|

市場調查報告書

商品編碼

1636580

光固化成形法(SLA) 技術 3D 列印 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Stereolithography (SLA) Technology 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

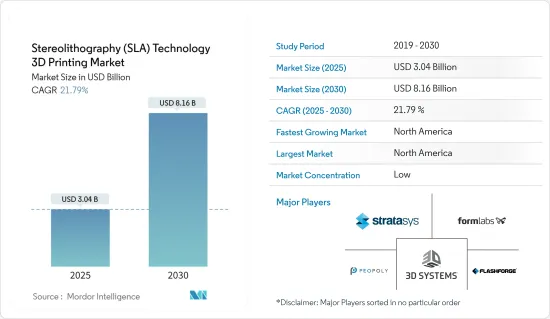

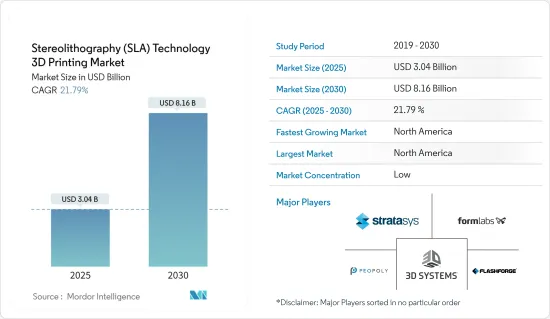

光固化成形法技術3D列印市場規模預計到2025年為30.4億美元,預計到2030年將達到81.6億美元,在預測期內(2025-2030年)複合年成長率為21.79%。

主要亮點

- 光固化成形法(SLA) 技術以其精度和製造複雜組件的能力而聞名,是不斷擴大的 3D 列印市場的關鍵組成部分。 SLA 3D 列印領域的一個顯著趨勢是不斷提高印表機速度和效率。製造商正專注於生產更快的雷射系統和微調軟體演算法,所有這些都是為了在不影響精度的情況下縮短列印時間。

- 另一個值得注意的趨勢是樹脂材料的擴展。高強度、耐熱、生物相容性和軟性樹脂的出現擴大了 SLA 技術的吸引力,服務於醫療、汽車和航太等領域。例如,2024 年 11 月,Formlabs 宣布推出新的 SLA 樹脂系列。該系列有兩種類型:“Creator Tough Resin”和“Creator Super Clear Resin”,兩者都具有優異的斷裂伸長率。透過拋光和透明塗層等後處理進一步增強其強度和透明度。

- 此外,桌上型 SLA 印表機的經濟性和易用性正在推動小型企業、業餘愛好者和教育機構的採用。後處理自動化的發展也是一個重要的進步。自動化樹脂清洗和固化的解決方案使生產工作流程更加簡化,並增加了 SLA 在大批量製造中的吸引力。 2024 年 9 月,Formlabs 透過引入 SLA 和 SLS後處理工具,在其已經豐富的超過 45 種材料庫中添加了兩種新材料,豐富了其產品組合。這些新增內容旨在擴展 3D 列印的應用並簡化使用者最終獲得消費者可接受的零件的路徑。

- 然而,3D列印並非沒有障礙。一個關鍵挑戰在於工業級 SLA 印表機和相關設備的初始投資較高。這種財務障礙通常會阻礙小型企業採用 SLA 技術。此外,SLA 列印的後處理既費力又耗時。零件列印完成後,會經歷幾個重要的後處理過程,包括酒精清洗、支撐材料去除和打磨。這些任務通常是手動完成的,存在人為錯誤的固有風險。

光固化成形法(SLA) 技術 3D 列印市場趨勢

醫療產業預計成長最快

- SLA 3D 列印市場在很大程度上受到醫療行業對複雜和客製化醫療解決方案的需求的推動。該技術擅長以無與倫比的精度列印複雜的患者特定模型和設備,重塑醫療原型製作和製造格局。

