|

市場調查報告書

商品編碼

1636219

中國SLI電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

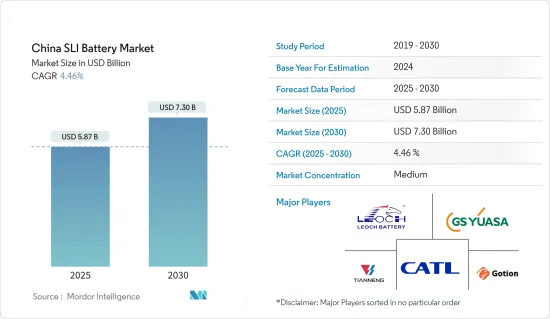

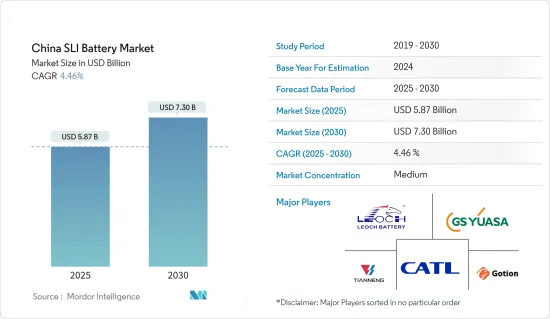

預計2025年中國SLI電池市場規模為58.7億美元,預計2030年將達73億美元,預測期間(2025-2030年)複合年成長率為4.46%。

主要亮點

- 從中期來看,該地區汽車產業的成長、政府對電池製造的支持性政策和法規等因素預計將成為預測期內中國SLI電池市場的主要驅動力。

- 另一方面,來自替代電池化學物質的競爭正在加劇,可能對預測期內的市場研究構成威脅。

- 儘管如此,對 SLI 電池的持續研發工作預計將在未來為 SLI 電池市場創造多個機會。

中國SLI電池市場趨勢

VRLA 電池大幅成長

- 在中國汽車工業的快速成長和對免維護電池解決方案的需求不斷成長的推動下,閥控式鉛酸電池(VRLA)產業已成為中國SLI電池市場的主要參與者。 VRLA電池也稱為密閉式鉛酸電池,由於與傳統電解型鉛酸電池相比具有許多優點,因此在SLI市場中受到歡迎。

- 這些好處包括提高安全性、減少維護要求以及提高極端溫度下的性能。隨著中國作為全球最大汽車產業的地位不斷鞏固,SLI市場對VRLA電池的需求顯著成長,國內外製造商都在爭奪這個競爭激烈的市場佔有率。

- 根據國際汽車工業組織統計,由於國內外市場對汽車的需求迅速增加,中國汽車產量逐年大幅增加。例如,2022年至2023年,產量將成長11.6%以上,複合年成長率約為3.5%,顯示我國汽車工業正在快速成長。

- 近年來,中國的 SLI VRLA 電池產業取得了顯著的技術進步,製造商專注於提高電池壽命、充電接受能力和整體效率。該領域的主要趨勢之一是增強板柵合金和活性材料配方的開發,從而延長循環壽命並改善冷啟動性能。

- 例如,2023年12月,TAILG推出了尖端鈉離子電池技術,開啟了SLI電池領域的新篇章。與傳統 VRLA 電池相比,這項創新技術具有令人印象深刻的遠距性能、延長的保固期、改進的低溫耐用性和增強的安全功能。 TAILG的高階電動自行車將是配備這種先進鈉離子電池的先鋒車型,並將在中國獨家推出。

- 此外,隔膜技術的進步提高了電解保留率並降低了內阻,進一步提高了 VRLA 電池在 SLI 應用中的整體性能。這些技術改進不僅使 VRLA 電池相對於傳統的基於電解的鉛酸電池更具競爭力,而且使 VRLA 電池成為某些汽車應用中新興電池技術的可行替代品。

- 因此,鑑於上述幾點,VRLA電池類型預計在預測期內將顯著成長。

汽車產業的擴張推動市場成長

- 中國汽車工業的快速成長預計將成為未來幾年中國 SLI 電池市場的主要推動力。作為全球最大的汽車市場,中國汽車產銷量持續高速成長,對SLI電池的需求不斷成長。這種成長不僅受到國內消費的推動,也受到中國作為世界汽車製造中心的崛起的推動。

