|

市場調查報告書

商品編碼

1637847

亞太零售分析:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Retail Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

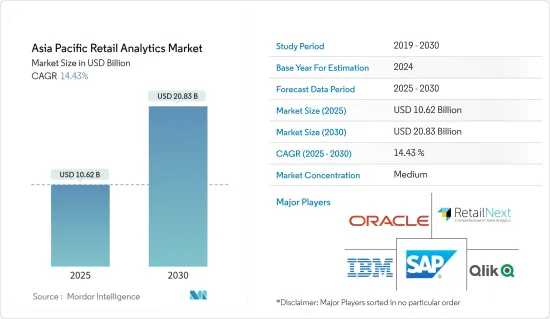

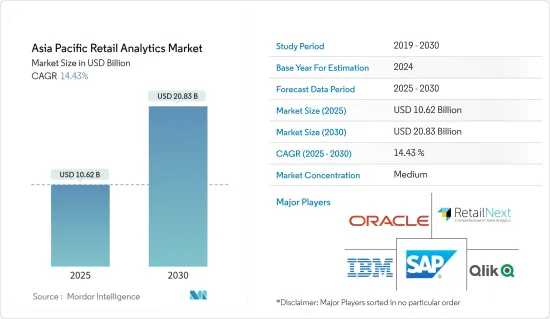

亞太地區零售分析市場規模預計在 2025 年為 106.2 億美元,預計到 2030 年將達到 208.3 億美元,預測期內(2025-2030 年)的複合年成長率為 14.43%。

主要亮點

- 隨著零售商大量使用物聯網並快速採用分析工具,市場正在迅速擴張。

- 零售分析提供對存量基準、供應鏈動態、消費者需求、銷售等的資料,這對於行銷和採購決策至關重要。零售分析是對零售業務產生的資料的分析,以做出提高盈利的商業決策。供需資料分析可用於維持採購水準和行銷決策。

- 這包括提供見解以了解和改善零售業務、銷售趨勢、消費行為和整體業務績效。當今的消費者對零售業有著很高的標準,因此公司需要透過全通路提案、可操作的步驟和對新趨勢的快速調整來滿足日益成長的需求。所有這些活動都需要零售分析。隨著中國、日本、印度和其他新興國家建立更多的零售店,市場預計將會擴大。

- 例如,Reliance Retail 於 2023 年 2 月宣布計劃明年開設多家 Gap 商店,著眼於該國的中高階服裝市場。 Reliance Retail 去年收購了美國休閒服飾品牌 Gap 的印度分銷權。總體而言,該零售商計劃明年開設 50分店新店。此類分店可能會推動對零售分析解決方案的需求。

- 分析可以幫助零售商做出更好的行銷決策,改善業務流程,並透過確定需要改進和最佳化的領域提供更好的整體客戶體驗。隨著零售業在各國的快速擴張,該領域對分析解決方案的需求預計將會增加。例如,日本2023年2月零售額較上年同期成長6.6%,超過市場預期的5.8%的增幅,且高於1月修正後的5%的增幅。零售額連續12個月成長,為2021年5月以來的最快增幅。

- 此外,零售業擴大採用工業 4.0,這對市場擴張做出了巨大貢獻。由於智慧型手機和電子商務的日益普及,零售分析市場正在擴大。預測期內,收入水準的提高、政府對巨量資料和分析的支出以及對自動化零售服務的需求也有望推動區域零售分析市場的發展。

- 零售分析市場的成長在很大程度上受到與零售分析工具相關的安裝、維護、測試、授權和其他技術人事費用所需的高額資本支出的限制。此外,非正規零售業取得技術的機會有限以及預算緊張也是影響市場的因素。

亞太零售分析市場趨勢

解決方案部門預計將佔據主要市場佔有率

- 隨著零售業競爭日益激烈,最佳化業務流程和滿足客戶期望變得非常重要。每一步都涉及實施資料分析解決方案。客戶熱圖還可用於最佳化優惠和產品展示。此外,零售業對雲端服務的日益採用可能很快就會為亞太地區的零售分析市場創造機會。

- 此外,資料管理解決方案預計將主導該地區的零售分析領域。資料在零售業中最常用的使用方式之一是進行個人化行銷。如果零售商更關注資料管理方面,他們的努力就可以顯著改善。例如,將第三方資料新增至第一方資訊可以實現更精準的客戶定位。

- 此外,資料管理解決方案在零售和電子商務領域變得越來越重要。技術的進步和豐富的資訊使得企業能夠利用資料來改善業務並提供更好的客戶服務。更好的資料管理可以匯集和建立原本龐大且難以管理的資料集,從而提高整個零售流程的可視性。

