|

市場調查報告書

商品編碼

1636566

拉丁美洲充電電池:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Latin America Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

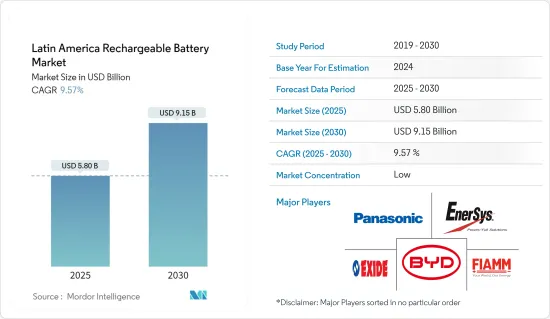

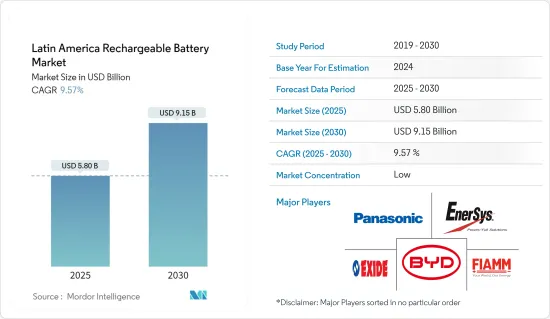

拉丁美洲充電電池市場規模預計到2025年為58億美元,預計2030年將達到91.5億美元,預測期內(2025-2030年)複合年成長率為9.57%。

主要亮點

- 從中期來看,鋰離子電池價格的下降、電動車普及率的提高以及可再生能源的日益採用預計將在預測期內推動拉丁美洲二次電池市場的發展。

- 相反,原料供需之間的不匹配將阻礙預測期內的市場成長。

- 然而,資料中心等商業基礎設施的需求不斷成長,以及電池回收和二次電池應用的需求不斷成長,預計將為拉丁美洲二次電池市場創造重大機會。

- 由於電動車銷量的快速成長和可再生能源的普及,預計巴西二次電池市場將顯著成長。

拉丁美洲充電電池市場趨勢

鋰離子電池成長顯著

- 在預測期內,鋰離子電池(LIB)預計將成為拉丁美洲二次電池市場成長最快的細分市場之一。由於其良好的容量重量比,鋰離子電池比其他類型的電池更受歡迎。推動鋰離子電池採用的其他因素包括卓越的性能(特點是長壽命和低維護)、長壽命和下降的價格趨勢。

- 與傳統鉛酸電池相比,鋰離子電池具有明顯的技術優勢。例如,鉛酸電池的使用壽命通常約為 400 至 500 次循環,而可充電鋰離子電池的平均壽命令人印象深刻,超過 5,000 次循環。此外,鋰離子電池需要較少的維護和更換。它還在整個放電週期中保持穩定的電壓,確保連接的電氣組件具有更持久的效率。

- 近年來,產業巨頭紛紛加強投資力度,注重規模經濟和研發,以提高電池性能。這種競爭的加劇大大降低了鋰離子電池的價格。由於技術進步、製造最佳化以及原料成本降低,鋰離子電池的體積加權平均價格已從2013年的780美元/kWh大幅下降至2023年的139美元/kWh。預測顯示,2025 年將進一步下降至約 113 美元/kWh,2030 年將進一步下降至 80 美元/kWh,這使得鋰離子電池成為越來越有吸引力的選擇。

- 從歷史上看,鋰離子電池主要用於行動電話和筆記型電腦等家用電子電器。然而,隨著可再生能源領域的電動車和電池能源儲存系統(BESS)越來越依賴鋰離子電池,它們的作用正在擴大。

