|

市場調查報告書

商品編碼

1636589

歐洲零售分析:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Retail Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

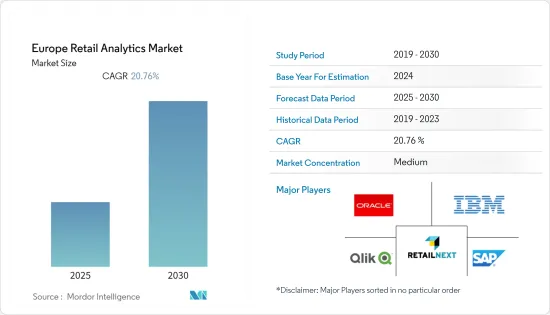

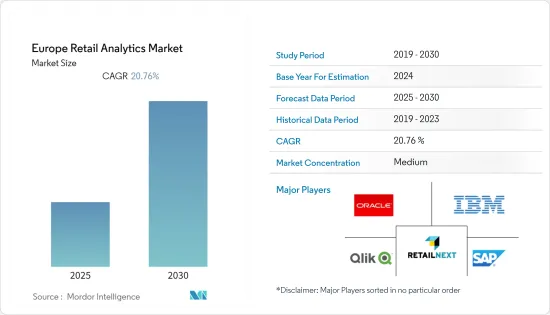

預計預測期內歐洲零售分析市場複合年成長率將達到 20.76%。

主要亮點

- 該地區使用零售分析的驅動力是能夠獲得有關客戶行為的具體、可操作的見解。我們的零售分析服務旨在為消費者提供個人化的關注。公司正在使用資料主導的零售分析解決方案來滿足不斷變化的消費者需求和零售商之間在客戶忠誠度方面日益激烈的競爭,幫助他們讓客戶更長時間地參與他們的業務。零售業中的預測分析使零售商能夠評估客戶資料並預測客戶的需求。

- 此外,從以客戶為中心的角度來看,實施零售分析策略旨在為企業提供所需的資源和技術,以創建和自動化跨線上管道的無縫消費者體驗。隨著越來越多的零售商採用客戶關係管理 (CRM) 系統,客戶體驗正在改善。此外,物聯網、POS、RFID等智慧型裝置的日益普及將產生大量資料,零售商可以利用資料來發現顧客的購買偏好和隱藏的客戶洞察。因此,零售商主要專注於改善客戶體驗,未來幾年對零售分析服務和軟體的需求預計將激增。

- 零售商的主要資源是庫存和貨架空間分配。分析是指使用分析方法來確定在正確的時間、正確的地點向正確的客戶提供正確的數量的正確產品。從微觀分析和品類規劃的角度來看,這一趨勢如今已成為零售業的持續過程。貨架空間管理的研究與商店中的顧客偏好以及不同產品組合的財務影響有關。

- 例如,歐洲新興企業Trax Ltd. 和 Roamler 已合作為消費包裝商品 (CPG) 公司提供商店審核服務。公司不斷拍攝貨架的照片,以了解貨架狀況。這提高了貨架上的產品供應量,並為商家提供了及時的洞察力,以便做出改善消費者體驗的決策。

- 決策支援系統(DSS)等商業情報工具使歐洲公司能夠產生壓力測試和銷售額預測。 DSS 允許公司進行敏感度分析,以評估外部變數(例如可能的封鎖或員工生病)業務的影響。與不使用分析和商業情報的公司相比,青睞資料主導決策的公司有望更好地管理危機並更快地恢復。

零售分析市場趨勢

雲端運算是市場促進因素之一

- 零售商在雲端中運行其分析和 BI 有許多理由和經濟利益。這些包括獨立於基礎設施的雲端環境的全天候可用性、縮短的 BI 組件部署時間、根據需求擴展或收縮基礎設施的靈活性、以及基礎設施採購的成本效益。此外,您可以在許可證上花費很多錢,並支援行動和基於網路的遠端存取來控制對資料庫的訪問,確保用戶安全並允許您執行分析。

- 了解 A&BI 平台的總擁有成本 (TOC) 是一項重要的考慮因素。必須評估成本比較,檢驗基礎設施許可證和支援的內部成本與外部雲端託管相比。使用 SaaS 時,整體擁有成本通常會較低,原因如下:首先,一些 SaaS 解決方案是多租戶平台,允許多個用戶共用支援軟體的基礎設施。即使在共用平台上,用戶也能保持其資訊的隱私和個人化。其次,SaaS 分析和 BI 平台不需要公司的伺服器、硬體或 IT 資源來運作軟體。