- 推動亞太地區零售分析產業發展的因素之一是資料分析解決方案。資料分析正在成為零售領域的一項改變遊戲規則的技術,為零售企業提供強大的工具來簡化流程、改善客戶體驗並增加銷售額。資料分析允許零售商透過分析客戶資料(例如購買歷史、瀏覽行為和社交媒體互動)來創建個人化的推薦、優惠和促銷。

- 亞太地區的零售業正在不斷變化,資料分析將對零售業未來的發展產生重大影響。此外,零售額的成長和零售業數位化的不斷提高,正在推動亞太地區新興經濟體零售商採用零售分析解決方案。例如,根據印度零售協會(RAI)的資料,2021年2月至2022年2月,全印度零售業的銷售額成長率為10%。同樣,北印度 2021 年 2 月至 2022 年 2 月的銷售成長率為 17%,西印度的銷售成長率為 16%。

日本可望成為亞太零售分析市場的主要動力

- 由於零售額成長和技術進步以及零售業對資料分析的需求不斷增加,日本的零售分析市場將在未來幾年實現顯著成長。此外,中國零售業正在進行的數位轉型為未來幾年零售分析解決方案的採用提供了巨大的成長機會。

- 此外,零售分析可以顯著增強您的行銷策略。它可以透過收集有關您目前和過去客戶的位置、年齡、偏好、購買模式和其他重要因素的資訊來識別您的理想客戶,從而幫助您鎖定客戶。更好的資料管理可以充分發揮資料的潛力,在許多方面改善零售業務並增強零售商電子商務網站的功能。這將有助於預測期內日本對零售分析解決方案的需求增加。

- 此外,即時分析、人工智慧和機器學習等解決方案預計在未來將變得更加重要。它們幫助零售商增加銷售額、簡化行銷計劃並為客戶提供無縫體驗。預計這些解決方案將作為資料分析解決方案的一部分被零售企業更廣泛地使用。

- 此外,隨著日本零售業零售額不斷成長,越來越多的零售公司和組織(如便利商店和超級市場)採用零售分析解決方案,需求預計將快速成長。例如,根據經濟產業省的資料,日本零售業的銷售額超過150兆日圓(103.5兆美元),其中超級市場的獨立店銷售額為15.15兆日圓(10.45兆美元)。最大佔有率。其次是便利商店,銷售額為 12.2 兆日圓(8.41 兆美元)。

亞太零售分析產業概況

亞太地區零售自動化市場處於半整合狀態,由少數大型企業主導。該市場的主要參與企業包括Oracle、IBM、SAP SE、Zoho、Adobe Systems Incorporated 等。這些公司透過收購、產品推出和合作等各種策略舉措不斷擴大其市場影響力,從而為市場成長做出了重大貢獻。以下是該領域的一些最新進展:

2022 年 11 月,Qlik 宣布推出一款名為「Qlik Cloud Data Integration」的創新產品。此企業整合平台即服務 (eiPaaS) 旨在為您的企業資料策略提供支援。我們透過建立即時資料整合結構將所有企業應用程式和資料來源連接到雲端來實現這一點。透過利用雲端的強大功能在不同的資料來源、目標和目的地之間建立即時資料連接,Qlik Cloud Data Integration 可讓企業的每個成員都滿懷信心地做出資料主導的決策。

2022年3月,知名企業資料管理供應商Informatica宣布推出其「智慧資料管理雲端」(IDMC)首個專注於零售業的版本。這個專門建構的平台名為“零售智慧數據管理雲端”,將利用 Informatica 支援機器學習的工具來編目、提取、整合和準備資料,以供分析和 AI 應用程式使用。這種客製化解決方案滿足並增強了零售企業的特定資料管理需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 買家的議價能力

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 更重視預測分析

- 資料量持續成長

- 銷售額預測需求不斷增加

- 市場限制

- 缺乏新興地區的公眾意識和專業知識

- 標準化和整合問題

第6章 市場細分

- 依部署方式

- 本地

- 一經請求

- 按類型

- 解決方案(分析、視覺化工具、資料管理等)

- 服務(整合、支援和諮詢)

- 按模組類型

- 策略與規劃(宏觀趨勢、關鍵績效指標、價值分析)

- 行銷(定價、忠誠度、細分分析)

- 財務管理(會計管理)

- 商店營運(詐欺偵測、勞動力分析)

- 商品行銷(產品組合最佳化、購物者路徑分析)

- 供應鏈管理(庫存、供應商、供需模型)

- 其他模組類型

- 依業務類型

- 中小型企業

- 大型組織

- 按地區

- 中國

- 印度

- 日本

- 韓國

第7章 競爭格局

- 公司簡介

- SAP SE

- Oracle Corporation

- Qlik Technologies, Inc.

- Zoho Corporation

- IBM Corporation

- Retail Next, Inc.

- Alteryx, Inc.

- Tableau Software, Inc.

