|

市場調查報告書

商品編碼

1636550

義大利二次電池:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Italy Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

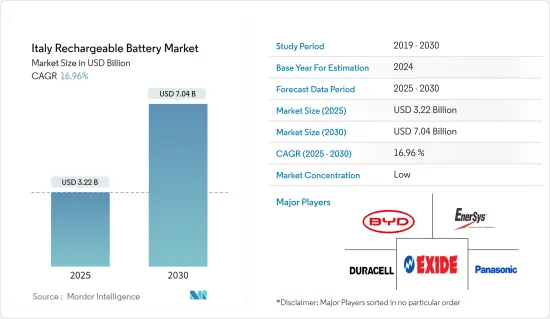

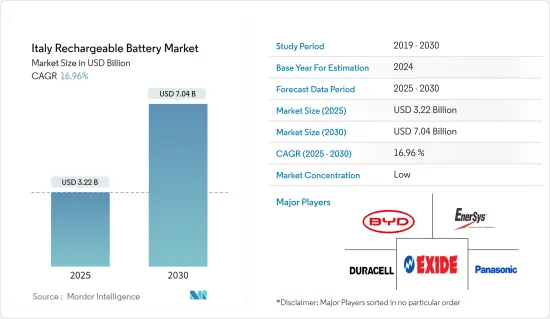

義大利二次電池市場規模預計在 2025 年為 32.2 億美元,預計到 2030 年將達到 70.4 億美元,預測期內(2025-2030 年)的複合年成長率為 16.96%。

主要亮點

- 從中期來看,預計電動車 (EV) 產量的增加和鋰離子電池價格的下降將在預測期內推動可充電電池的需求。

- 另一方面,原料蘊藏量短缺可能會嚴重限制二次電池市場的成長。

- 然而,智慧型手錶、無線耳機和智慧手環等穿戴式裝置的日益普及,預計將在不久的將來為二次電池市場參與者創造巨大的商機。

義大利二次電池市場趨勢

鋰離子電池類型佔市場主導地位

- 鋰離子二次電池因其眾多優點而受到青睞並在各個領域廣泛應用。它作為一種可靠、高效的電能能源儲存媒體的出現令人矚目。鋰離子二次電池的顯著特徵是其出色的能量密度,這使得它們能夠以緊湊、輕巧的形式容納強大的電力。

- 義大利鋰離子二次電池市場是一個充滿機會和挑戰的充滿活力的領域。由於其優異的容量重量比,鋰離子電池的普及度已經超過了其他技術。鋰離子電池的價格通常比同類產品高,而市場主要參與者都在大力投資研發和擴張。競爭加劇不僅增強了電池性能,而且還導致鋰離子電池價格下降。

- 2023 年,電池價格將出現明顯下降,穩定在 139 美元/千瓦時,降幅超過 13%,這得益於電動車 (EV) 和電池能源儲存系統(BESS) 平均電池組價格上漲。隨著採礦和精製能力的提高,鋰價格預計將在 2026 年穩定並達到 100 美元/kWh。

- 鋰離子二次電池是許多電池能源儲存系統(BESS) 的核心,具有高能量密度、快速充電和長循環壽命等特性。這些特性使其成為 BESS 應用中高效能源儲存的有吸引力的候選者。該地區的公司正在積極與領先組織合作,以加強 BESS舉措。

- 例如,2023 年 12 月,英國可再生能源發電公司 Octopus Energy 與 Next Capital Partners 成立了一家合資企業。他們的雄心勃勃的目標是在全國部署一個150萬千瓦的商業規模電池儲存系統。該計劃有望提升該地區的能源儲存能力,滿足未來幾年不斷成長的能源需求,從而推動對鋰離子二次電池的需求。

- 義大利對可再生能源,特別是太陽能和風能的重視是顯而易見的。鋰離子二次電池對於利用和儲存這種可再生能源至關重要,可確保在天氣條件變化的情況下實現穩定的電力供應。隨著2030年雄心勃勃的目標的製定,該國的可再生能源領域有望迎來更多的投資。