- SaaS A&BI 平台是自動化的、隨時可用的,大大減少了部署時間。可以透過標準的網頁瀏覽器存取 SaaS,從而減少學習曲線並提高採用率。所有使用者都可以使用 SaaS 解決方案,因為它們直覺、自助且熟悉。相較之下,內部部署 A&BI 基礎設施通常需要數月才能部署,並且需要經過培訓的員工來提取見解。

- 雲端解決方案相對於內部部署解決方案的優勢有望極大地推動雲端的採用。採用資料主導決策的公司預計將比不使用分析和商業情報的公司更好地管理危機並更快地恢復。

- 根據歐盟統計局的數據,2021 年,雲端在電子郵件和文件儲存中的使用仍然非常普遍,分別有 79% 和 66% 的使用雲端處理的組織報告稱,他們使用此類雲端服務並報告購買了雲端服務。與 2020 年相比,電子郵件、辦公室軟體以及會計和財務應用程式的雲端使用量略有增加(電子郵件和辦公室軟體增加 3 個百分點,會計應用程式增加 2 個百分點)。其他雲端服務的採用率保持相對穩定。

預計法國將實現強勁成長

- 這家法國零售商必須管理大量資訊,從員工資訊到庫存詳情、供應商資料和客戶購買行為。每次互動和資料點都是讓您的零售業務更有效率、更成功的機會。微軟的商業智慧工具 Power BI 記錄這些資料點,並透過建立客戶趨勢的圖形表示來幫助產生可操作的見解。這使得零售商能夠使用 BI資料透過個人化實現有效的鎖定客戶。

- 此外,隨著電子商務的快速崛起,商業智慧可以追蹤用戶與您的電子商務商店的互動方式。這些資訊使我們能夠進一步改善客戶的購物和服務體驗。此外,在電子商務中,商業情報使零售商能夠根據客戶行為做出更明智、更有效的決策。這些資料是即時提供的,有助於企業快速調整價格或更改產品供應。

- 此外,根據歐盟統計局的數據,2021 年在法國網路購物的人中,有 34% 在調查前的三個月內曾經進行過一到兩次線上購物。其餘三分之二的人在此期間在網路購物三次或三次以上。

- 根據Retail-Index的數據,截至2021年2月,法國零售市場共有382家零售公司,涵蓋20多個類別。服飾有超過 130 家商店,其中 52 家專門銷售鞋子和皮革製品。有28家零售公司專門從事食品零售。

- 有針對性的優惠和預測分析使這家法國零售商能夠為每位客戶制定高度細緻和個人化的優惠。例如,零售商可以透過提供激勵獎勵更頻繁購物的優惠來個性化店內體驗並推動購買。預測分析可用於向客戶提升銷售和交叉銷售。

零售分析行業概覽

歐洲零售分析市場報告中的主要參與者是 SAP SE、Oracle Corporation、Qlik Technologies, Inc.、Zoho Corporation、IBM Corporation、Retail Next, Inc.、Alteryx, Inc.、Tableau Software, Inc.、Adobe Systems Incorporated、 Microstrategy, Inc.、Prevedere Software, Inc.、Targit、Pentaho Corporation、ZAP Business Intelligence 和Fuzzy Logix 是部分國內參與者。

2022 年 11 月,RetailNext 宣布從市場研究公司 Ipsos 收購英國競爭對手 Retail Performance,以擴大其在歐洲和亞洲的客流量監測平台。 RetailNext 將此次收購描述為向英國和歐洲零售情報領域的策略擴張。該公司目前的監控業務每年記錄50個國家超過4,500家零售店的10多億次消費者訪問。

2022年9月,全球新一代數位服務和顧問公司Infosys與Microsoft Cloud for Retail建立合作夥伴關係。該合作夥伴關係將使零售商能夠快速重塑消費者體驗、實現流程現代化並透過雲端和資料增強系統。作為 Microsoft Cloud for Retail 合作夥伴,Infosys 的零售雲端解決方案和產業服務由 Infosys Cobalt 提供,是 Microsoft Cloud 產品的補充。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 更重視預測分析

- 資料量持續成長

- 銷售額預測需求不斷增加

- 限制因素

- 缺乏新興地區的公眾意識和專業知識

- 標準化和整合問題

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 依部署方式

- 本地

- 雲

- 按類型

- 解決方案(分析、視覺化工具、資料管理等)

- 服務(整合、支援和諮詢)

- 按模組類型

- 策略與規劃(宏觀趨勢、關鍵績效指標、價值分析)

- 行銷(定價、忠誠度、細分分析)

- 財務管理(會計管理)

- 商店營運(詐欺偵測、勞動力分析)

- 商品行銷(產品組合最佳化、購物者路徑分析)

- 供應鏈管理(庫存、供應商、供需模型)

- 其他模組類型

- 依業務類型

- 中小型企業

- 大型組織

- 按國家

- 英國

- 德國

- 法國

- 其他國家

第6章 競爭格局

- 公司簡介

- SAP SE

- Oracle Corporation

- Qlik Technologies, Inc.

