|

市場調查報告書

商品編碼

1636547

中東和非洲二次電池市場佔有率分析、產業趨勢、成長預測(2025-2030)Middle East And Africa Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

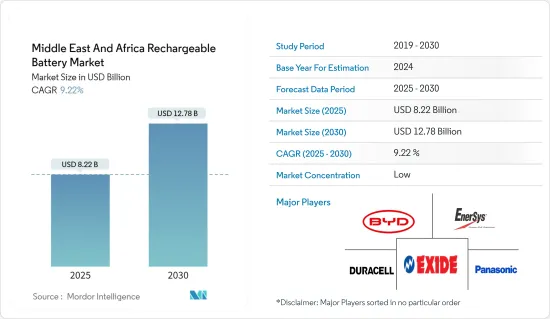

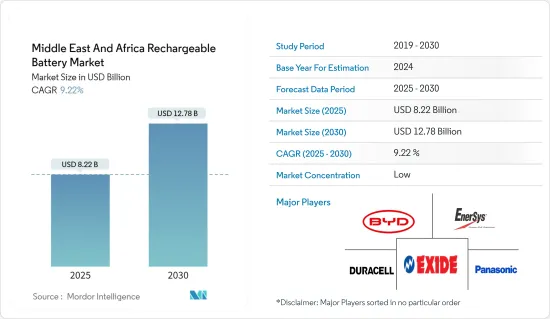

中東和非洲二次電池市場規模預計到2025年為82.2億美元,預計到2030年將達到127.8億美元,預測期內(2025-2030年)複合年成長率為9.22%。

主要亮點

- 從中期來看,電動車(EV)產量的增加和鋰離子電池價格的下降預計將在預測期內推動二次電池需求。

- 另一方面,蘊藏量的短缺可能會嚴重限制二次電池市場的成長。

- 智慧型手錶、無線耳機和智慧手環等穿戴式裝置的日益普及預計將在不久的將來為可充電電池市場的參與企業創造巨大的商機。

- 預計阿拉伯聯合大公國的中東和非洲充電電池市場將顯著成長。

中東和非洲充電電池市場趨勢

鋰離子電池佔市場主導地位

- 中東和非洲鋰離子二次電池市場是一個充滿活力、機會與挑戰並存的市場。由於其卓越的容量重量比,鋰離子電池比其他技術更受歡迎。長壽命、最少維護、延長保存期限和大幅降價等優點進一步推動了鋰離子電池的採用。

- 鋰離子電池歷來比同類電池貴,但市場領導者正在加大投資。對實現規模經濟和加強研發力度的關注加劇了競爭並壓低了鋰離子電池的價格。

- 2023年,電池價格將出現顯著下降,穩定在139美元/kWh。隨著採礦和精製能的增加,鋰價格預計將穩定並到 2026 年達到 100 美元/kWh 大關。

- 隨著電動車和永續能源儲存解決方案需求激增,中東和非洲國家正在增加對鋰電池研發的投資。非洲擁有豐富的鋰礦床,正成為全球鋰離子電池供應鏈的重要參與企業。

- 剛果民主共和國、辛巴威和奈米比亞等擁有大量鋰蘊藏量的國家正成為主要投資目標。這些國家擁有豐富的鋰資源,是快速成長的電動車市場的重要參與企業。

- 此外,世界向清潔能源和交通的轉變推動了對電動車(EV)前所未有的需求。電動車的蓬勃發展直接擴大了對鋰離子二次電池的需求。 2022 年 4 月,沙烏地阿拉伯與 Lucid Motors(一家由該國公共投資基金 (PIF) 部分資助的上市公司)簽署協議,在未來 10 年內採購 10 萬輛電動車。

- 同樣,2023 年 9 月,肯亞政府與電動二輪車製造商合作部署了超過 100 萬輛電動車。該合作夥伴關係還包括 Spiro 安裝 3,000 個電池充電和交換站、加強肯亞的電動車基礎設施並建立當地製造工廠。