- 中國推動汽車電氣化(重點是全電動和插電式混合動力汽車)也正在影響 SLI 電池市場。輕度混合動力車和微混合動力汽車仍然依賴內燃機,但採用了不同程度的電氣化,其發展正在為 SLI 電池製造商創造新的機會。這些混合動力系統通常需要更先進的電池解決方案,既可以處理傳統的啟動功能,也可以處理再生煞車和其他電力負載。

- 例如,根據國際能源總署(IEA)的數據,混合動力汽車在中國獲得了大力支持。 2022年至2023年,該國混合動力汽車銷量成長80%,2019年至2023年複合年成長率超過214.78%。這表明混合動力汽車在該國的普及,進而將推動對 SLI 電池的需求。

- 隨著中國汽車製造商擴大採用這些混合動力技術作為全面電氣化的基石,對能夠滿足這兩個要求的先進 SLI 電池的需求預計將會增加。這一趨勢凸顯了 SLI 電池產業需要持續創新,以滿足中國不斷變化的汽車格局。

- 例如,2024年1月,中國制定了更雄心勃勃的目標,到2027年新能源汽車佔新車銷量的45%,以適應電動車型的快速普及。這一轉變預計將對 SLI 電池市場產生重大影響,傳統汽車電池的需求預計將下降,先進的電池技術將被採用。

- 日本的汽車生產規模如此之大,需要強大的汽車零件供應鏈,其中包括SLI電池,這對於傳統內燃機汽車的啟動、照明和點火系統至關重要。隨著越來越多的汽車下線並上路,對原始設備(OE)和替換SLI電池的需求預計將激增,這為在中國市場營運的電池製造商帶來了巨大的成長機會。

- 因此,如前所述,中國汽車工業的擴張預計將在預測期內推動市場。

中國SLI電池產業概況

中國的SLI電池市場呈現半瓜分狀態。市場的主要企業(排名不分先後)包括GS湯淺國際有限公司、天能電池Group Limited、理士國際科技有限公司、寧德時代新能源科技有限公司、寧德時代新能源科技有限公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 不斷成長的汽車工業

- 政府扶持政策

- 抑制因素

- 與替代電池的競爭

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 按類型

- 電池被淹

- VRLA 電池

- EBF電池

- 按最終用戶

- 車

- 其他最終用戶

第6章 競爭狀況

- 併購、合資、聯盟、協議

- Strategies Adopted & SWOT Analysis for Leading Players

- 公司簡介

- GS Yuasa International Ltd

- Tianneng Battery Group Co.

- Leoch International Technology Limited Inc.

- Contemporary Amperex Technology Co. Limited

- Gotion Inc.

- Farasis Energy(GanZhou)Co. Ltd

- Clarios International Inc.

- Guangzhou NPP Power Co. Ltd

- Qingyuan Yiyuan Power Supply Co. Ltd

- EVE Energy Co. Ltd

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第7章 市場機會及未來趨勢

- 研發投資

簡介目錄

Product Code: 50003482

The China SLI Battery Market size is estimated at USD 5.87 billion in 2025, and is expected to reach USD 7.30 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing automotive industry in the region and supportive government policies and regulations regarding battery manufacturing in the country are expected to be significant drivers for the Chinese SLI battery market during the forecast period.

- On the other hand, there is increasing competition from alternate battery chemistries that may pose a threat to the market studied during the forecast period.

- Nevertheless, continued efforts to conduct research and development regarding SLI batteries are expected to create several opportunities for the SLI battery market in the future.

China SLI Battery Market Trends

VRLA Battery to Witness Significant Growth

- The valve-regulated lead-acid (VRLA) battery segment has emerged as a significant player in the Chinese SLI battery market, driven by the country's rapidly growing automotive industry and increasing demand for maintenance-free battery solutions. VRLA batteries, also known as sealed lead-acid batteries, have gained popularity in the SLI market due to their numerous advantages over traditional flooded lead-acid batteries.

- These benefits include improved safety, reduced maintenance requirements, and enhanced performance in extreme temperatures. As China continues to solidify its position as the world's largest automotive industry, the demand for VRLA batteries in the SLI market has experienced substantial growth, with both domestic and international manufacturers vying for market share in this highly competitive landscape.

- According to the International Organization of Motor Vehicle Manufacturers, automobile production in China has been on a significant rise over the years due to burgeoning automobile demands from both domestic and international markets. For instance, between 2022 and 2023, production increased by more than 11.6%, with an annual average growth rate of approximately 3.5%, signifying the rapid growth in the country's automobile industry.