- Zoho Corporation

- IBM Corporation

- Retail Next, Inc.

- Alteryx, Inc.

- Tableau Software, Inc.

- Adobe Systems Incorporated

- Microstrategy, Inc.

- Prevedere Software, Inc.

- Targit

- Pentaho Corporation

- ZAP Business Intelligence

- Fuzzy Logix

第7章投資分析

- 近期併購

- 投資展望

第 8 章:歐洲零售分析市場的未來趨勢

The Europe Retail Analytics Market is expected to register a CAGR of 20.76% during the forecast period.

Key Highlights

- The driving factor for using retail analytics in the region is that it provides tangible and practical insights into customer behavior. Retail analytics services are designed to give each consumer tailored attention. Companies have used data-driven retail analytics solutions that keep customers engaged with the company for a longer period in response to changing consumer needs and increasing rivalry among retailers for customer loyalty. Retail predictive analytics allows retailers to evaluate customer data and anticipate client wants and desires.

- Furthermore, from a customer-centric standpoint, implementing a retail analytics strategy is intended to offer businesses the resources and technology required to create and automate seamless consumer experiences across online channels. Customer experiences are improving as more retailers implement customer relationship management (CRM) systems. Furthermore, the increased use of IoT, POS, RFID and other smart devices generates enormous data, which merchants can utilize to find client buying preferences and hidden customer insights. As a result, retailers primarily focus on improving customer experience, which is expected to immediately drive demand for retail analytics services and software in the coming years.

- A retailer's primary resources are product inventory and shelf space allotment. It refers to the use of analytics to decide product offers in the right place, at the right time, and in the appropriate quantity for the right customers. In terms of micro-level analysis and assortment planning, this trend has now become a constant process in the retail industry. Shelf space management is being studied in relation to client preferences in the store and the financial impact of various assortments.

- For instance, Trax Ltd. and Roamler, two European startups, have joined forces to provide shop auditing services to consumer packaged goods (CPG) corporations. Companies constantly capture shelf photos and provide insights about shelf conditions. It improves product availability on the shelf and enables merchants to get timely insights and make decisions to improve shopper experiences.

- Business intelligence tools like decision support systems (DSS) have allowed companies in Europe to produce stress tests and sales forecasts, which are significantly used to assess a company's ability to operate under challenging economic scenarios. Utilizing DSS, companies can perform sensitivity analyses to evaluate the impacts of external variables, such as a possible lockdown or employee sickness, on their operations. Companies that favor data-driven decision-making are more expected to manage the crisis better and recover faster than businesses that do not use analytics and business intelligence.

Retail Analytics Market Trends

Cloud Segment is One of the Factors Driving the Market

- There are various reasons and financial benefits for retailers to have their analytics and BI on the cloud. Some of them are the 24x7 availability of the cloud environment without any infrastructure dependency, the reduction of the time taken to deploy BI components, the flexibility of scaling up or scaling down the infrastructure based on the requirement, and the cost-effectiveness in terms of infrastructure procurement. Additionally, the massive spending on licenses and the support of mobile and web-based remote access to control database access ensure user security and perform analytics.

- Knowing the Total Cost of Ownership (TOC) of the A&BI platform is a significant consideration. A cost comparison that examines the internal costs of infrastructure licensing and support compared to external cloud hosting must be assessed. With SaaS, the total cost of ownership is typically lower due to several factors. First, some SaaS solutions are multitenant platforms that allow several users to share the software's underlying infrastructure. Even though it could be a shared platform, users retain their private and separate information. Second, SaaS analytics and BI platforms don't need the business's servers, hardware, or IT resources to get the software up and running.

- Because SaaS A&BI platforms are automated and ready to use, they have significantly less implementation time- typically a matter of days. SaaS is accessible via standard web browsers, resulting in reduced learning curves and higher adoption rates. Because SaaS solutions are intuitive, self-service, and approachable, they are accessible to all users. On the other hand, implementation of on-premise A&BI infrastructure generally takes months and requires trained employees to extract insights.

- The advantages of cloud solutions over on-premise solutions are expected to drive cloud deployment significantly. Companies that favor data-driven decision-making are expected to manage the crisis better and recover faster than businesses that do not use analytics and business intelligence.

- According to Eurostat, In 2021, the usage of the cloud for e-mail and file storage was still prevalent, with 79% and 66% of organizations utilizing cloud computing, respectively, reporting purchasing these sorts of cloud services. Compared to 2020, the use of e-mail, office software, and accounting and financial apps in the cloud increased moderately (+3 % points for both e-mail and office software and +2% points for accounting applications). The adoption of other forms of cloud services remained relatively constant.