- SLA 技術對於手術範本、修復體、牙齒矯正器和解剖模型的製造至關重要,可增強術前計劃和患者溝通。公司正積極推出牙科和醫療領域的產品。例如,2024 年 4 月,立體光刻技術(SLA) 和選擇性雷射燒結 (SLS) 領域的領導者 Formlabs 宣布推出半個世紀以來的首款新型 3D 列印機,其模型專為牙科和醫療應用而設計。

- 利用生物相容性和可滅菌樹脂有助於創建患者專用的醫療設備,並確保符合嚴格的醫療標準。此外,醫療用途樹脂配方的創新擴大了 SLA 的應用,特別是在整形外科和客製化植入方面。

- 此外,SLA 技術樹脂材料的進步正在推動其在醫療領域的採用。例如,Formlabs 宣布推出六種新樹脂。四種改良的通用樹脂,一種專為快速原型製作和正畸模型而客製化的高速模型樹脂,以及專為高精度牙科工作而設計的精密模型樹脂。

- 透過利用生物相容性和無菌樹脂,該行業生產符合嚴格醫療標準的患者專用醫療設備。此外,樹脂配方的創新,尤其是醫療應用領域的創新,正在將 SLA 的應用擴展到整形外科和自訂植入等領域。

北美地區佔比最大

- 北美憑藉其強大的工業基礎和對先進製造技術的大量投資,在SLA 3D列印市場中佔據著舉足輕重的地位。該地區是主要 3D 列印公司的所在地,並廣泛應用於醫療保健、航太和汽車等關鍵領域。北美是 3D Systems 和 Formlabs 等行業領導者的所在地,處於 SLA 解決方案持續創新和發展的前沿。

- 在北美,尤其是美國醫療領域已全面採用SLA 3D列印。地區公司正在推出專為醫療用途量身定做的尖端 3D 列印硬體和材料,突顯他們對創新解決方案的承諾。

- 例如,總部位於加州的 Proclaim Health 旨在透過 3D 列印徹底改變牙線,創造改善牙齒和牙齦健康的工具。使用 3D 列印,我們對設計進行微調,優先考慮表面品質、生物相容性、半透明度和成本效益等功能方面。

- 市場成長得到監管認可的進一步支持,例如 FDA 對 3D 列印醫療設備的認可。同時,航太和國防領域利用 SLA 技術進行原型製作,生產符合嚴格精度標準的輕型複雜零件。

- 北美學術和研究機構正處於關鍵時刻,將 SLA 3D 列印納入其課程,以推動創新並培養精通積層製造的勞動力。例如,2024年,李大學在其山頂校園開設了最先進的3D列印中心,以滿足對3D列印資源快速成長的需求。該中心目前還擁有 10 台長絲印表機和一台最先進的大幅面 SLA 印表機。

立體光刻技術(SLA)技術3D列印產業概述

由創新和客製化驅動的全球和區域參與企業正在主導市場。醫療保健、汽車和航太等行業擴大採用這些創新。主要參與企業包括 3D Systems、Formlabs Inc.、Stratasys Ltd.、Peopoly 和 FlashForge。這些公司利用先進的材料相容性、高精度印表機和簡化的工作流程來服務工業和消費應用。

創新是競爭策略的基石。該公司正在投資新的樹脂配方,以實現更高的列印解析度、提高效率並擴大材料相容性。例如,領先的公司正在與軟體供應商、材料供應商和最終用戶合作,共同開發特定於應用的解決方案。

憑藉強大的工業基礎和積極的研發努力,北美和歐洲引領 SLA 3D 列印市場。相較之下,在政府措施、具成本效益的製造以及不同領域日益普及的推動下,亞太地區正迅速崛起為強大的競爭對手。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估宏觀經濟趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 對快速原型製作的需求不斷成長

- 樹脂材料的進展

- 市場限制因素

- 初期投資成本高

- 需要後處理

第6章 市場細分

- 按用途

- 原型製作

- 巡迴

- 最終用途產品

- 教育/研究

- 按行業分類

- 車

- 醫療保健

- 消費品

- 航太

- 製造業

- 教育

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- 3D Systems Inc.

