|

市場調查報告書

商品編碼

1636545

亞太地區充電電池:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Asia-Pacific Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

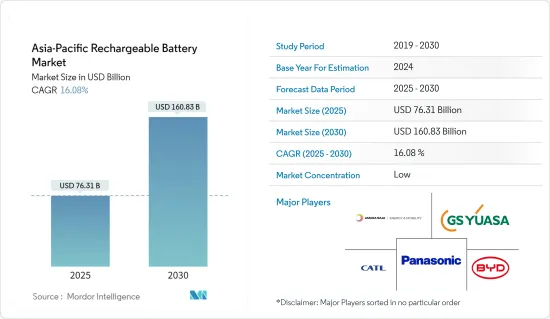

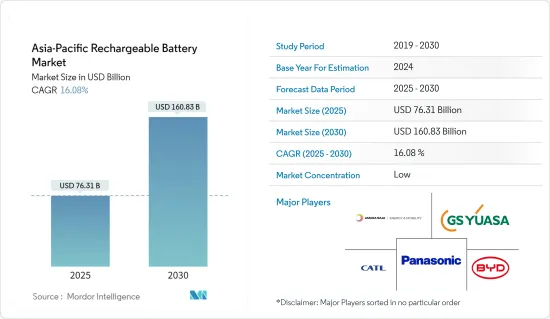

亞太地區充電電池市場規模預估至2025年為763.1億美元,預估至2030年將達1,608.3億美元,預測期間(2025-2030年)複合年成長率為16.08%。

主要亮點

- 從中期來看,鋰離子電池價格的下降、電動車滲透率的提高以及可再生能源領域的擴張預計將在預測期內推動亞太二次電池市場的發展。

- 另一方面,原料供需不匹配預計將阻礙預測期內的市場成長。

- 由於新電池技術和先進電池化學物質的不斷發展,亞太二次電池市場可能會產生巨大的商機。

- 在該地區的國家中,由於電動車、家用電子電器產品和可再生計劃擴大採用能源儲存系統,印度預計將出現強勁成長。

亞太二次電池市場趨勢

鋰離子電池成長迅速

- 在各種電池技術中,鋰離子電池(LIB)在二次電池市場中佔據主導地位,預計在預測期內將快速成長。鋰離子電池因其優越的容量重量比、較長的保存期限、較低的維護要求以及不斷下降的價格而變得比其他類型的電池更受歡迎。

- 與傳統鉛酸電池相比,鋰離子電池具有多項技術優勢。鉛酸電池通常永續 400 到 500 次循環,而可充電鋰離子電池永續超過 5,000 次循環。此外,鋰離子電池需要較少的維護和更換。它還可以在整個放電週期中保持穩定的電壓,從而提高所連接電氣組件的效率。

- 亞太地區的主要企業正在大力投資鋰離子電池,並專注於研發和規模經濟。這種競爭的加劇正在壓低鋰離子電池的價格。由於技術進步、製造最佳化以及原料成本降低,鋰離子電池的平均價格已從2013年的780美元/千瓦時暴跌至2023年的139美元/千瓦時。預計2025年將進一步降至113美元/度左右,2030年將進一步降至80美元/度左右。按地區分類,2023年中國電池組平均價格將創下最低紀錄,為126美元/度。中國國內激烈的競爭促使製造商增加產量,以滿足快速成長的電池需求。電池成本的這種下降趨勢很可能使鋰電池成為所有電池中的有利選擇。

- 從歷史上看,鋰離子電池曾為行動電話和筆記型電腦等家用電子電器產品提供動力。近年來,它已被應用於混合動力汽車、各類純電動車(BEV)、可再生能源中的電池能源儲存系統(BESS)等。

- 例如,電網規模的電池儲能系統對於實現淨零排放至關重要。我們列出了從短期平衡和電網穩定性到長期能源儲存和斷電後恢復的基本服務。國際能源總署(IEA)預測,電網規模的電池將引領能源儲存的成長。 2022年,每年系統規模蓄電池擴容1,121萬千瓦中,中國佔比將超過42%,總合超過481萬千瓦。中國計劃在 2025 年安裝超過 30 GW 的 BESS(主要使用鋰離子電池),中國的雄心壯志表明 BESS 的未來將蓬勃發展,從而導致亞太地區對二次電池的需求激增。

- 2023年12月,韓國財政部宣布計畫未來5年向鋰電池產業注入38兆韓元。韓國將設立1兆韓元的促進基金,並投資736億韓元的研發費用,以加強國內鋰電池生產所需的礦產蘊藏量。這些舉措,再加上培育電池再利用和回收生態系統的努力,將重振鋰離子電池產業並強化二次電池市場。