- Adobe Systems Incorporated

- Microstrategy, Inc.

- Prevedere Software, Inc.

- Targit

- Pentaho Corporation

- ZAP Business Intelligence

- Fuzzy Logix

第8章投資分析

第9章 市場機會與未來趨勢

The Asia Pacific Retail Analytics Market size is estimated at USD 10.62 billion in 2025, and is expected to reach USD 20.83 billion by 2030, at a CAGR of 14.43% during the forecast period (2025-2030).

Key Highlights

- The market is expanding quickly due to retailers using the Internet of Things more frequently and adopting analytics tools faster.

- Retail analytics provides analytical data on inventory levels, supply chain movement, consumer demand, sales, etc., essential for marketing and procurement decisions. Retail analytics is the analysis of data generated by retail operations to make business decisions that drive profitability. Data analytics on supply and demand can be applied to maintain procurement levels and make marketing decisions.

- This includes offering insights to comprehend and improve the retail business's operational procedures, sales trends, consumer behavior, and overall performance. Because of consumers' high standards for retail today, companies must satisfy these growing demands with tailored omnichannel offers, practical procedures, and prompt adjustments to emerging trends. All of these activities require retail analytics. The market is expected to expand as more retail establishments open in countries such as China, Japan, India, and other developing nations.

- For instance, Reliance Retail announced in February 2023 that it planned to open multiple Gap stores next year with an eye toward the country's mid-premium apparel market. Reliance Retail acquired the rights to sell American casual wear brand Gap in India last year. The retailer plans to open 50 new locations overall in the upcoming year. The opening of such stores will increase demand for retail analytical solutions.

- Analytics can help retailers make better marketing decisions, improve business processes, and provide better overall customer experiences by identifying areas for improvement and optimization. The demand for analytical solutions in the sector is anticipated to increase with the rapid expansion of the retail industry across all countries. For instance, retail sales in Japan rose by 6.6% YoY in February 2023, exceeding market expectations of 5.8% and accelerating from a revised 5% growth in January. Retail trade increased for the 12th month, running the fastest since May 2021.

- Additionally, the retail sector's growing adoption of Industry 4.0 has significantly aided the market's expansion. The market for retail analytics is expanding due to the rising popularity of smartphones and e-commerce. During the forecast period, it is also anticipated that increasing income levels, government spending on big data and analytics, and demand for automated retail-based services will stimulate the regional retail analytics market.

- Retail analytics market growth is significantly constrained by the high capital expenditures required for installation, maintenance, testing, licensing, and other technical labor costs associated with retail analytics tools. Another factor impacting the market is the unorganized retail sectors' limited access to technology and tight budgets.

APAC Retail Analytics Market Trends

Solutions Segment is Anticipated to Hold Major Market Share

- The retail industry is becoming more competitive, so optimizing business processes and satisfying customer expectations is crucial. Every step includes the implementation of data analytical solutions. Customer heat mapping can also be used to optimize offers and product placement. Additionally, the retail industry's growing use of cloud services will soon open up opportunities in the Asia Pacific retail analytics market.

- Moreover, data management solutions are anticipated to dominate the region's retail analytic sector. One of the ways data is used in retail most frequently is for personalized marketing. If retailers focused more on the management side of data, their efforts could be significantly improved. For instance, adding data from third-party sources to their first-party information can help them target customers more precisely.

- Furthermore, the importance of data management solutions has grown within the retail and e-commerce sectors. Businesses can use data to enhance operations and provide better customer service as a result of the development of technology and the abundance of information now at their disposal. Better data management increases visibility across retail processes by compiling and structuring otherwise enormous, unmanageable data sets.

- One of the factors propelling the Asia-Pacific retail analytic industry is data analytical solutions. Data analytics has emerged as a game-changing technology in the retail sector that gives retailers strong tools to streamline their processes, enhance customer experiences, and boost sales. Retailers can use data analytics to create individualized recommendations, offers, and promotions by analyzing customer data such as purchase history, browsing behavior, and social media interactions.

- The retail sector in Asia-Pacific is constantly changing, and data analytics significantly impacts how retail will develop in the future. Moreover, the growth in retail sales coupled with increasing digitization in the retail sector is driving the adoption of retail analytics solutions among retail businesses in the emerging countries in Asia Pacific. For instance, according to the data from the Retailers Association of India (RAI), Pan India sales growth in the retail industry from February 2021 to February 2022 was 10%. Similarly, the sales growth in North India and Western India was 17% and 16% from February 2021 to February 2022.

Japan is Expected to Witness Significant Traction in APAC Retail Analytics Market

- The retail analytics market in Japan is analyzed to witness substantial growth in the coming years owing to the growth in retail sales and technological advancements in the retail sector coupled with the growing demand for data analytics in retail businesses. Moreover, the growing digital transformation in the country's retail sector is further offering substantial growth opportunities for the adoption of retail analytics solutions in the coming years.