- Formlabs

- Stratysys

- Peopoly

- XYZ printing

- FlashForge

- Zortrax

- B9Creations

- Shining 3D

- Prusa Research as

- Anycubic

- Phrozen Technology

- Kudo3D

- Asiga

- MiiCraft

- Uniz Technology LLC

第8章投資分析

第9章市場的未來

The Stereolithography Technology 3D Printing Market size is estimated at USD 3.04 billion in 2025, and is expected to reach USD 8.16 billion by 2030, at a CAGR of 21.79% during the forecast period (2025-2030).

Key Highlights

- Stereolithography (SLA) technology stands out as a crucial component of the expansive 3D printing market, celebrated for its precision and capability to craft intricate components. A prominent trend in the SLA 3D printing arena is the relentless push towards enhanced printer speed and efficiency. Manufacturers are channeling efforts into crafting swifter laser systems and fine-tuning software algorithms, all aimed at curtailing print times without compromising on accuracy.

- Another noteworthy trend is the expanding array of resin materials. The availability of high-strength, temperature-resistant, biocompatible, and flexible resins has broadened SLA technology's appeal, serving sectors like healthcare, automotive, and aerospace. For example, in November 2024, Formlabs unveiled a fresh lineup of SLA resins, catering specifically to hobbyists and makers. This lineup features the Creator Tough Resin and Creator Super Clear Resin, both boasting impressive elongation at break. Their strength and transparency can be further accentuated through post-processing methods such as polishing and clear coatings.

- Moreover, the surge in affordability and user-friendliness of desktop SLA printers has spurred their adoption among small businesses, hobbyists, and educational entities. The move towards automation in post-processing is another pivotal advancement. With solutions for automated resin washing and curing, production workflows are becoming more streamlined, enhancing SLA's appeal for high-volume production. In September 2024, Formlabs enriched its portfolio by adding two new materials to its already extensive library of 45+, alongside introducing SLA and SLS post-processing tools. These additions aim to broaden 3D printing applications and simplify the journey for users to attain final, consumer-ready parts.

- However, the landscape isn't without its hurdles. A significant challenge lies in the steep initial investment for industrial-grade SLA printers and their associated equipment. This financial barrier often deters small and medium-sized enterprises from embracing SLA technology. Furthermore, the post-processing demands of SLA printing can be both labor-intensive and time-consuming. Once parts are printed, they undergo several essential post-processing steps: washing with alcohol, support material removal, and sanding. Typically executed manually, these tasks carry an inherent risk of human error.

Stereolithography (SLA) Technology 3D Printing Market Trends

Healthcare Sector is Expected to be the Fastest Growing Segment

- The SLA 3D printing market is being significantly propelled by the healthcare sector's demand for intricate and tailored medical solutions. This technology's prowess in crafting complex, patient-specific models and devices with unparalleled precision is reshaping the landscape of medical prototyping and production.

- SLA technology is pivotal in producing surgical guides, prosthetics, dental aligners, and anatomical models, enhancing both preoperative planning and patient communication. Companies are actively introducing products tailored for the dental and healthcare arenas. For example, in April 2024, Formlabs, a leader in stereolithography (SLA) and selective laser sintering (SLS), unveiled its first new 3D printer in half a decade, alongside a model tailored for dental and healthcare uses.

- Utilizing biocompatible and sterilizable resins has facilitated the creation of patient-specific medical devices, ensuring compliance with rigorous healthcare standards. Moreover, innovations in resin formulations for medical purposes have expanded SLA's applications, notably in orthopedics and bespoke implants.

- Furthermore, advancements in resin materials for SLA technology are propelling its adoption in the healthcare domain. For instance, Formlabs introduced six new resins, featuring four reformulated general-purpose variants, a fast model resin tailored for swift prototypes and orthodontic models, and a precision model resin designed for high-accuracy dental tasks.

