|

市場調查報告書

商品編碼

1639490

印度石油和天然氣 -市場佔有率分析、行業趨勢、成長預測(2025-2030 年)India Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

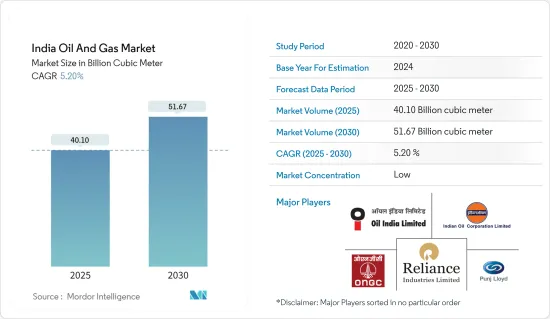

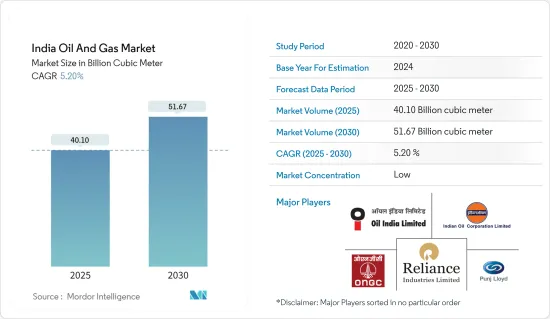

印度石油和天然氣市場規模預計到2025年為401億立方米,預計到2030年將達到516.7億立方米,預測期內(2025-2030年)複合年成長率為5.2%。

由於新冠肺炎 (COVID-19) 疫情的爆發,地區性停工和精煉石油產品需求減少,對市場帶來了負面影響。目前市場已恢復至疫情前水準。

主要亮點

- 天然氣管道容量增加和石油產品需求增加等因素預計將在預測期內推動印度石油和天然氣市場的發展。此外,石油和天然氣市場是能源市場的主要產業,作為世界主要燃料對全球經濟有重要影響。石油和天然氣生產和分配所涉及的流程和系統非常複雜、資本密集型,並且需要尖端技術。

- 然而,嚴重依賴原油和天然氣進口來滿足國內需求以及原油價格的大幅波動預計將阻礙印度油氣市場的成長。

- KG盆地已發現大量氣體水合物。經濟可開採的氣體水合物對公司來說是一個重要的商機,可以增加天然氣產量。

印度石油和天然氣市場趨勢

下游產業預計將大幅成長

- 印度的能源需求預計在未來20年將成長50%。需求的成長是由於世界人口的增加和開發中國家生活水準的提高。石油燃料仍然是世界各地的主要能源來源,新能源和可再生能源在世界各地變得越來越普遍。預計這一趨勢將在未來幾十年持續下去,有利於石油和天然氣下游市場的成長。

- 已決定在全國範圍內建立新的煉油廠。例如,2023年2月,印度斯坦石油公司(HPCL)宣布計畫於2024年1月在拉賈斯坦邦啟動年產900萬噸的Barmer煉油和石化計劃。

- 該國2021-2022會計年度精製吞吐量為24922萬噸,高於2017年的約23397萬噸。這一數字的成長是對馬達汽油和柴油等運輸燃料的高需求以及住宅市場對液化石油氣持續高需求的結論。

- 推動更高精製能力需求的另一個主要因素是該國油田數量的增加,特別是在克里希納戈達瓦里盆地和拉賈斯坦邦的巴爾默地區。這些油田的高天然氣產量正在擴大國內煉油廠和石化聯合體的產能。

- 由於幾個即將實施的大型計劃,預計下游產業在預測期內將出現強勁成長。

中游產業投資增加可能推動市場發展

- 管道是遠距運輸天然氣、原油和石油產品最經濟的方式。預計未來幾年中游產業將在印度石油和天然氣市場中佔據重要佔有率。

- 截至2022年3月,印度擁有約10,419公里的原油管線(陸上:9,825公里,海上:594公里),17,389公里的天然氣管道(陸上:17,365公里,海上:24公里),以及14,729產品平臺。截至 2022 年 3 月,除管道外,印度還擁有五個液化天然氣接收站。

