|

市場調查報告書

商品編碼

1639518

印尼太陽能:市場佔有率分析、產業趨勢、成長預測(2025-2030)Indonesia Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

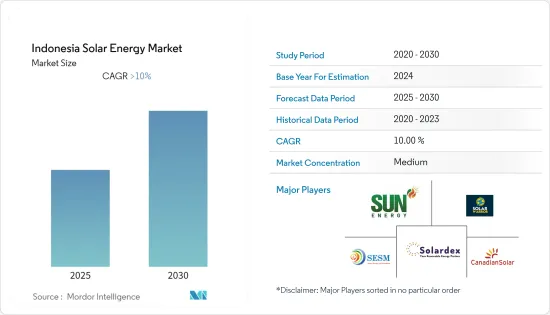

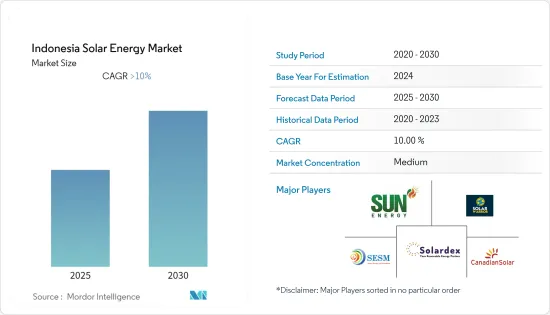

預計印尼太陽能市場在預測期內將維持10%以上的複合年成長率。

COVID-19 對 2020 年市場產生了負面影響。市場現在可能會達到大流行前的水平。

主要亮點

- 從中期來看,由於開發活動對可再生能源的需求增加以及太陽能技術成本下降等因素預計將推動市場發展。

- 另一方面,高度依賴石化燃料來滿足能源需求是阻礙市場成長的主要因素。

- 對環境排放法規的日益關注導致現有燃煤電廠提前退役,預計將為印尼太陽能市場創造重大機會。

印尼太陽能市場趨勢

離網市場預計將顯著成長

- 印尼是一個人口眾多、地形獨特的國家,由超過 17,508 個島嶼組成。由於地形分散,該國的電力產業面臨重大挑戰。約40%的非電氣化地區主要位於爪哇島以外,難以連接國家電網。

- 近年來,太陽能發電在能源結構中的成長相對較小。目前的太陽能發電開發活動大多是安裝在偏遠地區的獨立太陽能發電系統和一些大容量併網系統。

- 總合國際可再生能源機構預測,2021年印尼離網總裝置容量將達67.59兆瓦,而2017年為43兆瓦,年增率為11.4%。預計這一成長率在預測期內也會增加。

- 印尼計劃在2025年將電氣化率提升至99.7%。印尼政府正在推動利用新能源和可再生的農村電氣化計劃,而光伏微型電網被認為是農村電氣化成本最低的選擇。

- 此外,2022年11月,國際可再生能源機構(IRENA)預計,到2030年太陽能將成為印尼能源系統的支柱。根據IRENA最新報告《印尼能源轉型展望》,預計2030年太陽能將成為印尼能源系統的支柱。太陽能預計將成為這項轉型的支柱,佔 1,000GW 總發電量中的 798GW。在太陽能發電設備總量中,光電發電量高達840GW。由於地理挑戰,大多數裝置預計將脫離電網。

- 例如,2022年11月,沙烏地阿拉伯能源公司ACWA Power宣布贏得印尼國有電力公司PT Perusahaan Listrik Negara (PLN)建造兩個浮體式太陽能光電(PV)計劃的合約。該合約涵蓋裝機容量為60 MWac的Saguling計劃和裝置容量為50 MWac的浮體式太陽能發電工程Singkarak。兩個計劃總合容量為110MWac,總投資1.05億美元。

- 過去幾年,政府推出了多項計畫和計劃,引入太陽能為離網村莊提供電力,並在偏遠地區取代柴油發電。這鼓勵了離網太陽能領域的大規模利用。

- 因此,由於上述因素,預計在預測期內,印尼太陽能市場的離網部分將顯著成長。

替代性再生能源來源抑制市場需求

- 印尼擁有豐富的可再生能源,特別是風力發電。根據亞洲風力發電協會統計,印尼的平均風速在1.3至6.3 m/s之間。主要風力發電潛力位於東努沙登加拉和西努沙登加拉,平均風速超過 5 m/s。印尼的風力發電潛力估計為 9.5GW。

- 根據能源礦產資源部統計,截至2021年風電裝置容量為154MW。然而,該國計劃在2025年安裝180萬千瓦的風電。

- 2022年3月,法國開發署與PLN簽署協議,在萬丹省Pandeglang開發一座200MW風電場。預計將於 2022 年開始建設,並於 2025 年開始商業營運。

- 除風電外,2022年9月,印尼國營電力公司PT Perusahaan Listrik Negara (PLN)將在印尼西爪哇省投資8.5億美元,以增加可再生能源對能源結構的貢獻,並宣布已於2022年9月開始興建。該發電廠計劃於 2027 年投入運作。

- 此類替代性可再生能源計劃將從該國的可再生能源結構中剔除太陽能並限制市場成長。

- 因此,考慮到上述幾點,替代性可再生能源很可能會在預測期內阻礙該國太陽能市場的成長。

印尼太陽能產業概況

印尼的太陽能市場適度細分。市場上的主要企業(排名不分先後)包括 Canadian Solar Inc.、PT. Surya Utama Nuansa、PT Solardex Energy Indonesia、PT. Sumber Energi Surya Nusantara 和 PT. Sumber Energi Sukses Makmur。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 可再生能源結構(印度尼西亞,2021 年)

- 2028年太陽能裝置容量及預測(單位:GW)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章 市場區隔(依連結方式)

- 在併網

- 離網

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Canadian Solar Inc.