- Additionally, retail analytics can significantly enhance marketing strategies. It can assist in customer targeting by identifying the ideal customer using information gathered on the location, age, preferences, buying patterns, and other significant factors of current and previous customers. Better data management will unlock data's full potential, improving retail operations on many fronts and enhancing the functionality of retailers' e-commerce sites. Thus propelling the demand for retail analytics solutions in Japan over the forecast period.

- Furthermore, it is anticipated that in the future, solutions like real-time analytics, artificial intelligence, and machine learning will become even more significant. These can aid retailers in increasing sales, streamlining their marketing plans, and giving customers a seamless experience. These solutions are anticipated to be used more frequently in retail businesses as part of data analytics solutions.

- Moreover, the demand is expected to grow at a rapid pace as more retail businesses and organizations, such as convenience stores, supermarkets, etc., adopt retail analytics solutions owing to growth in retail sales in the Japanese retail industry. For instance, according to the data from METI (Japan), the sales value of the retail industry in Japan exceeded JPY 150 trillion (USD 103.5 Trillion), out of which supermarkets accounted for the largest share of JPY 15.15 trillion (USD 10.45 trillion) as a standalone store type. Convenience stores followed as the second strongest retail type, with the sales of goods and services generating JPY 12.2 trillion (USD 8.41 trillion).

APAC Retail Analytics Industry Overview

The Asia Pacific Retail Automation Market exhibits semiconsolidated, with several major players dominating the industry. Key participants in this market include Oracle, IBM, SAP SE, Zoho, and Adobe Systems Incorporated, among others. These companies are continuously fortifying their market presence through various strategic initiatives, including acquisitions, product launches, and partnerships, which significantly contribute to the market's growth. Here are some recent developments within this sector:

In November 2022, Qlik introduced a transformative product known as "Qlik Cloud Data Integration." This Enterprise Integration Platform as a Service (eiPaaS) offering is designed to empower enterprise data strategies. It achieves this by creating a real-time data integration fabric connecting all enterprise applications and data sources to the cloud. By harnessing the capabilities of the cloud and establishing real-time data connections between diverse data sources, targets, and destinations, Qlik Cloud Data Integration enables all members of the enterprise to make data-driven decisions with confidence.

In March 2022, Informatica, a renowned enterprise data management vendor, unveiled the first retail-specific version of its "Intelligent Data Management Cloud" (IDMC). This specialized platform, known as "Intelligent Data Management Cloud for Retail," leverages Informatica's suite of machine learning-powered tools to assist retailers in cataloging, ingesting, integrating, and preparing data for use in analytical and AI applications. This tailored solution caters to the unique data management needs of the retail sector, further enhancing its capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining power of Buyers

- 4.2.2 Bargaining power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Bargaining power of Buyers

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Predictive Analysis

- 5.1.2 Sustained increase in volume of data

- 5.1.3 Growing demand for sales forecasting

- 5.2 Market Restraints

- 5.2.1 Lack of general awareness and expertise in emerging regions

- 5.2.2 Standardization and Integration issues

6 MARKET SEGMENTATION

- 6.1 By Mode of Deployment

- 6.1.1 On-Premise

- 6.1.2 On-Demand

- 6.2 By Type

- 6.2.1 Solutions (Analytics, Visualization Tools, Data Management, etc.)

- 6.2.2 Services (Integration, Support & Consulting)

- 6.3 By Module Type

- 6.3.1 Strategy & Planning (Macro Trends, KPI, Value Analysis)

- 6.3.2 Marketing (Pricing, Loyalty and Segment Analysis)

- 6.3.3 Financial Management (Accounts Management)

- 6.3.4 Store Operations (Fraud Detection, Workforce Analytics)

- 6.3.5 Merchandising (Assortment Optimization, Shopper Path Analytics)

- 6.3.6 Supply Chain Management (Inventory, Vendor and Supply-Demand Modelling)

- 6.3.7 Other Module Types

- 6.4 By Business Type

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large-scale Organizations

- 6.5 Geography

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Japan

- 6.5.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 Qlik Technologies, Inc.

- 7.1.4 Zoho Corporation

- 7.1.5 IBM Corporation

- 7.1.6 Retail Next, Inc.

- 7.1.7 Alteryx, Inc.

- 7.1.8 Tableau Software, Inc.

- 7.1.9 Adobe Systems Incorporated

- 7.1.10 Microstrategy, Inc.

- 7.1.11 Prevedere Software, Inc.

- 7.1.12 Targit

- 7.1.13 Pentaho Corporation

- 7.1.14 ZAP Business Intelligence

- 7.1.15 Fuzzy Logix