France is Expected to Observe Significant Growth

- Retail businesses in France have to manage an enormous amount of information, from employee information to inventory details and supplier data to customer buying behavior. Every interaction and data point offers an opportunity to make the retail business more efficient and successful. Microsoft's Power BI, a BI tool, records these data points and helps generate actionable insights via its graphical representations of customer trends. Retailers can thus leverage BI data for effectively targeting customers through personalization.

- Moreover, with the rapid rise of e-commerce, business intelligence can track how users interact with e-commerce stores. This information can further enhance the customer shopping and service experience. E-commerce also allows retailers to make smart, efficient decisions based on customer behavior with business intelligence. This data can be viewed in real-time, enabling businesses to adjust prices or alter merchandise offerings quickly.

- Further, according to Eurostat, among people shopping online in France in 2021, 34 % did so once or twice in the three months before the survey. The remaining two-thirds engaged in this activity three or more times during this period.

- According to Retail-Index, The French retail market had 382 separate retailer enterprises across over 20 categories as of February 2021. There were over 130 different stores in the garment industry, with 52 specializing in selling footwear and leather goods. Twenty-eight retail enterprises focused on the food retail sector.

- Targeted offers and predictive analytics enable merchants in France to develop highly personalized offers to all their customers at a very granular level. For instance, retailers can personalize the in-store experience by providing offers to incentivize frequent buying to drive more purchases, thereby achieving higher sales across all their channels. Predictive analytics can be used to upsell or cross-sell a customer.

Retail Analytics Industry Overview

The major players operating in the European retail analytics market report are SAP SE, Oracle Corporation, Qlik Technologies, Inc., Zoho Corporation, IBM Corporation, Retail Next, Inc., Alteryx, Inc., Tableau Software, Inc., Adobe Systems Incorporated, Microstrategy, Inc., Prevedere Software, Inc., Targit, Pentaho Corporation, ZAP Business Intelligence, Fuzzy Logix, among other domestic players.

In November 2022, RetailNext announced the acquisition of U.K. rival Retail Performance from market research firm Ipsos to expand its foot-traffic-monitoring platform in Europe and Asia. RetailNext described the transaction as a strategic expansion in the United Kingdom and Europe's retail intelligence area. The company's current monitoring operations log more than 1 billion consumer visits annually across over 4,500 retail locations in 50 countries.

In September 2022, Infosys, a global player in next-generation digital services and consulting, partnered with Microsoft Cloud for Retail. Retail organizations will be able to rapidly reimagine consumer experiences, refresh processes, and amplify systems with cloud and data due to this partnership. Infosys cloud solutions and industry services for retailers would be made available as a Microsoft Cloud for Retail partners, complementing Microsoft Cloud products within Infosys Cobalt.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Emphasis on Predictive Analysis

- 4.2.2 Sustained Increase in Volume of Data

- 4.2.3 Growing Demand for Sales Forecasting

- 4.3 Restraints

- 4.3.1 Lack of General Awareness and Expertise in Emerging Regions

- 4.3.2 Standardization and Integration Issues

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Mode of Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Type

- 5.2.1 Solutions (Analytics, Visualization Tools, Data Management, etc.)

- 5.2.2 Services (Integration, Support & Consulting)

- 5.3 By Module Type

- 5.3.1 Strategy & Planning (Macro Trends, KPI, Value Analysis)

- 5.3.2 Marketing (Pricing, Loyalty and Segment Analysis)

- 5.3.3 Financial Management (Accounts Management)

- 5.3.4 Store Operations (Fraud Detection, Workforce Analytics)

- 5.3.5 Merchandising (Assortment Optimization, Shopper Path Analytics)

- 5.3.6 Supply Chain Management (Inventory, Vendor and Supply-Demand Modelling)

- 5.3.7 Other Module Types

- 5.4 By Business Type

- 5.4.1 Small & Medium Enterprises

- 5.4.2 Large-scale organizations

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Other Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Oracle Corporation

- 6.1.3 Qlik Technologies, Inc.

- 6.1.4 Zoho Corporation

- 6.1.5 IBM Corporation

- 6.1.6 Retail Next, Inc.

- 6.1.7 Alteryx, Inc.

- 6.1.8 Tableau Software, Inc.

- 6.1.9 Adobe Systems Incorporated

- 6.1.10 Microstrategy, Inc.

- 6.1.11 Prevedere Software, Inc.

- 6.1.12 Targit

- 6.1.13 Pentaho Corporation

- 6.1.14 ZAP Business Intelligence

- 6.1.15 Fuzzy Logix

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers & Acquisitions

- 7.2 Investment Outlook