|

市場調查報告書

商品編碼

1637798

泰國石油和天然氣 -市場佔有率分析、行業趨勢、成長預測(2025-2030 年)Thailand Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

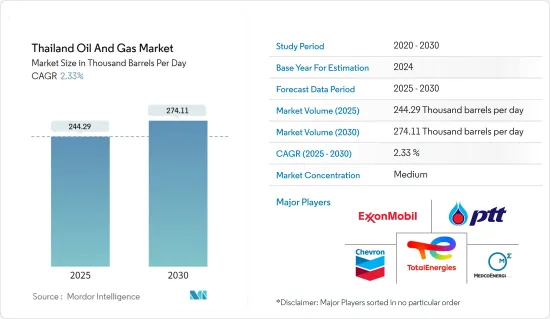

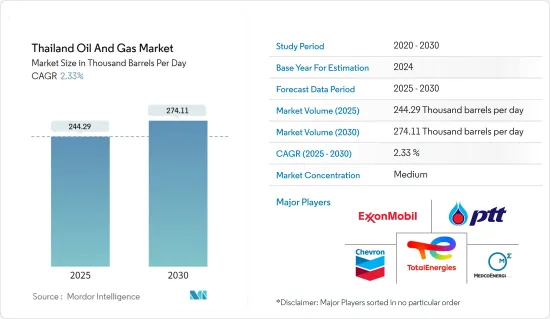

預計2025年泰國石油和天然氣市場規模為244,290桶/日,預計2030年將達到274,110桶/日,預測期間(2025-2030年)複合年成長率為2.33%。

主要亮點

- 從中期來看,天然氣管道容量增加和石油產品需求等因素預計將在預測期內推動泰國石油和天然氣市場的發展。

- 同時,該國向可再生能源轉型的新計劃可能會阻礙泰國的石油和天然氣市場。

- 新天然氣田的發現預計將在預測期內為泰國石油和天然氣市場創造多個機會。

泰國石油和天然氣市場趨勢

下游產業可望大幅成長

- 下游部門對應於石油和天然氣運往最終客戶或零售市場之前的最終過程。此製程生產的主要產品包括汽油、液化天然氣、柴油和其他潤滑油。

- 2022年,泰國石油產品出口量達到約191,300桶/日,較上年略有成長。同年,泰國出口的柴油比其他石油產品都多。

- 泰國的精製下游產業(精製能力和加工能力)在東南亞地區市值排名第二,僅次於新加坡。近年來,由於國內石油需求增加、油價上漲、旅遊業健康發展以及穩定且較高的精製利潤,精製能力不斷成長。

- 另一方面,煉油廠加工能力近年來不斷增加。該國目前擁有六座煉油廠,其中大部分由該國國有石油和天然氣集團 PTT 部分或全部擁有。泰國正在提高精製能力,以滿足不斷成長的國內和地區需求。

- 泰國領先的精製泰國石油公司已決定斥資約 48 億美元擴建其位於林查班是是拉差香甜辣椒醬煉油廠的現有原油精製。

- 擴建還包括增加渣油加氫裂解裝置、真空瓦斯油加氫裂解裝置、氫氣製造裝置、柴油加氫脫硫裝置、石腦油加氫裂解裝置、硫回收裝置和以渣油瀝青為燃料的發電廠。

- 2021 年 8 月,現代工程公司從 IRPC PCL訂單了價值 2.56 億美元的 EPC(設計、採購和施工)契約,用於維修日產位於曼谷東南約 170 公里的羅勇府的 215,000 桶煉油廠。現代汽車表示,該項目預計按照 IRPC 的計劃於 2024 年初完成。