- 此類措施和投資將擴大該地區的電動車產量,並在預測期內增加對鋰離子電池的需求。

阿拉伯聯合大公國實現顯著成長

- 阿拉伯聯合大公國已成為中東和非洲充滿活力的經濟和技術進步中心。隨著國家的發展,對可攜式電源,尤其是電池能源儲存系統(BESS)的需求預計在未來幾年將快速成長。

- BESS 對於將太陽能和風能等可再生能源無縫整合到電網中至關重要。 BESS 可以緩解能源生產的波動並確保持續可靠的電力供應。

- 根據國際可再生能源機構(IRENA)的報告,2023年阿拉伯聯合大公國可再生能源裝置容量將達到605萬千瓦,在過去10年中成長了驚人的45倍。值得注意的是,2022年至2023年間成長率接近68%。

- 展望未來,阿拉伯聯合大公國政府承諾在2050年投資1,640億美元,以滿足不斷成長的能源需求並促進永續經濟成長。杜拜2050年能源策略已經實現了2020年7%的能源來自清潔能源來源的目標。該策略的雄心勃勃的目標是到 2030 年達到 25%,到 2050 年達到 75%。這些雄心勃勃的目標將增加該地區對電池儲能系統的需求。

- 電動車(EV)在阿拉伯聯合大公國穩步普及。國際能源總署(IEA)的資料顯示,2023年電動車銷量將達28,900輛,與前一年同期比較成長52.9%。預測顯示,未來幾年電動車銷量將大增。

- 為了支持永續交通,阿拉伯聯合大公國正在積極推動電動車的採用。隨著全球社會邁向綠色未來,阿拉伯聯合大公國不僅推廣電動車,也大力投資必要的充電基礎設施。

- 2023年7月,能源和基礎設施部(MoEI)宣布了全面的電動車政策。該措施旨在為電動車充電基礎設施建立強力的監管標準,並有可能加強阿拉伯聯合大公國電池市場。

- 此外,MoEI 還制定了一個雄心勃勃的目標,即到 2050 年,阿拉伯聯合大公國道路上 50% 的車輛為電動車輛。這符合杜拜到 2030 年持有42,000 輛電動車的目標。

- 鑑於這些措施和預測,預計未來幾年阿拉伯聯合大公國對二次電池的需求將大幅增加。

中東和非洲二次電池產業概況

中東和非洲的二次電池產業較為分散。主要企業(排名不分先後)包括比亞迪有限公司、金霸王公司、Exide Industries Ltd.、EnerSys 和松下控股公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車 (EV) 產量增加

- 鋰離子電池價格下降

- 抑制因素

- 原料蘊藏量不足

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 技術部分

- 鋰離子電池

- 鉛酸電池

- 其他(鎳氫、鎳鎘等)

- 目的

- 汽車電池

- 工業電池(用於電源、固定電池(電信、UPS、能源儲存系統(ESS) 等)

- 手提電池(家用電子電器產品等)

- 其他

- 地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 奈及利亞

- 卡達

- 埃及

- 南非

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Saft Groupe SA

- Exide Industries Ltd

- ABM East Africa

- Amperex Technology Co. Limited

- Murrata Manufacturing Co. Ltd.

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 擴大穿戴式裝置的採用

簡介目錄

Product Code: 50004023

The Middle East And Africa Rechargeable Battery Market size is estimated at USD 8.22 billion in 2025, and is expected to reach USD 12.78 billion by 2030, at a CAGR of 9.22% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) production and declining lithium-ion battery prices are expected to drive the demand for the rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more is expected to create significant opportunities for rechargeable battery market players in the near future.

- United Arab Emirates (UAE) is anticpated to witness significant growth in the Middle East and Africa rechargeable battery market.

Middle East And Africa Rechargeable Battery Market Trends

Lithium-Ion Battery to Dominate the Market

- The Middle East and Africa's lithium-ion rechargeable battery market is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion batteries are outpacing other technologies in popularity, thanks to their superior capacity-to-weight ratio. Their adoption is further fueled by advantages like extended lifespan, minimal maintenance, enhanced shelf life, and a notable drop in prices.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been ramping up investments. Their focus on achieving economies of scale and bolstering R&D efforts has intensified competition, subsequently driving down lithium-ion battery prices.

