|

市場調查報告書

商品編碼

1636488

印度電動車電池電解:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

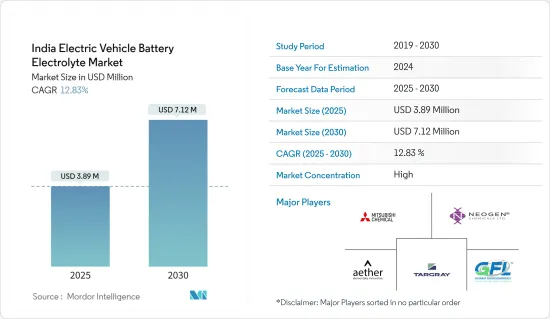

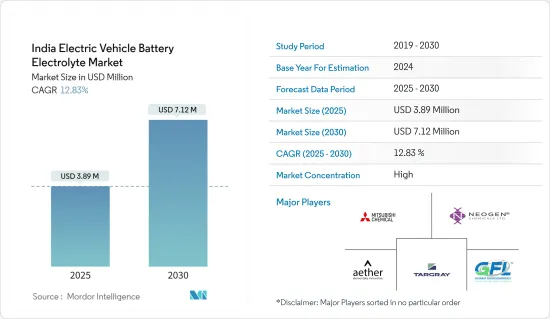

印度電動車電池電解市場規模預計到2025年為389萬美元,預計2030年將達到712萬美元,預測期內(2025-2030年)複合年成長率為12.83%。

主要亮點

- 從中期來看,預計市場將受到電動車滲透率不斷提高、政府措施和相關投資的推動。

- 另一方面,與原料可得性和供應相關的挑戰預計將對市場產生負面影響。

- 電解質材料的持續研發有望為市場提供未來的成長機會。

- 研究期間,鋰離子電池類型預計將成為印度電動車電池電解的最大市場。

印度電動車電池電解市場趨勢

鋰離子電池成長顯著

- 鋰離子電池處於電動車 (EV) 革命的前沿。由於其卓越的能量密度和較長的使用壽命,它們在汽車行業向永續能源解決方案的轉變中發揮著至關重要的作用。

- 2023年4月,Neogen Chemicals與日本MU Ionic Solutions Corporation合作,加強其製造能力。該協議允許 Neogen 利用 MUIS 的專有製造技術。這項策略性舉措使Neogen能夠在印度每年生產30,000噸電解液,直接滿足國內鋰離子電池製造商不斷成長的需求。此類新興市場的發展將推動電動車電池電解市場的成長。

- 同樣,2023年4月,古吉拉特氟化工公司(GFL)宣布了一項為期三年的6億美元投資計劃,用於在印度生產電池和電解槽。該公司位於古吉拉突邦Dahej 的工廠將開始生產六氟磷酸鋰 (LiPF6),這是一種鋰離子電池的關鍵電解質鹽。 GFL計畫從年產能1,800噸開始擴大規模,以滿足快速成長的鋰離子電池需求,並支持印度電動車電解市場的擴張。

- 2023 年 12 月,Ami Organics 與一家著名的全球電解質公司簽署了合作備忘錄,為在古吉拉突邦生產電池和電解質鋪平了道路。為了體現其對印度「印度製造」計畫的承諾,Ami Organics 將投資 3,580 萬美元建造專用電解生產設施。

- 近年來,鋰離子電池價格暴跌,相關零件需求增加。根據彭博社NEF報道,2023年鋰離子電池的平均價格將為139美元/度數,較2014年下降了五倍。價格下降正在加速鋰離子電池的採用,並預示著電解液市場的光明前景。

- 鑑於鋰離子電池和電解生產的上述趨勢,印度電動車電池電解市場未來幾年可能會大幅成長。

政府鼓勵電動車普及的激勵措施

- 電動車 (EV) 在減少交通部門的碳排放方面發揮著至關重要的作用。印度政府的FAME India計畫正積極推動電動和混合動力汽車的採用,目標是到2030年將所有交通工具的30%轉換為電動車。電動車普及率的激增預計將使印度電動車電池電解液市場受益。