- 2022年2月,印度政府宣布,2025年將油氣探勘面積擴大一倍至50萬平方公里,到2030年擴大至100萬平方公里,以增加國內產量。

- 截至2022年6月30日,印度天然氣管理局有限公司(GAIL)在33,815公里的天然氣管網中擁有最大佔有率。

- 截至2022年,印度石油公司佔印度原油管線的50.88%(15,113公里)。印度政府計劃投資99.7億美元擴大該國天然氣管網,刺激市場成長。

- 2022年3月,印度石油公司(IOC)核准投資9.326億美元,用於開發九個地區的城市燃氣發行(CGD)網路。

- 因此,中游產業投資的增加正在推動印度石油和天然氣市場的發展。預計在預測期內,管道覆蓋範圍將大幅增加,其中石油產品平臺預計將在該領域增加最多。

印度石油和天然氣產業概況

印度的石油和天然氣市場較為分散。主要參與企業(排名不分先後)包括石油天然氣公司 (ONGC)、印度石油有限公司 (OIL)、信實工業公司、印度石油有限公司 (IOCL) 和旁傑勞埃德有限公司 (Punj Lloyd Limited)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年天然氣產量預測(單位:億立方公尺)

- 至2028年原油產量預測(單位:億立方公尺)

- 至2028年煉油廠裝置容量及預測(單位:千桶/日)

- LNG接收站裝置容量(MTPA) 及預測至 2028 年

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 部門

- 上游

- 部署地點

- 陸上

- 離岸

- 下游

- 煉油廠

- 石化廠

- 中產階級

- 運輸

- 貯存

- LNG接收站

- 上游

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 市場佔有率分析

- 公司簡介

- Oil and Natural Gas Corporation

- Oil India Limited

- Reliance Industries

- Indian Oil Corporation Limited

- Punj Lloyd Limited

- Bharat Petroleum Corporation Limited

- GAIL (India) Limited

- Hindustan Petroleum Corporation Limited

- Cairn India

第7章 市場機會及未來趨勢

The India Oil And Gas Market size is estimated at 40.10 billion cubic meter in 2025, and is expected to reach 51.67 billion cubic meter by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and a decline in demand for refined petroleum products. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- Factors such as the increasing natural gas pipeline capacity and the increasing demand for petroleum products are expected to drive the Indian oil and gas market during the forecast period. Also, the oil and natural gas market is a major industry in the energy market and plays an influential role in the global economy as the world's primary fuel source. The processes and systems involved in producing and distributing oil and gas are highly complex, capital-intensive, and require state-of-the-art technology.

- However, a huge dependence on imports of crude oil and natural gas to satisfy domestic demand and the high volatility of crude oil prices are expected to hinder the growth of the Indian oil and gas market.

- There have been significant gas hydrate discoveries in the KG Basin. Economically feasible extraction of the gas hydrates may create immense opportunities for the companies, which may lead to a boom in natural gas production.

India Oil and Gas Market Trends

The Downstream Sector is Expected to Witness Significant Growth

- Indian energy demand is anticipated to grow by 50% in the next two decades. This growth in demand can be attributed to the growing world population and an improvement in living standards in developing countries. Even though new and renewable energy sources are gaining popularity around the world, petroleum fuel remains a major energy source globally. This trend is expected to continue for the next few decades and favors the growth of the oil and gas downstream market.

- New refineries were set to be established in various parts of the country. For instance, in February 2023, Hindustan Petroleum Corp (HPCL) announced that the company plans to start its 9 million tonne-a-year Barmer refinery and petrochemical project in Rajasthan state by January 2024.