- In 2023, battery prices saw a notable dip, settling at USD 139/kWh - a drop exceeding 13%. With the ramp-up of extraction and refining capacities, lithium prices are projected to stabilize, aiming for the USD 100/kWh mark by 2026.

- As the demand for electric vehicles and sustainable energy storage solutions surges, Middle Eastern and African nations are ramping up investments in lithium battery R&D. With its rich lithium deposits, Africa is positioning itself as a key player in the global lithium-ion battery supply chain.

- Countries like the Democratic Republic of Congo, Zimbabwe, and Namibia, boasting significant lithium reserves, are becoming prime targets for investments. These nations' abundant lithium resources position them as pivotal players in the burgeoning EV market.

- Moreover, the global shift towards cleaner energy and transportation has ignited an unprecedented demand for electric vehicles (EVs). This EV boom directly amplifies the need for lithium-ion rechargeable batteries. A testament to this trend: in April 2022, Saudi Arabia inked a deal with Lucid Motors, a company partly owned by the Kingdom's Public Investment Fund (PIF), to procure 100,000 EVs over the next decade.

- In a similar vein, in September 2023, Kenya's government collaborated with an electric motorbike manufacturer to introduce over a million EVs to the nation. The partnership includes Spiro's commitment to set up 3,000 battery charging and swapping stations, bolstering Kenya's EV infrastructure, and establishing a local manufacturing facility.

- Such initiatives and investments are poised to amplify EV production in the region, driving up the demand for lithium-ion rechargeable batteries during the forecast period.

United Arab Emirates (UAE) to Witness Significant Growth

- The United Arab Emirates (UAE) has emerged as a vibrant center for economic and technological progress in the Middle East and Africa. As the nation evolves, the demand for portable power sources, especially battery energy storage systems (BESS), is poised to surge in the coming years.

- BESS is pivotal in seamlessly integrating renewable energy sources, such as solar and wind, into the power grid. They mitigate fluctuations in energy production, ensuring a consistent and reliable electricity supply.

- As reported by the International Renewable Energy Agency (IRENA), the UAE's installed renewable energy capacity reached 6.05 GW in 2023, marking a staggering 45-fold increase over the past decade. Notably, a growth rate of nearly 68% was observed between 2022 and 2023.

- With an eye on the future, the UAE government has committed to investing USD 164 billion by 2050, aiming to meet the surging energy demand and foster sustainable economic growth. Dubai's Energy Strategy 2050 has already hit its 2020 target of deriving 7% of its energy from clean sources. The strategy ambitiously aims for 25% by 2030 and a remarkable 75% by 2050. Such ambitious targets are set to bolster the demand for BESS in the region.

- The UAE is witnessing a steady uptick in electric vehicle (EV) adoption. Data from the International Energy Agency (IEA) indicates that 28,900 EVs were sold in 2023, marking a 52.9% increase from the previous year. Projections suggest a significant surge in EV sales in the coming years.

- To champion sustainable transportation, the UAE is fervently promoting EV adoption. As the global community pivots towards a greener future, the UAE is not just encouraging EVs but is also heavily investing in the necessary charging infrastructure.

- In July 2023, the Ministry of Energy and Infrastructure (MoEI) unveiled a comprehensive electric vehicle policy. This policy aims to establish robust regulatory standards for EV charging infrastructure, potentially bolstering the battery market in the UAE.

- Furthermore, MoEI has set an ambitious target: by 2050, 50% of all vehicles on UAE roads will be electric. This aligns with Dubai's goal of having 42,000 EVs by 2030.

- Given these initiatives and projections, the demand for rechargeable batteries in the UAE is set to witness a significant upswing in the coming years.

Middle East And Africa Rechargeable Battery Industry Overview

The Middle East and Africa rechargeable Battery is semi-fragmented. Some key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Nigeria

- 5.3.4 Qatar

- 5.3.5 Egypt

- 5.3.6 South Africa

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Saft Groupe SA

- 6.3.7 Exide Industries Ltd

- 6.3.8 ABM East Africa

- 6.3.9 Amperex Technology Co. Limited

- 6.3.10 Murrata Manufacturing Co. Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

02-2729-4219

+886-2-2729-4219