|

市場調查報告書

商品編碼

1637770

東南亞石油和天然氣 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Southeast Asia Oil and Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

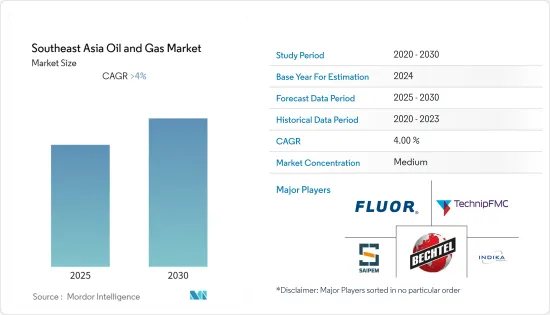

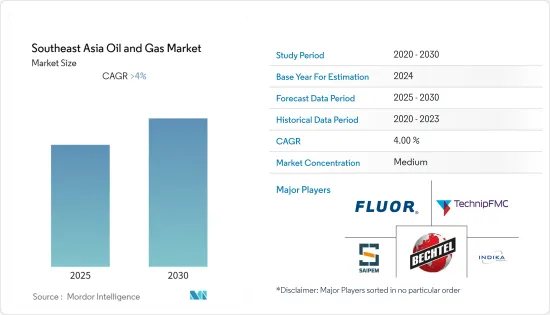

預計東南亞油氣市場在預測期內將維持4%以上的複合年成長率。

2020年,COVID-19對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,從煤炭到天然氣的能源轉型預計將在預測期內推動市場。

- 另一方面,原油蘊藏量下降和上游產業投資不足預計將抑制市場成長。

- 汶萊、越南、緬甸等國油氣產業上、中、下游三個領域都具有巨大潛力。這被視為東南亞油氣市場的機會。

- 由於正在建設大量新煉油廠,預計印尼將主導東南亞石油和天然氣市場。

東南亞油氣市場趨勢

下游產業主導市場

- 由於化學品、石化和運輸等產業對精製產品的需求不斷增加,東南亞的精製產業正在迅速擴張。到2030年,該地區總人口預計將增加約13%。

- 根據BP《2022年世界能源統計年鑑》顯示,截至2021年,新加坡精製能力最大,為146.1萬桶/日,其次是泰國、印尼、馬來西亞、越南等東南亞國家。

- 隨著石油產品需求的增加和各國力求自給自足,預計該地區的下游基礎設施將在未來幾年大幅擴張。印尼、馬來西亞、汶萊、新加坡、泰國、越南和菲律賓等國家正在製定擴建現有煉油廠或建造新煉油廠的計畫。

- 過去二十年來,馬來西亞在精製活動上投入巨資,以滿足國內對石油產品的大部分需求,而石油產品長期以來一直依賴新加坡煉油廠。此外,馬來西亞還在 Kerteh、Gebeng 和 Pasir Gudang Tanjung Langsat 建造了三個主要石化聯合企業 (IPC)。

- 此外,汶萊和越南等經濟體預計將在未來幾年訂單下游產業的多個 EPC 合約。

- 例如,2022年8月,越南石油天然氣集團國有子公司PetroVietnam宣布計劃在南部頭頓省巴巴建設一座原油加工能力為24至26噸/年的煉油廠。施工過程分為兩個階段。第一階段預計耗資135億美元,第二階段預計耗資50億美元。石化和精製第一期工程每年將處理12至13噸原油。該工廠的年生產能力將為7至9噸石油和2至3噸石化產品。第二階段將追加投資,加工量提高一倍,石油年產量增加3至5噸,石化產品產量增加5.5至7.5噸。

因此,綜合以上幾點,預計東南亞油氣市場將以下游為主。

印尼主導市場

- 截至2021年,印尼已探明石油蘊藏量為25億桶,探明天然氣蘊藏量為49.7兆立方英尺。此外,印尼具有多樣化的地理特徵。該地質盆地包括60個沉積盆地,其中印尼西部有36個已充分探勘,其中14個正在生產石油和天然氣。大量的石油和天然氣蘊藏量正在推動該國的探勘和生產活動,並可能在預測期內刺激石油和天然氣市場。

- 2022 年石油產量為 834,000 桶/日,低於 2021 年的 858,000 桶/日。在印度尼西亞,上游產業的活動增加,以彌補成熟油田產量下降的影響。

- 此外,印尼政府也宣布計劃在 2025 年之前將日產的精製能力提高一倍,達到 220 萬桶。由於這些計劃,大型煉油廠和石化廠的建設和升級計劃即將到來,目前正在進行中。

- 例如,2023年1月,印尼能源部宣布計劃今年提供10個油氣區塊,其中包括南海區塊,作為促進能源生產和新發現的努力的一部分。到 2030 年,該國的目標是原油產量達到 100 萬桶/日 (bpd),天然氣產量達到 120 億立方英尺/日 (mmscfd)。

- 因此,鑑於上述幾點,預計印尼在預測期內將主導東南亞油氣市場。

東南亞石油天然氣產業概況

東南亞石油和天然氣市場適度分割。市場的主要企業包括(排名不分先後)TechnipFMC PLC、Fluor Corporation、Bechtel Corporation、Saipem SpA 和 PT.JGC Indonesia。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年東南亞石油及天然氣產量及預測

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 部門

- 川上

- 在河裡

- 下游

- 2028 年之前的市場規模和需求預測(按地區)

- 印尼

- 泰國

- 越南

- 馬來西亞

- 其他東南亞地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- TechnipFMC PLC

- Saipem SpA

- Bechtel Corporation

- Fluor Corporation

- John Wood Group PLC

- Petrofac Limited

- PT Barata Indonesia(Persero)

- PT Meindo Elang Indah

- PT Indika Energy Tbk

- PT Rekayasa Industri

- Sinopec Engineering(Group)Co. Ltd.