- 儘管拉丁美洲的鋰離子電池製造業仍處於起步階段,但由於該地區豐富的重要原料蘊藏量和多樣化終端用戶不斷成長的需求,預計該市場將快速成長。

- 拉丁美洲被稱為“鋰三角”,擁有豐富的鋰蘊藏量,這對鋰離子電池至關重要。這個三角區包括阿根廷、玻利維亞和智利,這三個國家合計持有全球一半以上的鋰蘊藏量。由於阿塔卡馬沙漠廣泛存在富鋰鹵水礦床,智利是鋰生產的領導者。儘管採礦面臨挑戰,玻利維亞的烏尤尼鹽沼仍然是世界上最大的鋰蘊藏量之一。阿根廷在普納地區擁有鹽田,也扮演重要角色。這些國家共同構成全球鋰離子電池生產供應鏈不可或缺的一部分。

- 根據美國地質調查局預測,2023年中期,智利鋰產量約44,000噸,阿根廷為9,600噸,巴西為4,900噸。拉丁美洲產量如此之大,在世界鋰離子電池領域中佔據著至關重要的地位。

- 拉丁美洲國家正在加強深化對電動車供應鏈的參與。阿根廷、智利、玻利維亞和巴西等國家正在尋求利用其豐富的礦產資源、提高加工能力和汽車製造,將其開採的大部分鋰轉化為電池化學品。正如阿根廷礦業相關人員強調的那樣,該公司也進軍電池和電動車的生產。

- 2023年4月,中國領先的電動車製造商比亞迪宣布計畫斥資2.9億美元在智利安託法加斯塔地區興建一座鋰陰極工廠。預計此類策略舉措將在未來幾年激增。

- 2023 年中期,阿根廷政府宣布了建造首家鋰離子電池工廠的計畫。該工廠將使用美國主要礦業公司 Livent Corporation 在當地採購和加工的碳酸鋰。該工廠由國有 YPF 子公司 YPF Tecnologia (Y-TEC) 建造,標誌著阿根廷致力於為其豐富的鋰蘊藏量增值的承諾。該公司將投資700萬美元,目標年產能13MWh、固定式蓄電池1000個。此外,我們強調向熱衷於生產鋰離子電池的當地公司提供技術轉移的機會。

- 鋰離子電池因其重量輕、充電速度快、充電週期長和成本下降而有望主導市場,特別是由於該地區鋰蘊藏量巨大和工業進步。

巴西,預計將出現顯著成長

- 預計巴西將在不久的將來成為拉丁美洲充電電池市場的參與企業。這種快速成長的關鍵促進因素是電動車、可再生能源和消費品等各個領域對電池的需求不斷成長。此外,該行業的擴張得到了政府支持措施和國內創新的支持。

- 近年來,由於政府的激勵措施,電動車(EV)在巴西迅速普及。巴西2023年的電動車銷量將達到約52,000輛(33,000輛PHEV、19,000輛BEV),較2022年的18,500輛(10,000輛PHEV、8,500輛BEV)大幅成長。電動車銷量的快速成長預計將振興二次電池市場。

- 從 2024 年 1 月開始,巴西將對 100% 進口電動車 (EV) 徵收 10% 的課稅。對此,多家中國汽車製造商正活性化本土投資。其中,比亞迪正在巴西建立生產基地,計畫於2024年底至2025年初投產,長城汽車工廠計畫於2024年投產。這些措施預計將加強巴西國內電動車製造並擴大對二次電池的需求。

- 巴西正在積極努力減少碳排放並減少對石化燃料的依賴,這反映了全球趨勢。為了鼓勵向電動車過渡,各國政府正在推出各種補貼和激勵措施。一個典型的例子是綠色出行創新計劃,該計劃於 2023年終啟動,將於 2024 年至 2028 年間為開發低排放交通技術的公司提供超過 190 億巴西雷亞爾的稅收優惠。這些舉措將加強電動車產業並有利於二次電池市場。

- 除汽車領域外,工業領域也在推動市場成長。越來越多的產業正在將二次電池用於備用電源和可再生能源儲存等應用。快速成長的可再生能源領域,特別是太陽能和風能,正在推動對先進電池技術的需求。

