteries Ltd

- Exide Technologies

- Luminous Power Technologies Pvt. Ltd.

- EnerSys

- HBL Power Systems Ltd.

- East Penn Manufacturing Company

- FIAMM Energy Technology

- Clarios

- SAFT Groupe SA

- Varta AG

- 其他知名公司名單(公司名稱、總部地點、相關產品及服務、聯絡等)

- 市場排名分析

第7章 市場機會及未來趨勢

- 人們越來越關注電池和回收

- 拓展新車和售後市場應用的新興市場

簡介目錄

Product Code: 50003547

The Germany SLI Battery Market size is estimated at USD 0.95 billion in 2025, and is expected to reach USD 1.11 billion by 2030, at a CAGR of 3.18% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing demand for SLI batteries from industrial and agricultural applications and increasing adoption of motor vehicles are expected to drive the demand for SLI batteries during the forecast period.

- On the other hand, the increasing penetration of alternative battery chemistries is expected to restrain the growth of the market.

- Nevertheless, increased focus on battery recycling and expansion in emerging markets for both new vehicles and after-market replacements are expected to create significant opportunities for market players in the near future.

Germany SLI Battery Market Trends

Increasing Adoption of Motor Vehicles Drives the Market

- The increasing adoption of motor vehicles in Germany drives the growth of the market. The increasing adoption of motor vehicles is leading to increased demand for reliable and efficient automotive batteries.

- Robust automotive production and sales bolster the demand for SLI batteries in Europe. The United Kingdom and Germany are significant automotive markets, and SLI batteries are used in new vehicles and after-market replacements. The sales of electric vehicles rose significantly over the study period.

- According to the International Energy Agency, in 2023, the total number of EVs sold in Germany was 0.7 million, which was steady compared to 2022 and an increase of 5.5 times compared to 2019. As numerous projects are initiated, sales are expected to rise exponentially in the coming years, which will raise the demand for SLI batteries during the forecast period.

- Furthermore, to achieve sustainable transportation, the country is actively promoting the use of electric vehicles (EVs). Leading companies across the region are investing significantly to promote motor vehicle production.

- In January 2024, Northvolt, a Swedish lithium-ion battery manufacturer, received EU approval for a substantial EUR 902 million (USD 986.43 million) German state aid package to build an electric vehicle (EV) battery production plant in Heide, Germany. The approval supports Germany and the wider European Union in achieving net-zero targets. Such investments are likely to increase the production of EVs across the region and raise the demand for SLI batteries during the forecast period.

- As of 2023, companies were making advancements in battery technology, such as VRLA batteries, which became more popular due to their maintenance-free nature and improved performance. These batteries are gradually replacing traditional flooded lead-acid batteries in many applications; this factor is expected to create more opportunities for motor vehicles during the forecast period.

- Such projects and investments are likely to increase vehicle production across the region and raise the demand for SLI batteries during the forecast period.

The Automotive End-user Segment is Expected to Grow

- The automotive industry in Germany is expanding, with increasing demand for both passenger and commercial vehicles. This growth drives the need for reliable SLI batteries. The sales of automobiles have risen significantly over the last few years, and the revenue generated by the industry has linearly increased.

- For instance, according to the Statistisches Bundesamt, in 2023, the revenue generated from domestic automobile sales in Germany was EUR 171.16 billion (USD 184.13 billion), an increase of 11.34% compared to 2022. Automobile revenue and sales are expected to rise significantly in the coming years as the government announces numerous initiatives and programs to raise vehicle production across the region.

- The German government has been proactive in promoting electric vehicles (EVs) through various initiatives aimed at reducing pollution, decreasing dependence on fossil fuels, and fostering sustainable development. The government introduced the High-Tech Strategy 2025 and a significant subsidy to promote electric vehicles across the country. This is likely to significantly impact the demand for SLI batteries across the region.

- In 2023, the government announced a new electric vehicle subsidy for new consumers up to EUR 6,000 (USD 6,500), while plug-in hybrids could get up to EUR 4,500 (USD 4,900). Such initiatives are likely to accelerate the production and demand for EVs across the country and raise the demand for SLI batteries during the forecast period.

- The shift toward automotive vehicles is a significant factor driving the segment's growth. The leading companies around the region are expected to launch numerous projects and investments to increase vehicle production across the country in the coming years.

- For instance, in June 2023, Ford announced it would open a USD 2 billion electric vehicle factory in Cologne, Germany, to produce 250,000 electric vehicles each year. The Cologne EV plant is likely to achieve the automaker's goal of producing 2 million EVs annually by 2026. These types of projects boost EV production and, in turn, the demand for SLI batteries.

- Such initiatives and developments are likely to boost the growth of the automotive end-user segment.

Germany SLI Battery Industry Overview

The German SLI battery market is semi-fragmented. Key players (not in particular order) include Exide Technologies, EnerSys, East Penn Manufacturing Co., Luminous Power Technologies Pvt. Ltd, and Amara Raja Batteries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Pestle Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Amara Raja Batteries Ltd

- 6.3.2 Exide Technologies

- 6.3.3 Luminous Power Technologies Pvt. Ltd.

- 6.3.4 EnerSys

- 6.3.5 HBL Power Systems Ltd.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 FIAMM Energy Technology

- 6.3.8 Clarios

- 6.3.9 SAFT Groupe SA

- 6.3.10 Varta AG

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Focus on Battery Recycling

- 7.2 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

02-2729-4219

+886-2-2729-4219