- 為了彰顯這一勢頭,愛迪生於 2023 年 3 月宣布向可再生能源投資 50 億歐元,目標到 2030 年將實現 6GW 的容量。同樣,2023年1月,Solarig與Alantra合資成立了發電容量為190萬千瓦的太陽能發電企業N-Sun Energy,該公司計劃到2025年在義大利建成50座發電廠。

- 這些項目不僅有望擴大該地區的可再生能源生產,也預示著鋰離子二次電池需求的激增。

汽車產業強勁成長

- 長期以來,汽車完全依賴內燃機(ICE)。然而,隨著環境問題日益嚴重,人們明顯轉向電動車(EV)。電動車主要使用鋰離子二次電池。鋰離子二次電池因其能量密度高、重量輕、自放電低、維護要求低而受到青睞。

- 插電式混合動力汽車和電動車由鋰離子二次電池系統動力來源。鋰離子電池具有快速充電功能和高能量密度,非常適合滿足OEM對續航里程和充電時間的要求。相較之下,鉛基牽引電池重量大、比能量低,不適合全混合動力汽車或電動車。

- 電動車在義大利越來越受歡迎。根據國際能源總署(IEA)的資料,2023年義大利的電動車銷量將達13.6萬輛,較2022年成長19.3%。預計未來幾年電動車銷量將大幅成長。

- 義大利支持電動車(EV),以此作為邁向永續交通的一步。透過加強電動車的普及和投資充電基礎設施,義大利正跟上全球向綠色未來的轉變。

- 義大利採取了一項引人注目的舉措,於 2024 年 2 月宣布了一項 9.5 億歐元(10 億美元)的補貼計畫。目的是鼓勵向更清潔的汽車(電動車)轉型並促進汽車產業的發展。具體來說,羅馬將向低收入者提供高達 13,750 歐元的補貼,幫助他們購買售價不超過 35,000 歐元(不含增值稅)的全新全電動汽車。

- 此外,政府正在大力投資本地充電基礎設施。該公司在 2023 年 1 月的公告中透露了到 2026 年建造超過 21,000 個充電站的計畫。國家復甦和恢復計劃預計到 2030 年將擁有“約 600 萬輛電動車”和“31,500 個公共快速充電站”,符合歐洲脫碳目標。

- 政府的這些積極措施將促進電動車的銷售並擴大充電基礎設施,從而在預測期內增加對二次電池的需求。

義大利二次電池產業概況

義大利的副砲是半碎片的。主要企業(不分先後順序)包括比亞迪股份有限公司、金霸王公司、埃克塞德工業有限公司、EnerSys、松下控股株式會社。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 電動車產量增加

- 鋰離子電池價格下跌

- 限制因素

- 原料蘊藏量短缺

- 驅動程式

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章 市場區隔

- 依電池類型

- 鋰離子電池

- 鉛酸電池

- 其他 (NiMh、Nicd 等)

- 按應用

- 汽車電池

- 工業電池

- 行動電源

- 其他用途

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Saft Groupe SA

- Exide Industries Ltd

- FIAMM Energy Technology SpA

- Amperex Technology Co. Limited

- Gotion High tech Co Ltd

- List of Other Prominent Companies

- Market Ranking/Share Analysis

第7章 市場機會與未來趨勢

- 穿戴式裝置的普及率不斷提高

簡介目錄

Product Code: 50004026

The Italy Rechargeable Battery Market size is estimated at USD 3.22 billion in 2025, and is expected to reach USD 7.04 billion by 2030, at a CAGR of 16.96% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) production and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

Italy Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion rechargeable batteries, celebrated for their myriad advantages, find extensive applications across diverse sectors. Their ascent as a trusted and efficient medium for electrical energy storage is noteworthy. A standout feature of lithium-ion batteries is their impressive energy density, allowing them to pack substantial power into a compact, lightweight form.

- Italy's lithium-ion rechargeable battery market is a dynamic arena, brimming with both opportunities and challenges. Thanks to their superior capacity-to-weight ratio, lithium-ion batteries are outpacing other technologies in popularity. While lithium-ion batteries typically command a premium price compared to their counterparts, leading market players are heavily investing in R&D and scaling operations. This intensified competition has not only bolstered battery performance but also contributed to a downward trend in lithium-ion battery prices.

