|

市場調查報告書

商品編碼

1640630

歐洲 3D 列印 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

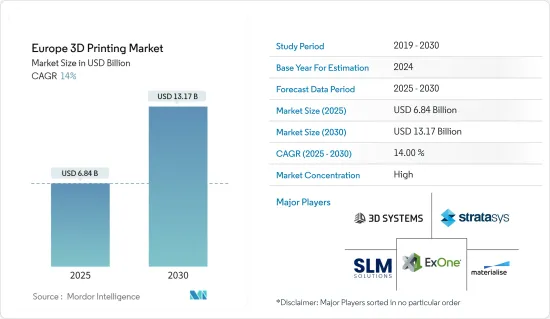

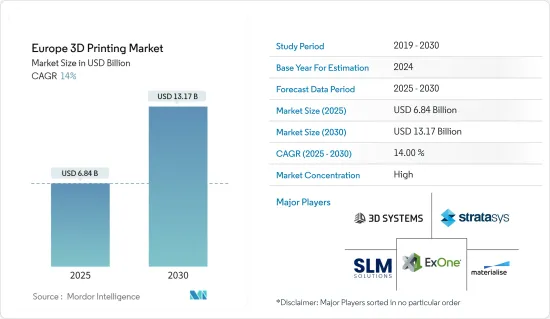

預計 2025 年歐洲 3D 列印市場規模為 68.4 億美元,到 2030 年將達到 131.7 億美元,預測期內(2025-2030 年)的複合年成長率為 14%。

歐洲是3D列印技術的領先中心。在歐洲,大多數需求來自需要快速、穩定且價格實惠的原型的中小型企業。

關鍵亮點

- 3D列印技術將從根本上顛覆許多領域的傳統生產,因為它可以以更低的成本提供差異化的產品和解決方案。由於政府的舉措和投入,以及 3D 列印為客製化產品、提高效率和改善產品品質提供的機會,該技術在歐洲的發展主導。

- 3D 列印技術在工業產品、航太、汽車、國防、醫療、教育和研究等各個應用領域的應用日益廣泛,推動 3D 列印市場的成長。

- 不過,有人指出,採用3D列印技術的一大障礙是初始成本高。這些支出包括軟體、硬體、材料、積層製造和製造專業知識、認證和工人培訓。建立3D系統所需的資金和人力遠遠超過標準列印技術所需的。然而,隨著商用桌面 3D 列印機的推出,該公司正在幫助最終用戶避免高昂的前期成本。

- 3D列印技術已顯著滲透至醫療、航空等關鍵產業領域,並以可觀的成長率成長。飛機製造商正在投資數十億美元開發這項技術,利用金屬粉末製造渦輪葉片、噴射引擎燃燒噴嘴和結構部件。

- 阻礙市場成長的主要因素包括缺乏標準流程控制、可用性有限以及 3D 列印材料成本高。

歐洲 3D 列印市場趨勢

3D 原型零件在汽車產業的採用率很高

- 歐洲汽車工業蓬勃發展,已成為各國發展和財富的先驅和推動力量。過去幾年裡,歐洲汽車產業已躍居全球產業前列。

- 歐洲是許多全球汽車OEM的所在地,3D 列印技術已廣泛應用於汽車產業的設計、研發應用。 BMW、賓士、奧迪、捷豹路虎和大眾等汽車產業的主要企業正在歐洲市場為 3D 技術和印表機創造潛在空間。

- 根據OICA預測,2023年德國將成為歐洲最大的乘用車生產國,產量達411萬輛。排名第二的是西班牙,乘用車產量為191萬輛。

- 2022年4月,黑石科技公司製定了銷售電動車3D列印鈉離子電池的計畫。該公司計劃在德國多伯恩的一個原型工廠投資 3,200 萬歐元(33,905,316 美元),並在本世紀中葉推出 3D 列印固態電池。固態電池將首先安裝在柏林的電動公車上,並在真實場景中進行測試。

- 此外,位於德國梅爾肯尼格的福特快速技術中心採用了多種 3D 列印技術來在短時間內生產原型。工程師和設計師無需前置作業時間將工作發送給公司,而是可以在幾小時內獲得他們的設計。設計師可以在快速技術中心創建當天原型,並在幾個小時內創建多個設計迭代。福特積層製造專家 Bruno Alves 表示,實體原型比數位模型具有優勢:

德國可望佔據主要佔有率

- EOS、Renishaw、SLM Solutions、Ultimaker 和 Photocentric 等來自各行各業的老字型大小企業因其在積層製造領域的技術專長而聞名於整個歐洲。 3D列印機主要集中在西歐,其中德國、英國、義大利、法國等國家推動AM的發展和應用。

- 此外,該地區各國對市場的投資不斷增加可能會進一步創造巨大的需求。據德國貿易投資署 (GTAI) 稱,德國擁有歐洲最先進的 3D 列印和積層製造業務,包括航太、汽車、家電和牙科。

