|

市場調查報告書

商品編碼

1636546

印度的二次電池:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

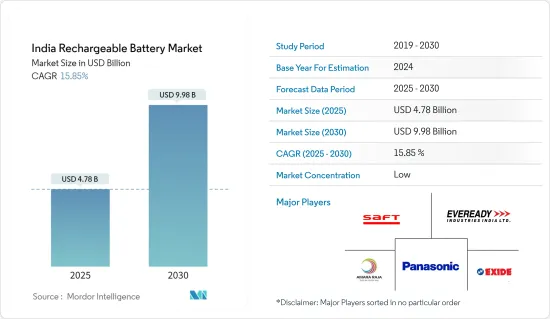

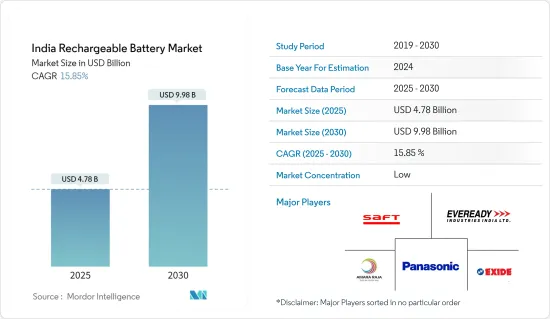

印度二次電池市場規模預計在 2025 年為 47.8 億美元,預計到 2030 年將達到 99.8 億美元,預測期內(2025-2030 年)的複合年成長率為 15.85%。

主要亮點

- 從中期來看,家用電器需求增加以及可再生能源滲透率上升等因素預計將成為預測期內印度二次電池市場最重要的促進因素之一。

- 另一方面,電池採購受到明顯的供應鏈限制。這將在預測期內對印度二次電池市場構成威脅。

- 然而,能量密度、充電週期和能量保持能力的不斷進步使得二次電池的效率更高。預計這一因素將在未來幾年為市場創造許多機會。

印度二次電池市場的趨勢

鋰離子電池:預計成長

- 預計鋰離子電池在上述市場將實現顯著成長。鋰離子電池因其良好的容量重量比而變得越來越受歡迎,尤其是與其他類型的電池相比。推動鋰離子電池廣泛應用的其他因素包括其卓越的性能(尤其是其長壽命和低維護)、長使用壽命以及價格下降。鋰離子電池的價格分佈通常高於同類電池,但其優勢正在推動需求。

- 家用電子電器擴大轉向鋰離子電池,鋰離子電池也越來越受歡迎。這部分包括智慧型手機、筆記型電腦、平板電腦和穿戴式裝置。鑑於業界對輕量化組件、高效充電週期和延長電池壽命的需求,鋰離子電池正在成為首選。隨著消費者對先進電子設備的需求不斷增加,對鋰離子電池的需求也將上升,有助於擴大市場。

- 此外,世界逐漸轉向太陽能和風能等再生能源來源,也增加了對能源儲存解決方案的需求。鋰離子電池在這方面表現出色,能夠巧妙地儲存來自可再生能源的多餘能源,並在需要時釋放。此功能不僅有助於穩定電網,而且還減少對石化燃料的依賴。

- 近年來,鋰離子電池和電池組的價格大幅下降,對終端用戶產業的吸引力越來越大。繼 2022 年價格小幅上漲之後,2023 年又恢復了下降趨勢。其中,鋰離子電池組成本下降14%,達到139美元/度數的歷史最低水準。價格下降主要歸因於整個電池價值鏈的產能擴張,以及原料和零件成本的降低。

- 此外,依賴鋰進口的印度正在積極尋求國內鋰蘊藏量,以減輕全球價值鏈的脆弱性。為了滿足這項需求,印度政府已授權監管機構查明該國的鋰蘊藏量。

- 例如,2023 年 5 月,印度地質調查局 (GSI) 宣佈在拉賈斯坦邦納高爾區的德加納發現了這種重要礦物的新礦床。這些新發現的蘊藏量遠遠超過先前的蘊藏量,估計有潛力滿足該國 80% 的鋰需求。值得注意的是,鋰礦床位於德加納的倫瓦特山脈和鄰近地區,這些地區一直為該國供應鎢。