- 同時,印度的生產連結獎勵(PLI) 計畫已獲得核准,預算為 30.9 億美元,以促進該國的電動車製造。 PLI系統為汽車製造商提供電動車年銷量13-15%的政府補助。這項激勵措施不僅旨在增加電動車銷量,還幫助製造商降低與投資新技術相關的成本。因此,這項舉措刺激了印度各地對電動車電池電解的需求。

- 此外,電動交通促進計畫(EMPS)培育印度電動車製造生態系統,同時鼓勵使用電動二輪車和電動三輪車。 EMPS 提供每千瓦時電池容量約 60 美元的補貼。不過,這項補貼要么是出廠價(不含稅的車輛價格)的 15%,要么有一定的上限(摩托車約為 120 美元,電動人力車和電動推車約為 300 美元,電動機車約為600 美元) )。預計此類措施將增加印度對電動車電池電解質等零件的需求。

- 此外,印度電動車市場近年來呈現持續上升趨勢。國際能源總署的資料顯示,2023年印度電動車銷量將達到8.2萬輛,與前一年同期比較成長驚人的70%。在此勢頭下,印度電動車需求可望進一步成長,電解市場也可望重振。

- 考慮到這些趨勢和市場發展,印度電動車電池電解液市場前景被認為是充滿希望的。

印度電動汽車電池電解產業概況

印度電動車電池電解市場正走向半固體。主要企業(排名不分先後)包括 Neogen Chemicals、Gujarat Fluorochemicals、Mitsubishi Chemical Group Corporation、Targray Technology International Inc 和 Aether Industries Limited。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府支持電動車引進的措施

- 鋰離子電池價格下降

- 抑制因素

- 原料可用性和供應限制

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 電解質類型

- 液體電解質

- 凝膠電解質

- 固體電解質

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Ami Organics Electrolytes Private Ltd.

- Neogen Chemicals

- Gujarat Fluorochemicals

- 3M India

- BASF Shanshan Battery Materials Co.

- Targray Technology International Inc

- Aether Industries Limited

- Tatva Chintan Pharma Chem Limited

- Mitsubishi Chemical Group

- SK Industries

第7章 市場機會及未來趨勢

- 電解質材料的研發

The India Electric Vehicle Battery Electrolyte Market size is estimated at USD 3.89 million in 2025, and is expected to reach USD 7.12 million by 2030, at a CAGR of 12.83% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles, government policies, and associated investments in them are likely to drive the market.

- On the other hand, challenges associated with raw material availability and supply is expected to have a negative impact on the market.

- Continuous research and development in electrolyte materials is expected to provide future growth opportunities for the market.

- The lithium-ion battery type is expected to be the largest market for the India Electric Vehicle Battery Electrolyte during the study period.

India Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery to Grow Significantly

- Lithium-ion batteries are at the forefront of the electric vehicle (EV) revolution. Their superior energy density and extended life cycle make them pivotal to the automotive industry's shift toward sustainable energy solutions.

- In April 2023, Neogen Chemicals bolstered its manufacturing capabilities through a partnership with Japan's MU Ionic Solutions Corporation. The agreement allows Neogen to leverage MUIS's proprietary manufacturing technology. This strategic move positions Neogen to produce 30,000 MT annually of electrolyte solutions in India, directly addressing the rising demand from domestic lithium-ion cell manufacturers. Such developments are poised to fuel the growth of the electric vehicle battery electrolyte market.

- Similarly, in April 2023, Gujarat Fluorochemicals (GFL) announced a USD 600 million investment plan over three years, targeting battery and electrolyzer production in India. Their facility in Dahej, Gujarat, will commence operations with the production of Lithium hexafluorophosphate (LiPF6), a crucial electrolyte salt for lithium-ion batteries. Starting with a production capacity of 1800 tonnes per annum (tpa), GFL plans to scale up in response to the burgeoning demand for lithium-ion batteries, underscoring the expanding electric vehicle battery electrolyte market in India.

