|

市場調查報告書

商品編碼

1636560

東南亞充電電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Southeast Asia Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

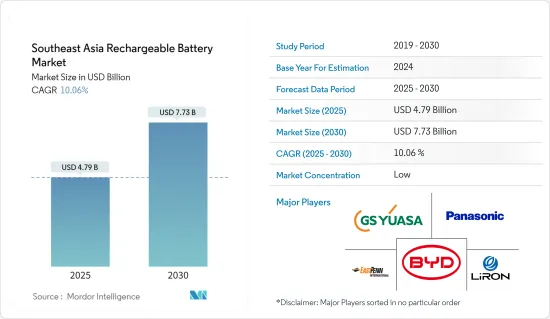

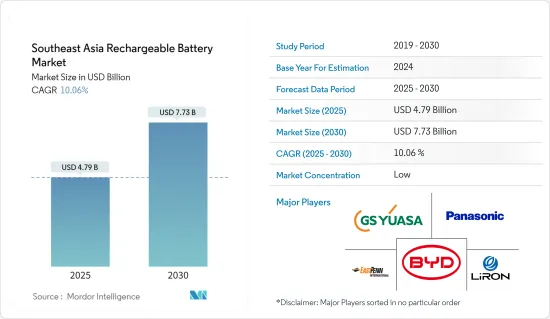

東南亞可充電電池市場規模預計到2025年為47.9億美元,預計2030年將達到77.3億美元,預測期內(2025-2030年)複合年成長率為10.06%。

主要亮點

- 從中期來看,鋰離子電池價格的下降、電動車滲透率的提高以及可再生能源領域的擴張預計將在預測期內推動東南亞二次電池市場的發展。

- 另一方面,當地電池生產所需的原料蘊藏量稀缺預計將阻礙預測期內的市場成長。

- 隨著新電池技術和先進電池化學材料的不斷發展,東南亞二次電池市場可能會創造巨大的商機。

- 其中,泰國預計在預測期內將出現顯著成長。

東南亞二次電池市場趨勢

汽車領域預計將主導市場

- 在東南亞,汽車應用預計將在不久的將來成為二次電池(尤其是鋰離子電池)的主導領域。電動車(EV)在該地區越來越受歡迎,預計將顯著增加對二次電池的需求。這種轉變主要是由於汽油和天然氣等燃料價格的波動,以及各國對排放法規的日益關注,促使人們放棄傳統汽車。

- 此外,鉛酸電池在汽車行業的啟動、照明和點火(SLI)配件中發揮著重要作用。這些 SLI 電池提供強勁的初始啟動能力,這對於啟動汽車引擎至關重要。由於它比深迴圈電池更小、更輕,因此其需求預計將持續存在,從而在短期內加強東南亞的二次電池市場。

- 根據東協汽車聯合會的資料,印尼、馬來西亞和泰國在汽車銷售方面領先東南亞。就2023年汽車銷售而言,印尼將以超過100萬輛的銷量領先,其次是馬來西亞,約80萬輛,泰國約77.5萬輛。如此強勁的汽車銷售預計將促進二次電池的普及。

- 電動車(EV)最近在東南亞越來越受歡迎。幾個主要國家已經制定或更新了 2025 年至 2050 年期間的電動車指令。例如,菲律賓專注於發展公共交通,目標是到 2030 年讓所有車輛中 21% 為電動車輛,到 2040 年讓這一比例達到 50%。菲律賓電動車協會 (EVAP) 將 2030 年電動車普及率的預測從 30 萬輛提高到 100 萬輛,主要依靠行業獎勵、監管清晰度以及對電動車優勢認知的提高。

- 印尼的目標是到 2025 年電動車佔汽車銷量的 20%,並計劃在 2030 年國內生產 60 萬輛電動車。這些目標將成為整個電動車供應鏈(包括銷售、生產和充電站)的里程碑,並將刺激對充電電池的需求。

- 馬來西亞正在積極發展電動車製造業,並吸引大量電動車電池生產投資。例如,2023年8月,Eve Energy Malaysia在吉打居林投資4.223億美元(19.3億令吉)的電池製造工廠破土動工,該工廠是國際圓柱形電池工業的一部分。該工廠計劃生產電動摩托車用21700型圓柱形鋰離子電池,計劃於2026年開始運作。

- 2023年8月,印尼透露,美國電動車巨頭特斯拉正在考慮在該國投資生產鋰電池材料。預計很快就會發布正式公告。印尼正在與特斯拉進行談判,以利用其豐富的鎳蘊藏量(這對電動車電池至關重要),並吸引對電池製造和汽車生產的投資。

- 隨著這些新興市場的發展,汽車產業很可能在未來幾年推動東南亞二次電池市場的發展。

泰國正在經歷顯著的成長

- 泰國是汽車領域的投資目的地。 50年來,泰國已從一個簡單的汽車零件組裝國家發展成為東南亞首屈一指的汽車生產和出口中心。隨著電動車(EV)產量快速成長,在汽車製造商增加投資的支持下,泰國二次電池產業有望實現穩定成長。

