|

市場調查報告書

商品編碼

1636220

中東和非洲的 SLI 電池:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Middle East And Africa SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

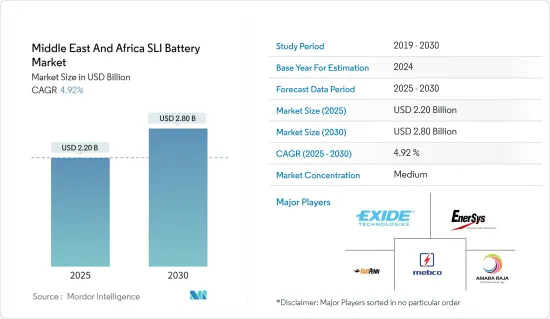

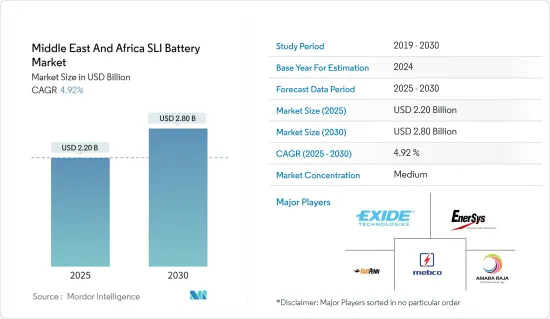

中東和非洲SLI電池市場規模預計到2025年為22億美元,預計到2030年將達到28億美元,預測期內(2025-2030年)複合年成長率為4.92%。

主要亮點

- 從中期來看,工業和農業應用對 SLI 電池的需求不斷增加,以及汽車普及率的不斷提高,預計將在預測期內推動 SLI 電池的需求。

- 另一方面,由於替代電池的滲透率不斷提高,中東和非洲SLI電池市場的成長預計將受到限制。

- 儘管如此,人們對電池回收的日益關注及其在新興市場(無論是新車還是售後市場更換)的擴張預計將在不久的將來為 SLI 電池市場參與者提供重大機會。

- 由於電動車的採用不斷增加,預計阿拉伯聯合大公國將成為預測期內調查市場中成長最快的地區。

中東和非洲SLI電池市場趨勢

汽車普及帶動市場

- 中東和非洲汽車的激增正在推動 SLI 電池市場的顯著成長。汽車普及率的不斷提高對SLI電池市場產生了直接影響,推動了對可靠、高效汽車電池的需求。

- 此外,強勁的汽車生產和銷售正在推動中東和非洲對 SLI 電池的需求。阿拉伯聯合大公國 (UAE) 和以色列是重要的汽車市場,新車和售後替換電池均使用 SLI 電池。在此期間,電動車銷量大幅成長。

- 根據國際能源總署(IEA)預測,到2023年,包括以色列在內的中東和非洲主要國家的電動車銷量將達到65,000輛,其次是阿拉伯聯合大公國,銷量為28,900輛。未來幾年,隨著眾多計劃的啟動,銷售量預計將呈指數級成長,這可能會直接增加預測期內對SLI電池的需求。

- 中東和非洲的汽車市場正在擴大,多家全球汽車製造商在該地區建立了製造和組裝工廠。這種本地生產支持了車輛的可用性和可負擔性,並滿足了全部區域對車輛不斷成長的需求。

- 例如,2023年9月,肯亞政府與一家電動機車製造商合作,為這個東非國家帶來了超過100萬輛電動車。作為協議的一部分,Spiro 計劃在該國安裝 3,000 個電池充電和交換站並建立製造工廠,以加強肯亞的電動車基礎設施。未來幾年,此類計劃可能會增加全部區域的汽車產量和對 SLI 電池的需求。

- 此外,主要企業正在推進閥控式鉛酸電池 (VRLA) 等電池技術,此類電池因其免維護和性能改進而變得越來越受歡迎。這些電池在許多應用中逐漸取代傳統電解型鉛酸電池,並在預測期內為汽車應用創造機會。