- 2024年3月,松下集團宣布與印度石油公司(IOCL)成立合資企業,生產圓柱形鋰離子電池。該合資企業基於印度對二輪車、三輪車和 BESS 的需求預測,凸顯了該地區鋰離子二次電池製造的成長趨勢。

- 由於鋰離子電池重量輕、充電快、充電週期長、成本下降和工業進步,預計在預測期內將成為亞太地區成長最快的二次電池市場。

印度正在經歷顯著的成長

- 在電動車 (EV) 普及率不斷提高、家用電子電器需求迅速成長以及政府支持能源儲存解決方案的舉措的推動下,印度可充電電池市場有望實現顯著成長。對市場擴張至關重要的二次電池需求激增,很大程度上是由於家用電子電器領域智慧型手機、筆記型電腦和其他行動裝置的激增。

- 此外,印度政府大力推廣電動車,這增加了對二次電池的需求,特別是在電動車領域。國際能源總署 (IEA) 的資料凸顯了這一趨勢,預計 2023 年印度純電動車 (BEV) 銷量將激增至 82,000 輛左右,與前一年同期比較大幅成長 70%。印度政府制定了雄心勃勃的目標,即到 2030 年,新登記的私家車 30%、巴士 40%、商用車 70%、兩輪和三輪車 80% 為電動車。的需求預計將快速成長。

- 為了加強國內生產並減少電動車電池的進口依賴,印度政府於2021年初推出了生產連結獎勵(PLI)計畫。該計劃將在五年內投資21.2億美元,旨在在該國建立具有競爭力的ACC電池製造系統,產能達到50 GWh,另外5 GWh的利基ACC技術將重點發展。 PLI計劃提供每1KWh補貼以及根據實際銷售增加價值額實現率確定的產量掛鉤補貼。到 2022 年,信實新能源太陽能有限公司、現代全球汽車有限公司、Ola Electric Mobility Private Limited 和 Rajesh Exports Limited 等四家知名公司將獲得該計劃的激勵措施,政府承諾支持擴大國內電池生產。了。

- 利用印度對能源儲存不斷成長的需求以及向永續解決方案的轉變,國內外參與企業正在大力投資印度充電電池市場。例如,2022年4月,電池領域領導企業Exide Industries宣布計畫在卡納塔克邦興建鋰離子電池製造工廠,投資約7.18億美元。該工廠的初始產能為 6GWh,預計將於 2024 年投入運作,並計劃在未來幾年內擴建至 12GWh 的綜合鋰離子電池工廠。

- 另一個值得注意的舉措是,電池技術新興企業Log9 Materials 於 2023 年 4 月在班加羅爾賈庫爾開設了印度第一家鋰離子電池製造工廠。 Log9 的產能從 50MWh 開始,雄心勃勃地規劃到 2025 年第一季將電池製造能力擴大到 1GWh,電池組製造能力擴大到 2GWh。 2024 年 3 月,GoodEnough Energy 宣布計劃於 2024 年 10 月在查謨和克什米爾開始營運印度第一家電池超級工廠。 GoodEnough 的工廠投資15 億印度盧比(1,807 萬美元)建造初始7GWh 工廠,並計劃到2027 年投資30 億印度盧比(3,700 萬美元)將產能增加到20GWh,GoodEnough 的工廠將產生重大影響,並有可能排放重大影響。該超級工廠符合印度雄心勃勃的目標,即到 2030 年將可再生能源產能提高到 500 吉瓦,較 2023 年的 176 吉瓦左右大幅成長。為了進一步加強這些努力,印度政府正在向致力於推廣電池儲存計劃的公司提供價值 4.52 億美元的激勵措施。

- 憑藉龐大的消費群、政府的支持措施以及電池製造的進步,印度充電電池市場在可預見的未來將實現強勁成長。

亞太充電電池產業概況

亞太地區充電電池市場較為分散。該市場的主要企業包括(排名不分先後)松下公司、寧德時代新能源科技有限公司、比亞迪有限公司、GS湯淺公司和Amara Raja Energy & Mobility Ltd.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 鋰離子電池成本下降

- 抑制因素

- 原料供需不匹配

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 科技

- 鉛酸電池

- 鋰離子

- 其他技術(NiMh、Nicd 等)

- 目的

- 汽車電池

- 工業電池(用於電源、固定電池(電信、UPS、能源儲存系統(ESS) 等)

- 可攜式電池(家用電子電器產品等)

- 其他

- 地區

- 印度

- 中國

- 日本

- 韓國

- 泰國

- 印尼

- 越南

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Corporation

- Contemporary Amperex Technology Co. Limited

- BYD Co.Ltd.