- In December 2023, Ami Organics entered into a Memorandum of Understanding with a prominent global electrolyte firm, paving the way for battery cell and electrolyte production in Gujarat. Demonstrating its commitment to India's "Make in India" initiative, Ami Organics is investing USD 35.8 million in a dedicated electrolyte production facility.

- Over the years, lithium-ion battery prices have plummeted, driving up demand for related components. Bloomberg NEF reports that the average lithium-ion battery price in 2023 was USD 139 USD/KWh, marking a staggering fivefold reduction since 2014. This price drop has accelerated the adoption of lithium-ion batteries, suggesting a bright future for the electrolyte market.

- Given the aforementioned trends in lithium-ion batteries and electrolyte production, the electric vehicle battery electrolyte market in India is poised for significant growth in the coming years.

Government Incentives to Raise Adoption of Electric Vehicles

- Electric vehicles (EVs) play a pivotal role in curbing carbon emissions from the transportation sector. The Indian government's FAME India scheme actively promotes the adoption of electric and hybrid vehicles, targeting a transition of 30% of total transportation to electric vehicles by 2030. This anticipated surge in electric vehicle adoption is poised to benefit India's electric vehicle battery electrolyte market.

- In a parallel effort, India's Production Linked Incentive (PLI) scheme, with an approved budget of USD 3.09 billion, has bolstered domestic electric vehicle manufacturing. The PLI scheme offers automakers a government grant ranging from 13-15% of their annual electric vehicle sales value. This incentive not only aims to amplify EV sales but also assists manufacturers in mitigating the costs associated with new technology investments. Consequently, this initiative has spurred demand for electrolytes in electric vehicle batteries across India.

- Furthermore, the Electric Mobility Promotion Scheme (EMPS) champions the use of electric two-wheelers and three-wheelers while simultaneously nurturing India's electric vehicle manufacturing ecosystem. Under the EMPS, a subsidy of approximately USD 60 is granted for each kilowatt hour of battery capacity. However, this subsidy is limited to 15% of the ex-factory cost (the vehicle's price at the factory gate before taxes) or specific caps: around USD 120 for two-wheelers, USD 300 for e-rickshaws and e-carts, and USD 600 for e-autos, whichever is lower for each category. Such initiatives are anticipated to elevate the demand for components like electrolytes in India's electric vehicle batteries.

- Additionally, India's electric vehicle market has shown a consistent upward trajectory in recent years. Data from the International Energy Agency reveals that electric car sales in India reached 82,000 units in 2023, marking a staggering 70% surge from the prior year. Given this momentum, the demand for electric vehicles in India is poised for further growth, which in turn is set to invigorate the electrolyte market.

- In light of these trends and developments, the outlook for India's Electric Vehicle Battery electrolyte Market appears promising.

India Electric Vehicle Battery Electrolyte Industry Overview

The India electric vehicle battery electrolyte market is semi-consolidated. Some of the major players (not in particular order) include Neogen Chemicals, Gujarat Fluorochemicals, Mitsubishi Chemical Group, Targray Technology International Inc, and Aether Industries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government policies supporting adoption of electric vehicles

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Limited avalibility and supply of raw materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid Batteries

- 5.1.2 Lithium-ion Batteries

- 5.1.3 Other Battery Types

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ami Organics Electrolytes Private Ltd.

- 6.3.2 Neogen Chemicals

- 6.3.3 Gujarat Fluorochemicals

- 6.3.4 3M India

- 6.3.5 BASF Shanshan Battery Materials Co.

- 6.3.6 Targray Technology International Inc

- 6.3.7 Aether Industries Limited

- 6.3.8 Tatva Chintan Pharma Chem Limited

- 6.3.9 Mitsubishi Chemical Group

- 6.3.10 S K Industries

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research & Development in electrolyte material