- 此類計劃和投資可能會增加該全部區域的汽車產量,並在預測期內增加對 SLI 電池的需求。

阿拉伯聯合大公國實現顯著成長

- 由於多種因素,包括車輛採用率的增加、電池技術的進步以及對節能解決方案的日益重視,阿拉伯聯合大公國 SLI 電池市場預計將成長。

- 電動車(EV)產量的增加將對SLI電池市場產生重大影響。全部區域對電動車的需求正在顯著增加,阿拉伯聯合大公國是主要生產國之一。

- 根據國際能源總署統計,2023年阿拉伯聯合大公國電動車總銷量為28,900輛,較2022年成長52.9%。由於眾多計劃即將推出,預計未來幾年銷量將呈指數級成長,這將直接增加預測期內對 SLI 電池的需求。

- 此外,阿拉伯聯合大公國正在積極推廣電動車(EV)的使用,以實現永續交通。隨著世界透過鼓勵使用電動車走向更綠色的未來,該國正在擁抱電力革命。

- 例如,能源和基礎設施部(MoEI)宣布了電動車政策,旨在作為一個強大的法規結構,促進電動車充電站基礎設施的標準化,以滿足電動車的充電需求。這些政策和舉措將刺激電動車需求,對當地 SLI 電池市場產生重大影響。

- 此外,為了滿足不斷成長的需求,製造商正在投資先進的電池技術,以提供更好的性能、更長的使用壽命和更環保。預計這將刺激該地區 SLI 電池市場的創新。

- 例如,2024年3月,浦項大學的研究團隊有效提升了固態電池的壽命和效率。底部電塗裝是使這一結果成為可能的突破性策略。這導致人們繼續研究在固態固態電池中使用固體電解質和元素鋰 (Li),以提供更安全的選擇。這些進步預計將增加未來幾年對先進技術的需求,並在預測期內增加對 SLI 電池的需求。

- 此類計劃和開發可能會增加未來全國對 SLI 電池的需求。

中東和非洲SLI電池產業概況

中東和非洲的 SLI 電池市場處於半分散狀態。主要參與者(排名不分先後)是 Exide Technologies、EnerSys、Middle East Penn Manufacturing Co、Amara Raja Batteries Ltd. 和 Middle East Battery Company (MEBCO)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 汽車普及率不斷提高

- 工業和農業應用對 SLI 電池的需求不斷成長

- 抑制因素

- 替代電池的擴展

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按類型

- 電池被淹

- VRLA 電池

- EBF電池

- 按最終用戶

- 車

- 其他最終用戶

- 按地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 卡達

- 其他中東和非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- Strategies Adopted & SWOT Analysis for Leading Players

- 公司簡介

- Amara Raja Batteries Ltd

- Exide Technologies

- Middle East Battery Company(MEBCO)

- EnerSys

- Leoch International Technology Limited Inc.

- East Penn Manufacturing Company

- C&D Technologies Inc.

- Clarios International Inc.

- SAFT Groupe SA

- First National Battery Pty Ltd

- List of Other Prominent Companies(Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 市場排名分析

第7章 市場機會及未來趨勢

- 新興市場擴大新車和售後更換

簡介目錄

Product Code: 50003483

The Middle East And Africa SLI Battery Market size is estimated at USD 2.20 billion in 2025, and is expected to reach USD 2.80 billion by 2030, at a CAGR of 4.92% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing demand for SLI batteries from industrial and agricultural applications and increasing adoption of motor vehicles are expected to drive the demand for SLI batteries during the forecast period.

- On the other hand, the increasing penetration of alternative battery chemistries is expected to restrain the growth of the SLI battery market in Middle East and Africa.

- Nevertheless, increased focus on battery recycling and expansion in emerging markets for both new vehicles and after-market replacements are expected to create significant opportunities for SLI battery market players in the near future.

- The United Arab Emirates is expected to be the fastest-growing region in the market studied during the forecast period due to the rising adoption of electric motor vehicles.

Middle East and Africa SLI Battery Market Trends

Increasing Adoption of Motor Vehicles Drives the Market

- The increasing adoption of motor vehicles in Middle East and Africa is driving significant growth in the SLI battery market. The increasing adoption of motor vehicles directly impacts the SLI battery market, driving demand for reliable and efficient automotive batteries.

- Furthermore, robust automotive production and sales are bolstering the demand for SLI batteries in Middle East and Africa. The United Arab Emirates (UAE) and Israel are significant automotive markets, and SLI batteries are used in both new vehicles and aftermarket replacements. The sales of electric vehicles rose significantly over the period.