- 從這些見解中可以清楚看出,鋰離子電池在未來幾年將顯著成長。

可再生能源的普及正在推動市場

- 由於可再生能源(尤其是太陽能和風能)日益融入國家能源框架,印度二次電池市場預計將顯著成長。由於可再生能源的間歇性,主要由二次電池組成的能源儲存系統對於管理這種變化並維持穩定的電力供應至關重要。

- 此外,印度政府雄心勃勃的可再生能源目標,加上支持政策和獎勵,正在幫助擴大二次電池市場。政府的目標是到2030年可再生能源裝置容量達到500GW,其中很大一部分來自太陽能和風能,該計畫凸顯了對大規模能源儲存解決方案的需求,對二次電池的需求正在擴大。

- 根據印度新可再生能源部統計,截至2024年4月,印度可再生能源裝置容量為144.75吉瓦,其中太陽能佔57.08%,風能佔31.89%。該省對於實現2030年可再生能源目標的軌跡充滿信心。

- 隨著印度不斷擴大可再生能源產能,對電池能源儲存技術的需求將會飆升。這種成長將推動對二次電池的需求,二次電池對於在高峰時段儲存多餘的能量並在低谷時段分配能量至關重要。

- 值得注意的進展是,德里電力監管委員會 (DERC) 於 2024 年 5 月批准了印度首個商業獨立電池儲能系統 (BESS)計劃。 20MW/40MWh BESS 將安裝在 BRPL 的 33/11kV Kilokari 變電站,目標時間表為計劃開始後的 18 到 20 個月,以便快速開始運作。

- 此外,印度偏遠和農村地區通常沒有並聯型,而微電網和離網可再生系統的興起也推動了對二次電池的需求。這些能源儲存解決方案對於確保穩定的電力供應至關重要,從而振興當地社區並促進永續發展。

- 鑑於這些動態,可再生能源應用的激增可能會在未來幾年顯著推動印度的二次電池市場。

印度二次電池產業概況

印度二次電池市場比較分散。該市場的主要企業(不分先後順序)包括 Saft Groupe SA、Eveready Industries India Ltd.、Exide Industries、Panasonic Corporation和 Amara Raja Energy &Mobility Ltd.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 擴大可再生能源的使用

- 家電需求不斷成長

- 限制因素

- 供應鏈約束

- 驅動程式

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章 市場區隔

- 依技術分類

- 鉛酸

- 鋰離子

- 其他(鎳氫電池、鎳鎘電池等)

- 按應用

- 汽車電池

- 工業電池

- 可攜式電源

- 其他用途

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Eveready Industries India Ltd.

- LG Chem Ltd.

- Contemporary Amperex Technology Co Ltd

- Exide Industries

- Saft Groupe SA

- Samsung SDI Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- Duracell Inc.

- Amara Raja Energy & Mobility Ltd

- 市場排名/佔有率(%)分析

- 其他主要企業名單

第7章 市場機會與未來趨勢

- 技術創新的進步

簡介目錄

Product Code: 50004022

The India Rechargeable Battery Market size is estimated at USD 4.78 billion in 2025, and is expected to reach USD 9.98 billion by 2030, at a CAGR of 15.85% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for consumer electronics coupled with rising penetration of renewable energies are expected to be among the most significant drivers for the India Rechargeable Battery Market during the forecast period.

- On the other hand, the supply chain constraints for the battery procuring is high. This poses a threat to the India Rechargeable Battery Market during the forecast period.

- Nevertheless, continued advancements in energy density, charging cycles, and energy hold-up led to more efficient rechargeable batteries. This factor is expected to create several opportunities for the market in the future.

India Rechargeable Battery Market Trends

Lithium-ion Battery Expected to Witness Growth

- Lithium-ion batteries are poised for substantial growth in the market under consideration. Their rising popularity, especially when compared to other battery types, can be attributed to their favorable capacity-to-weight ratio. Additional factors fueling their adoption encompass superior performance (notably, longevity and low maintenance), an extended shelf life, and a trend of declining prices. While lithium-ion batteries typically command a higher price point than their counterparts, their advantages are driving demand.

- Consumer electronics are increasingly turning to lithium-ion batteries, further propelling their popularity. This sector encompasses smartphones, laptops, tablets, and wearables. Given the industry's demand for lightweight components, efficient charging cycles, and prolonged battery life, lithium-ion batteries emerge as the prime choice. As the appetite for advanced electronics grows among consumers, so too will the demand for lithium-ion batteries, bolstering market expansion.