- The Chinese VRLA battery industry for SLI applications has witnessed remarkable technological advancements in recent years, with manufacturers focusing on improving battery life, charge acceptance, and overall efficiency. One of the key trends in this segment is the development of enhanced grid alloys and active material formulations, which have led to increased cycle life and improved cold-cranking performance.

- For instance, in December 2023, TAILG unveiled its cutting-edge sodium-ion battery technology, heralding a new chapter in the realm of SLI batteries. This innovative technology, which surpasses traditional VRLA batteries, boasts impressive long-range capabilities, extended warranties, heightened low-temperature resilience, and bolstered safety features. TAILG's premium e-bikes are expected to lead the charge, becoming the pioneering models to showcase these advanced sodium-ion batteries, with an initial launch set exclusively in China.

- Additionally, advancements in separator technology have resulted in better electrolyte retention and reduced internal resistance, further enhancing the overall performance of VRLA batteries in SLI applications. These technological improvements not only boosted the competitiveness of VRLA batteries against traditional flooded lead-acid batteries but also positioned them as viable alternatives to emerging battery technologies in specific automotive applications.

- Therefore, as per the points mentioned above, the VRLA battery types are expected to witness significant growth during the forecast period.

Expanding Automotive Industry to Drive the Market's Growth

- The rapid growth of China's automotive industry is poised to be a primary driver for the country's SLI battery market in the coming years. As the world's largest automotive market, China's vehicle production and sales volumes continue to expand at a remarkable pace, creating an ever-increasing demand for SLI batteries. This growth is not only driven by domestic consumption but also by China's rising prominence as a global automotive manufacturing hub.

- China's push toward vehicle electrification, while primarily focused on fully electric and plug-in hybrid vehicles, has implications for the SLI battery market. The development of mild hybrid and micro-hybrid vehicles, which still rely on internal combustion engines but incorporate varying degrees of electrification, creates new opportunities for SLI battery manufacturers. These hybrid systems often require more sophisticated battery solutions that can handle both traditional starting functions and support regenerative braking and other electrical loads.

- For instance, according to the International Energy Agency, hybrid vehicles have gained massive traction in China. Between 2022 and 2023, the sales of hybrid vehicles in the country increased by 80%, while between 2019 and 2023, the annual average growth rate was over 214.78%. This signifies the popularity of hybrid vehicles in the country, which, in turn, drives the demand for SLI batteries.

- As Chinese automakers increasingly adopt these hybrid technologies as a stepping stone toward full electrification, the demand for advanced SLI batteries capable of meeting these dual requirements is expected to rise. This trend underscores the need for continuous innovation in the SLI battery industry to keep pace with China's evolving automotive landscape.

- For instance, in January 2024, China set a more ambitious target, aiming for new energy vehicles to constitute 45% of all new auto sales by 2027, responding to the rapid adoption of electric models. This shift is expected to significantly impact the market for SLI batteries, as the demand for traditional automotive batteries is expected to decline in favor of advanced battery technologies.

- The sheer scale of vehicle production in the country necessitates a robust supply chain for automotive components, including SLI batteries, which are essential for the starting, lighting, and ignition systems of conventional internal combustion engine vehicles. As more vehicles roll off production lines and onto Chinese roads, the demand for both original equipment (OE) and replacement SLI batteries is expected to surge, providing substantial growth opportunities for battery manufacturers operating in the Chinese market.

- Therefore, as mentioned above, the country's expanding automotive industry is expected to drive the market during the forecast period.

China SLI Battery Industry Overview

The Chinese SLI battery market is semi-fragmented. Some of the key players in this market (in no particular order) are GS Yuasa International Ltd, Tianneng Battery Group Co., Leoch International Technology Limited Inc., Contemporary Amperex Technology Co. Limited, and Gotion Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Automotive Industry

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 Competition From Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd

- 6.3.2 Tianneng Battery Group Co.

- 6.3.3 Leoch International Technology Limited Inc.

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 Gotion Inc.

- 6.3.6 Farasis Energy (GanZhou) Co. Ltd

- 6.3.7 Clarios International Inc.

- 6.3.8 Guangzhou NPP Power Co. Ltd

- 6.3.9 Qingyuan Yiyuan Power Supply Co. Ltd

- 6.3.10 EVE Energy Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Investment in Research and Development Activities

02-2729-4219

+886-2-2729-4219