- 如上所述,由於煉油廠擴建和精製油需求增加,預計泰國的精製能力將在預測期內略有增加。

從煤炭到天然氣的能源轉型前景將推動市場

- 為了滿足國際上對無污染燃料能源的需求,並將碳排放減少到淨零,泰國已經宣布從煤炭經濟轉型為天然氣經濟。

- 泰國充分意識到其天然氣蘊藏量正在耗盡,因此已經開始透過開發各種港口基礎設施來涉足液化天然氣(LNG)領域。最近完工的非工廠液化LNG接收站的產能為每年 750 萬噸,成為該國轉型為天然氣的典範。

- 2022年,泰國天然氣消費量達到約507億立方米,較上年略有成長。 2022年泰國天然氣消費量將成長10%。

- 泰國有多個興建中的發電廠,包括Gulf 是拉差香甜辣椒醬發電廠(2.5吉瓦)、Hin Kong計劃(1.4吉瓦)、春武里吳計劃發電廠(2.6吉瓦)以及素叻府的兩座發電廠(700兆瓦)每個)有幾個天然氣發電廠。隨著這些發電廠的運作,泰國的天然氣需求預計將增加。

- 2021年2月,泰國國家石油公司PTT宣布,計畫2021年至2025年在所有業務上投資283億美元。 PTT 專注於發展該國的液化天然氣和天然氣產業,探索未來的能源機會。

- 因此,鑑於上述情況,預計該國不斷上升的能源轉型將在預測期內推動石油和天然氣市場的發展。

泰國石油天然氣產業概況

泰國的石油和天然氣市場是半固定的。市場主要企業包括(排名不分先後)PTT Public Company Limited、雪佛龍公司、埃克森美孚、TotalEnergies SE 和 MedcoEnergi。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的原油產量預測

- 天然氣產量:預測至 2028 年

- 煉油廠裝置容量及預測至2028年

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 亞洲最大下游產業擴張

- 從煤炭到天然氣的能源轉型

- 抑制因素

- 政府採取措施轉向清潔燃料

- 促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔:依行業

- 上游

- 中產階級

- 下游

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- PTT Public Company Limited

- Chevron Corporation

- MedcoEnergi

- Bangchak Corporation PCL

- Pan Orient Energy(Siam)Ltd.

- Sea Oil Energy Limited

- Royal Dutch Shell PLC

- Mitsui Oil Exploration Co. Ltd.

- TotalEnergies SE

- Exxon Mobil Corporation

第7章 市場機會及未來趨勢

第8章 新天然氣田發現

簡介目錄

Product Code: 47226

The Thailand Oil And Gas Market size is estimated at 244.29 thousand barrels per day in 2025, and is expected to reach 274.11 thousand barrels per day by 2030, at a CAGR of 2.33% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing natural gas pipeline capacity and the demand for petroleum products are expected to drive the Thailand oil and gas market during the forecast period.

- On the other hand, the country's new plans to transition towards renewable energy sources might hinder the Thailand oil and gas market.

- Nevertheless, discovering new oil and gas fields is expected to create several opportunities for the Thailand oil and gas market during the forecast period.

Thailand Oil and Gas Market Trends

Downstream Segment Expected to Witness Significant Growth

- The downstream sector corresponds to the final processes before the crude oil or gas can be dispensed to the final end customers or retail market. Major refineries for crude oil and natural gas processing plants are set up for the same; the process thus generates other major side products like gasoline, liquified natural gas, diesel, and other lubricants.

- In 2022, the export volume of petroleum products from Thailand amounted to almost 191.3 thousand barrels per day, a slight increase compared to the previous year. In the same year, Thailand exported diesel fuel the most compared to other petroleum products.

- The downstream refining sector of Thailand in the Southeast Asia region (in refining capacity and throughput) is one of the largest based on market cap, just after Singapore. The refinery throughput has grown in recent years due to rising domestic petroleum demand, rising petroleum prices, healthy growth in the tourism sector, and stable and high refinery margins.

- On the other hand, the refinery throughput has been increasing in recent years. The country currently has six refinery complexes, most of which are owned partially or fully by the country's national oil and gas conglomerate PTT. The country has been increasing its refining capacity to meet its growing domestic and regional demand.