- In 2023, driven by rising average battery pack prices in electric vehicles (EVs) and battery energy storage systems (BESS), battery prices saw a notable dip, settling at USD 139/kWh, marking a decline of over 13%. With the ramp-up of extraction and refining capacities, lithium prices are projected to stabilize, aiming for the USD 100/kWh mark by 2026.

- Central to many Battery Energy Storage Systems (BESS), lithium-ion rechargeable batteries shine with their high energy density, rapid charging, and extended cycle life. These attributes make them prime candidates for efficient energy storage and release in BESS applications. Companies in the region are actively collaborating with leading organizations to bolster BESS initiatives.

- As an illustration, in December 2023, Octopus Energy Generation, a British renewable energy firm, forged a joint venture with Next Capital Partners. Their ambitious goal is to roll out 1.5 GW of commercial-scale battery storage systems nationwide. This initiative is poised to bolster regional storage capabilities, addressing the surging energy demand in the years ahead, and subsequently driving up the demand for lithium-ion rechargeable batteries.

- Italy's commitment to renewable energy sources, notably solar and wind, is evident. Lithium-ion batteries are pivotal in harnessing and storing this renewable energy, ensuring consistent power supply despite weather variances. With ambitious targets set for 2030, the country's renewable energy sector is poised for heightened investments.

- Highlighting this momentum, in March 2023, Edison unveiled a EUR 5 billion investment in renewables, aiming for a 6 GW capacity by 2030. Similarly, in January 2023, Solarig and Alantra's collaboration on the 1.9 GW solar PV venture, N-Sun Energy, underscores the focus on Southern Europe, with a significant 50 plants slated for completion in Italy by 2025.

- These undertakings not only promise to amplify renewable energy output in the region but also signal a burgeoning demand for lithium-ion rechargeable batteries in the foreseeable future.

Automobile Segment to Witness Significant Growth

- For a long time, vehicles relied solely on internal combustion engines (ICE). However, as environmental concerns grow, there's a noticeable shift towards electric vehicles (EV). Predominantly, EVs utilize lithium-ion rechargeable batteries, favored for their high energy density, lightweight nature, minimal self-discharge, and low maintenance needs.

- Plug-in hybrids and electric vehicles are powered by lithium-ion battery systems. Thanks to their rapid recharge capability and high energy density, lithium-ion batteries uniquely satisfy OEM demands for both driving range and charging time. In contrast, lead-based traction batteries fall short for full hybrids or electric vehicles, given their heavier weight and lower specific energy.

- Italy is seeing a steady uptick in electric vehicle adoption. Data from the International Energy Agency (IEA) reveals that in 2023, Italy sold 136,000 electric vehicles, marking a 19.3% increase from 2022. Projections indicate a significant surge in EV sales in the coming years.

- Italy is championing electric vehicles (EVs) as a step towards sustainable transportation. By bolstering EV adoption and investing in charging infrastructure, Italy aligns with the global shift towards a greener future.

- In a notable move, Italy unveiled in February 2024 a substantial 950 million euro (USD 1 billion) subsidy initiative. This aims to facilitate the transition to cleaner cars (EVs) and invigorate the auto sector. Specifically, Rome is offering subsidies of up to 13,750 euros to lower earners, aiding their purchase of new fully electric vehicles priced up to 35,000 euros, excluding VAT.

- Moreover, the government is making significant investments in the region's charging infrastructure. Highlighting this commitment, a January 2023 announcement detailed plans for over 21,000 charging stations by 2026. The National Recovery and Resilience Plan envisions "around 6 million EVs by 2030" and "31,500 public fast charging points" to align with European decarbonization goals.

- Such proactive government measures are poised to bolster EV sales, expand charging infrastructure, and subsequently elevate the demand for rechargeable batteries in the forecast period.

Italy Rechargeable Battery Industry Overview

The Italy rechargeable Battery is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Saft Groupe SA

- 6.3.7 Exide Industries Ltd

- 6.3.8 FIAMM Energy Technology SpA

- 6.3.9 Amperex Technology Co. Limited

- 6.3.10 Gotion High tech Co Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

02-2729-4219

+886-2-2729-4219