|

市場調查報告書

商品編碼

1640492

義大利石油和天然氣 -市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Italy Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

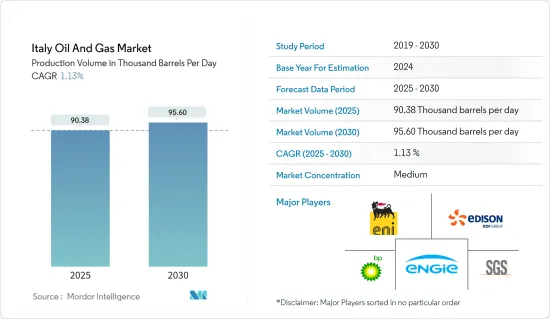

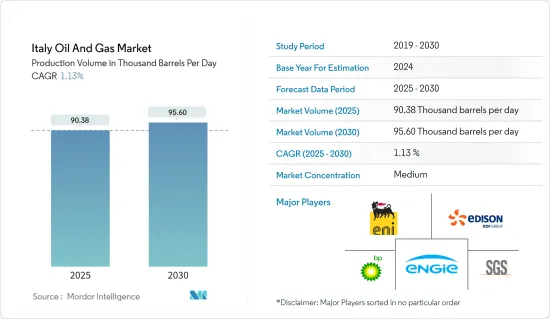

義大利石油和天然氣市場規模(基於產量)預計將從 2025 年的 90,380 桶/天成長至 2030 年的 95,600 桶/天,預測期內(2025-2030 年)複合年成長率為 1.13%。

關鍵亮點

- 從中期來看,預計政府支持政策和石油天然氣基礎設施發展等因素將在預測期內推動市場發展。

- 然而,在預測期內,可再生能源的不斷滲透可能會抑製石油和天然氣市場的成長。

- 該國擁有尚未開發的海上石油和天然氣潛力,預計將創造巨大的商機。

義大利石油和天然氣市場趨勢

中游產業可望主導市場

- 中游部門專注於石油和天然氣產品的運輸、儲存和分銷。義大利正在尋求加強其能源基礎設施,對管道、倉儲設施和終端的投資至關重要。開發強大的中游基礎設施有助於有效地將石油和天然氣從生產地點運送到精製和最終用戶。

- 義大利正在增加對天然氣作為煤炭和石油替代清潔能源的依賴。天然氣需要廣泛的中游基礎設施來將其從生產基地和進口終端運輸到發行網路、發電廠和工業消費者。由於環境法規和向清潔能源來源的轉變,對天然氣的需求不斷成長,也增加了中游產業的重要性。

- 義大利是原油和天然氣的重要進口國。中游產業在接收、儲存和分配進口石油和天然氣方面至關重要,可確保穩定供應以滿足國內需求。同樣,出口天然氣需要發達的中游基礎設施將天然氣運送到國際市場。

- 根據能源實驗室的《世界能源統計評論》,近年來國內液化天然氣進口量大幅增加。 2022 年的進口量將比 2021 年成長 50% 以上,過去 10 年每年成長率為 7.2%。

- 2023年5月,義大利政府宣布位於托斯卡納皮翁比諾港的新的浮體式液化天然氣(LNG)終端將於5月底開始商業營運。維尼爾進一步預測,該終端將在 2023 年輸送約 20 億立方公尺天然氣,隔年輸送約 50 億立方公尺天然氣。

- 該國有多個石油和天然氣管道計劃。拉韋納-基耶蒂天然氣管道可能會被升級後的基礎設施所取代。計劃長約175公里,預計36個月內完工。計劃預計將於 2022 年啟動。

- 由於這些發展,預計中游部分將在預測期內佔據最大佔有率。

可再生能源的成長預計將抑制市場成長

- 與許多其他國家一樣,義大利正在積極發展可再生能源,以減少碳排放並應對氣候變遷。政府推出了支持性政策和獎勵,鼓勵開發和採用太陽能、風能和水力發電等可再生能源技術。隨著可再生能源變得更具成本效益和技術更先進,能源消耗模式正在發生變化,減少了對石油和天然氣等石化燃料的依賴。

- 不斷擴張的可再生能源產業為傳統的石油和天然氣市場帶來了競爭。可再生能源在成本、效率和可靠性方面的競爭力日益增強。隨著太陽能和風能成本不斷下降,它們正成為越來越受歡迎的發電方式,為石化燃料提供有吸引力的替代品。來自再生能源的競爭限制了石油和天然氣市場的成長潛力。

- 根據國際可再生能源機構統計,近年來可再生能源裝置量大幅增加。 2023年可再生能源總設備容量將達到65.157吉瓦,較2022年成長率超過9.5%。

- 義大利政府積極推動和支持可再生能源計劃。此項支持將包括財政獎勵、上網電價和可再生能源計劃補貼。這種支持將進一步加速再生能源的開發和部署,使其成為對投資者和能源消費者更具吸引力的選擇。因此,由於對可再生能源的偏好日益增加,可能需要支持對石油和天然氣計劃的投資。

- 2023年5月,義大利能源服務營運商Gestore dei Servizi Energetici(GSE)公佈了其最新一輪可再生能源容量招標的獲勝者,其中包括總合422兆瓦的風能、太陽能和水力發電計劃。此次競賽是該地區第11次推廣和實施可再生能源發電的競標。

- 因此,預計可再生能源領域的發展在預測期內將成為市場的主要限制因素。

義大利石油和天然氣產業概況

義大利石油和天然氣市場適度整合。市場的主要企業包括 Eni SpA、Edison SpA、Engie SA、SGS Italia SpA 和 BP PLC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029 年義大利石油和天然氣產量預測(千桶/天)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 國內石油和天然氣需求不斷成長