- The country's oil refinery throughput in the fiscal year (2021-2022) was 249.22 million metric tons, a growth from the 2017 figures, which were around 233.97 million metric tons. The increased value is the conclusion of the high demand for transport fuels like motor gasoline and diesel and the constantly high demand for LPG in the market's residential segment.

- The other major factor that has led to the requirement of high refining capacity is the increasing number of fields in the country, especially in the Krishna-Godavari Basin and Barmer Region of Rajasthan State. The high natural gas production from these fields has led to an expansion in the capacity of refineries and petrochemical complexes in the country.

- Owing to several major upcoming projects, the downstream sector is expected to witness significant growth during the forecast period.

Increasing Investment in the Midstream Sector May Drive the Market

- The pipeline is the most economical way of transporting natural gas, crude oil, and petroleum products over a long distance due to increasing investments in upcoming pipelines in the country. The midstream segment is expected to contribute a decent share in the Indian oil and gas market in the coming years.

- As of March 2022, the country had around 10,419 km of crude oil pipelines (onshore: 9,825 km and offshore: 594 km), 17,389 km of natural gas pipelines (onshore: 17,365 km and offshore: 24 km), and 14,729 km of refined products pipelines, being operated by IOCL, BORL, Cairn India, OIL, HMEL, and ONGC. In addition to the pipelines, India had 5 LNG terminals in March 2022.

- In February 2022, the government of India announced to double its exploration area of oil and gas to 0.5 million sq. km. by 2025 and to 1 million sq. km. by 2030 with a view to increasing domestic output.

- As of June 30, 2022, the Gas Authority of India Ltd (GAIL) had the largest share of the country's natural gas pipeline network, i.e., 33,815 km.

- As of 2022, Indian Oil Corporation accounted for 50.88% (15113 km) of India's crude pipeline network. The Indian government is set to invest USD 9.97 billion to expand the gas pipeline network across the country, culminating in the growth of the market.

- In March 2022, Indian Oil Corporation (IOC) Limited approved to invest USD 932.6 million for the development of City Gas Distribution (CGD) network in 9 geographical areas.

- Hence, increasing investments in the midstream sector have driven the India oil and gas market. Pipeline coverage is expected to increase substantially during the forecast period, with the petroleum product pipeline expected to increase the most in the segment.

India Oil and Gas Industry Overview

The India oil and gas market is fragmanted. Some of the key players (in no particular order) include Oil and Natural Gas Corporation (ONGC), Oil India Limited (OIL), Reliance Industries, Indian Oil Corporation Limited (IOCL), and Punj Lloyd Limited., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Natural Gas Production Forecast in billion cubic meters, till 2028

- 4.3 Crude Oil Production Forecast in billion cubic meters, till 2028

- 4.4 Refinery Installed Capacity and Forecast in thousand barrels per day, till 2028

- 4.5 LNG Terminals Installed Capacity and Forecast in MTPA, till 2028

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.2 Restraints

- 4.9 Supply Chain Analysis

- 4.10 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.1.1 Location of Deployment

- 5.1.1.1.1 Onshore

- 5.1.1.1.2 Offshore

- 5.1.2 Downstream

- 5.1.2.1 Refineries

- 5.1.2.2 Petrochemical Plants

- 5.1.3 Midstream

- 5.1.3.1 Transportation

- 5.1.3.2 Storage

- 5.1.3.3 LNG Terminals

- 5.1.1 Upstream

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Oil and Natural Gas Corporation

- 6.4.2 Oil India Limited

- 6.4.3 Reliance Industries

- 6.4.4 Indian Oil Corporation Limited

- 6.4.5 Punj Lloyd Limited

- 6.4.6 Bharat Petroleum Corporation Limited

- 6.4.7 GAIL (India) Limited

- 6.4.8 Hindustan Petroleum Corporation Limited

- 6.4.9 Cairn India