- GS Yuasa Corporation

- Samsung SDI Co. Ltd

- LG Chem Ltd.

- Clarios, LLC.

- Amara Raja Energy & Mobility Ltd

- Exide Industries Ltd

- Duracell Inc.

- Saft Groupe SA

- Tianjin Lishen Battery Joint-Stock Co. Ltd.

- Tesla Inc.

- 其他知名公司名單(公司名稱、總部地點、相關產品及服務、聯絡等)

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 新型電池技術與先進電池化學材料的開發進展

簡介目錄

Product Code: 50004021

The Asia-Pacific Rechargeable Battery Market size is estimated at USD 76.31 billion in 2025, and is expected to reach USD 160.83 billion by 2030, at a CAGR of 16.08% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector are expected to drive the Asia-Pacific rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create vast opportunities for the Asia-Pacific rechargeable battery market.

- Among the countries in the region, India is expected to have significant growth due to the rise in the adoption of electric vehicles, consumer electronics, and energy storage systems in renewable projects.

Asia-Pacific Rechargeable Battery Market Trends

Lithium-ion Battery to be the Fastest Growing

- Among various battery technologies, lithium-ion batteries (LIBs) are poised to dominate the rechargeable battery market, showcasing rapid growth during the forecast period. Their rising popularity over other battery types can be attributed to their superior capacity-to-weight ratio, extended shelf life, reduced maintenance needs, and plummeting prices.

- Li-ion batteries boast several technical advantages over traditional lead-acid batteries. While lead-acid batteries typically offer 400-500 cycles, rechargeable Li-ion batteries can exceed 5,000 cycles. Moreover, Li-ion batteries demand less frequent maintenance and replacements. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for connected electrical components.

- Major players in the Asia-Pacific region are heavily investing in lithium-ion batteries, focusing on R&D and economies of scale. This surge in competition has driven down lithium-ion battery prices. Thanks to technological advancements, manufacturing optimizations, and falling raw material costs, the average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further drop to around USD 113/kWh by 2025 and USD 80/kWh by 2030. Regionally, China recorded the lowest average battery pack prices at USD 126/kWh in 2023. Intense local competition in China saw manufacturers ramping up production to capture the burgeoning battery demand. Such declining trends in battery costs are likely to make it a lucrative choice among all batteries.

- Historically, lithium-ion batteries powered consumer electronics like mobile phones and laptops. Recently, they've been adapted for hybrids, the full range of battery electric vehicles (BEVs), and battery energy storage systems (BESS) in renewable energy, largely due to their reduced environmental impact.

- Grid-scale BESS, for instance, is pivotal in achieving Net Zero Emissions. They provide essential services, from short-term balancing and grid stability to long-term energy storage and post-blackout restoration. The International Energy Agency (IEA) forecasts that grid-scale battery energy storage will spearhead energy storage growth. In 2022, China contributed over 42% of the 11.21 GW annual grid-scale battery storage additions, totaling over 4.81 GW. With plans to install over 30 GW of BESS by 2025, predominantly using lithium-ion batteries, China's ambitions signal a booming future for BESS and, consequently, a surging demand for rechargeable batteries in the Asia-Pacific.

- In December 2023, South Korea's Ministry of Finance unveiled a plan to inject KRW 38 trillion into the lithium battery industry over the next five years, with formal implementation set for 2024. Alongside establishing a KRW 1 trillion promotion fund, South Korea is channeling KRW 73.6 billion into R&D and bolstering reserves of critical minerals for domestic lithium battery production. These moves, coupled with efforts to foster a battery reuse and recycling ecosystem, are set to invigorate the lithium-ion battery sector and bolster the rechargeable battery market.

- March 2024 saw Panasonic Group announce a joint venture with Indian Oil Corporation Ltd (IOCL) for cylindrical lithium-ion battery production. This venture, driven by anticipated demand for two and three-wheel vehicles and BESS in India, underscores the region's growing lithium-ion battery manufacturing trend.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, declining costs, and industry advancements, lithium-ion batteries are set to emerge as the fastest-growing battery technology in the Asia-Pacific rechargeable battery market during the forecast period.