- 基礎建設成長

- 限制因素

- 與可再生能源的競爭

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 部門

- 上游

- 下游

- 中游

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Eni SpA

- Edison SpA

- Engie SA

- SGS Italia SpA

- BP PLC

- TotalEnergies SE

- Zenith Energy Ltd(CA)

- Shell PLC

- Saipem SpA

- Schlumberger NV

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 存在尚未開發的海上採礦區

簡介目錄

Product Code: 53758

The Italy Oil And Gas Market size in terms of production volume is expected to grow from 90.38 thousand barrels per day in 2025 to 95.60 thousand barrels per day by 2030, at a CAGR of 1.13% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as supportive government policies and developing oil and gas infrastructure are expected to drive the market during the forecast period.

- On the other hand, increasing penetration of renewable energy is likely to restrain the growth of the oil and gas market during the forecast period.

- Nevertheless, untapped offshore oil and gas prospects in the country are expected to create significant opportunities.

Italy Oil And Gas Market Trends

The Midstream Segment is Expected to Dominate the Market

- The midstream segment focuses on transporting, storing, and distributing oil and gas products. As Italy aims to enhance its energy infrastructure, investing in pipelines, storage facilities, and terminals is crucial. Developing a robust midstream infrastructure ensures efficient movement of oil and gas from production sites to refineries and end consumers.

- Italy has increasingly relied on natural gas as a cleaner alternative to coal and oil. Natural gas requires an extensive midstream infrastructure to transport it from production fields or import terminals to distribution networks, power plants, and industrial consumers. The growth in natural gas demand, driven by environmental regulations and the shift toward cleaner energy sources, amplifies the importance of the midstream segment.

- Italy is a significant importer of crude oil and natural gas. The midstream segment is crucial in receiving, storing, and distributing imported oil and gas, ensuring a steady supply to meet domestic demand. Similarly, for natural gas exports, a well-developed midstream infrastructure is necessary to transport the gas to international markets.

- According to the Energy Institute Statistical Review of World Energy, the import of LNG in the country has increased significantly in recent years. In 2022, the imports increased by more than 50% compared to 2021, with an increase of 7.2% annually in the past decade.

- In May 2023, the Italian Government announced that the newly established floating liquefied natural gas (LNG) terminal at the Tuscan port of Piombino would commence its commercial operations by the end of May. Venier further expected the terminal to offer approximately 2 billion cubic meters (bcm) of gas in 2023 and around five bcm in the following year.

- The country has a few oil and gas pipeline projects. The Ravenna-Chieti gas pipeline is likely to be replaced by upgraded infrastructure. The project will be around 175 km, which is likely to be completed within 36 months from the date of construction. The project started in 2022.

- Owing to such developments, the midstream sector is expected to have the largest share during the forecast period.

Growth of Renewables is Expected to Restrain Market Growth

- Like many other countries, Italy is actively transitioning toward renewable energy sources to reduce carbon emissions and combat climate change. The government has implemented supportive policies and incentives to promote developing and adopting renewable energy technologies such as solar, wind, and hydropower. As renewable energy becomes more cost-effective and technologically advanced, there is a shift in energy consumption patterns, reducing dependence on fossil fuels like oil and gas.

- The expanding renewable energy sector poses competition to the traditional oil and gas market. Renewables are becoming more competitive in terms of cost, efficiency, and reliability. As the costs of solar and wind power continue to decline, they are increasingly preferred for electricity generation, making them attractive alternatives to fossil fuels. This competition from renewables limits the growth potential of the oil and gas market.

- According to the International Renewable Energy Agency, renewable energy installations have increased significantly in recent years. In 2023, the total installed renewable installed capacity was 65.157 GW, showing a growth rate of more than 9.5% compared to 2022.

- The Italian government is actively promoting and supporting renewable energy initiatives. This support includes financial incentives, feed-in tariffs, and subsidies for renewable energy projects. Such support further accelerates the development and adoption of renewables, making them more attractive options for investors and energy consumers. As a result, investments in oil and gas projects may need help due to the increasing preference for renewable energy sources.

- In May 2023, Italy's energy services operator, Gestore dei Servizi Energetici (GSE), declared the winners of its latest call for renewable energy capacity, encompassing wind, solar, and hydropower projects totaling 422 MW. This competition marked the 11th round of tenders in the region to promote and implement renewable energy generation.

- Thus, the development of the renewable energy sector is expected to be a significant restraint for the market during the forecast period.

Italy Oil And Gas Industry Overview

The Italian oil and gas market is moderately consolidated. Some of the major players in the market include Eni SpA, Edison SpA, Engie SA, SGS Italia SpA, and BP PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Italy Oil and Gas Production Forecast in Thousand Barrels Per Day, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Higher Demand for Oil and Gas in the Country

- 4.5.1.2 Growing Infrastructure Development

- 4.5.2 Restraints

- 4.5.2.1 Competition from Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Downstream

- 5.1.3 Midstream

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Eni SpA

- 6.3.2 Edison SpA

- 6.3.3 Engie SA

- 6.3.4 SGS Italia SpA

- 6.3.5 BP PLC

- 6.3.6 TotalEnergies SE

- 6.3.7 Zenith Energy Ltd (CA)

- 6.3.8 Shell PLC

- 6.3.9 Saipem SpA

- 6.3.10 Schlumberger NV

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Presence of Untapped Offshore Locations

02-2729-4219

+886-2-2729-4219