- 根據國際可再生能源機構(IRENA)預測,2023年巴西可再生能源裝置容量將達到約194GW,較2020年成長28.8%。到2023年,巴西將擁有超過37吉瓦的太陽能發電能力和超過29吉瓦的風力發電能力。隨著政府計劃進一步提高電池能源儲存系統(BESS)的容量,預計對電池儲能系統(BESS)的需求將會增加。

- 2024年5月,挪威能源巨頭Statkraft AS宣布投資9.26億雷亞爾(1.807億美元),在巴西巴伊亞的兩個風電場安裝275兆瓦的太陽能發電能力。該太陽能資產名為 Sol de Brotas,將與 519MW Ventos de Santa Eugenia 聯合發電廠和 79.8MW Morro do Cruzeiro 風力發電聯合發電廠整合。

- Sol de Brotas 計劃於 2024 年建成,將使用 BESS 技術,並將分階段開始營運:Morro do Cruzeiro 於 2025 年 8 月開始營運,Ventos de Santa Eugenia 於 2025 年 11 月開始營運。

- 2023年初,美國Fractal EMS和巴西You.On在巴西整合了30MW/60MWh電池儲能系統(BESS)。 Fractal EMS 強調,BESS 將最佳化尖峰負載期間的電力供應,提高輸電彈性並減少對調峰電站的依賴。此類計劃顯示巴西對工業二次電池的需求不斷成長,尤其是 Fractal EMS 的設備無關方法以及 You.On 選擇科華逆變器和 CATL 液冷電池。

- 鑑於這些動態,巴西二次電池市場可能在短期內顯著成長。

拉丁美洲充電電池產業概況

拉丁美洲充電電池市場較為分散。該市場的主要企業包括(排名不分先後)Exide Industries Ltd、BYD Company Ltd、FIAMM Energy Technology SpA、Panasonic Holdings Corporation 和 EnerSys。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 增加可再生能源的部署

- 抑制因素

- 原料供需不匹配

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 科技

- 鉛酸電池

- 鋰離子

- 其他技術(NiMh、Nicd 等)

- 目的

- 汽車電池

- 工業電池(用於電源、固定電池(電信、UPS、能源儲存系統(ESS) 等)

- 可攜式電池(家用電子電器產品等)

- 其他

- 地區

- 巴西

- 墨西哥

- 智利

- 哥倫比亞

- 阿根廷

- 其他拉丁美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Company Ltd

- EnerSys

- Panasonic Holdings Corporation

- Exide Industries Ltd

- FIAMM Energy Technology SpA

- C&D Technologies Inc.

- Duracell Inc.

- Saft Groupe SA

- Clarios

- Acumuladores Moura SA

- 其他知名公司名單(公司名稱、總部地點、收益、相關產品、業務部門、聯絡資訊等)

- 市場排名分析

第7章 市場機會及未來趨勢

- 資料中心等商業基礎設施的需求

- 電池回收和二次利用的需求

簡介目錄

Product Code: 50004072

The Latin America Rechargeable Battery Market size is estimated at USD 5.80 billion in 2025, and is expected to reach USD 9.15 billion by 2030, at a CAGR of 9.57% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing adoption of renewable energy are expected to drive the Latin America rechargeable battery market during the forecast period.

- Conversely, a mismatch in the demand and supply of raw materials is poised to impede the market's growth during the forecast period.

- However, rising demand from commercial infrastructures like data centers, coupled with the growing need for battery recycling and the second-life application of batteries, is set to unlock vast opportunities for the rechargeable battery market in Latin America.

- Brazil stands to see substantial growth in the rechargeable battery market, driven by surging electric vehicle sales and a broader adoption of renewable energy in the region.

Latin America Rechargeable Battery Market Trends

Lithium-ion Batteries to Witness Significant Growth

- During the forecast period, lithium-ion batteries (LIB) are poised to be among the fastest-growing segments in the Latin American rechargeable battery market. Their favorable capacity-to-weight ratio is making lithium-ion batteries increasingly popular compared to other types. Additional factors driving their adoption include superior performance (characterized by longevity and low maintenance), an extended shelf life, and a downward trend in prices.

