|

市場調查報告書

商品編碼

1640662

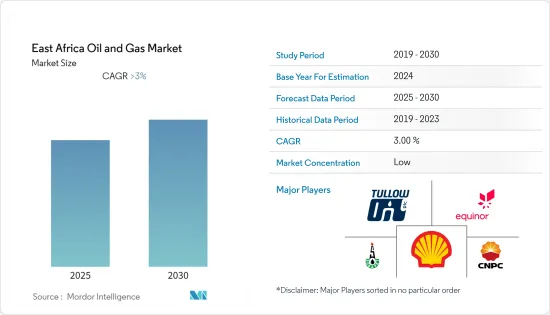

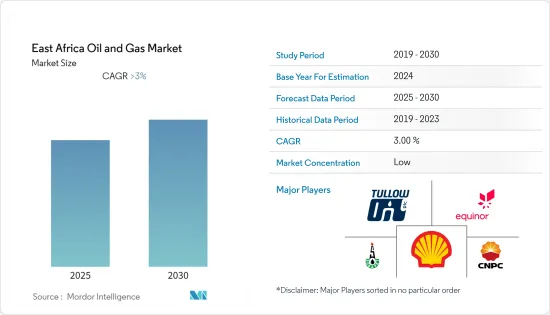

東非石油和天然氣 -市場佔有率分析、行業趨勢和成長預測(2025-2030 年)East Africa Oil and Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,東非石油和天然氣市場預計將以超過 3% 的複合年成長率成長。

2020年,新冠肺炎疫情對市場產生了負面影響。現在,市場可能會達到疫情前的水準。

關鍵亮點

- 由於該地區石油和天然氣的需求和產量不斷成長,預計未來 5 到 10 年市場將會成長。

- 另一方面,預計預測期內南蘇丹和索馬利亞等東非國家的內戰造成的政治不穩定將阻礙東非石油和天然氣市場的成長。

- 預計石油和燃氣公司將投資東非天然氣田的探勘和生產,這可能在預測期內為東非石油和天然氣市場創造豐厚的成長機會。

- 預計南蘇丹將經歷顯著成長,並且預測期內可能會實現較高的複合年成長率。這一成長是由該地區海上天然氣田蓬勃發展的探勘和生產所推動的。

東非石油和天然氣市場趨勢

中游產業強勁成長

- 東亞中游油氣產業對東非經濟至關重要。這是因為該地區的大部分進出口收益都花在了石油產品上。該地區石油需求的增加和公民購買力的提高正在推動所調查市場的成長。

- 截至 2021 年,南蘇丹是東非最大的石油生產國。該國石油產量約750萬噸。

- 隨著東非地區發現天然氣田且各國政府努力減少進口,中游產業在 2021 年變得至關重要。

- 2022 年 4 月,薩索爾有限公司宣布計劃建造一條天然氣管道,並透過提案的非洲復興管道 (ARP) 從魯伍馬盆地進口天然氣,這將切分蘊藏量。利用這些資源,該公司選擇了用油輪運輸液化天然氣(LNG)。

- 2022年10月,坦尚尼亞和肯亞領導人同意加快建造天然氣管道,這將有助於擴大兩國貿易並節省能源成本。

- 2022年11月,非洲-加勒比海-太平洋-歐洲聯盟(ACP-EU)聯合議會大會決議推翻先前的決定,允許烏干達開發東非原油管線(EACOP)計劃。這條管道全長1,443公里,從烏干達西部地區的油田一直延伸到坦尚尼亞的坦噶港。

- 因此,隨著該地區石油使用量的增加和更多資本注入該行業,中游行業可能會大幅成長。

南蘇丹實現顯著成長

- 南蘇丹石油產量從 2016 年的 680 萬噸增加到 2017 年的 750 萬噸。預計預測期內產量增加將推動南蘇丹石油和天然氣市場的成長。

- 2021年1月,南蘇丹石油部宣布恢復團結州塔爾吉特油田的石油生產。塔爾吉特(Taljit)在南團結州也被稱為 5A 區塊,由 Sudd 石油作業公司(SPOC)營運。

- 截至2022年10月,南蘇丹的石油蘊藏量估計為35億桶。據南蘇丹石油部稱,南蘇丹近90%的石油和天然氣蘊藏量尚未開發。

- 此外,南蘇丹於 2021 年啟動了第一許可的交涉發放,發放了五個探勘許可證。政府希望透過此舉吸引多元化的外國投資者,刺激上游投資,以增加原油產量。

- 預計未來幾年南蘇丹的石油和天然氣產業將大幅成長,尤其是投資不斷擴大、天然氣產量不斷增加的中游領域。

東非石油和天然氣產業概況

東非石油和天然氣市場本質上是一體化的。市場的主要企業(不分先後順序)包括蘇丹國家石油公司、中國石油天然氣集團公司、殼牌公司、Equinor ASA 和 Tullow Oil PLC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 至2028年原油產量及預測(單位:千桶/日)