- 根據德國聯邦統計局預測,2023年德國汽車產業收益將達4,576億歐元(4,936億美元),較前一年有所成長。

- 德國三分之一的大型工業公司已經在使用 3D 列印機,三分之二的公司已開始利用這項技術。這可能為市場參與企業創造有利可圖的機會,以擴大他們在該國的影響力,從而促進市場成長。

- 例如,2022年12月,德國3D列印技術供應商Headmade Materials宣布有意加入冷金屬融合聯盟(Cold Metal Fusion Alliance)和其他重要的市場參與企業。 ColdMetalFusion 是產業領導者的夥伴關係,擁有幾代燒結、積層製造和傳統工業製造經驗。聯盟合作夥伴共同為金屬製造客戶提供服務、材料、設備和技術。

歐洲3D列印產業概況

歐洲擁有大量影響3D列印市場的全球性和地區性公司,但歐洲市場的大部分由主要企業主導。因此,預計 3D 列印市場將呈現整合趨勢。 3D Systems Corporation、Materialise NV、Stratasys Ltd.、ExOne Co.、SLM Solutions Group AG 等是歐洲市場的主要企業。所有這些參與企業都參與了競爭策略,包括收購、合作、新產品開發和市場開發,以鞏固主導地位。

2022年10月,賽峰集團將在法國開設一個新的積層製造園區。賽峰集團新建的 12,500平方公尺工廠匯集了透過積層製造生產零件所需的所有步驟,從研發到工程和製造。該工廠配備了最先進的設備,例如3D列印機,利用3D數位影像將金屬粉末轉化為飛機和引擎零件,目前工廠運作100多名頂尖工程師、科學家和技術人員,齊心協力製造所有部分。

2022年7月,一家歐洲汽車公司推出了一款SLM Solutions金屬3D列印機。該客戶擁有超過 10 台 3D持有,其中包括多台 SLM 500 和 SLM 250 系統。該公司可能會使用金屬 AM 來製造汽車零件,重點是連續製造。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章 市場分析

- 市場促進因素

- 政府措施和支出

- 輕鬆開發客製化產品

- 市場問題

- 啟動成本高,技術純熟勞工短缺

第6章 市場細分

- 按組件

- 硬體

- 按服務

- 依技術分類

- 立體光刻技術(SLA)

- 熔融沉積建模(FDM)

- 電子束熔煉

- 數位光處理

- 選擇性雷射燒結 (SLS)

- 其他

- 按最終用戶產業

- 車

- 航太和國防

- 醫療

- 建築學

- 能源

- 食物

- 其他

- 按國家

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

第7章 競爭格局

- 公司簡介

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- General Electric Company(GE Additive)

- Sisma SPA

- ExOne Co.

- SLM Solutions Group AG

- Hewlett Packard Inc.

- Ultimaker BV

- Materialise NV

第8章投資分析

第9章:市場的未來

The Europe 3D Printing Market size is estimated at USD 6.84 billion in 2025, and is expected to reach USD 13.17 billion by 2030, at a CAGR of 14% during the forecast period (2025-2030).

Europe is a major hub for 3D printing technology. In Europe, the majority of demand is coming from SMEs that need high-speed, robust, and reasonably priced prototypes.

Key Highlights

- The use of 3D printing technology will radically disrupt conventional production in many sectors, as it is capable of delivering differentiated products and solutions at a lower cost. This technology is taking the lead in Europe, thanks to initiatives and spending of governments, opportunities for offering customized products through 3D printing, increased efficiency as well and higher product quality.

- The increase in the rate of adoption of 3D printing technology in various application segments, such as industrial products, aerospace, automotive, defense, healthcare, education & research, are facilitating the growth of the 3D printing market.

- However, the significant barrier to implementing 3D printing technology has been identified as expensive initial costs. This expenditure includes software, hardware, materials, additive and manufacturing expertise, certification, and worker training. The cash and manpower necessary to build a three-dimensional system are significantly more than those needed for standard printing technologies. However, with the commercial desktop 3D printer launch, companies are assisting end-customers in lowering the expensive initial expenses.

- The significant penetration of 3D printing technology was observed in important industry segments like health and aeronautics, where growth is increasing at a promising rate. 3D printing is helping to create more efficient processes in the aerospace sector; aircraft manufacturers have invested billions in developing the use of metal powders through this technology to make turbine blades, jet engine combustion nozzles, and structural parts.

- Nonetheless, some of the major factors inhibiting market growth include lack of standard process control and limited availability or significant costs in terms of 3D printing materials.

Europe 3D Printing Market Trends

High Adoption of 3D Prototype Parts in Automotive Industry

- The European automotive sector has been thriving and has emerged as a pioneer and driving force behind the country's development and wealth. In past years, the European automotive sector has risen to the forefront of the global industry.

- With the presence of many global automotive OEMs, Europe enjoys the broad-scale implementation of 3D printing technology for design formulation and R&D applications in the automotive industry. Top automotive leaders such as BMW, Mercedes, Audi, Jaguar Land Rover, Volkswagen, and many others have created a potential space for 3D technology and printers in the European market.