- Moreover, the global pivot towards renewable energy sources, like solar and wind, is amplifying the demand for energy storage solutions. Lithium-ion batteries excel in this domain, adeptly storing surplus energy from renewables and releasing it as needed. This capability not only aids in grid stability but also diminishes dependence on fossil fuels.

- In recent years, a notable decline in the prices of lithium-ion batteries and cell packs has rendered them increasingly appealing to end-user industries. Following minor price surges in 2022, a downward trend resumed in 2023. Specifically, the cost of lithium-ion battery packs plummeted by 14%, achieving a historic low of USD 139/kWh. This price drop is largely due to reductions in raw material and component costs, alongside an expansion in production capacity throughout the battery value chain.

- Additionally, India, a nation reliant on lithium imports, has been actively scouting for domestic lithium reserves to mitigate vulnerabilities in the global value chain. Responding to this need, the Indian government has mandated regulatory bodies to pinpoint any domestic lithium reserves.

- For instance, in May 2023, the Geological Survey of India (GSI) unveiled a fresh deposit of this vital mineral in Degana, situated in Rajasthan's Nagaur district. These newly discovered reserves are projected to dwarf previous finds, potentially satisfying 80% of the nation's lithium demand. Notably, the lithium deposits are located in Renvat Hill and its neighboring regions in Degana, an area with a history of supplying tungsten to the country.

- Given these insights, it's evident that lithium-ion batteries are set for significant growth in the coming years.

Increasing Penetration of Renewable Energy To Drive The Market

- India's rechargeable battery market is set for substantial growth, driven by the rising integration of renewable energy sources, especially solar and wind power, into the nation's energy framework. Given the intermittent nature of renewable energy, energy storage systems, predominantly rechargeable batteries, are essential to manage this variability and maintain a consistent electricity supply.

- Additionally, the Indian government's ambitious renewable energy targets, bolstered by supportive policies and incentives, are propelling the rechargeable battery market's expansion. With a goal of achieving a renewable energy capacity of 500 GW by 2030, and a substantial portion from solar and wind, the government's plans underscore the need for extensive energy storage solutions, amplifying the demand for rechargeable batteries.

- As of April 2024, India's installed renewable energy capacity stands at 144.75 GW, with solar and wind contributing 57.08% and 31.89%, respectively, according to the Ministry of New and Renewable Energy. The ministry confidently asserts its trajectory towards the 2030 renewable energy goals.

- With India's ongoing expansion in renewable energy capacity, the appetite for battery energy storage technology is set to surge. This uptick will bolster the demand for rechargeable batteries, which are pivotal in storing surplus energy during peak production and dispensing it during lulls.

- In a notable development, the Delhi Electricity Regulatory Commission (DERC) granted regulatory approval in May 2024 for India's first commercial standalone Battery Energy Storage System (BESS) project. The 20 MW/40 MWh BESS, located at BRPL's 33/11 kV Kilokari substation, aims to achieve operational status swiftly, targeting an 18-20 month timeline from project inception.

- Moreover, the rise of microgrids and off-grid renewable systems in India's remote and rural locales, often devoid of grid connectivity, is amplifying the demand for rechargeable batteries. These energy storage solutions are vital for ensuring a steady electricity supply, thereby uplifting communities and fostering sustainable growth.

- Given these dynamics, the surge of renewable energy adoption is poised to significantly bolster India's rechargeable battery market in the coming years.

India Rechargeable Battery Industry Overview

The India Rechargeable Battery Market is fragmented. Some of the key players in this market (in no particular order) are Saft Groupe SA, Eveready Industries India Ltd., Exide Industries, Panasonic Corporation, and Amara Raja Energy & Mobility Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Penetration of Renewable Energy

- 4.5.1.2 Growing Demand for Consumer Electronics

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Applications

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Eveready Industries India Ltd.

- 6.3.2 LG Chem Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd

- 6.3.4 Exide Industries

- 6.3.5 Saft Groupe SA

- 6.3.6 Samsung SDI Co., Ltd.

- 6.3.7 Murata Manufacturing Co., Ltd.

- 6.3.8 Panasonic Corporation

- 6.3.9 Duracell Inc.

- 6.3.10 Amara Raja Energy & Mobility Ltd

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

02-2729-4219

+886-2-2729-4219