|

市場調查報告書

商品編碼

1640341

英國石油和天然氣:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United Kingdom Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

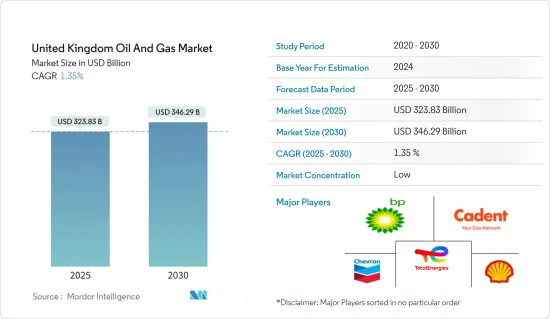

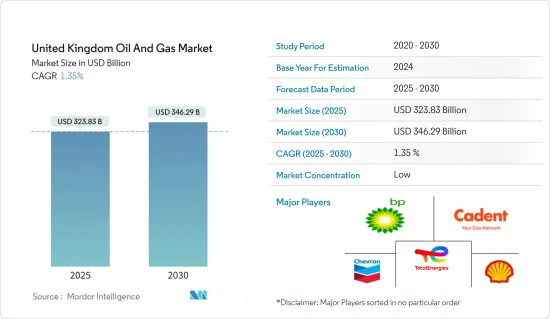

預計2025年英國石油和天然氣市場規模為3,238.3億美元,預計2030年將達到3,462.9億美元,預測期間(2025-2030年)的複合年成長率為1.35%。

主要亮點

- 從中期來看,預計預測期內該國石油和天然氣產量的增加以及石油和天然氣基礎設施建設投資的增加將推動市場發展。

- 另一方面,由於可再生能源技術的成長和最近的地緣政治發展導致的石油和天然氣價格波動預計將在預測期內抑制市場發展。

- 然而,預計預測期內全國範圍內新天然氣田的發現將為研究市場創造巨大的商機。

英國石油與天然氣市場趨勢

上游部分預計主導市場

- 英國在北海擁有豐富的石油和天然氣蘊藏量,數十年來一直是其主要產油源。儘管蘊藏量正在減少,但公司仍擁有大量資源,需要繼續進行探勘和生產。

- 英國在北海擁有完善的海上探勘和生產基礎設施。這些基礎設施包括海上平台、管道和倉儲設施。這種基礎設施的存在為上游公司提供了競爭優勢,因為它能夠有效地開採和運輸石油和天然氣資源。

- 此外,英國在北海擁有悠久的海上石油和天然氣作業歷史,在石油和天然氣資源的探勘和生產方面積累了重要的技術專長。該行業在鑽井技術、油藏管理和生產最佳化等領域累積了知識和經驗。這種專業知識使英國在上游石油業務中佔據優勢。

- 《世界能源統計評論》顯示,2022 年英國原油產量將為每天 778,000 桶,較 2021 年下降近 11%。造成這一下降的主要原因是北海蘊藏量下降。為了應對這個問題,英國公司已經開始在其他地區探勘石油和天然氣生產。

- 例如,2023年2月,英國本土上游公司Delta Energy宣佈在許可證號為P2252的彭薩科拉地區發現重大油氣。該公司聲稱該潛在的天然氣儲存超過3000億立方英尺天然氣。

- 因此,鑑於上述情況,預計英國上游產業將在預測期內主導石油和天然氣市場。

可再生能源的成長預計將抑制市場

- 英國對低碳經濟轉型有著雄心勃勃的目標。碳定價、可再生能源獎勵和更嚴格的排放標準等政府政策和法規旨在鼓勵可再生能源的開發和採用。這些政策可能會減少對石油和天然氣的需求,特別是在發電和運輸等可再生能源可以提供替代品的領域。

- 此外,隨著可再生能源產業的不斷擴大,它將吸引大量投資。這可能會耗盡石油和天然氣行業的資金,並使傳統石油和天然氣計劃更難獲得資金。投資者可能認為可再生能源計劃在長期內更具經濟可行性和環境永續,從而減少對新的石油和天然氣探勘和生產計劃。

- 例如,根據國際可再生能源機構的數據,2022年英國的可再生能源裝置容量將比2021年增加7%以上。 2022 年可再生能源裝置容量將超過 5,200 萬千瓦,而 2021 年為 4,890 萬千瓦。

- 2022年12月,維斯塔斯宣布已訂單英國Infinergy旗下Limekiln計劃的108兆瓦訂單。業務範圍包括V136-4.5MW渦輪機的安裝、供貨和試運行。風力渦輪機的總數將接近24台。預計安裝和試運行將於2024年完成。

- 可再生能源的成長可能會導致對石油和天然氣等石化燃料的需求下降。風能、太陽能和水力發電等再生能源來源的成本競爭力越來越強,被認為更環保。能源消耗模式的這種轉變可能會減少對石油和天然氣的整體需求,特別是在可以輕鬆轉換為可再生能源的地區。

- 因此,正如上面指出的那樣,預計再生能源來源的不斷增加將在預測期內阻礙英國石油和天然氣市場的成長。

英國石油與天然氣產業概況

英國石油和天然氣市場分散。市場上的主要企業(不分先後順序)包括殼牌公司、英國石油公司、道達爾能源公司、雪佛龍公司和 Cadent Gas Ltd。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測(美元)