- 根據泰國電動車協會(EVAT)的報告,泰國註冊的電池式電動車(BEV)數量大幅增加,2023年達到約100,219輛,較2022年成長380%,增幅驚人。這一勢頭仍在持續,截至 2024 年 2 月底,泰國註冊了約 22,278 輛新純電動車,進一步增加了對二次電池的需求。

- 政府對電動車購買者的激勵措施和對製造商的支持措施極大地刺激了泰國電動車的引進。例如,新推出的國內電動車購買補貼計畫凸顯了泰國成為東南亞電動車生產中心的野心。根據將於 2024 年至 2027 年實施的 EV3.5 計劃,政府將為每輛車提供 50,000泰銖(1,397.02 美元)至 100,000泰銖(2,794.04 美元)的補貼,以培育電動汽車行業並吸引外國投資。

- 泰國的目標是到 2030 年電動車佔汽車銷售的 30%,這與其成為區域電動車生產強國的願景一致。這種雄心壯志使泰國成為未來二次電池市場的中心,並為電池製造商帶來了利潤豐厚的機會。

- 此外,根據泰國4.0計劃,泰國政府正在整合雲端運算和巨量資料等尖端技術,這表明對資料中心以及電池的需求將會增加。

- 電池製造商正在積極擴大在泰國的業務。一個著名的例子是寶馬集團,該集團於 2024 年 3 月開始在羅勇建造「第五代」高壓電池工廠。這座佔地 4,000平方公尺的組裝廠整合到寶馬現有的汽車工廠中,將加強該公司的電氣化策略,特別是計劃於 2025 年底推出的純電動車。 BMW在該項目上投資超過 4,200 萬歐元。

- 鑑於這些動態,泰國預計在未來幾年內引領東南亞二次電池市場。

東南亞二次電池產業概況

亞太地區充電電池市場已縮減一半。市場主要企業包括(排名不分先後)松下公司、比亞迪有限公司、GS湯淺公司、East Penn Manufacturing Co.和LiRON LIB Power Pte Ltd。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 鋰離子電池成本下降

- 抑制因素

- 缺乏本地生產電池所需的原料

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 科技

- 鉛酸電池

- 鋰離子

- 其他技術(NiMh、Nicd 等)

- 目的

- 汽車電池

- 工業電池(用於電源、固定電池(電信、UPS、能源儲存系統(ESS) 等)

- 可攜式電池(家用電子電器產品等)

- 其他

- 地區

- 泰國

- 印尼

- 越南

- 馬來西亞

- 菲律賓

- 新加坡

- 緬甸

- 其他東南亞地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Corporation

- BYD Co.Ltd.

- GS Yuasa Corporation

- East Penn Manufacturing Co.

- LiRON LIB Power Pte Ltd.

- Samsung SDI Co. Ltd

- LG Chem Ltd.

- Clarios, LLC.

- Exide Industries Ltd

- Tianjin Lishen Battery Joint-Stock Co. Ltd.

- Leoch International Technology Limited

- 其他知名公司名單(公司名稱、總部地點、相關產品及服務、聯絡等)

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 新型電池技術與先進電池化學材料的開發進展

簡介目錄

Product Code: 50004066

The Southeast Asia Rechargeable Battery Market size is estimated at USD 4.79 billion in 2025, and is expected to reach USD 7.73 billion by 2030, at a CAGR of 10.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector are expected to drive the Southeast Asia rechargeable battery market during the forecast period.

- On the other hand, the lack of raw material reserves required for the local production of batteries is likely to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create vast opportunities for the Southeast Asia rechargeable battery market.

- Among the countries, Thailand is likely to witness significant growth during the forecast period.

Southeast Asia Rechargeable Battery Market Trends

Automotive Segment is Expected to Dominate the Market

- In Southeast Asia, automotive applications are poised to emerge as a dominant segment for rechargeable batteries, especially lithium-ion batteries, in the near future. The rising adoption of electric vehicles (EVs) in the region is set to significantly boost the demand for rechargeable batteries. This shift is largely driven by fluctuating fuel prices, including gasoline and natural gas, and an increasing emphasis on emission controls across various countries, prompting a move away from conventional vehicles.

- Furthermore, lead-acid batteries play a crucial role in the automotive industry's starting, lighting, and ignition (SLI) accessories. These SLI batteries deliver a powerful initial burst, essential for starting a vehicle's engine. Being smaller and lighter than deep-cycle batteries, their demand is projected to persist, bolstering the rechargeable battery market in Southeast Asia in the short term.

- Data from the ASEAN Automotive Federation highlights that Indonesia, Malaysia, and Thailand lead Southeast Asia in motor vehicle sales. In 2023, Indonesia topped the chart with over one million vehicle sales, trailed by Malaysia and Thailand with nearly 800,000 and 775,000 sales, respectively. Such robust vehicle sales are anticipated to bolster the uptake of rechargeable batteries.