- Offering distinct technical advantages, lithium-ion (Li-ion) batteries outshine traditional lead-acid batteries. For instance, while lead-acid batteries typically last for about 400-500 cycles, rechargeable Li-ion batteries boast an impressive average of over 5,000 cycles. Furthermore, Li-ion batteries demand less frequent maintenance and replacement. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for connected electrical components.

- In recent years, major industry players have ramped up investments, focusing on economies of scale and R&D to boost battery performance. This surge in competition has led to a notable drop in lithium-ion battery prices. Thanks to technological advancements, manufacturing optimizations, and falling raw material costs, the volume-weighted average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further decline to approximately USD 113/kWh by 2025 and USD 80/kWh by 2030, making lithium-ion batteries an increasingly attractive option.

- Historically, lithium-ion batteries found their primary application in consumer electronics like mobile phones and laptops. However, their role has expanded, with electric vehicles and battery energy storage systems (BESS) in the renewable energy sector increasingly relying on them.

- While the lithium-ion battery manufacturing industry in Latin America is still in its nascent stages, the region's abundant reserves of essential raw materials and the surging demand from diverse end-users signal a rapid market growth.

- Latin America, often dubbed the Lithium Triangle, boasts vast lithium reserves, a crucial component for lithium-ion batteries. This triangle encompasses Argentina, Bolivia, and Chile, collectively holding over half of the world's known lithium reserves. Chile leads in production, thanks to its extensive lithium-rich brine deposits in the Atacama Desert. Bolivia's Salar de Uyuni stands out as one of the globe's largest lithium reserves, despite extraction challenges. Argentina, with its salt flats in the Puna region, also plays a significant role. Together, these nations are integral to the global lithium-ion battery production supply chain.

- According to the US Geological Survey, lithium production figures for mid-2023 were approximately 44,000 metric tons in Chile, 9,600 metric tons in Argentina, and 4,900 metric tons in Brazil. Such substantial output positions Latin America as a pivotal player in the global lithium-ion battery landscape.

- Latin American countries are intensifying efforts to deepen their involvement in the electric vehicle supply chain. By capitalizing on their mineral wealth, enhancing processing capabilities, and eyeing vehicle manufacturing, nations like Argentina, Chile, Bolivia, and Brazil aim to transform more of their mined lithium into battery chemicals. They're also venturing into battery and electric vehicle manufacturing, as highlighted by Argentina's mining officials.

- In April 2023, BYD Co Ltd, China's leading electric vehicle manufacturer, announced plans for a USD 290 million lithium cathode factory in Chile's Antofagasta region, as reported by Chile's economic development agency, CORFO. Such strategic moves are expected to proliferate in the coming years.

- In mid-2023, the Argentinean government revealed plans for its inaugural lithium-ion battery plant. This facility will utilize lithium carbonate sourced and processed locally by US mining giant Livent Corporation. Constructed by YPF Tecnologia (Y-TEC), a subsidiary of the state-owned YPF, the plant signifies Argentina's commitment to adding value to its rich lithium reserves. With a USD 7 million investment, the facility aims for an annual production capacity of 13MWh, translating to 1,000 stationary energy storage batteries. Moreover, it emphasizes technology transfer opportunities for local firms keen on lithium-ion battery production.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, and the backdrop of declining costs, lithium-ion batteries are set to dominate the market, especially with the region's significant lithium reserves and industry advancements.

Brazil is Expected to Witness Significant Growth

- Brazil is poised to emerge as a dominant player in the Latin American rechargeable battery market in the near future. This surge is primarily fueled by the escalating demand for batteries across diverse sectors, notably electric mobility, renewable energy, and consumer goods. Furthermore, the industry's expansion is bolstered by supportive government initiatives and technological innovations within the nation.

- Recently, Brazil has seen a swift uptick in electric vehicle (EV) adoption, thanks to government-backed incentives. In 2023, Brazil's EV sales reached approximately 52,000 units (33,000 PHEV and 19,000 BEV), a substantial leap from 2022's 18,500 units (10,000 PHEV and 8,500 BEV). This surge in EV sales is anticipated to bolster the rechargeable battery market in the years ahead.