- By leveraging biocompatible and sterilizable resins, the industry is producing patient-specific medical devices that adhere to stringent healthcare standards. Additionally, innovations in resin formulations, especially for medical uses, are expanding SLA's applications into fields like orthopedics and custom implants.

North America Holds One of the Largest Share

- North America's robust industrial foundation and substantial investments in advanced manufacturing technologies position it as a pivotal player in the SLA 3D printing market. The region boasts major 3D printing firms and widespread adoption across vital sectors, notably healthcare, aerospace, and automotive. With industry leaders like 3D Systems and Formlabs, North America is at the forefront of continuous innovation and the evolution of SLA solutions.

- In North America, the healthcare sector, especially in the U.S., has wholeheartedly adopted SLA 3D printing. Regional firms are introducing cutting-edge 3D printing hardware and materials tailored for healthcare, emphasizing their commitment to innovative solutions.

- For instance, Proclaim Health, a California-based company is revolutionizing dental flossing through 3D printing, aiming to develop a tool that enhances dental and gum health. Leveraging 3D printing, they're fine-tuning their design to prioritize functional aspects like surface quality, biocompatibility, translucency, and cost-effectiveness.

- Market growth is further bolstered by regulatory endorsements, such as the FDA's support for 3D-printed medical devices. Meanwhile, the aerospace and defense sectors harness SLA technology for prototyping and crafting lightweight, intricate components that adhere to stringent precision standards.

- Academic and research institutions in North America are pivotal, weaving SLA 3D printing into their curricula, driving innovation, and nurturing a workforce skilled in additive manufacturing. For instance, in 2024, Leigh University inaugurated a state-of-the-art 3D printing hub on its Mountaintop campus, responding to the surging demand for 3D printing resources. This hub now boasts an additional 10 filament printers and a cutting-edge, larger-scale SLA printer.

Stereolithography (SLA) Technology 3D Printing Industry Overview

Several global and regional players, driven by innovation and customization, dominate the market. Industries such as healthcare, automotive, and aerospace are increasingly adopting these innovations. Key players include 3D Systems, Formlabs Inc., Stratasys Ltd, Peopoly, FlashForge, etc. These companies utilize advanced material compatibility, high-precision printers, and streamlined workflows to serve both industrial and consumer applications.

Innovation is the cornerstone of competitive strategy. Companies are channeling investments into new resin formulations, achieving higher print resolutions, enhancing efficiency, and broadening material compatibility. Collaborations and partnerships play a pivotal role; for instance, major players are teaming up with software providers, material suppliers, and end-users to co-create application-specific solutions.

North America and Europe lead the SLA 3D printing market, bolstered by robust industrial bases and active R&D endeavors. In contrast, the Asia-Pacific region is swiftly emerging as a formidable contender, fueled by government initiatives, cost-effective manufacturing, and rising adoption across diverse sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of Impact of Macroeconomic Trends on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Rapid Prototyping

- 5.1.2 Advancement in Resin Material

- 5.2 Market Restraints

- 5.2.1 High Initial Investment Costs

- 5.2.2 Post Processing Requirements

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Prototyping

- 6.1.2 Tooling

- 6.1.3 End-Use Products

- 6.1.4 Education and Research

- 6.2 By End-User Vertical

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Consumer Goods

- 6.2.4 Aerospace

- 6.2.5 Manufacturing

- 6.2.6 Education

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Inc.

- 7.1.2 Formlabs

- 7.1.3 Stratysys

- 7.1.4 Peopoly

- 7.1.5 XYZ printing

- 7.1.6 FlashForge

- 7.1.7 Zortrax

- 7.1.8 B9Creations

- 7.1.9 Shining 3D

- 7.1.10 Prusa Research a.s

- 7.1.11 Anycubic

- 7.1.12 Phrozen Technology

- 7.1.13 Kudo3D

- 7.1.14 Asiga

- 7.1.15 MiiCraft

- 7.1.16 Uniz Technology LLC