- Thai Oil, the flagship refining company from Thailand, had already decided to expand its existing crude refining facility in Sriracha Oil Refinery in Laem Chabang by fueling approximately 4.8 billion dollars.

- In addition, the expansion will also see the addition of a residue hydrocracker, a vacuum gas oil hydrocracker, a hydrogen manufacturing unit, a diesel hydrodesulfurization unit, a naphtha hydrotreater, a sulfur recovery unit, and an electric power plant fueled by residue pitch.

- In August 2021, Hyundai Engineering received a USD 256 million EPC (engineering, procurement, and construction) order from IRPC PCL to upgrade its refinery with a total capacity of 215,000 barrels per day in Rayong, about 170 km southeast of Bangkok. According to Hyundai, the facility is expected to complete in early 2024 in line with the IRPC's plan.

- Thus, with all the above mentioned, Thailand's oil refining capacity is expected to grow slightly during the forecast period due to the expansion of refineries and increased demand for refined oil.

Energy Transition from Coal to Natural Gas Expected to Drive the Market

- To cope with the international clean fuel energy requirements and reduce its carbon footprints towards net zero, Thailand has already announced its transition from a coal-based economy to a gas-based economy.

- Well aware of its depleting natural gas reserves,, Thailand has already started to venture into Liquified Natural Gas (LNG) by developing its infrastructural requirements in its various seaports. The recently completed LNG terminal in Nong Fab, with a capacity of 7.5 million mt/year, has been the nation's example as it shifts towards natural gas.

- In 2022, natural gas consumption in Thailand amounted to around 50.7 billion cubic meters, slightly inclined compared to the previous year. Natural gas consumption in Thailand witnessed an increase of 10 percent in 2022.

- The country has a few under-construction and planned natural gas power plants, such as the Gulf Sriracha power plant (2.5 GW), Hin Kong Power Project (1.4 GW), Chonburi Ng Project power station (2.6 GW), and two other power plants in Surat Thani with 700 MW each. Commissioning of these power plants is expected to increase natural gas demand in Thailand.

- In February 2021, Thailand's state-controlled oil firm, PTT, announced that it s planned an investment of USD 28.3 billion across all its operations for 2021-2025. It focuses on developing the country's LNG and natural gas industry while seeking future energy opportunities.

- Therefore, owing to the above points, the increasing energy transition in the country is expected to drive the oil and gas market during the forecast period.

Thailand Oil and Gas Industry Overview

The Thailand oil and gas market is semi consolidated. Some of the major players in the market (in no particular order) are PTT Public Company Limited, Chevron Corporation, Exxon Mobil Corporation, TotalEnergies SE, and MedcoEnergi.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Crude Oil Production Forecast, till 2028

- 4.3 Natural Gas Production Forecast, till 2028

- 4.4 Refinery Installed Capacity and Forecast, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Expanding the Asia's Largest Downstream Sector

- 4.7.1.2 Energy Transition from Coal to Natural Gas

- 4.7.2 Restraints

- 4.7.2.1 Government Policies to Shift Towards Cleaner Fuels

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION - BY SECTOR

- 5.1 Upstream

- 5.2 Midstream

- 5.3 Downstream

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 PTT Public Company Limited

- 6.3.2 Chevron Corporation

- 6.3.3 MedcoEnergi

- 6.3.4 Bangchak Corporation PCL

- 6.3.5 Pan Orient Energy (Siam) Ltd.

- 6.3.6 Sea Oil Energy Limited

- 6.3.7 Royal Dutch Shell PLC

- 6.3.8 Mitsui Oil Exploration Co. Ltd.

- 6.3.9 TotalEnergies SE

- 6.3.10 Exxon Mobil Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 Discovery of New Oil and Gas Fields

02-2729-4219

+886-2-2729-4219