- According to OICA, in 2023, Germany produced the most significant passenger cars in Europe, 4.11 million. Spain ranked second, with almost 1.91 million passenger cars produced.

- In April 2022, Blackstone Technology formulated a plan to market 3D-printed sodium-ion cells for electric cars. The business plans to launch its 3D-printed solid-state battery in the middle of the decade after investing EUR 32 million (USD 33,900,531.60 Million) in a prototype facility in Dobeln, Germany. The solid-state batteries would first be put in the electric buses in Berlin to be tested in a real-world scenario.

- Moreover, several 3D printing methods are employed to manufacture prototypes with rapid turnaround times at Ford's Rapid Technologies Center in Merkenich, Germany. Instead of sending a task out to a business with a several-week lead time, engineers and designers can have their designs in their hands within hours. Designers can create same-day prototypes in the Rapid Technology Center, iterating on numerous designs in a matter of hours. According to Bruno Alves, an additive manufacturing expert at Ford, physical prototypes can have advantages over digital models.

Germany is Expected to Hold the Major Share

- A wide range of established industry players, including EOS, Renishaw, SLM Solutions, Ultimaker, and Photocentric, are well-known throughout Europe for their technical expertise in the field of additive manufacturing. The majority of 3D printers are located in Western Europe, with countries such as Germany, the United Kingdom, Italy, and France driving AM development and applications.

- Moreover, increasing investments in the market studied by various countries in the region may further create significant demand. According to GTAI (Germany Trade & Investment), Germany is home to some of Europe's most advanced 3D printing and additive manufacturing businesses, including aerospace, automotive, equipment, and dentistry.

- According to Statistisches Bundesamt, in 2023, the German automobile industry generated revenues of EUR 457.6 billion (USD 493.6 billion) in the motor vehicles segment, an increase from the previous year.

- One in every three big German industrial companies already uses 3D printing, and two out of every three have already used the technology. This, in turn, may create lucrative opportunities for the market players to expand their footprint in the country, thus boosting market growth.

- For instance, in December 2022, HeadmadeMaterials, a German 3D printing technology provider, intended to enter the ColdMetalFusionAlliance and other significant market players. ColdMetalFusion is a partnership of industry leaders with generations of sintering, additive manufacturing, and traditional industrial production experience. Partners of the Alliance collaborate to provide services, materials, equipment, and technology to clients in the metal production business.

Europe 3D Printing Industry Overview

Though the presence of many regional as well as global players in the European region is influencing the 3D printing market, the major chunk of the European market is captured by prominent players. Hence, the market for 3D printing is expected to be consolidated in nature. 3D Systems Corporation, Materialise NV, Stratasys Ltd., ExOne Co., and SLM Solutions Group AG, among others, are some major players in the European market. All these players are involved in competitive strategic developments such as acquisition, partnership, new product development, and market expansion to augment their leadership position in the European 3D printing market.

In October 2022, Safran opened a new additive manufacturing campus in France. Safran's new 12,500 m2 facility houses all the procedures required to create parts utilizing additive manufacturing, from R&D through engineering and production. With cutting-edge equipment, including 3D printers that employ 3D digital images to transform metallic powders into airplane and engine parts, more than 100 top-tier engineers, scientists, and technicians are currently operating at the factory to make components for the whole team.

In July 2022, a European automobile company installed metal 3D printers from SLM Solutions. The customer has over ten machines in its 3D printing fleet, including many SLM 500 and SLM 250 systems. It is believed to be using metal AM to build car elements, emphasizing serial manufacturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of New Entrants

- 4.2.5 Threat Of Substitutes

- 4.2.6 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment Of COVID-19 Impact On The Industry

5 MARKET DYANMICS

- 5.1 Market Drivers

- 5.1.1 Initiatives and Spending By Government

- 5.1.2 Ease in Development of Customized Products

- 5.2 Market Challenges

- 5.2.1 High Initial Costs and a Scarcity of Skilled Workers

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Services

- 6.2 By Technology

- 6.2.1 Stereo Lithography (SLA)

- 6.2.2 Fused Deposition Modeling (FDM)

- 6.2.3 Electron Beam Melting

- 6.2.4 Digital Light Processing

- 6.2.5 Selective Laser Sintering (SLS)

- 6.2.6 Other Technologies

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Aerospace and Defense

- 6.3.3 Healthcare

- 6.3.4 Construction and Architecture

- 6.3.5 Energy

- 6.3.6 Food

- 6.3.7 Other End-user Industries

- 6.4 By Country

- 6.4.1 Germany

- 6.4.2 United Kingdom

- 6.4.3 France

- 6.4.4 Italy

- 6.4.5 Spain

- 6.4.6 Netherlands

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Stratasys Ltd.

- 7.1.2 3D Systems Corporation

- 7.1.3 EOS GmbH

- 7.1.4 General Electric Company (GE Additive)

- 7.1.5 Sisma SPA

- 7.1.6 ExOne Co.

- 7.1.7 SLM Solutions Group AG

- 7.1.8 Hewlett Packard Inc.

- 7.1.9 Ultimaker BV

- 7.1.10 Materialise NV