- Trina Solar Co. Ltd

- TotalEnergies SE

- PT. Sumber Energi Sukses Makmur

- PT. Solardex Energy Indonesia

- PT. Surya Utama Nuansa

- PT. Sumber Energi Surya Nusantara

第7章 市場機會及未來趨勢

The Indonesia Solar Energy Market is expected to register a CAGR of greater than 10% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, factors like increasing demand for renewable energy due to developmental activities and decreasing cost of solar PV technology are expected to drive the market.

- On the other hand, heavy dependency on fossil fuels to meet the energy demand is a significant restraint hindering the market's growth.

- Nevertheless, the increasing concern over environmental emission control, which leads to the premature retirement of existing coal power plants, is expected to create enormous opportunities for Indonesia's solar energy market.

Indonesia Solar Energy Market Trends

Off-Grid Segment Expected to Witness Significant Growth

- Indonesia is a populous country with a distinctive terrain, having over 17,508 islands. The distributed topography of the country poses a substantial difficulty to the country's power sector. Around 40% of off-grid regions are primarily located outside Java island and are unlikely to be accessible by the national grid.

- Solar PV growth has been a relatively small component of the energy mix in recent years. Most current solar development activity comprises stand-alone solar PV systems located in distant areas and some bigger capacity on-grid systems.

- According to International Renewable Energy Agency, Indonesia's total off-grid installation capacity was 67.59 MW in 2021 compared to 43 MW in 2017, registering a growth rate of 11.4% yearly. The growth rate is expected to increase during the forecasted period.

- The electrification ratio of Indonesia has been planned to increase to 99.7% by 2025. The Indonesian government is pushing forward with plans to electrify rural areas of the country using new and renewable energy, and PV mini-grids are considered the least-cost option for the electrification of rural areas.

- Moreover, in November 2022, The International Renewable Energy Agency (IRENA) estimated that solar could become the backbone of Indonesia's energy system by 2030. According to their latest report, "Indonesia Energy Transition Outlook." Solar is expected to become the backbone of this transformation, accounting for 798 GW of the total 1,000 GW. PV accounts for up to 840 GW of the total solar installations. The majority of installations are expected to be off-grid due to geographical challenges.

- For instance, in November 2022, Saudi energy firm ACWA Power announced that they had secured a contract from the Indonesian state-owned utility PT Perusahaan Listrik Negara (PLN) to build two floating solar photovoltaic (PV) power projects. The contract covers the 60MWac Saguling project and Singkarak, a floating solar project with 50MWac capacity. The two projects will have a combined capacity of 110MWac and be built with a total investment of USD 105 million.

- Over the past years, the government has launched several programs and projects for solar PV deployment to supply electricity to un-electrified villages or replace diesel-based generation in remote regions. This strengthens the case for large-scale usage of the off-grid solar energy segment.

- Therefore, based on the factors mentioned above, the off-grid segment is expected to witness significant growth in the Indonesian solar energy market during the forecast period.

Alternative Renewable Energy Sources Restraining the Market Demand

- Indonesia is naturally endowed with renewable energy sources, particularly wind energy. According to Asia Wind Energy Association, the average wind speeds in Indonesia range from 1.3 to 6.3 m/s. The main wind energy potential lies in East and West Nusa Tenggara, which have average wind speeds of more than five m/s. The approximate wind power potential in Indonesia is estimated to be 9.5 GW.

- According to the Ministry of Energy and Mineral Resources, as of 2021, the wind power installed capacity stood at 154 MW. However, the country has plans to install 1.8 GW of wind energy by 2025.

- In March 2022, French Development Agency signed an agreement with PLN development of a 200 MW wind farm in Pandeglang, Banten. The construction will likely begin in 2022, and commercial operations are expected by 2025.

- Other than wind energy, in September 2022, Indonesia's state utility company PT Perusahaan Listrik Negara (PLN) announced that the company had started the construction of USD 850 million 1040 MW hydro-power plant in West Jawa part of Indonesia to increase the renewable power contribution to its energy mix. The power plant is expected to come online in 2027.

- Such alternative renewable energy projects shave off solar energy in the country's renewable energy mix, thus, restraining the market growth.

- Thus, considering the points mentioned above, alternative renewable energy sources are likely to hamper the country's solar energy market growth during the forecast period.

Indonesia Solar Energy Industry Overview

The Indonesia solar energy market is moderately fragmented. Some of the major players in the market (in no particular order) include Canadian Solar Inc. and PT. Surya Utama Nuansa, PT Solardex Energy Indonesia, PT. Sumber Energi Surya Nusantara, and PT Sumber Energi Sukses Makmur.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Indonesia, 2021

- 4.3 Solar Energy Installed Capacity and Forecast, in GW, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - BY CONNECTION

- 5.1 On-grid

- 5.2 Off-grid

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Canadian Solar Inc.

- 6.3.2 Trina Solar Co. Ltd

- 6.3.3 TotalEnergies SE

- 6.3.4 PT. Sumber Energi Sukses Makmur

- 6.3.5 PT. Solardex Energy Indonesia

- 6.3.6 PT. Surya Utama Nuansa

- 6.3.7 PT. Sumber Energi Surya Nusantara