- Recently, electric vehicles (EVs) have gained traction in Southeast Asia. Several key nations have set or updated EV mandates for 2025 to 2050. The Philippines, for instance, aims for EVs to constitute 21% of its total vehicles by 2030, emphasizing public transport, and 50% by 2040. The Electric Vehicle Association of the Philippines (EVAP) has upped its e-vehicle adoption forecast from 300,000 units in 2030 to a million, banking on sector incentives, clearer regulations, and heightened awareness of EV benefits.

- Indonesia targets 20% of car sales to be EVs by 2025, with a goal of producing 600,000 EVs domestically by 2030. These ambitions translate into milestones across the EV supply chain, including sales, production, and charging stations, likely spurring the demand for rechargeable batteries.

- Malaysia is actively fostering its EV manufacturing sector, attracting notable investments in EV battery production. For example, in August 2023, Eve Energy Malaysia broke ground on a USD 422.3 million (MYR 1.93 billion) battery manufacturing facility in Kulim, Kedah, part of the International Cylindrical Battery Industrial Park. Set to produce 21700-format cylindrical lithium-ion batteries for electric two-wheelers, the facility aims for a 2026 commissioning.

- In August 2023, Indonesia revealed that Tesla, the U.S. electric car giant, is contemplating an investment in lithium battery material production in the country. An official announcement is anticipated soon. Indonesia is in talks with Tesla, aiming to draw investments in battery manufacturing and automobile production, leveraging its rich nickel reserves, vital for EV batteries.

- Given these developments, the automotive sector is set to lead the rechargeable battery market in Southeast Asia in the coming years.

Thailand to Witness a Significant Growth

- Thailand stands out as a prime destination for investments in the automobile sector. Over the past 50 years, Thailand has evolved from merely assembling auto components to becoming Southeast Asia's foremost automotive production and export hub. With a surge in electric vehicle (EV) production, the Thai rechargeable battery industry is poised for steady growth, fueled by heightened investments from automakers.

- As reported by the Electric Vehicle Association of Thailand (EVAT), Thailand saw a remarkable surge in battery electric vehicle (BEV) registrations, hitting approximately 100,219 units in 2023, marking an impressive 380% jump from 2022. Continuing this momentum, by the end of February 2024, Thailand registered around 22,278 new BEVs, further amplifying the demand for rechargeable batteries.

- Government incentives for EV buyers and supportive measures for manufacturers have significantly spurred the adoption of EVs in Thailand. For instance, the newly introduced purchase subsidy scheme for domestically produced EVs underscores Thailand's ambition to be a Southeast Asian EV production hub. Under the EV3.5 scheme, running from 2024 to 2027, the government offers subsidies between THB 50,000 (USD 1,397.02) and THB 100,000 (USD 2,794.04) per vehicle, highlighting its commitment to nurturing the EV industry and drawing foreign investments.

- Thailand aims to have EVs make up 30% of all vehicle sales by 2030, aligning with its vision of becoming a regional EV production powerhouse. Such ambitions position Thailand as a future hub for the rechargeable battery market, presenting lucrative opportunities for battery manufacturers.

- Additionally, under the Thailand 4.0 Programme, the government is integrating advanced technologies like cloud computing and big data, signaling a rising demand for data centers and, consequently, batteries.

- Battery manufacturers are actively expanding their operations in Thailand. A notable example is BMW Group, which in March 2024, began constructing its 'Gen-5' high-voltage battery facility in Rayong. This 4,000 square meter assembly, integrated into BMW's existing car plant, is set to bolster the company's electrification strategy, especially with BEV rollouts planned for the latter half of 2025. BMW has committed over EUR 42 million to this venture.

- Given these dynamics, Thailand is poised to lead the rechargeable battery market in Southeast Asia in the coming years.

Southeast Asia Rechargeable Battery Industry Overview

The Asia-Pacific rechargeable battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, BYD Company Ltd., GS Yuasa Corporation, East Penn Manufacturing Co., and LiRON LIB Power Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves Required For Local Production Of Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Thailand

- 5.3.2 Indonesia

- 5.3.3 Vietnam

- 5.3.4 Malaysia

- 5.3.5 Philippines

- 5.3.6 Singapore

- 5.3.7 Myanmar

- 5.3.8 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 BYD Co.Ltd.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 East Penn Manufacturing Co.

- 6.3.5 LiRON LIB Power Pte Ltd.

- 6.3.6 Samsung SDI Co. Ltd

- 6.3.7 LG Chem Ltd.

- 6.3.8 Clarios, LLC.

- 6.3.9 Exide Industries Ltd

- 6.3.10 Tianjin Lishen Battery Joint-Stock Co. Ltd.

- 6.3.11 Leoch International Technology Limited

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

02-2729-4219

+886-2-2729-4219