|

市場調查報告書

商品編碼

1636561

中國充電電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

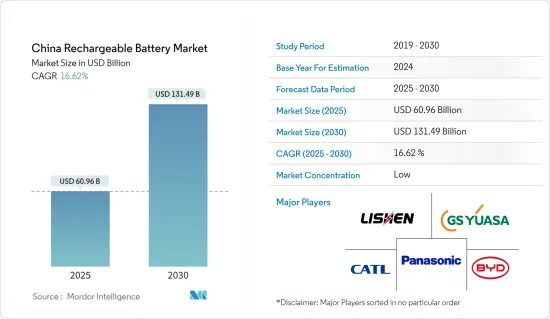

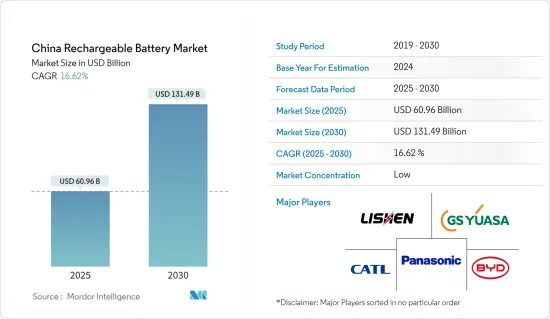

預計2025年中國二次電池市場規模為609.6億美元,預計2030年將達1,314.9億美元,預測期間(2025-2030年)複合年成長率為16.62%。

主要亮點

- 從中期來看,鋰離子電池成本的下降、電動車的快速普及、可再生能源領域能源儲存需求的上升以及家用電子電器產品的採用預計將在預測期內推動中國二次電池市場的發展。

- 另一方面,原料供需不匹配以及環境和安全問題預計將阻礙預測期內的市場成長。

- 隨著新電池技術和先進電池化學技術的不斷發展,中國二次電池市場存在巨大機會。

中國二次電池市場發展趨勢

汽車領域預計將主導市場

- 在中國,汽車產業有望成為二次電池(尤其是鋰離子電池)的主要應用領域。電動車(EV)的日益普及將極大地支持二次電池產業的成長。

- 汽車使用電池作為輔助電源為部件提供動力並在啟動過程中協助引擎。傳統汽車主要依賴鉛酸電池和鎳氫電池,而電動車正在轉向鋰離子電池。

- 電動車 (EV) 領域採用鋰離子電池的原因與鋰離子電池為家用電子電器產品帶來的好處相同。隨著電動車產業的快速擴張,它已經超越家用電子電器產業,成為二次電池尤其是鋰離子電池的最大消費國。

- 電動車正在引起世界各地的關注,因為它們有望抑制溫室氣體排放並減少對石化燃料的依賴。中國對電動車的需求持續成長,在全球轉型為永續交通的過程中發揮關鍵作用。對電動車不斷成長的需求刺激了對二次電池的需求不斷成長。

- 例如,根據國際能源總署(IEA)的報告,2023年中國純電動車銷量將達到540萬輛,比2022年的440萬輛成長22%。到2023年,這一數字將佔全球整體的約56%。而且,2023年中國純電動汽車保有量將達到1,610萬輛以上,比上年成長近50%。

- 到了2023年,中國鞏固了全球領先汽車出口國的地位,出口汽車超過400萬輛,其中電動車(包括插電式混合動力車(PHEV))達到120萬輛。這意味著電動車出口年增與前一年同期比較%,整車出口成長65%。歐洲和亞太國家,特別是泰國和澳大利亞,已成為這些出口的主要市場。考慮到這些趨勢,中國將保持其作為全球最大電動車市場的地位,並暫時確保對二次電池的強勁需求。

- 目前正在努力增加對電池製造的投資。例如,2024年1月,中國著名汽車公司比亞迪在中國徐州舉行了鈉離子電池工廠的奠基儀式。該工廠投資100億元人民幣,年產電動車電池30吉瓦時(GWh)。

- 鑑於這些發展,中國汽車電池產業未來幾年可能會大幅成長。

鋰離子電池價格下跌帶動市場

- 通常,鋰離子電池比其他二次電池更昂貴。然而,產業主要企業正在大力投資研發和擴大生產,加劇競爭並壓低鋰離子電池的價格。

- 得益於技術進步、製造最佳化以及原料成本降低,鋰離子電池全球體積加權平均價格已從2013年的780美元/kWh大幅下降至2023年的139美元/kWh。預計 2025 年將進一步降至 113 美元/千瓦時左右,2030 年將進一步降至 80 美元/千瓦時左右。值得注意的是,2023年中國電池組平均價格為126美元/kWh,為全球最低。由於激烈的本土競爭,中國製造商增加了產量,以滿足快速成長的電池需求。成本下降使得鋰離子電池成為越來越有吸引力的選擇。