- Samsung Engineering Co. Ltd.

第7章 市場機會及未來趨勢

The Southeast Asia Oil and Gas Market is expected to register a CAGR of greater than 4% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the country's energy transition from coal to natural gas is expected to drive the market during the forecast period.

- On the other hand, declining crude oil reserves along with a lack of investments in the upstream sector are expected to restrain market growth.

- Nevertheless, countries such as Brunei, Vietnam, and Burma have enormous potential for the oil and gas industry across all three sectors: upstream, midstream, and downstream. This will likely act as an opportunity for the Southeast Asian oil and gas market.

- Indonesia is expected to dominate the Southeast Asian oil and gas market, owing to the large number of new refineries being constructed.

Southeast Asia Oil & Gas Market Trends

The Downstream Sector to Dominate the Market

- The refining sector in Southeast Asia is expanding rapidly due to increased demand for refined products from sectors such as chemical, petrochemical, and transportation. By 2030, the region's total population is expected to increase by roughly 13%.

- According to the BP Statistical Review of World Energy 2022, Singapore had the largest refining capacity of 1,461 thousand barrels per day as of 2021, followed by Thailand, Indonesia, Malaysia, Vietnam, and other Southeast Asian countries.

- With rising demand for petroleum products and countries working to become self-sufficient, downstream infrastructure in the region is anticipated to expand significantly in the coming years. Indonesia, Malaysia, Brunei, Singapore, Thailand, Vietnam, the Philippines, and other countries have developed plans to enlarge existing refineries or build new ones.

- Malaysia has invested heavily in refining activities over the last two decades, and it can now meet the majority of its domestic demand for petroleum products after depending on Singapore refineries for many years. In addition, three major integrated petrochemical complexes (IPCs) in Malaysia have been built in Kerteh, Gebeng, and Pasir Gudang-Tanjung Langsat.

- Furthermore, economies such as Brunei and Vietnam are on the verge of receiving several EPC contracts in the downstream sector in the coming years.

- For instance, in August 2022, PetroVietnam, a state-owned subsidiary of the Vietnam Oil and Gas Group, revealed plans to construct an oil refinery with a crude oil processing capacity of 24 to 26 MT/year in Ba Ria, Vung Tau Province, southern Vietnam. The building process will be divided into two stages. The first and second phases are anticipated to cost USD 13.5 billion and USD 5 billion, respectively. The first section of the petrochemical and refinery plant will process 12 to 13 metric tons of crude oil per year. The plant's annual production will be 7 to 9 MT of petroleum and 2 to 3 MT of petrochemicals. In the second phase, the plant will receive extra investments to double its processing capacity and raise its output by 3 to 5 metric tons of petroleum and 5.5 to 7.5 metric tons of petrochemicals per year.

Therefore, owing to the above points, the downstream sector is expected to dominate the Southeast Asian oil and gas market.

Indonesia to Dominate the Market

- As of 2021, Indonesia had proven oil reserves of 2.5 billion barrels and proven gas reserves of 49.7 trillion cubic feet. In addition, it has a varied geographical profile. The geological basins include 60 sedimentary basins, 36 of which have already been fully explored in Western Indonesia, and 14 of which produce oil and gas. Significant oil and gas reserves boost the country's research and production activities, which will most likely stimulate the oil and gas market during the forecast timelines.

- Oil output in 2022 was 834 thousand barrels per day, down from 858 thousand barrels per day in 2021. The nation is seeing increased activity in the upstream sector to compensate for declining output from maturing fields.

- Further, the Indonesian government announced its plans to double the refining capacity by 2025, aiming to reach 2.2 million barrels daily. As a result of these plans, major refinery and petrochemical plant construction and upgrade projects are upcoming and are in the pipeline.

- For instance, in January 2023, the Indonesian Energy Ministry announced plans this year to offer ten oil and gas working areas, including a block in the South China Sea, as part of efforts to boost energy production and make new discoveries. By 2030, the country hopes to reach a crude oil lifting capacity of 1 million barrels per day (bpd) and a gas lifting capacity of 12,000 million standard cubic feet per day (mmscfd).

- Therefore, owing to the above points, Indonesia is expected to dominate the Southeast Asian oil and gas market during the forecast period.

Southeast Asia Oil & Gas Industry Overview

The Southeast Asian oil and gas market is moderately fragmented. Some of the major players in the market (in no particular order) include TechnipFMC PLC, Fluor Corporation, Bechtel Corporation, Saipem SpA, and PT. JGC Indonesia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Southeast Asia Oil and Gas Production and Forecast, till 2028

- 4.3 Market Size and Demand Forecast in USD billion, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 Indonesia

- 5.2.2 Thailand

- 5.2.3 Vietnam

- 5.2.4 Malaysia

- 5.2.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TechnipFMC PLC

- 6.3.2 Saipem SpA

- 6.3.3 Bechtel Corporation

- 6.3.4 Fluor Corporation

- 6.3.5 John Wood Group PLC

- 6.3.6 Petrofac Limited

- 6.3.7 PT Barata Indonesia (Persero)

- 6.3.8 PT Meindo Elang Indah

- 6.3.9 PT Indika Energy Tbk

- 6.3.10 PT Rekayasa Industri

- 6.3.11 Sinopec Engineering (Group) Co. Ltd.

- 6.3.12 Samsung Engineering Co. Ltd.