- 天然氣產量及預測(百萬噸油當量,2028 年)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 部門

- 上游

- 中游

- 下游

- 開發地點

- 陸上

- 海上

- 地區

- 莫三比克

- 坦尚尼亞

- 南蘇丹

- 肯亞

- 其他東非地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Shell PLC

- Sudan National Petroleum Corporation

- China National Petroleum Corporation

- Equinor ASA

- Tullow Oil PLC

- Oil and Natural Gas Corporation

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 56411

The East Africa Oil and Gas Market is expected to register a CAGR of greater than 3% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the next five to ten years, the market is likely to grow because of rising demand and production of oil and natural gas in the region.

- On the other hand, political instability due to civil war in countries in East Africa, like South Sudan and Somalia, is expected to hamper the East Africa Oil and Gas Market's growth during the forecast period.

- Nevertheless, oil and gas companies are expected to invest in the exploration and production of East Africa's oil and gas fields, likely creating lucrative growth opportunities for the East African oil and gas market in the forecast period.

- South Sudan is expected to grow a lot and is likely to record a high CAGR during the time frame of the forecast. This growth is due to the fact that exploration and production of offshore gas fields in the area are growing quickly.

East Africa Oil and Gas Market Trends

Midstream Sector to Witness Significant Growth

- East Asia's midstream oil and gas industry is important to East Africa's economy because most of the region's imports and export earnings are spent on petroleum products.The increasing demand for oil and the rising purchasing power of the citizens in the region have been boosting the growth of the market studied.

- South Sudan was the leading oil producer in East Africa as of 2021. Oil production amounted to roughly 7.5 million metric tons in the country.

- With the discovery of gas fields in the area and the government's push to cut down on imports, the East African midstream sector became very important in 2021.

- In April 2022, Sasol Ltd. announced plans to construct a gas pipeline and import natural gas via the proposed African Renaissance Pipeline (ARP) from the Rovuma Basin, opting for tanker deliveries of liquefied natural gas (LNG) to best tap into Mozambique's offshore gas reserves.

- In October 2022, the leaders of Tanzania and Kenya agreed to speed up the building of a natural gas pipeline that would help both countries trade more and save money on energy costs.The projected natural gas pipeline would run 600 kilometers between Dar es Salaam and Mombasa.

- In November 2022, the African, Caribbean, Pacific, and European Union (ACP-EU) Joint Parliamentary Assembly overturned an earlier decision and voted to allow Uganda to develop the East African Crude Pipeline (EACOP) project. The 1,443-kilometer-long pipeline runs from Uganda's Western Region oil wells to Tanzania's seaport of Tanga.

- Thus, the midstream sector is likely to grow a lot because more oil is being used in the region and more money is being put into the sector.

South Sudan to Witness Significant Growth

- South Sudan increased its oil production from 6.8 million metric tons in 2016 to 7.5 million metric tons in 2017. Increased production is expected to generate growth in the South Sudan oil and gas market during the forecast period.

- In January 2021, the Ministry of Petroleum in South Sudan announced that oil production in Unity State's Tharjiath oilfield had resumed after nearly eight years of shutdown following the outbreak of civil war in the country in 2013. Tharjiath, also known as Block 5A in southern Unity state, is operated by the Sudd Petroleum Operating Company (SPOC).

- South Sudan's oil reserves were estimated to be 3.5 billion barrels as of October 2022. This made them the third largest in sub-Saharan Africa, after Nigeria and Angola.The Ministry of Petroleum says that almost 90% of South Sudan's oil and gas reserves have not been used yet.

- Furthermore, South Sudan launched its first-ever licensing round in 2021, offering five exploration licenses, through which the government hopes to attract a diverse group of foreign investors to stimulate upstream investment and increase its crude oil production.

- South Sudan's oil and gas industry is expected to grow a lot over the next few years, especially in the midstream sector, where investment is growing and gas production is going up.

East Africa Oil and Gas Industry Overview

The East African Oil and Gas Market is consolidated in nature. Some of the major players in the market (not in particular order) include Sudan National Petroleum Corporation, China National Petroleum Corporation, Shell PLC, Equinor ASA, and Tullow Oil PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Crude Oil Production and Forecast in thousand barrels per day, till 2028

- 4.3 Natural Gas Production and Forecast in million-ton oil equivalent, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Location of Development

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Mozambique

- 5.3.2 Tanzania

- 5.3.3 South Sudan

- 5.3.4 Kenya

- 5.3.5 Rest of East Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 Sudan National Petroleum Corporation

- 6.3.3 China National Petroleum Corporation

- 6.3.4 Equinor ASA

- 6.3.5 Tullow Oil PLC

- 6.3.6 Oil and Natural Gas Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219