- According to the International Energy Agency, in 2023, the total EV sales across major countries in Middle East and Africa, like Israel, were 65,000 units, followed by the United Arab Emirates at 28,900 units. Sales are expected to rise exponentially in the coming years as numerous projects are initiated, which may directly raise the demand for SLI batteries during the forecast period.

- The automotive market in the Middle East and Africa is expanding, with several global automakers establishing manufacturing and assembly plants in the region. This local production supports vehicle availability and affordability and fulfills the rising demand for motor vehicles across the region.

- For instance, in September 2023, the Kenyan government joined forces with an electric motorbike producer to bring over a million electric vehicles into the East African nation. As part of the deal, Spiro plans to establish 3,000 battery charging and swapping stations to enhance Kenya's EV infrastructure and establish a manufacturing facility within the country. Such projects are likely to raise the production of motor vehicles and the demand for SLI batteries across the region in the coming years.

- Additionally, companies are advancing in battery technology, such as valve-regulated lead-acid (VRLA) batteries, which are becoming more popular due to their maintenance-free nature and improved performance. These batteries are gradually replacing traditional flooded lead-acid batteries in many applications, creating opportunities for motor vehicles during the forecast period.

- Such projects and investments are likely to increase motor vehicle production across the region, thereby increasing demand for SLI batteries during the forecast period.

The United Arab Emirates to Witness Significant Growth

- The SLI battery market in the United Arab Emirates is expected to experience growth driven by various factors, such as the increasing adoption of motor vehicles, advancements in battery technology, and a rising emphasis on energy-efficient solutions.

- The rising production of electric vehicles (EVs) has significant implications for the SLI battery market. The demand for EVs is rising significantly across the region, with the United Arab Emirates being one of the leading producers.

- According to the International Energy Agency, in 2023, the total number of EVs sold in the United Arab Emirates was 28,900, an increase of 52.9% compared to 2022. Sales are expected to rise exponentially in the coming years as numerous projects are initiated soon, directly raising the demand for SLI batteries during the forecast period.

- Furthermore, to achieve sustainable transportation, the United Arab Emirates is actively promoting the use of electric vehicles (EVs). The country is embracing the electric revolution as the world transitions toward a greener future by encouraging the use of electric vehicles.

- For instance, the Ministry of Energy and Infrastructure (MoEI) announced an electric vehicle policy that is envisaged to serve as a robust regulatory framework to facilitate standards for the infrastructure of electric vehicle charging stations that could cater to the charging demand of electric vehicles. These policies and initiatives are poised to significantly impact the local SLI battery market by boosting demand for EVs.

- Moreover, to meet the rising demand, manufacturers are investing in advanced battery technologies that offer better performance and longer life and are more environmentally friendly. This is likely to spur innovation in the SLI battery market across the region.

- For instance, in March 2024, a group of researchers from Pohang University effectively improved the longevity and efficiency of all-solid-state batteries. Bottom electrodeposition is a revolutionary strategy that made this accomplishment possible. To provide a safer alternative, this leads to continued research into the use of solid electrolytes and the element lithium (Li) in all-solid-state batteries. Such advancements are likely to raise the demand for advanced technology in the coming years and increase the demand for SLI batteries during the forecast period.

- Such projects and developments are likely to raise the demand for SLI batteries across the country in the future.

Middle East and Africa SLI Battery Industry Overview

The Middle East and Africa SLI battery market is semi-fragmented. Some key players (not in particular order) are Exide Technologies, EnerSys, East Penn Manufacturing Co., Amara Raja Batteries Ltd, and Middle East Battery Company (MEBCO).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Other End Users

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Egypt

- 5.3.5 Nigeria

- 5.3.6 Qatar

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Amara Raja Batteries Ltd

- 6.3.2 Exide Technologies

- 6.3.3 Middle East Battery Company (MEBCO)

- 6.3.4 EnerSys

- 6.3.5 Leoch International Technology Limited Inc.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 C&D Technologies Inc.

- 6.3.8 Clarios International Inc.

- 6.3.9 SAFT Groupe SA

- 6.3.10 First National Battery Pty Ltd

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Markets for Both New Vehicles and After-market Replacements

02-2729-4219

+886-2-2729-4219