- 近年來,中國積極擴大鋰離子電池的生產,以滿足國內和國際需求。根據國際能源總署(IEA)預計,2022年中國鋰離子電池製造能力約為1.20TWh,佔全球整體的76%以上。據預測,此產能將迅速增加到2025年超過293太瓦時,2030年達到465太瓦時,鞏固中國在全球市場的主導地位。產量的激增,尤其是在中國,正在推動規模經濟,進一步降低成本並提高預測期內的滲透率。

- 此外,亞太地區尤其是中國的電池製造商的產品價格甚至低於全球平均水平。這些低價背後的一個主要因素是中國人事費用的下降。隨著全球對行動電話、平板電腦和筆記型電腦等電子產品的需求迅速成長,預計鋰離子電池將在未來十年佔據電池市場的主導地位,尤其是在中國和印度等國家。

- 中國的鋰離子電池製造業正在蓬勃發展,寧德時代等公司成為收益和產量成長的主要企業。市場佔有率的增加預計將進一步降低鋰離子電池的成本。

- 這種持續且顯著的成本降低使鋰離子電池成為從電網規模應用到微電網的所有能源儲存市場的首選。此外,隨著電池價格持續下降,到2030年,電動車(EV)將在主要小型車領域展開價格競爭,預示著電動車市場將迎來大幅成長時期。

- 因此,鋰離子電池成本的持續下降預計不僅將提高鋰離子電池的滲透率,還將刺激中國二次電池市場在預測期內的成長。

中國二次電池產業概況

中國二次電池市場細分。市場主要企業(排名不分先後)包括比亞迪股份有限公司、寧德時代新能源科技有限公司、GS湯淺國際有限公司、天津力神電池股份有限公司和松下電器產業株式會社。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 鋰離子電池成本下降

- 電動車的擴張

- 擴大可再生能源領域的採用

- 抑制因素

- 原料供需不匹配

- 環境和安全問題

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 科技

- 鉛酸電池

- 鋰離子

- 其他技術(NiMh、Nicd 等)

- 目的

- 汽車電池

- 工業電池(用於電源、固定電池(電信、UPS、能源儲存系統(ESS) 等)

- 可攜式電池(家用電子電器產品等)

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Corporation

- BYD Co.Ltd.

- GS Yuasa Corporation

- Contemporary Amperex Technology Co. Limited

- TianJin Lishen Battery Joint-Stock Co. Ltd

- East Penn Manufacturing Co.

- LG Chem Ltd.

- Samsung SDI Co. Ltd

- Exide Industries Ltd

- Leoch International Technology Limited

- 其他知名公司名單

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 新型電池技術與先進電池化學材料的開發進展

簡介目錄

Product Code: 50004067

The China Rechargeable Battery Market size is estimated at USD 60.96 billion in 2025, and is expected to reach USD 131.49 billion by 2030, at a CAGR of 16.62% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the declining lithium-ion battery cost, rapid adoption of electric vehicles, growing need for energy storage in renewable energy sector and the adoption of consumer electronics are likely to drive the China rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials and the environmental and safety concerns are expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely hold a vast opportunities for China rechargeable battery market.

China Rechargeable Battery Market Trends

Automotive Segment is Expected to Dominate the Market

- In China, the automotive sector is poised to emerge as a primary application for rechargeable batteries, notably lithium-ion batteries. The rising adoption of electric vehicles (EVs) is set to significantly boost the growth of the rechargeable battery industry.

- Automobiles utilize batteries as secondary power sources, either to energize components or assist the engine during cranking. While conventional vehicles predominantly rely on lead-acid and nickel-metal-hydride batteries, EVs have transitioned to lithium-ion batteries.

- The electric vehicle (EV) sector embraced lithium-ion batteries for the same advantages they offer in consumer electronics. As the EV industry has rapidly expanded, it has eclipsed the consumer electronics sector, becoming the foremost consumer of rechargeable batteries, especially lithium-ion variants.

- Globally, electric vehicles are garnering attention for their promise to curtail greenhouse gas emissions and lessen reliance on fossil fuels. In China, a pivotal player in the global shift towards sustainable transportation, the demand for EVs has seen a consistent uptick. This rising demand for EVs has, in turn, spurred a heightened need for rechargeable batteries.