India to Witness Significant Growth

- Driven by the rising adoption of electric vehicles (EVs), surging demand for consumer electronics, and government initiatives championing energy storage solutions, the Indian rechargeable battery market is on the brink of significant growth. The surge in demand for rechargeable batteries, pivotal for the expansion of the market, is largely attributed to the widespread adoption of smartphones, laptops, and other portable devices in the consumer electronics sector.

- Moreover, the Indian Government's aggressive push towards electric mobility is amplifying the demand for rechargeable batteries, especially in the EV segment. Data from the International Energy Agency (IEA) highlights this trend, noting that battery electric vehicle (BEV) sales in India soared to approximately 82,000 units in 2023, marking a remarkable 70% uptick from the previous year. With the Indian Government setting ambitious targets for 2030 - envisioning 30% of newly registered private cars, 40% of buses, 70% of commercial cars, and a staggering 80% of two-wheelers and three-wheelers to be electric - the demand for rechargeable batteries, particularly lithium-ion variants, is set to surge.

- In a bid to bolster local manufacturing and reduce reliance on imported Advance Chemistry Cell (ACC) batteries for electric vehicles, the Indian Government rolled out a Production Linked Incentive (PLI) Scheme in early 2021. With a substantial outlay of USD 2.12 billion spread over five years, the scheme aims to establish a competitive ACC battery manufacturing setup in the country, targeting a capacity of 50 GWh, with an additional focus on 5 GWh of niche ACC technologies. The PLI Scheme offers a production-linked subsidy, determined by the applicable subsidy per KWh and the achieved percentage of value addition based on actual sales. By 2022, four prominent companies - Reliance New Energy Solar Limited, Hyundai Global Motors Company Limited, Ola Electric Mobility Private Limited, and Rajesh Exports Limited - secured incentives under this scheme, underscoring the government's commitment to boosting local battery cell production.

- Capitalizing on India's growing energy storage demands and its shift towards sustainable solutions, both local and international players are making significant investments in the Indian rechargeable battery market. For instance, in April 2022, Exide Industries, a major player in the battery sector, unveiled plans for a lithium-ion cell manufacturing plant in Karnataka, with an investment of approximately USD 718 million. The facility, starting with a 6 GWh capacity, is set to become operational by 2024, with plans to expand to a 12 GWh integrated lithium-ion battery facility in subsequent years.

- In another notable move, battery technology startup Log9 Materials inaugurated India's inaugural lithium-ion cell manufacturing facility in Jakkur, Bengaluru, in April 2023. Starting with a capacity of 50 MWh, Log9 has ambitious plans to scale up to 1 GWh for cell manufacturing and 2 GWh for battery pack manufacturing by Q1 2025. March 2024 saw GoodEnough Energy announcing its plans to commence operations at India's first battery energy storage gigafactory in Jammu and Kashmir by October 2024. With an investment of INR 1.5 billion (USD 18.07 million) for the initial 7 GWh facility and a projected spend of INR 3 billion (USD 37 million) by 2027 to elevate capacity to 20 GWh, GoodEnough's facility aims to significantly impact the industry, potentially cutting over 5 million tons of carbon emissions annually. This gigafactory aligns with India's ambitious goal to ramp up its renewable energy capacity to 500 GW by 2030, a significant leap from around 176 GW in 2023. To further bolster these efforts, the Indian government is extending incentives worth USD 452 million to companies engaged in promoting battery storage projects.

- With a vast consumer base, supportive governmental policies, and strides in battery manufacturing, the Indian rechargeable battery market is set for robust growth in the foreseeable future.

Asia-Pacific Rechargeable Battery Industry Overview

The Asia-Pacific rechargeable battery market is fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, Contemporary Amperex Technology Co. Limited, BYD Company Ltd., GS Yuasa Corporation, and Amara Raja Energy & Mobility Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Thailand

- 5.3.6 Indonesia

- 5.3.7 Vietnam

- 5.3.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 BYD Co.Ltd.

- 6.3.4 GS Yuasa Corporation

- 6.3.5 Samsung SDI Co. Ltd

- 6.3.6 LG Chem Ltd.

- 6.3.7 Clarios, LLC.

- 6.3.8 Amara Raja Energy & Mobility Ltd

- 6.3.9 Exide Industries Ltd

- 6.3.10 Duracell Inc.

- 6.3.11 Saft Groupe SA

- 6.3.12 Tianjin Lishen Battery Joint-Stock Co. Ltd. Source: https://www.mordorintelligence.com/industry-reports/southeast-asia-battery-market

- 6.3.13 Tesla Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

02-2729-4219

+886-2-2729-4219