- Starting January 2024, Brazil imposed a 10% tax on imported 100% electric vehicles (EVs), set to escalate to 18% in July and peak at 35% by July 2026. In response, several Chinese automakers are ramping up local investments. Notably, BYD is establishing a manufacturing complex in Brazil, targeting production by late 2024 or early 2025, while Great Wall Motor's plant is set to commence operations in 2024. These moves are expected to enhance Brazil's domestic EV manufacturing and amplify the demand for rechargeable batteries.

- Echoing global trends, Brazil is actively working to curtail carbon emissions and reduce fossil fuel reliance. To facilitate this transition to electric mobility, the government has rolled out various subsidies and incentives. A prime example is the Green Mobility and Innovation Programme launched at the end of 2023, offering over BRA 19 billion in tax incentives from 2024 to 2028 for companies developing low-emission transport technologies. Such initiatives are poised to bolster the EV sector, subsequently benefiting the rechargeable battery market.

- Beyond the automotive realm, the industrial sector is also driving market growth. Industries are increasingly turning to rechargeable batteries for applications like backup power and renewable energy storage. The burgeoning renewable energy sector, especially solar and wind, is fueling the demand for advanced battery technologies.

- According to the International Renewable Energy Agency (IRENA), Brazil's renewable energy capacity reached about 194 GW in 2023, marking a 28.8% increase from 2020. In 2023, Brazil boasted over 37 GW in solar and 29 GW in wind energy capacities. With government plans to further boost these capacities, the demand for battery energy storage systems (BESS) is set to rise.

- In May 2024, Norwegian energy giant Statkraft AS unveiled a BRL 926 million (USD 180.7 million) investment to install 275 MW of solar capacity at two wind parks in Bahia, Brazil. The solar asset, named Sol de Brotas, will integrate with the 519 MW Ventos de Santa Eugenia complex and the 79.8 MW Morro do Cruzeiro wind power complex.

- Scheduled for construction in 2024, Sol de Brotas will utilize BESS technology, with operations commencing in phases: Morro do Cruzeiro in August 2025 and Ventos de Santa Eugenia in November 2025.

- In early 2023, United States-based Fractal EMS Inc and Brazil's You.On integrated a 30 MW/60 MWh battery energy storage system (BESS) in Brazil. Fractal EMS highlighted that the BESS will optimize power delivery during peak loads, enhancing transmission line resilience and reducing reliance on peaker plants. Such projects, especially with Fractal EMS's equipment-agnostic approach and You.On's choice of Kehua inverters and CATL liquid-cooled batteries, signal a growing trend in Brazil, boosting the demand for industrial rechargeable batteries.

- Given these dynamics, Brazil's rechargeable battery market is set for substantial growth in the foreseeable future.

Latin America Rechargeable Battery Industry Overview

The Latin Americarechargeable battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include Exide Industries Ltd, BYD Company Ltd, FIAMM Energy Technology SpA, Panasonic Holdings Corporation, and EnerSys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Growing Renewable Energy Installation

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Mexico

- 5.3.3 Chile

- 5.3.4 Colombia

- 5.3.5 Argentina

- 5.3.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 EnerSys

- 6.3.3 Panasonic Holdings Corporation

- 6.3.4 Exide Industries Ltd

- 6.3.5 FIAMM Energy Technology SpA

- 6.3.6 C&D Technologies Inc.

- 6.3.7 Duracell Inc.

- 6.3.8 Saft Groupe SA

- 6.3.9 Clarios

- 6.3.10 Acumuladores Moura S.A.

- 6.4 List of Other Prominent Companies (Company Name, Headquarters, Revenue, Relevant Products, Operating Sector, Contact Details, etc.) (In Brief Tabular Format)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand from Commercial Infrastructures Such as Data Centers

- 7.2 Need for a Battery Recycling and Second-life Applications

02-2729-4219

+886-2-2729-4219