- For instance, the International Energy Agency (IEA) reported that in 2023, battery electric car sales in China hit 5.4 million, marking a 22% increase from 4.4 million in 2022. This figure constituted approximately 56% of the global total for 2023. Additionally, China's battery electric car stock reached over 16.10 million in 2023, nearly a 50% rise from the previous year.

- China solidified its position as the world's leading auto exporter in 2023, exporting over 4 million cars, including 1.2 million EVs (encompassing plug-in hybrid electric vehicles (PHEVs)). This marked an 80% increase in electric car exports compared to the previous year, which itself saw a 65% rise in overall car exports. Europe and Asia-Pacific nations, notably Thailand and Australia, emerged as primary markets for these exports. Given these trends, China is set to maintain its status as the largest EV market globally, ensuring a robust demand for rechargeable batteries in the foreseeable future.

- Efforts are underway to bolster investments in battery manufacturing. For example, in January 2024, BYD, a prominent Chinese automotive firm, broke ground on a sodium-ion battery facility in Xuzhou, China. With a hefty investment of CNY 10 billion, the facility is slated to produce batteries with an annual capacity of 30 gigawatt-hours (GWh), specifically for EVs.

- Given these dynamics, China's automotive battery segment is poised for substantial growth in the coming years.

Declining Lithium-ion Battery Prices to Drive the Market

- Typically, lithium-ion batteries command a higher price than other rechargeable batteries. Yet, key industry players are investing heavily in R&D and scaling up production, intensifying competition and driving down lithium-ion battery prices.

- Due to technological advancements, manufacturing optimizations, and falling raw material costs, the global volume-weighted average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further dip to approximately USD 113/kWh in 2025 and USD 80/kWh by 2030. Notably, in 2023, average battery pack prices in China were the lowest globally, at USD 126/kWh. The intense local competition saw Chinese manufacturers boost production to capture the surging battery demand. Such declining costs position lithium-ion batteries as an increasingly attractive option.

- In recent years, China has been aggressively expanding its lithium-ion battery manufacturing to cater to both domestic and international demand. According to the International Energy Agency (IEA), in 2022, China's lithium-ion battery manufacturing capacity was approximately 1.20 TWh, accounting for over 76% of the global total. Projections indicate this capacity will soar to over 2.93 TWh by 2025 and 4.65 TWh by 2030, solidifying China's dominance in the global market. This surge in production, especially in China, is facilitating economies of scale, further driving down costs and boosting adoption rates during the forecast period.

- Moreover, battery manufacturers in the Asia-Pacific region, especially in China, are pricing their products even below the global average. A significant factor for these lower prices is China's reduced labor costs. Given the surging global demand for gadgets like mobile phones, tablets, and laptops-especially in nations like China and India-lithium-ion batteries are poised to dominate the battery market over the next decade.

- China's lithium-ion battery manufacturing is on a rapid upswing, with companies like CATL leading in both revenue and production growth. This expanding market share is anticipated to further drive down lithium-ion battery costs.

- This consistent and pronounced cost reduction positions lithium-ion batteries as the preferred choice across all energy storage markets, from grid-scale applications to microgrids. Moreover, as battery prices continue to drop, electric vehicles (EVs) are set to become price-competitive across major light-duty segments before 2030, heralding a significant growth phase for the EV market.

- Thus, the ongoing decline in lithium-ion battery costs is not only set to boost their adoption but is also expected to spur the growth of the rechargeable battery market in China during the forecast period.

China Rechargeable Battery Industry Overview

The China rechargeable battery market is fragmented. Some of the key players in the market (not in any particular order) include BYD Company Ltd., Contemporary Amperex Technology Co. Limited, GS Yuasa International Ltd, TianJin Lishen Battery Joint-Stock Co. Ltd, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Cost

- 4.5.1.2 Increasing Adoption of Electric Vehicles

- 4.5.1.3 Growing Adoption of Renewable Energy Sector

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.2.2 Environmental and Safety Concerns

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 BYD Co.Ltd.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 TianJin Lishen Battery Joint-Stock Co. Ltd

- 6.3.6 East Penn Manufacturing Co.

- 6.3.7 LG Chem Ltd.

- 6.3.8 Samsung SDI Co. Ltd

- 6.3.9 Exide Industries Ltd

- 6.3.10 Leoch International Technology Limited

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

02-2729-4219

+886-2-2729-4219