- 2028 年石油和天然氣產量及預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 國內石油及天然氣產量

- 投資石油和天然氣基礎設施開發

- 限制因素

- 可再生能源的成長

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 按行業

- 上游

- 中游

- 下游

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Shell PLC

- BP PLC

- TotalEnergies SE

- Chevron Corporation

- Cadent Gas Ltd

- ESSO UK Limited

- BG Group Limited

- Valaris PLC

- Centrica PLC

- Dana Petroleum E&P Limited

第7章 市場機會與未來趨勢

- 發現新的天然氣田

簡介目錄

Product Code: 51677

The United Kingdom Oil And Gas Market size is estimated at USD 323.83 billion in 2025, and is expected to reach USD 346.29 billion by 2030, at a CAGR of 1.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the country's increasing oil and gas production and increasing investments in oil and gas infrastructure developments are expected to drive the market studied during the forecast period.

- On the other hand, the growth of renewable energy technologies and volatility in oil and gas prices due to recent geopolitical developments are expected to restrain the growth of the market studied during the forecast period.

- Nevertheless, the discovery of new oil and gas fields across the country is expected to create significant opportunities in the market studied during the forecast period.

UK Oil & Gas Market Trends

Upstream Segment Expected to Dominate the Market

- The United Kingdom has significant oil and gas reserves in the North Sea, which have been a major production source for several decades. Although the reserves have declined, they still present a substantial resource base that requires ongoing exploration and production efforts.

- The United Kingdom has a well-developed infrastructure for offshore exploration and production in the North Sea. This infrastructure includes offshore platforms, pipelines, and storage facilities. The presence of this infrastructure provides a competitive advantage for upstream companies as it enables efficient extraction and transportation of oil and gas resources.

- Moreover, the United Kingdom has a long history of offshore oil and gas operations in the North Sea, resulting in the development of significant technical expertise in the exploration and production of oil and gas resources. The industry has accumulated knowledge and experience in areas such as drilling techniques, reservoir management, and production optimization. This expertise gives the United Kingdom an advantage in upstream activities.

- According to the statistical review of world energy, the United Kingdom produced 778 thousand barrels per day of crude oil in 2022, a decrease of almost 11% compared to 2021. The primary reason for this decline is the declining reserves in the North Sea. To counter this, companies in the United Kingdom have started exploring other regions for oiling gas production.

- For instance, in February 2023, Delta Energy, a local upstream player in the United Kingdom, announced that they had made a significant oil and gas discovery at the Pensacola region on license P2252. The company claims that the potential natural gas reservoir has more than 300 bcf of natural gas in the reservoir.

- Therefore, as per the points mentioned above, the upstream sector in the United Kingdom is expected to dominate the oil and gas market during the forecast period.

Growth of Renewables Expected to Restrain the Market

- The United Kingdom has set ambitious targets to transition to a low-carbon economy. Government policies and regulations such as carbon pricing, renewable energy incentives, and stricter emission standards are designed to promote the development and adoption of renewable energy sources. These policies may reduce demand for oil and gas, particularly in sectors where renewable alternatives are feasible, such as power generation and transportation.

- Moreover, as the renewable energy sector continues to expand, it attracts significant investment. This can divert capital from the oil and gas industry, making it more challenging for traditional oil and gas projects to secure funding. Investors may view renewable energy projects as more financially viable and environmentally sustainable in the long term, leading to a reduction in investment in new oil and gas exploration and production projects.

- For instance, according to the International Renewable Energy Agency, in 2022, the installed renewable energy capacity in the United Kingdom increased by more than 7% compared to 2021. In 2022, the total renewable energy installed capacity crossed 52 GW compared to 48.9 GW in 2021.

- In December 2022, Vestas announced that it had received an order for 108 MW for the Limekiln project owned by Infinergy in the United Kingdom. The work scope includes installing, supplying, and commissioning V136-4.5 MW turbines. The total number of turbines is nearly 24. The installation and commissioning is expected to be completed by 2024.

- The growth of renewable energy can lead to a decline in demand for fossil fuels, including oil and gas. Renewable energy sources such as wind, solar and hydroelectric power are becoming increasingly cost-competitive and are considered more environment-friendly. This shift in energy consumption patterns can reduce the overall demand for oil and gas, particularly in sectors that can readily switch to renewable alternatives.

- Therefore, as per the points discussed above, the increasing adaption of renewable energy sources is expected to hinder the growth of the UK oil and gas market during the forecast period.

UK Oil & Gas Industry Overview

The UK oil and gas market is fragmented. Some of the key players in the market (in no particular order) include Shell PLC, BP PLC, TotalEnergies SE, Chevron Corporation, and Cadent Gas Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Crude Oil and Natural Gas Production and Forecast, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Domestic Oil and Gas Production

- 4.6.1.2 Investments in Oil and Gas Infrastructure Development

- 4.6.2 Restraints

- 4.6.2.1 Growth of Renewable Energy

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 BP PLC

- 6.3.3 TotalEnergies SE

- 6.3.4 Chevron Corporation

- 6.3.5 Cadent Gas Ltd

- 6.3.6 ESSO UK Limited

- 6.3.7 BG Group Limited

- 6.3.8 Valaris PLC

- 6.3.9 Centrica PLC

- 6.3.10 Dana Petroleum E&P Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Discovery of New Oil and Gas Fields

02-2729-4219

+886-2-2729-4219